Intercontinental Hotels Group PLC (LON: IHG), which owns hotel brands such as Holiday Inn and InterContinental, reported a decline in revenues in Q3 as coronavirus continues to batter the hospitality industry.

Fundamental analysis: Covid-19 creates havocAfter the breakout in March, the majority of hospitality companies saw a significant slump in revenues due to travel restrictions and lockdown measures, including IHG.

Revenue per available room, an essential accommodation industry metric, plummeted by 53.4% on the global basis during the last three months through September, a somewhat smaller decline compared to the 75% plunge recorded in the second quarter of 2020 upon the introduction of national lockdowns around the world.

Accommodation companies in Europe took the hardest hit as revenues tumbled by 72%, compared to the same period a year ago.

However, IHG said room bookings surged over the summer, followed by another plunge in September. In the summary, the number of room bookings on a global basis surged by 44%, compared to 25% seen in Q2.

Since September 30, IHG was forced to close 199 of its hotels, amounting to 3% of its total number.

Keith Barr, CEO of IHG emphasized the company’s favourable performance in trading during the summer and pointed out that the group signed 82 new hotels during that period.

“Trading improved in the third quarter, although progress continues to vary by region,” Barr said.

“Our actions have resulted in ongoing industry outperformance in our key markets, and we remain focused on leveraging the strength of our brands, scale and market positioning to recover strongly and drive future growth.”

He added that there will still be uncertainty when it comes to “the potential for further improvement in the short term” in the industry.

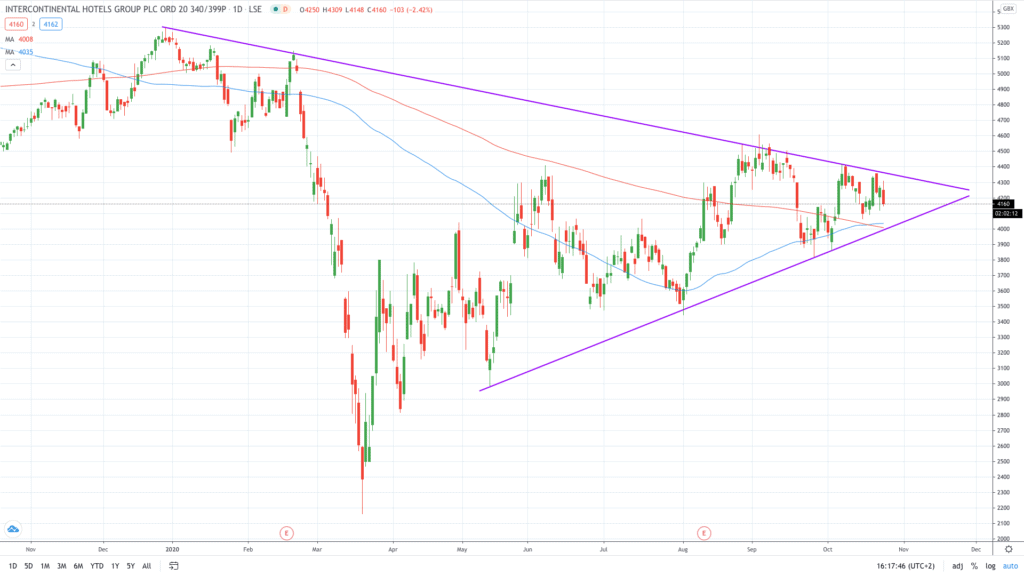

Technical analysis: Shares tumbleShares of IHG plunged about 2.5% today after the hotel chain owner reported a plunge in revenue. Today’s move lower pushed IHG stock price into the negative territory despite trading about 4% higher at one point this week.

HG stock daily chart (TradingView)

HG stock daily chart (TradingView) The price action is now moving towards the key support zone located around the £40.00 mark. This zone hosts the ascending trend line, as well as both the 100-DMA and 200-DMA. A break of this area would open the door for a deeper pullback to £38.00.

SummaryThe British hospitality company Intercontinental Hotels Group saw a slump in revenues in the third quarter as the coronavirus pandemic keeps pummeling the industry. As a result, shares swung to negative territory on a weekly basis.

The post Holiday Inn: IHG stock price tumbles as Covid-19 hurts hotel bookings appeared first on Invezz.