- Q2 Production of 12,453 Gold Equivalent Ounces ("GEO")

- Q2 AISC of $1,318 per ounce

(All numbers reported in US dollars)

TORONTO, ON / ACCESSWIRE / August 24, 2023 / Cerrado Gold Inc. (TSXV:CERT)(OTCQX:CRDOF) ("Cerrado" or the "Company") is pleased to announce the operational and financial results for the second quarter 2023 ("Q2/23") at its Minera Don Nicolas ("MDN") gold project in Santa Cruz Province, Argentina and report on its ongoing activities at the Monte Do Carmo gold project ("MDC") in Brazil. Production results at MDN were previously released on July 19, 2023. The Company's quarterly financial results are reported and available on SEDAR as well as on the Company's website (www.cerradogold.com).

Q2 2023 Minera Don Nicolas ("MDN") Operational Highlights:

- Gold production of 12,453 GEO in Q2/23, show a 7% improvement year-on-year ("yoy")

- AISC of $1,318 per ounce during Q2/23

Mark Brennan, CEO and Chairman, stated: "These results demonstrate another solid quarter of performance from the team at MDN. We are very pleased they have been able to maintain some of the lowest operating costs per ounce in the region. With our initial heap leach project at Las Calandrias now pouring gold, we look forward to increased production rates entering the fourth quarter of this year to meet our full year production target. At Monte Do Carmo, despite the modest delay in completing the feasibility study we expect to capitalize on several opportunities to maximize the value of the Serra Alta deposit. Additionally, we are highly confident our initiation of aggressive exploration programs currently underway in Brazil and Argentina will highlight the robust resource growth opportunities we expect to see in the coming years."

Second Quarter 2023 Operational and Financial Performance

Q2/23 and Full Year Operational Highlights

Minera Don Nicolas

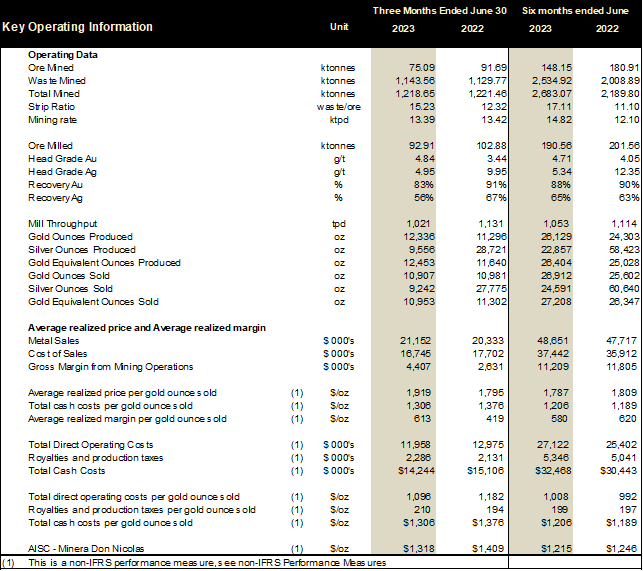

The Company produced 12,453 GEO ("Gold Equivalent Ounces") during the three months ended June 30, 2023, as compared to 11,640 GEO in the three months ended June 30, 2022. Production was 7% higher in the three months ended June 30, 2023, due to higher gold head grades.

The average quarterly gold head grade of 4.84 g/t recorded in the second quarter of 2023 represents a 41% increase as compared to the average head grade of 3.44 g/t in the second quarter of 2022. Gold recovery of 83% represents an 8% decrease in recovery as compared to 91% recorded in the second quarter of 2022. Silver recovery of 56% was also 16% lower than the silver recovery achieved in the second quarter of 2022.

During Q2/2023, the team continued exploration efforts to advance several greenfield and brownfield targets with the aim of increasing mine life and expanding the overall resource endowment, while continuing to support the move to underground mining at Paloma.

Las Calandrias Project

During Q2/2023, work on the engineering and construction of the Las Calandrias heap leach project was completed and placement of ore on to the pad commenced in April 2023. The first gold production was achieved in July 2023 (see Press Release dated July 10, 2023). The Calandrias Heap Leach project is expected to add incremental production to MDN commencing in 2023 and is the first step in Cerrado's plans for growing production capacity in Argentina in the near term. All Argentinian projects continue to be funded by operating cash flow and local debt facilities.

Monte Do Carmo Project, Brazil

During Q2/2023, the Company, together with its numerous advisors, continued to progress the completion of a bankable feasibility study ("FS") expected by the end of October 2023. In addition, regional exploration continues on the greater project area aimed at growing the known resources and extending the potential mine life. During the quarter, the exploration focus has been on the Northern extension of the Serra Alta deposit, to the East of the south pit and to the north of Gogo, as well as on testing more greenfield targets such as Divisa and Bit-3 for ongoing development.

The Preliminary License ("LP") was issued from the Instituto Natureza do Tocantins ("NATURATINS") on May 29, 2023 and the License of Installation/Construction ("LI") is expected to follow within 90 -120 days of the LP issuance.

The Company also continues to pursue project funding from the UK Export Credit Agency ("UKEF"), which is progressing well, and subject to successful due diligence and other review, is expected to be completed approximately by the end of Q1 2024.

Q2/2023 Financial Highlights

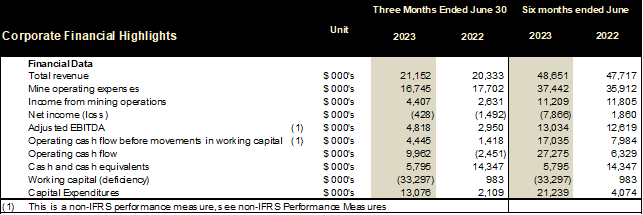

The Company generated revenue of $21.2 million for the three months ended June 30, 2023, from the sale of 10,953 GEO at an average realized price per gold ounce sold of $1,919 and price per silver ounce sold of $23.57. For the three months ended June 30, 2022, the Company generated revenue of $20.3 million from the sale of 11,302 GEO. Revenue from sales of gold and silver for the current period was slightly higher than the three months ended June 30, 2022, due to the higher realized price in the current period.

Cash costs per ounce sold were $1,306 per ounce in the three months ended June 30, 2023, as compared to cash costs per ounce sold of $1,376 per ounce in the three months ended June 30, 2022, a 6% decrease. The 6% decrease is a result of lower consumables and material costs compared to the second quarter of 2022, due to lower tonnage milled and processed.

Cash provided by operating activities during the first quarter ended June 30, 2023, was $9.9 million compared to cash used in operating activities of $2.5 million for the second quarter ended June 30, 2022. Cash provided by operating activities before working capital changes in 2023 consisted of $4.4 million as compared to $1.4 million of cash provided by operating activities before working capital changes in 2022.

Adjusted EBITDA was $4.8 million in the second quarter of 2023 as compared to $2.9 million in the second quarter of 2022. Current year adjusted EBITDA was higher due to higher mine operating margin and lower other expenses, offset by a higher tax expense Q2/2023.

Net loss for the three months ended June 30, 2023 was $0.4 million, as compared to a $1.5 million net loss for the three months ended June 30, 2022, a difference of $1.1 million. The decrease in net loss is primarily a result of an increase in mine operating margin of $1.8 million, a decrease in finance expense of $0.6 million, offset by an increase in non-cash remeasurement loss on the secured notes and stream of $0.7 million, and an increase in general and administrative expenses of $0.5 million recorded in the second quarter of 2023 as compared to the second quarter of 2022.

Basic and diluted loss per share for the three months ended June 30, 2023, was $0.01, compared to the basic and diluted earnings per share of $0.02 for the three months ended June 30, 2022, a $0.01 per share decrease as a result of higher mine operating margin and lower other expenses, offset by higher tax expense in the second quarter.

Additionally, in accordance with the recommendation of the HR & Compensation Committee of the Company considered at its meeting held on July 27, 2023, the board of directors approved today the grant of 3,940,000 stock options, 2,690,000 restricted share units, and 325,000 deferred share units to certain eligible participants under the Company's amended and restated omnibus incentive plan. The RSUs and DSUs vest on the first anniversary and the options are exercisable at $0.75 and vest one-third upon issuance, one-third in one year, and one-third in two years.

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Sergio Gelcich, P.Geo., Vice President, Exploration for Cerrado Gold Inc., who is a Qualified Person as defined in National Instrument 43-101.

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America. The Company is the 100% owner of both the producing Minera Don Nicolás and Las Calandrias mine in Santa Cruz province, Argentina, and the highly prospective Monte Do Carmo development project, located in Tocantins State, Brazil. In Canada, Cerrado Gold is developing it's 100% owned Mont Sorcier Iron Ore and Vanadium project located outside of Chibougamou, Quebec.

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias Heap Leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Brazil, Cerrado is rapidly advancing the Serra Alta deposit at its Monte Do Carmo Project, through feasibility and into production. Serra Alta is expected to be a high-margin and high-return project with significant exploration potential on an extensive and highly prospective 82,542 hectare land package.

In Canada, Cerrado holds a 100% interest in the Mont Sorcier Iron Ore and Vanadium Project, which has the potential to produce a premium iron ore concentrate over a long mine life at low operating costs and low capital intensity. Furthermore, its high grade and high purity product facilitates the migration of steel producers from blast furnaces to electric arc furnaces contributing to the decarbonisation of the industry and the achievement of SDG goals.

For more information about Cerrado please visit our website at: www.cerradogold.com.

| Mark Brennan CEO and Chairman |

Mike McAllister Vice President, Investor Relations Tel: +1-647-805-5662 mmcallister@cerradogold.com |

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation, all statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado. In making the forward- looking statements contained in this press release, Cerrado has made certain assumptions, including, but not limited to the time required to reach production capacity at Las Calandrias, the future operating costs in Argentina, as well the timing of the feasibility study at Monte Do Carmo. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.

View source version on accesswire.com:

https://www.accesswire.com/776471/Cerrado-Gold-Reports-Q2-Operating-Results