With a market cap of $42.3 billion, Rockwell Automation, Inc. (ROK) is a leading global industrial automation and digital transformation company based in Milwaukee, Wisconsin. Through its Intelligent Devices, Software & Control, and LifecycleIQ Services segments, it provides automation hardware, industrial software (like FactoryTalk), and ongoing services to manufacturers worldwide.

Shares of the industrial equipment and software maker have outperformed the broader market over the past 52 weeks. ROK stock has increased 29.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 13.7%. Moreover, shares of ROK are up 19.8% on a YTD basis, compared to SPX’s 13.4% gain.

Focusing more closely, shares of the company have also outpaced the Industrial Select Sector SPDR Fund’s (XLI) 8.2% return over the past 52 weeks and 14.2% rise in 2025.

Rockwell Automation released its fourth-quarter earnings on Nov. 6, and the results reflected a strong finish to the year. The company reported $2.3 billion in sales, representing a 14% year-over-year increase, with 13% organic growth. Adjusted EPS jumped 32% to $3.34. Growth was led by the Software & Control segment, which surged 31% to $657 million, and the Intelligent Devices segment, which rose 15% to $1.09 billion. The company also issued FY2026 guidance calling for 3–7% sales growth, 2–6% organic growth, and adjusted EPS of $11.20–$12.20. ROK shares popped 2.7% post announcement.

For the fiscal year ending in September 2026, analysts expect ROK’s adjusted EPS to grow 13.5% year-over-year to $11.95. Moreover, the company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

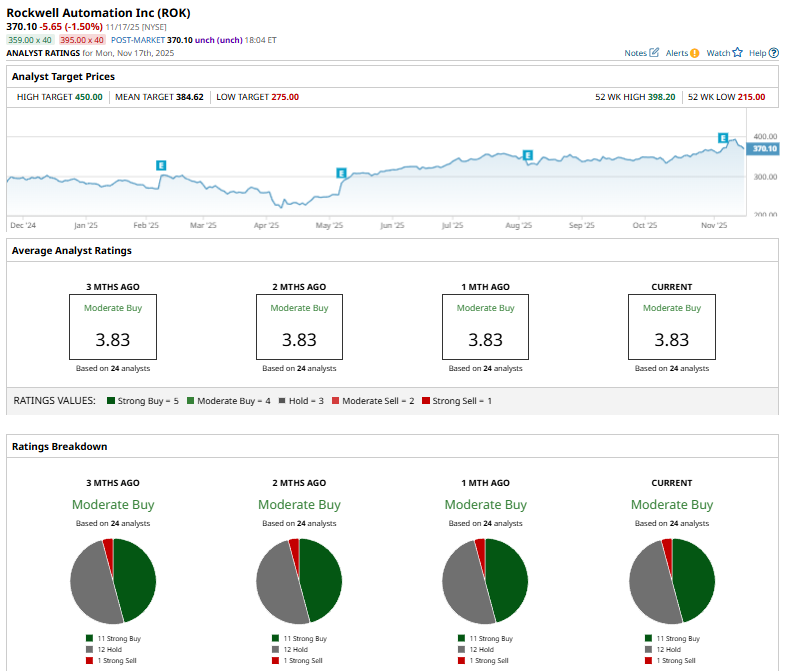

Among the 24 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings, 12 “Holds,” and one “Strong Sell.”

On Oct. 7, Wells Fargo analyst Joe O’Dea reaffirmed a “Hold” rating on Rockwell Automation and set a $355 price target.

The mean price target of $384.62 represents a 3.9% premium to ROK’s current price levels. The Street-high price target of $450 suggests a 21.6% potential upside.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Warren Buffett Says to Embrace Stock Volatility Because ‘A Tolerance for Short-Term Swings Improves Our Long-Term Prospects’

- Dear Coinbase Stock Fans, Mark Your Calendars for December 17

- Bridgewater Is Betting Big on This 1 Chip Stock (Not Nvidia). Should You Buy Shares Here?

- S&P Futures Slip on Souring Risk Sentiment