With a market cap of $63.7 billion, Quanta Services, Inc. (PWR) is a leading provider of specialized contracting services across the electric, gas, renewable energy, and communications sectors. Operating in the United States, Canada, Australia, and select international markets, Quanta delivers comprehensive infrastructure solutions through its Electric Power, Renewable Energy, and Underground Utility segments.

Shares of the Houston, Texas-based company have outperformed the broader market over the past 52 weeks. PWR stock has returned 31.7% over this time frame, while the broader S&P 500 Index ($SPX) has increased 12.3%. In addition, shares of the company are up 36.9% on a YTD basis, compared to SPX’s 12.5% gain.

Moreover, shares of the specialty contractor have outpaced the Industrial Select Sector SPDR Fund’s (XLI) 7.9% rise over the past 52 weeks.

PWR shares rose 1.2% on Oct. 30 as Quanta Services beat Q3 2025 quarterly expectations with adjusted EPS of $3.33, topping analysts’ estimates. Revenue also impressed, rising 17.5% to $7.63 billion, above forecasts, signaling strong demand across its electric and renewables segments. Additionally, the company raised its annual revenue outlook to $27.8 billion - $28.2 billion and maintained a solid adjusted EPS midpoint of $10.58.

For the fiscal year, ending in December 2025, analysts expect Quanta Services’ EPS to rise 18.3% year-over-year to $9.71. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

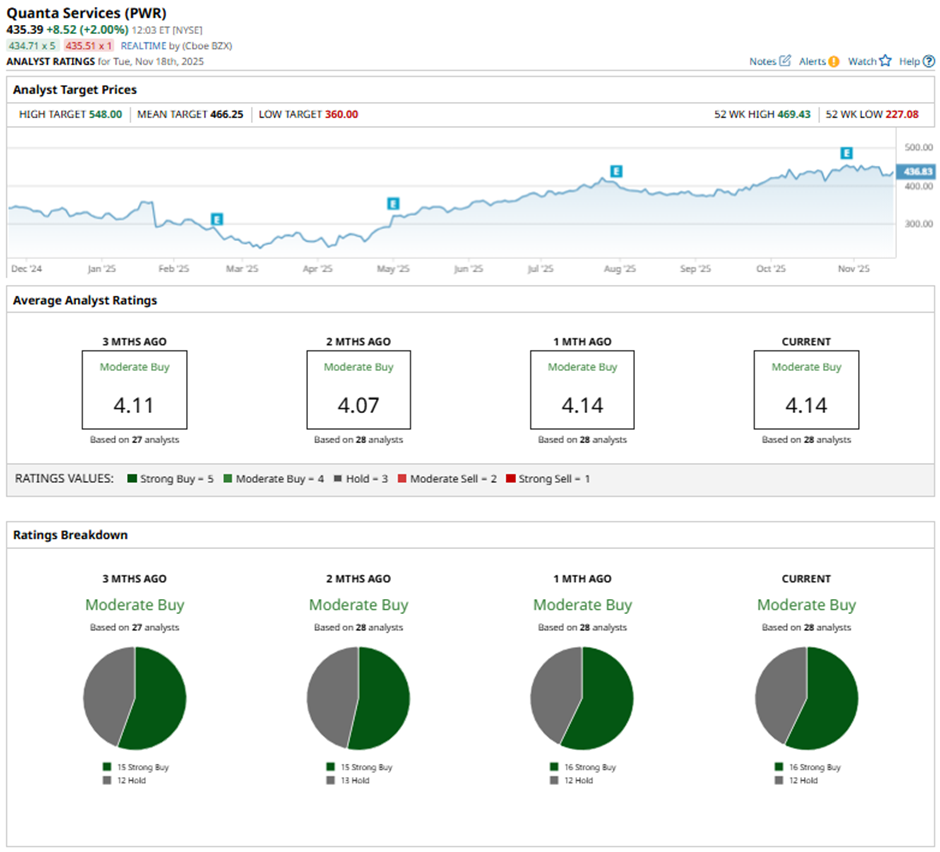

Among the 28 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 16 “Strong Buy” ratings and 12 “Holds.”

On Oct. 31, Evercore ISI’s Nicholas Amicucci raised Quanta Services’ price target to $480 and reiterated an “Outperform” rating.

The mean price target of $466.25 represents a 7.1% premium to PWR’s current price levels. The Street-high price target of $548 suggests a 25.9% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Data Science Points to Upside for Citigroup (C) Stock Despite the ‘Insurance’ Bet

- Domino's Pizza Stock is Undervalued Here - Shorting One-Month Put Options Yields 1.67%

- Peter Thiel Just Slashed His Stake in Tesla Stock by 76%. Should You Sell TSLA Too?

- Are These Beaten-Down Bottom 100 Stocks to Buy Ready to Rebound?