Jacobs Solutions Inc. (J) is a global technical professional services firm offering engineering, architecture, construction, consulting, and scientific services to both public-sector and private-sector clients. Headquartered in Dallas, Texas, the company operates across infrastructure, advanced facilities, and consulting segments and serves diverse industries such as energy, transportation, life sciences, government, and manufacturing. Jacobs Solutions has a market cap of around $18.1 billion.

Shares of Jacobs Solutions have rallied by 7.4% over the past 52 weeks, trailing behind the S&P 500 Index ($SPX), which gained 12.3% during the same stretch. On a year-to-date (YTD) basis, the stock rose 12.8% compared to the benchmark’s 12.5% gain.

Zooming in on the industrials sector, Jacobs Solutions’ shares have lagged behind the S&P 500 Industrial Sector SPDR (XLI) slightly. XLI rose 7.9% over the past 52 weeks and rallied 13.7% YTD.

Jacobs Solutions’ shares are gaining traction in 2025 largely because investors are bullish on its sharpened strategic focus. Earlier this year, the company laid out a multi-year “Challenge Accepted” growth plan, concentrating on high-growth markets like water & environment, life sciences, advanced manufacturing, and critical infrastructure.

With a strong pipeline across these secular growth areas, the market sees Jacobs as increasingly well-positioned to ride major macro trends like infrastructure modernization, sustainability, and digital transformation.

For fiscal 2025, which ended in September, analysts forecast 14.6% annual growth in EPS to $6.05 on a diluted basis. Moreover, the company has exceeded analyst estimates over the last four quarters, which is impressive.

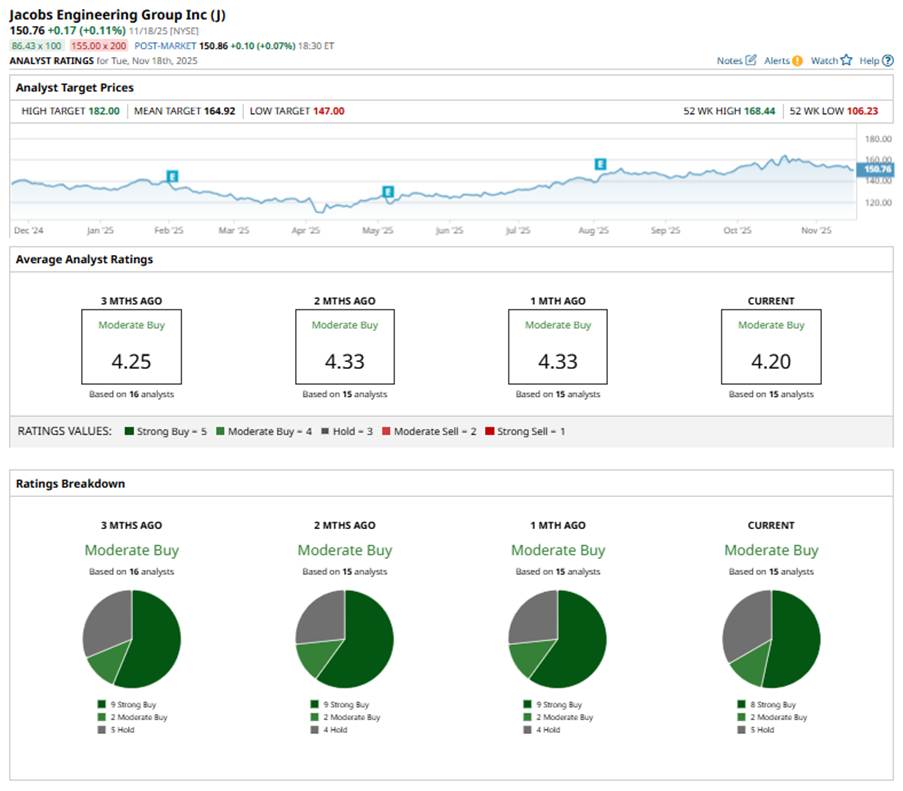

Meanwhile, among 15 analysts covering J stock, the consensus rating stands at “Moderate Buy.” That’s based on eight “Strong Buy” ratings, two “Moderate Buys,” and five “Hold” recommendations.

This configuration is slightly less bullish than one month ago, when there were nine “Strong Buy” ratings.

Last month, KeyBanc lifted its price target on Jacobs to $170 from $157, keeping an “Overweight” rating, citing the company’s strong momentum and strategic positioning in major infrastructure themes such as water, environmental, transportation, and advanced manufacturing markets.

The mean price target of $164.92 implies 9.4% upside potential from current levels. The Street-High target of $182 suggests that the stock could rally as much as 20.7%.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart