Super Micro Computer (SMCI) shares tumbled as much as 10% on Nov. 5 after the artificial intelligence (AI) server specialist reported its lowest-ever gross margin at 9.3%.

Investors bailed on SMCI stock today also because the company missed analysts estimates on both top and the bottom line in its fiscal first quarter.

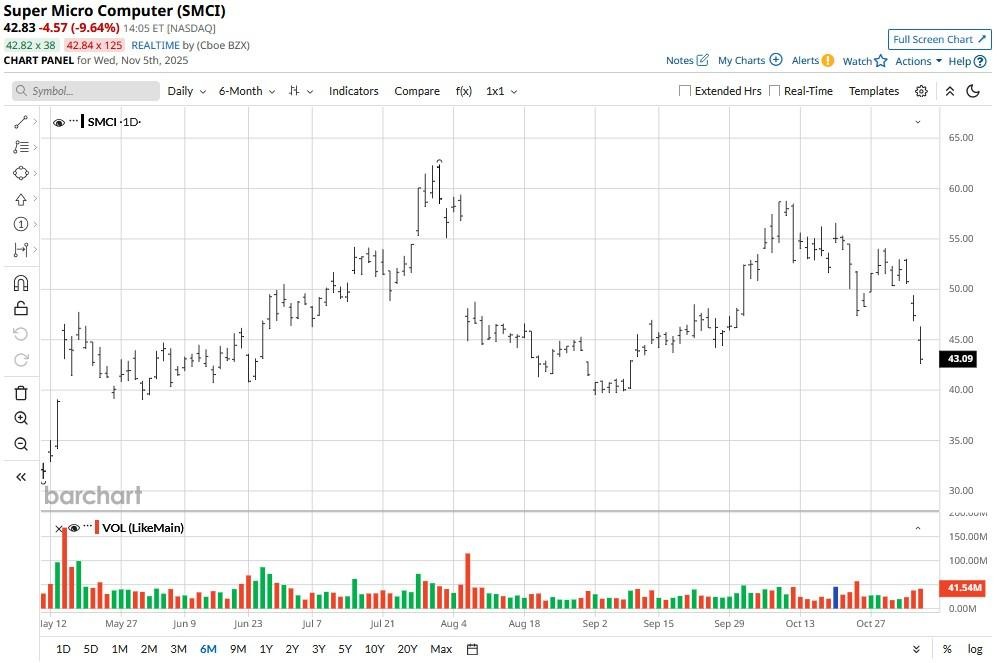

Following the post-earnings plunge, Supermicro shares are down some 30% versus their July high.

Is Now the Time to Sell the Rip in SMCI Stock?

Caution is warranted in buying SMCI shares on the post-earnings dip mostly because the margin situation looks unlikely to improve in the near term.

The artificial intelligence company ended its Q1 with $5.7 billion worth of inventory, up sharply from $4.7 billion in the same quarter last year.

Rising inventories mean Supermicro’s products aren’t selling as quickly as expected. Ultimately, they may force its management into lowering prices, adding further to pressure on margins.

Another red flag on Super Micro stock is the ever-increasing short interest that now stands at about 14%. Billionaire Philipe Laffont also cut his exposure recently to SMCI stock due to these risks.

Why Supermicro Shares May Not Recover in 2026

Supermicro stock remains unattractive as a long-term investment after Q1 earnings since the report confirms it’s struggling to keep up with rivals like Dell (DELL) and HPE (HPE) in artificial intelligence servers.

Additionally, lingering concerns of inadequate internal financial controls warrant steering clear of SMCI shares as well, even though they’re now trading at an attractive valuation of 24x forward earnings.

Note that Super Micro stock has now slipped below its 200-day moving average (MA), broadly viewed as a sign of brewing bearish momentum.

In short, with tech companies embracing AI en masse to unlock their next leg of rapid growth, the entire debate around whether Supermicro can reclaim some of its lost ground is kind of irrelevant.

There simply are too many better ways to ride the next wave of AI adoption now than SMCI.

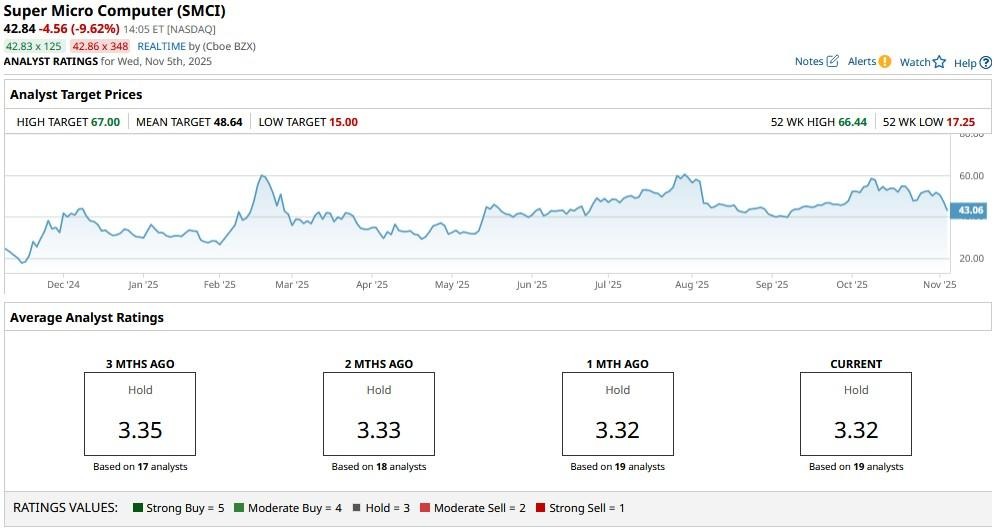

Wall Street Currently Rates Super Micro Computer at ‘Hold’

Wall Street firms aren’t particularly bullish on Super Micro shares heading into 2026 either.

The consensus rating on SMCI stock currently sits at “Hold” only and the analyst community may lower its price targets on the Nasdaq-listed firm from the current $48 after its disappointing first-quarter release.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Cisco Just Got a New Street-High Price Target. Should You Buy CSCO Stock Here?

- Palantir Just Got a New Street-High Price Target. Should You Buy PLTR Stock Here?

- Buy Nvidia Stock Now for the Next ‘Golden Wave’ of AI

- Super Micro Just Reported Its Lowest-Ever Gross Margin. Should You Ditch SMCI Stock Here?