Shares of Advanced Micro Devices (AMD) have posted stellar gains, climbing 129% over the past six months. This surge reflects AMD’s growing share within the AI-driven data center market. Further, the company’s expanding partner ecosystem and product momentum have strengthened its long-term growth narrative, driving its stock higher.

While AMD’s long-term prospects remain solid, the stock is under the spotlight ahead of its Financial Analyst Day, scheduled for Tuesday, Nov. 11. Notably, the rapid expansion of AMD’s data center AI segment positions the company for robust revenue and earnings growth in the coming years. However, with its shares already trading at high valuations, the question remains whether fresh details from the Financial Analyst Day will provide enough momentum to push the stock even higher.

Here’s What to Expect

AMD is expected to share new details around its data center AI growth plans, which will determine the trajectory of its share price. The focus will be on AMD’s continued momentum in the AI and high-performance computing markets, driven by its Instinct GPU lineup. The market will be eager to hear updates on the strong momentum of the Instinct MI350 Series GPUs, which have become a key driver of AMD’s data center AI business. Expectations are also building around the MI450 Series, slated for launch in the second half of 2026, which could further accelerate AMD’s presence in the high-performance computing space.

Despite the growing buzz around GPUs, AMD’s data center business is currently majorly driven by its EPYC server CPUs. In the latest quarter, server CPU revenue reached a record high, driven by surging demand for AMD’s 5th Gen EPYC Turin processors. These chips now represent nearly half of all EPYC sales, reflecting their rapid adoption among cloud and enterprise customers. Even older generations of EPYC processors continue to perform strongly, highlighting AMD’s solid footing across diverse workloads and customer needs.

Meanwhile, the Instinct MI350 Series GPUs are also ramping up quickly, making a meaningful contribution to the data center segment’s expanding revenue base. As the adoption of AI-driven computing accelerates across industries, GPUs are expected to play a larger role in AMD’s data center portfolio. This growing mix of CPU and GPU revenue positions AMD for faster, more diversified growth in the quarters ahead, and makes the upcoming Nov. 11 update one to watch closely for investors betting on AMD’s AI-driven future.

Should You Buy, Sell, or Hold AMD Stock?

AMD continues to gain momentum in the fast-growing data center AI market. In its latest quarter, the company posted impressive year-over-year revenue growth in its data center AI segment, powered by strong demand for its Instinct GPUs. The ramp-up of the MI350 Series and expanding adoption of the MI300 lineup have been key growth drivers, with major cloud and AI service providers already deploying these chips. Notably, larger rollouts are expected in the coming quarters, indicating solid growth in the near future.

Customer momentum is building rapidly as the company prepares to launch its next-generation MI400 Series accelerators and Helios rack-scale solutions in 2026. These new products could help AMD capture an even greater share of the booming AI infrastructure market.

A major catalyst for AMD’s long-term growth is its partnership with OpenAI. This collaboration has the potential to generate over $100 billion in revenue over the next several years, significantly expanding AMD’s footprint in the data center AI space. Additionally, Oracle’s (ORCL) plans to deploy tens of thousands of AMD GPUs across its Oracle Cloud Infrastructure starting in 2026 and continuing through 2027 and beyond strengthen its growth outlook.

AMD’s Instinct platforms are also gaining traction among sovereign AI projects and national supercomputing initiatives, further widening its market reach. Given the expected acceleration in its data center AI business and continued strength of its EPYC processors, AMD appears well-positioned to deliver robust growth in the years ahead.

However, valuation is a consideration. With AMD trading at a forward price-earnings ratio of around 81.6x, much of the optimism surrounding AMD’s future may already be reflected in the stock price. This suggests that while AMD remains a compelling long-term investment, short-term investors may want to exercise some caution given the lofty valuation.

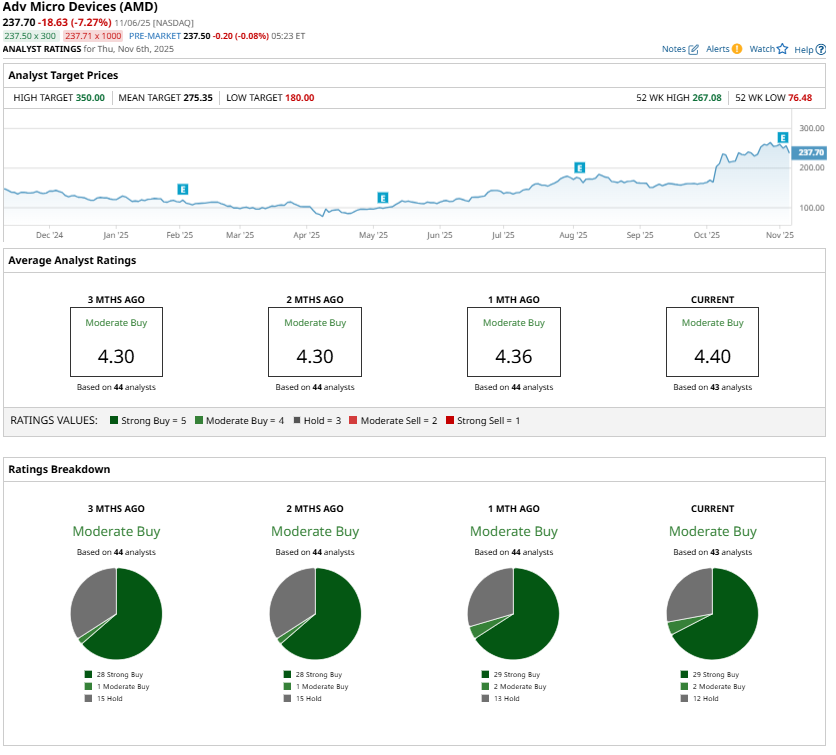

Overall, Wall Street remains cautiously optimistic, maintaining a “Moderate Buy” consensus on AMD stock.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart