The Charles Schwab Corporation (SCHW) is a major U.S. financial services company and savings and loan holding company headquartered in Westlake, Texas. With a market cap of $171.7 billion, it provides a comprehensive suite of services, including wealth management, securities brokerage, banking, asset management, custody, and financial advisory services, to individual investors, independent advisors, and institutional clients.

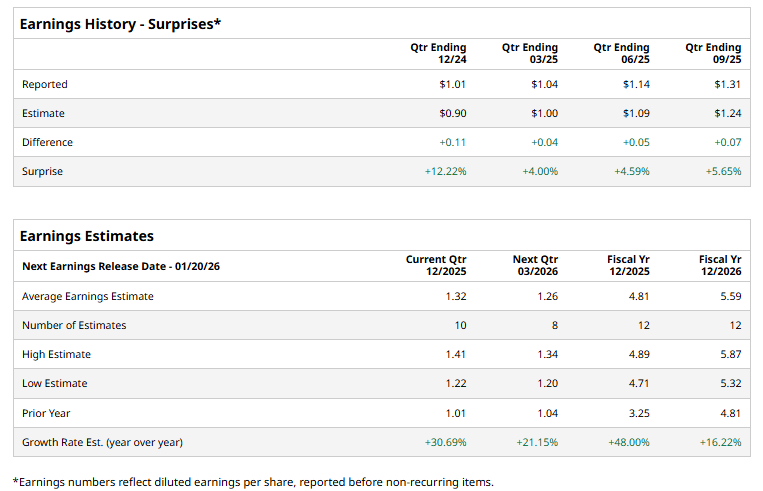

The leading financial services firm is expected to announce its fiscal fourth-quarter earnings for 2025 soon. Ahead of the event, analysts expect SCHW to report a profit of $1.32 per share on a diluted basis, up 30.7% from $1.01 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the current year, analysts expect SCHW to report EPS of $4.81, representing a 48% increase from $3.25 in fiscal 2024. Its EPS is expected to rise 16.2% year over year to $5.59 in fiscal 2026.

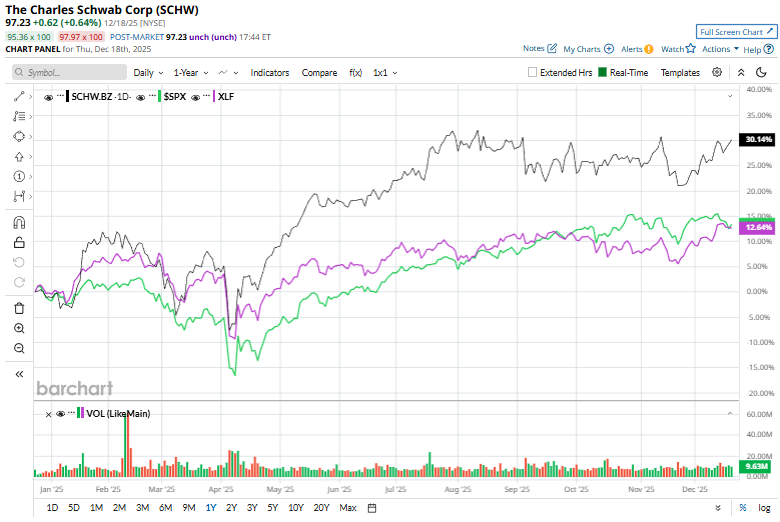

SCHW stock has climbed 31.5% over the past year, outperforming the S&P 500 Index’s ($SPX) 15.4% gains and the Financial Select Sector SPDR Fund’s (XLF) 14.5% gains over the same time frame.

Charles Schwab reported a strong Q3 performance on Oct. 16, comfortably beating market expectations, yet its shares dipped marginally. Client assets climbed 17% year over year to $11.6 trillion, while core net new assets reached $137.5 billion in the quarter, pushing year-to-date asset gathering to $355.5 billion, an increase of 41% from last year.

The strength in asset inflows translated into robust financial results, with net revenues rising 26.6% year over year to $6.1 billion, topping consensus estimates by 3%. Adjusted EPS surged 70.1% to $1.31, exceeding expectations by 5.7%.

Analysts’ consensus opinion on SCHW stock is fairly bullish, with a “Moderate Buy” rating overall. Out of 23 analysts covering the stock, 14 advise a “Strong Buy” rating, three suggest a “Moderate Buy,” four give a “Hold,” one recommends a “Moderate Sell,” and one advocates a “Strong Sell.” SCHW’s average analyst price target is $112.65, indicating a potential upside of 15.9% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 3 Dividend Kings Delivering Generational Income & Market-Beating Returns

- Mizuho Says This 1 Agentic AI Company Is the Top Software Stock to Buy in 2026

- Broadcom Stock Just Raised Its Dividend by 10%. Should You Buy AVGO Stock Now?

- Weight Watchers Is Going All In on GLP-1 Drugs. Should You Buy WW Stock Here?