With a market cap of $45.5 billion, Baker Hughes Company (BKR) provides a broad portfolio of products and services across the global energy and industrial value chain. It operates through its Oilfield Services & Equipment (OFSE) and Industrial & Energy Technology (IET) segments, serving upstream to downstream markets with solutions spanning oil and gas, LNG, power generation, and industrial applications.

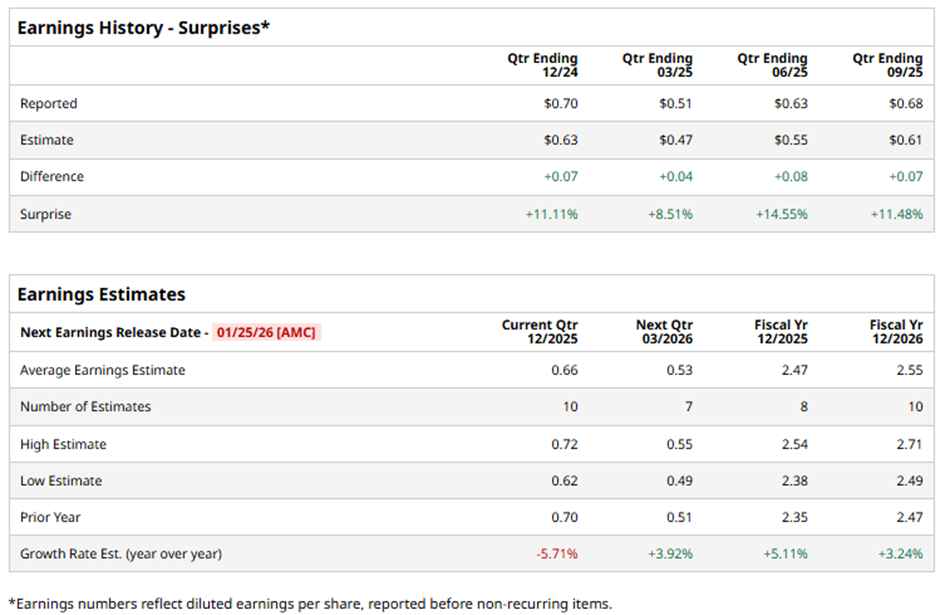

The Houston, Texas-based company is expected to announce its fiscal Q4 2025 results after the market closes on Sunday, Jan. 25. Ahead of this event, analysts predict BKR to report an adjusted EPS of $0.66, down 5.7% from $0.70 in the previous year's quarter. However, it has surpassed Wall Street's bottom-line estimates in the past four quarters.

For fiscal 2025, analysts forecast the oilfield services company to post adjusted EPS of $2.47, a rise of 5.1% from $2.35 in fiscal 2024.

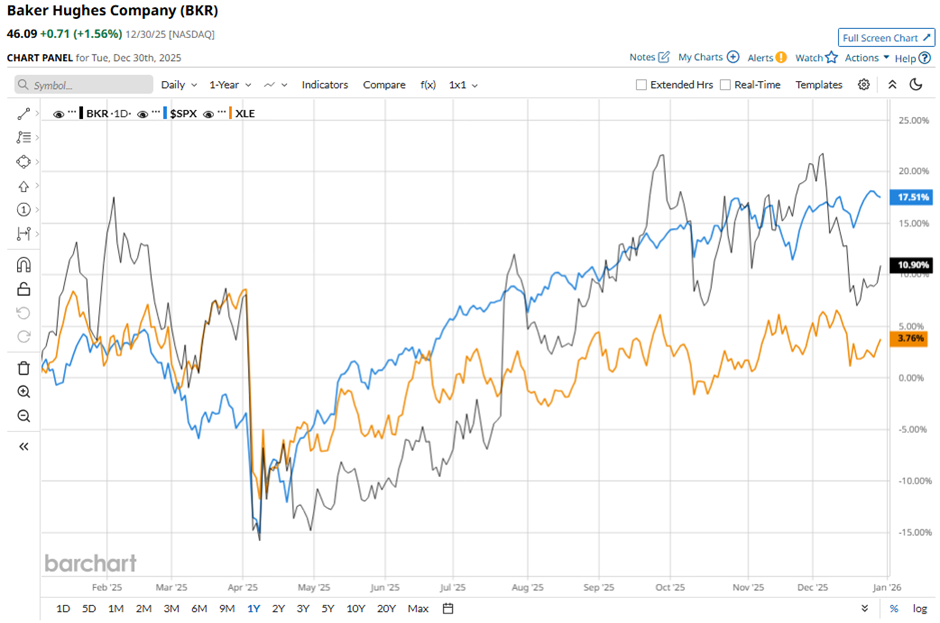

BKR stock has increased 12.6% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 16.8% gain. However, the stock has outpaced the State Street Energy Select Sector SPDR ETF's (XLE) 6.4% rise over the same period.

Despite beating estimates with Q3 2025 adjusted EPS of $0.68 and revenue of $7.01 billion on Oct. 23, Baker Hughes shares fell 3.3% the next day as net income dropped 20% year-over-year to $609 million. Investors were also concerned about weakness in the Oilfield Services & Equipment segment, where revenue fell 8% year-over-year to $3.64 billion and EBITDA margins softened to 18.5%, reflecting lower volumes, inflation, and an unfavorable mix.

Analysts' consensus rating on BKR stock is bullish, with a "Strong Buy" rating overall. Out of 19 analysts covering the stock, opinions include 14 "Strong Buys," one "Moderate Buy," and four "Holds." The average analyst price target for Baker Hughes is $55, suggesting a potential upside of 19.3% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart