Early Wednesday morning finds the Metals sector sharply lower.

When asked about it, AI gave a response listing the usual suspects CME raised margins, profit taking, market saturation, and the always hilarious “Geopolitical easing”.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.Meanwhile, the Grains sector did next to nothing overnight.

Morning Summary: It has been a wild week for the Metals sector of the commodity complex. Recall the major markets saw a meltdown Monday, only to turnaround and storm higher Tuesday. As I watched trade develop overnight, it was apparent the sector was headed for a red Wednesday, if not close at least pre-dawn hours. At this writing March silver (SIH26) is down $6.58 (8.4%) while February gold (GCG26) is off $67 (1.5%) and March copper (HGH26) is sitting 12.1 cents (2.1%) in the red. Elsewhere we see March palladium (PAH26) with a loss of $110.60 (6.4%) with February platinum (PLG26) down $218.20 (9.7%). Out of curiosity, I asked AI why Metals were lower this morning, and the response I got makes me think it was programmed by members of the BRACE Industry given it was a standard list of the usual suspects: CME margin hikes (possible, but most long-term investors aren’t overly concerned about this), Market saturation (yes, the good old “markets are overbought”, bringing to mind the old saying, “Markets can stay overbought longer than most of us can stay solvent), Geopolitical easing (Right. A day after Vlad the Invader claimed one of his palaces was attacked), Profit taking (this one makes sense given the historic run the sector has been on late in 2025.

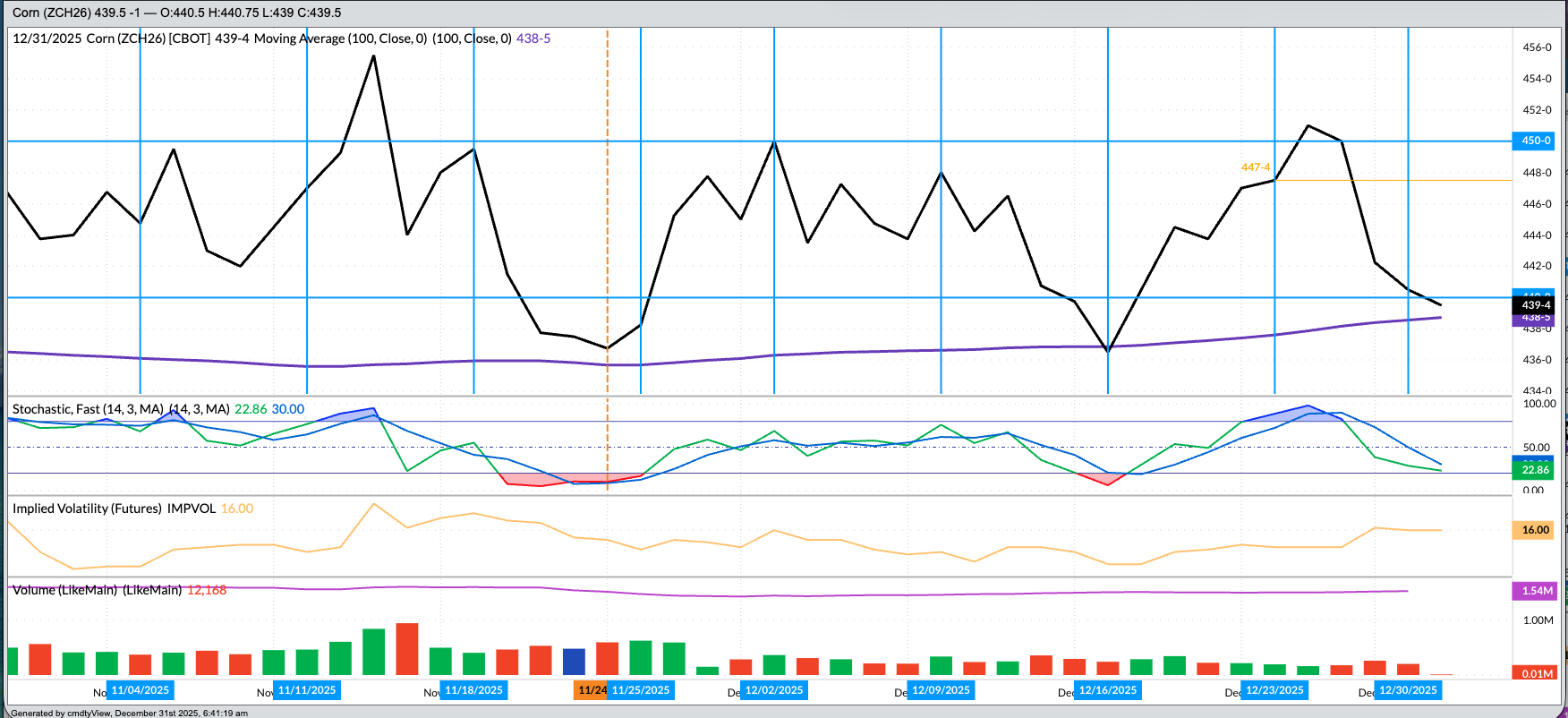

Corn: I’ll give you a guess as to the opening sentence for this segment. Anyone? Buller? If you said, “The corn market was quietly lower overnight”, well done, for that is once again the situation pre-dawn. (Next year, I will keep track of how many times this is the case.) The March issue (ZCH26) posted a 1.75-cent trading range, slipping as much as 1.5 cents on trade volume of fewer than 10,000 contracts as of this writing. I could say March is only 0.5 cent off its session low, but on the other hand, it is only 1.25 cents off its session high. While not much happened overnight, there will be some points of interest as Wednesday unfolds. Later this morning we will get the next weekly export sales and shipments update, for the week ending Thursday, December 18, with recent updates showing the pace projection for total marketing year shipments slowing down a bit. This afternoon, we get the next set of Commitments of Traders numbers with the previous showing a noncommercial net-long futures position of only 14,660 contracts as of Tuesday, December 16. Recall March corn closed Tuesday, December 23 at $4.4750, up 11.0 cents for the positioning week and indicating Watson had added to its net-long futures position[i].

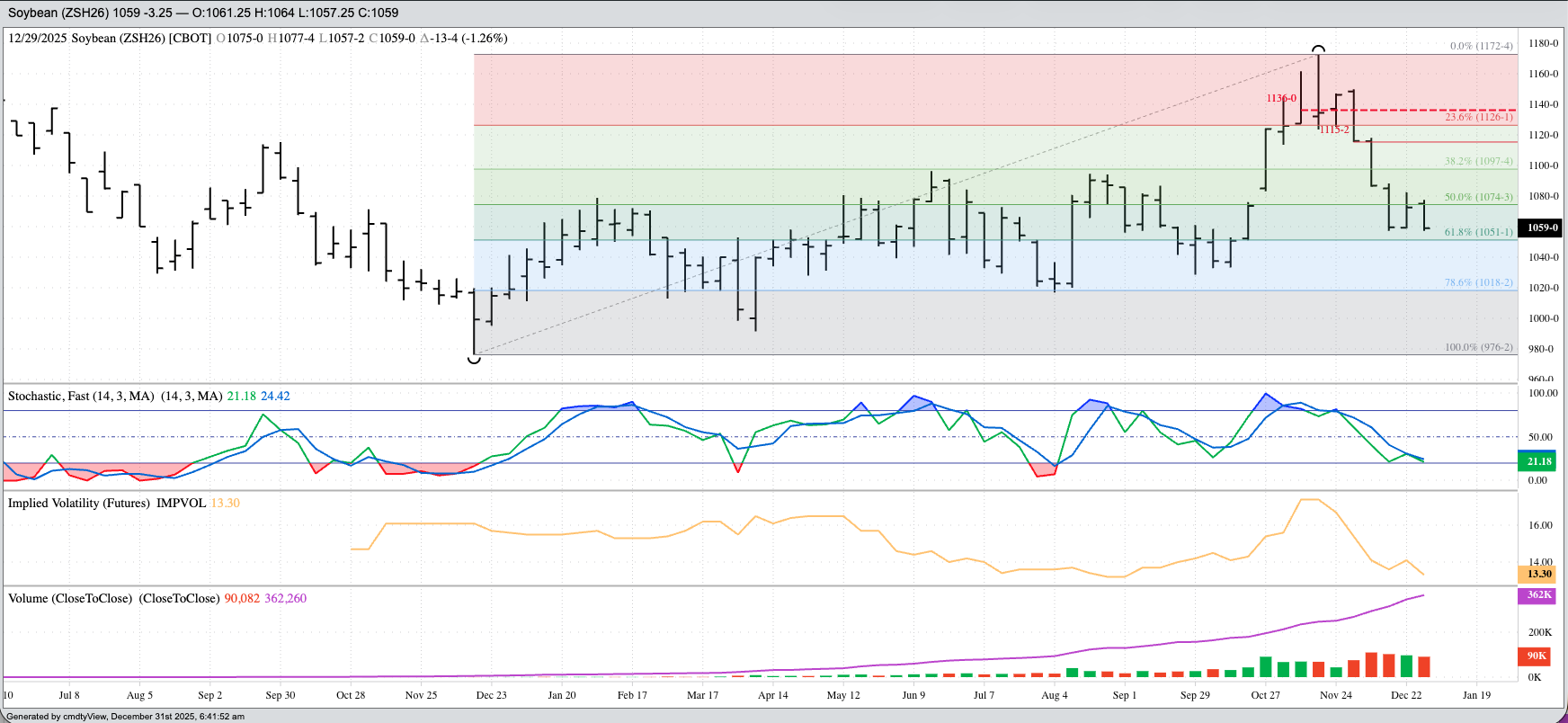

Soybeans: The soybean market was also in the red to start the day. The first thing that jumped out at me was the March issue (ZSH26) posted a low of $10.5725 overnight through early Wednesday morning, equaling its previous 4-week low. As a momentum indicator, a move below the previous mark would be viewed as intermediate-term bearish[ii]. A look back at Tuesday’s close and we see March finished at $10.6225, down 1.25 cents for the day. Last night the National Soybean Index was calculated near $9.8325, down just over 1.0 cent meaning national average basis was unchanged to fractionally stronger. Speaking of the Index, barring a collapse this last trading day of the year it should hold above its previous 5-year end of December low price of $9.4950 set last year. As for the latest weekly export sales and shipments numbers, the major point of interest will be total sales (total shipments plus unshipped sales) to China as Brazil’s next harvest grows larger on the horizon. The March-May spread closed Tuesday covering 50% calculated full commercial carry, what would be its largest percent covered on a weekly close since 52% the third week of October. The January issue had 1,062 contracts issued and stopped on its first day of delivery.

Wheat: The wheat sub-sector was in the red across the board early Wednesday morning. The March SRW issue (ZWH26) was down 2.0 cents after sliding as much as 3.25 cents overnight on trade volume of about 4,600 contracts. March HRW (KEH26) was down 4.25 cents, and off its session low by 1.5 cents, while registering fewer than 2,500 contracts changing hands. March HRS (MWH26) was sitting 2.0 cents lower at this writing on trade volume of 150 contracts. I don’t see anything to get overly excited about in those numbers, so let’s turn our attention to the next weekly export sales and shipments update. Previously, all wheat was on pace to see total marketing year shipments of 966 mb, a 25% increase from last year’s reported 776 mb. Does this mean all three wheat markets are fundamentally bullish? Not quite. Last night saw the three National Cash Indexes come in near $4.5425 (SRW), $4.5050 (HRW), and $5.6025 (HRS), still well below previous 5-year end of December low prices of $4.9275, $4.9775, and $5.7625 respectively. Based on the Law of Supply and Demand we know US fundamentals remain bearish and aren’t expected to change any time soon.

[i] Note March is closing in on its 100-day moving average near $4.3850.

[ii] I still use the Four-Week Rule discussed by John J. Murphy in his book, “Technical Analysis of the Futures Markets”, 1986 ed., pg. 268

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart