Broadcom (AVGO) made headlines earlier in the week due to insider selling that has raised investor concerns. The company’s CEO, Hock Tan, began the new year by offloading stock worth $24.3 million, selling 70,000 shares at $347.3. He now holds 908,474 shares in total. CFO Kirsten Spears and Chief Legal Officer Mark Brazeal also sold stock worth $10 million.

While insider selling like this always raises concerns, it isn’t something out of the ordinary. In fact, during the same week that these company officials were selling, analysts were encouraging people to buy. For example, Mizuho came up with a target price upgrade, while Cathie Wood of ARK Invest added more than $10 million worth of shares. She took advantage of a dip in AI stocks last week, which shows how investors are still keeping a close eye on the stock and waiting for the right opportunity to buy.

About Broadcom Stock

Broadcom sells a range of semiconductor solutions, software, and security solutions to customers across the globe. It is headquartered in Palo Alto, California, but has a presence in more than 100 locations in the world, spread mainly across the U.S., Europe, and Asia.

The stock’s 50% one-year returns are impressive, though they are just about in line with the 51% returns of the iShares Semiconductor ETF (SOXX) during the same period. As one of the leaders in custom chipmaking, the firm enjoys an edge, and that edge is reflected in its returns.

It is also interesting to look at the company’s valuations in the context of CEO Hock Tan’s sale. AVGO is trading at a forward P/E of 45.93x, 3.25% lower than its own 5-year historic average. So the question of peak valuation can be set aside, as he has had more attractive valuations to sell the stock at in the past. It is true that the dividend yield of 0.68% is not only well below the IT sector’s average of 1.4%, but it is also significantly below the stock’s own 5-year average of 2.05%. But then, CEOs seldom buy and sell a stock for its dividend yield.

Compared to peers, AVGO’s forward P/E of 45.93x is well above that of Nvidia’s (NVDA) 40.45x. However, this is nothing new and again does not point to any outrageous overvaluation that could force an insider to go for the exit. One can therefore safely assume that the business is going strong, and the insider selling has more to do with the individuals’ personal finances for 2026 rather than issues with the underlying business.

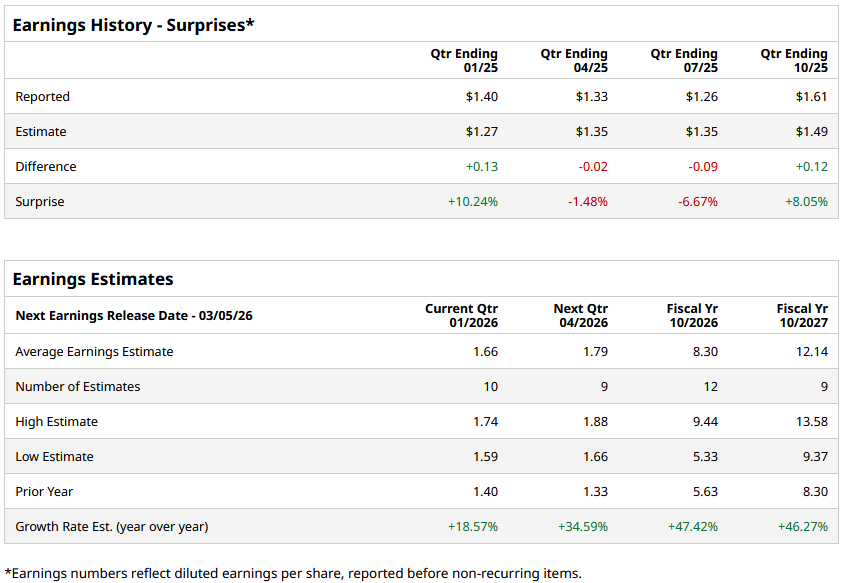

Broadcom Posts a Double Beat

Broadcom’s most recent quarterly earnings came out on Dec. 12. The EPS of $1.61 was 8.05% higher than estimates. The revenue of $18.02 billion also comfortably beat estimates. In fact, the ongoing quarter’s revenue is expected to come in at $19.1 billion, suggesting things are going strong.

Another positive factor for the company is its strong backlog. There is a $73 billion AI backlog, and CEO Hock Tan mentioned on the earnings call that bookings are expected to grow even stronger. The company is currently building a new facility in Singapore to cater to the demand for advanced packaging.

What Are Analysts Saying About AVGO Stock?

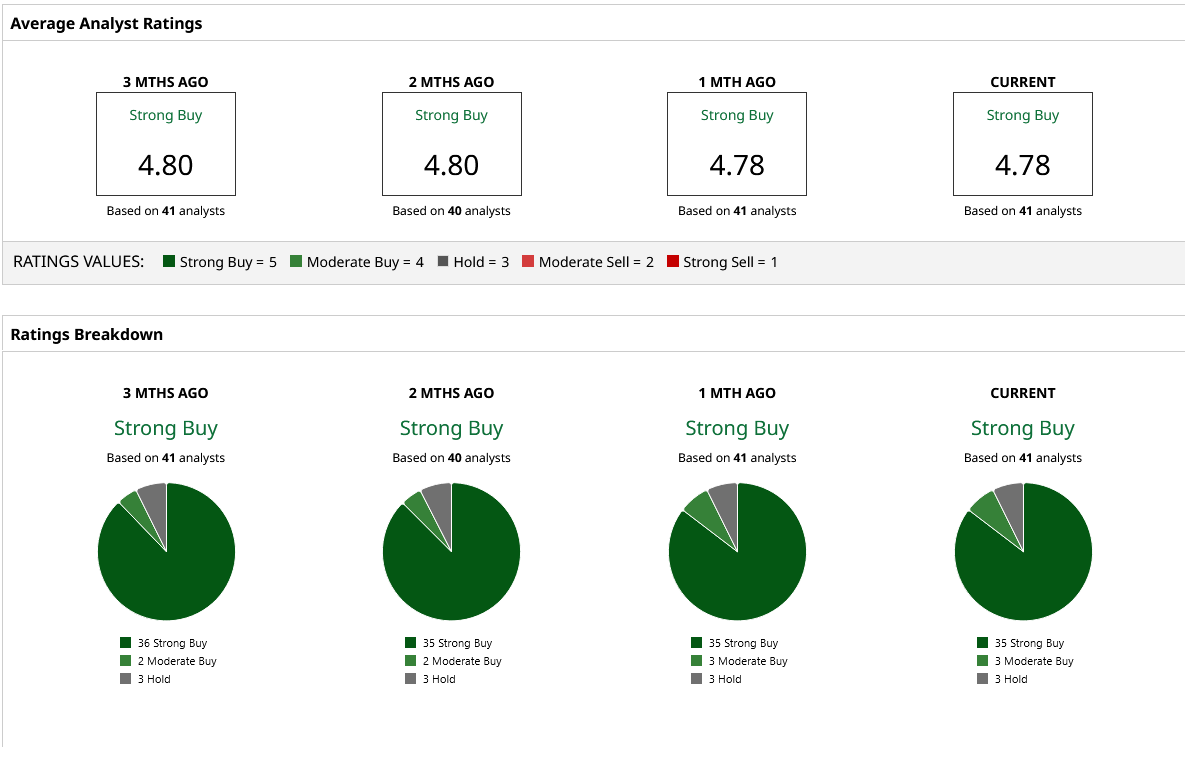

Of the 41 analysts who cover AVGO stock on Wall Street, 35 have a “Strong Buy” rating. This is hardly surprising considering the amount of investment expected to be poured into AI chips in the coming years. On Jan. 9, Mizuho raised its target price on the stock from $450 to $480. Even when insiders are selling, analysts continue to stay optimistic, which should give a good idea of how strong the sentiments are with AVGO.

Currently, the highest price target on Wall Street is $535, which offers more than 50% upside from here on. Even when we consider the median target price of $457, there is still 29% upside to be had. CEO Hock Tan may be selling his shares, but analyst optimism says investors should keep their shares and wait for further upside.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- A $3 Trillion Reason to Buy Nvidia Stock in January 2026

- Devon Energy Unusual Call Option Activity - Investors Expecting a Dividend Hike?

- As Trump Casts Doubt on the Netflix-Warner Bros. Discovery Deal, How Should You Play NFLX Stock?

- Broadcom CEO Hock Tan Just Sold $24 Million Worth of AVGO Stock. Should You Dump Shares Too?