Builders FirstSource, Inc. (BLDR) is one of the largest suppliers of structural building products, manufactured components, and value-added services to the professional market for new residential construction, repair, and remodeling in the United States. Headquartered in Irving, Texas, Builders FirstSource serves homebuilders, sub-contractors, remodelers, and consumers, and has grown through strategic acquisitions and expansion. Its market cap is around $14 billion.

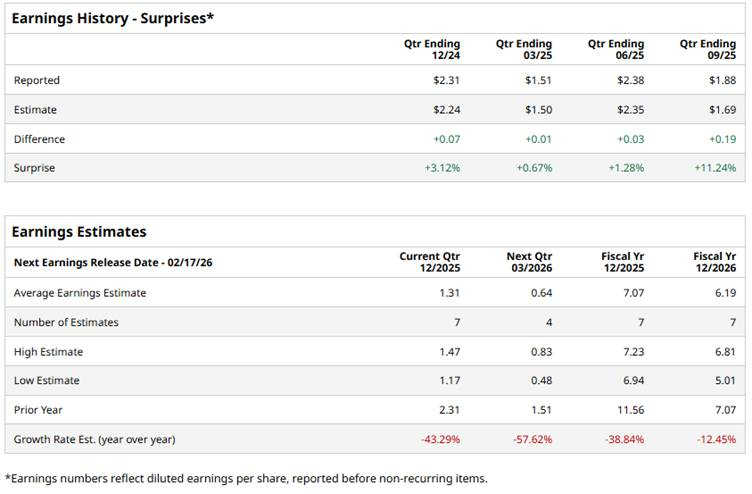

The company is gearing up to release its fiscal Q4 2025 results before the market opens on Tuesday, Feb. 17. Ahead of this event, analysts project BLDR to report an EPS of $1.31, a 43.3% decrease from $2.31 in the year-ago quarter. However, it has exceeded Wall Street’s bottom-line estimates in each of the last four quarters, which is noteworthy.

For fiscal 2025, analysts forecast the company to report EPS of $7.07, down 38.8% from $11.56 in fiscal 2024. Its EPS is projected to decline further by 12.5% year-over-year to $6.19 in fiscal 2026.

BLDR has declined 21.1% over the past 52 weeks, lagging behind the broader S&P 500 Index’s ($SPX) 16.9% return and the State Street Industrial Select Sector SPDR ETF’s (XLI) 21.9% gain over the same period.

BLDR faced pressure through much of 2025 largely due to soft housing market conditions, weaker sales and margin compression, which weighed on investor confidence. However, into 2026, the stock has been rising on renewed optimism, partly fueled by better housing data and sector sentiment that lifted homebuilder and building-materials stocks as investors anticipate potential policy support (like interest-rate easing) and potential stabilization in housing starts.

Analysts’ consensus view on BLDR is cautiously optimistic, with an overall “Moderate Buy” rating. Among 23 analysts covering the stock, 10 suggest a “Strong Buy,” one gives a “Moderate Buy,” 11 provide a “Hold” rating, and one has a “Strong Sell.” The average analyst price target for BLDR is $131.14, indicating a potential upside of 3.4% from the current levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart