With a market cap of $11.2 billion, Pinnacle West Capital Corporation (PNW) provides retail and wholesale electric services primarily across the state. Through its subsidiary, it generates, transmits, and distributes electricity using a diverse mix of nuclear, gas, oil, coal, and solar resources.

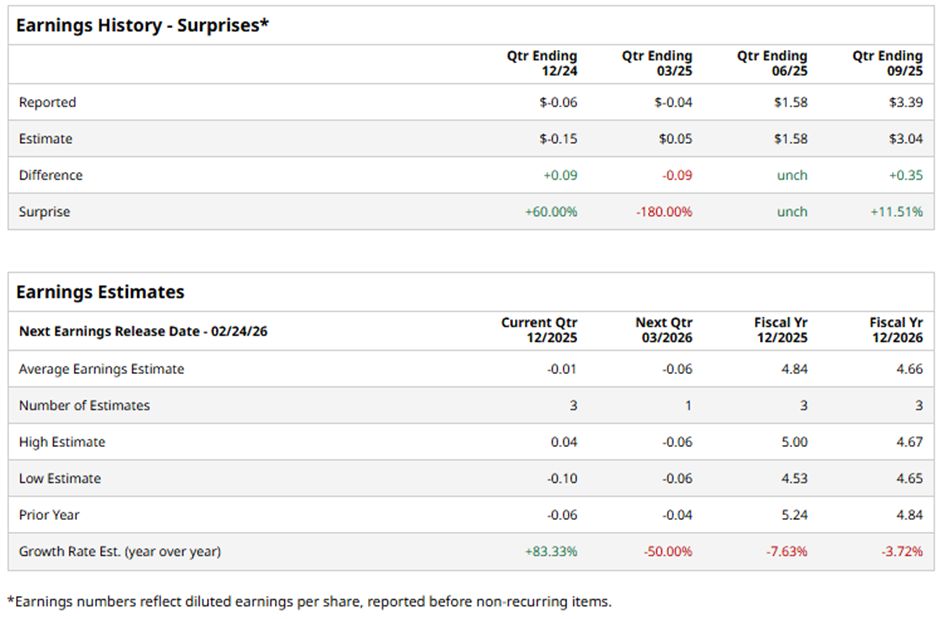

The Phoenix, Arizona-based company is expected to unveil its fiscal Q4 2025 results soon. Before the event, analysts anticipate PNW to report a loss of $0.01 per share, an 83.3% improvement from a loss of $0.06 per share in the year-ago quarter. It has exceeded or met Wall Street's bottom-line estimates in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts predict Pinnacle West Capital to report EPS of $4.84, a decline of 7.6% from $5.24 in fiscal 2024.

PNW stock has risen 8.2% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 16.9% gain and the State Street Utilities Select Sector SPDR ETF's (XLU) 9.4% return over the same period.

Shares of Pinnacle West recovered 1.1% on Nov. 3 after the company reported strong Q3 2025 results, posting consolidated net income of $413.2 million ($3.39 per share), up from $395.0 million ($3.37 per share) a year ago. Investor sentiment was further supported by 2.4% customer growth, 5.4% weather-normalized sales growth, and a record peak demand of 8,631 MW, driven by the third-hottest Arizona summer on record.

The company also raised its 2025 EPS guidance to $4.90 - $5.10 and announced plans to invest more than $2.5 billion annually through 2028 to support Arizona’s rapid growth.

Analysts' consensus rating on PNW stock is cautiously optimistic, with a "Moderate Buy" rating overall. Out of 17 analysts covering the stock, opinions include four "Strong Buys" and 13 "Holds." The average analyst price target for Pinnacle West Capital is $95.78, indicating a potential upside of 2.2% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart