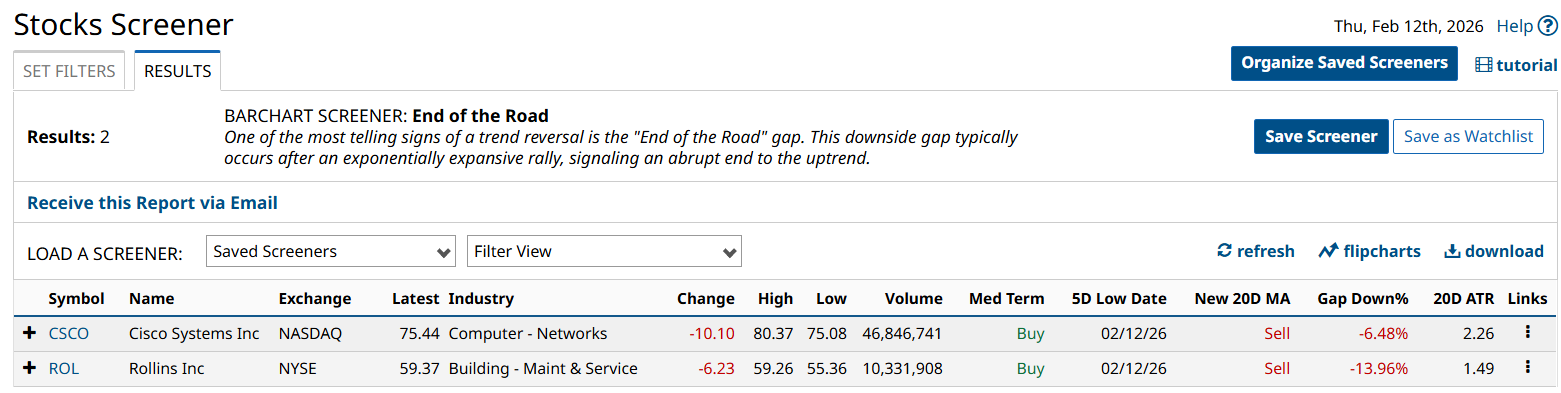

After last week’s “Godzilla-sized” End of the Road signal from tech giant Alphabet (GOOG) (GOOGL), we’ve got another tech monster hitting the screener today. None other than legacy tech name Cisco Systems (CSCO) hit the End of the Road with a thud earlier, as the company’s middling guidance and margin pressures have come under heavy scrutiny.

CSCO sliced right through its 50-day moving average, and now faces a test at its 100-day moving average, which has helped to contain lows in the stock since last October:

The stock’s daily and weekly closing prices around these key moving averages should be worth watching for investors considering whether it’s time to buy Big Tech on the dip.

For those in search of greener pastures, the strength in this market still lies in sectors with a tangible benefit – quite literally – think staples, materials, and energy. All of these S&P sectors are currently trading with more than 90% of components above their respective 50-day moving averages.

Drilling down on this group, our old friend Watts Water (WTS) in particular is a standout in today’s market, up more than 7% after its own quarterly report. This “boring” trade on water is now trading sharply higher out of its recent trading range, and could be establishing a new, higher base on the charts.

Here’s more insight on the bullish long-term thesis for water stocks & ETFs, including WTS >>

– John Rowland, CMT, is Barchart’s Senior Market Strategist and the host of Market on Close.

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart