Salesforce (CRM) has entered into a definitive agreement to acquire Cimulate, a rising player in AI-powered product discovery and agentic commerce, according to the company announcement. The deal is expected to close in the first quarter of fiscal year 2027, subject to customary closing conditions.

The acquisition brings some interesting firepower to Salesforce's Agentforce Commerce platform. Cimulate specializes in intent-aware search technology that goes way beyond basic keyword matching.

Instead of shoppers typing "blue shoes" and hoping for the best, the platform combines real and simulated shopping data to figure out what people actually want.

"The future of commerce is agentic, moving beyond simple transactions to intuitive, conversational discovery," said Nitin Mangtani, SVP and GM of Commerce and Retail at Salesforce.

Why This Deal Matters for Retailers

Shopping online can still feel clunky. You search for something, wade through irrelevant results, and often give up. Cimulate's technology is designed to fix that frustration by understanding shopper intent in real time.

Once integrated with Agentforce Commerce, retailers should be able to deliver search experiences that feel more natural and responsive to how people actually browse and buy. The goal is to help shoppers discover products faster and convert more often, while freeing up merchants to focus on brand building and growth.

John Andrews, CEO and co-founder of Cimulate, put it simply: “Joining Salesforce allows us to scale our technology and put it in the hands of the world's leading retailers.” The acquisition also brings Cimulate's specialized team to Salesforce, adding deep expertise in contextual e-commerce search.

Software Stocks Are Getting Crushed

But here's the thing—CRM stock, along with most software names, has been getting pounded lately. The company has lost about a quarter of its value in 2026, caught up in a broader selloff as investors worry that AI agents will replace traditional software products.

The WisdomTree Cloud Computing Fund (WCLD) has plummeted roughly 22% year-to-date (YTD). Other software companies are faring even worse. HubSpot (HUBS) is down 45%, Figma (FIG) has dropped 42%, and Shopify (SHOP) has fallen 24%.

The fear is that new AI tools from companies like Anthropic and OpenAI can now build apps, websites, and other digital products in seconds with just a few text prompts. Why pay for software subscriptions when AI can do it cheaper and faster?

CEO Marc Benioff isn't buying the doomsday scenario. He told CNBC's Jim Cramer in December that "We've got all the customers' data," and called Agentforce "the fastest growing product I have ever seen in the history of Salesforce."

CRM stock is down over 44% in the last 12 months, valuing the tech giant at $173 billion by market cap. Silicon Valley insiders say the most vulnerable companies are ones that “sit on top of the work”—tools like Atlassian (TEAM), Adobe (ADBE), and HubSpot that aren't core to businesses.

Notably, systems of record like Salesforce, which anchor enterprises with customer data, are harder to replicate with a weekend coding project.

The Verdict

Salesforce is making smart moves with acquisitions like Cimulate, doubling down on AI while leveraging its existing customer relationships and data moat. The company reported $550 million in Agentforce ARR last quarter, with 18,000 customers already using the platform.

For long-term investors willing to tolerate some volatility, the current selloff may present an opportunity. Salesforce isn't some nice-to-have productivity tool that AI can easily replace. It's deeply embedded in how businesses manage customer relationships, and the Cimulate deal demonstrates the company's commitment to staying ahead of the AI curve.

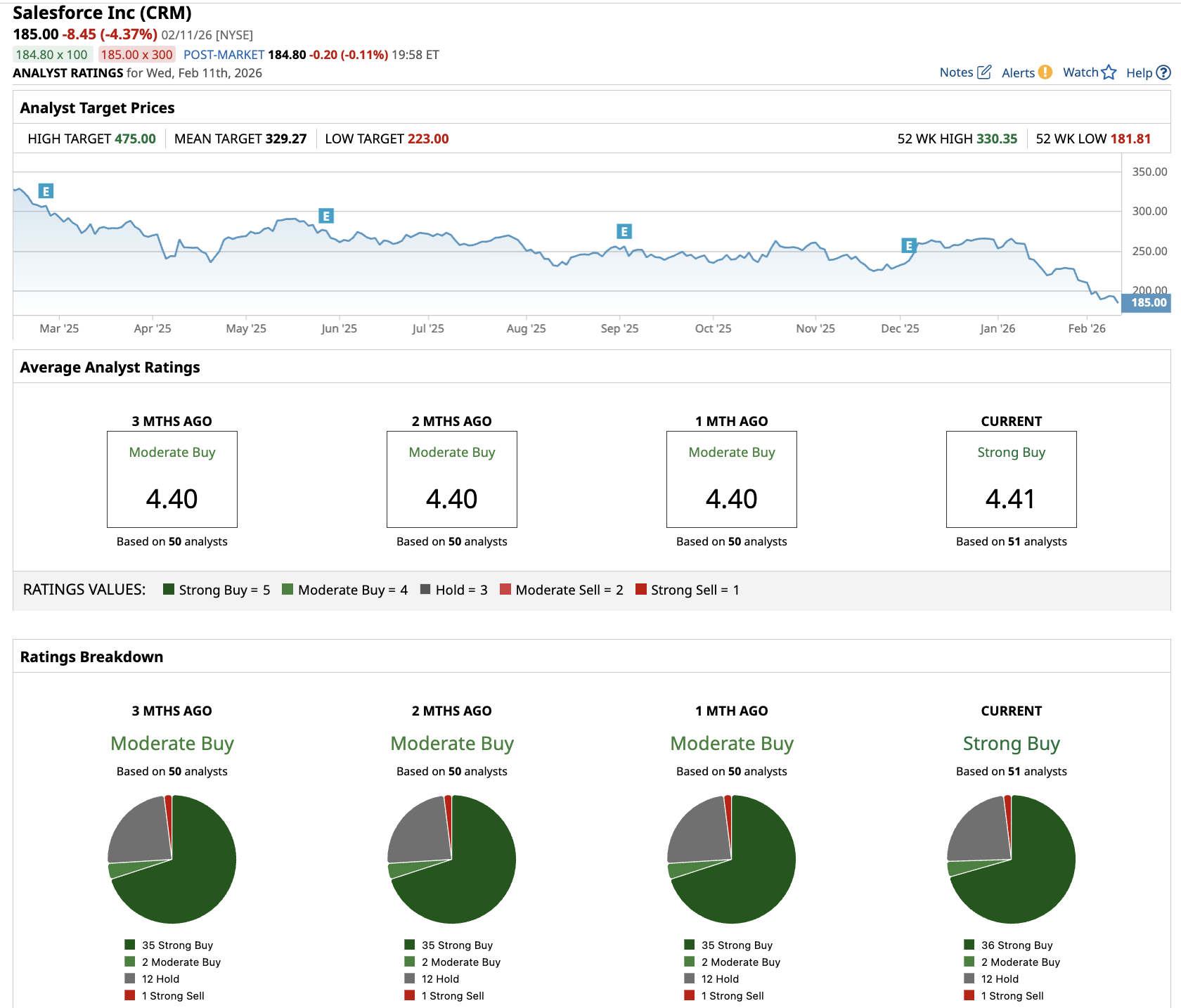

Out of the 51 analysts covering CRM stock, 36 recommend “Strong Buy,” two recommend “Moderate Buy,” 12 recommend “Hold,” and one recommends “Strong Sell.” The average CRM stock price target is $329.27, above the current price of $185.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Fastly Stock Just Surged Above Key Support Levels. Is It Too Late to Buy FSLY?

- The One Investing Habit Warren Buffett Used to Beat Wall Street for Decades, ‘Inactivity Strikes Us as Intelligent Behavior’

- 1 Analyst Just Gave Up on Under Armour Stock. Should You?

- Is Datadog Stock a Buy, Sell, or Hold in February 2026?