Shopify (SHOP) is the go-to e-commerce platform empowering over 5 million businesses to build online stores, manage inventory, process payments, and sell across channels like social media, marketplaces, and in-person POS. Its user-friendly drag-and-drop builder, 13,000+ apps, and AI tools like Shopify Magic make launching simple for beginners while scaling for enterprises like Tesla (TSLA) and Nestlé (NSRGY).

Founded in 2006, with headquarters in Ottawa, Canada. Today, it operates in 175+ countries worldwide, supporting merchants from North America and Europe to Asia-Pacific, Latin America, and Africa with localized payments and languages.

Shopify Stock Report

Shopify's stock has fallen sharply, down 1.5% over the past five days and sliding 35% in the last month. Over three months, it's off 30%. In six months, -27%, and year-to-date (YTD), -32%. Longer-term, it's shown some strength with a 52-week loss narrowed down to 9%, while gains started in the two-year timeframe with 23% and a three-year 172% rise.

Against the Nasdaq 100 ($IUXX), Shopify underperformed over 52 weeks (-9% vs. index +15%), but longer-term the stock comes out on top with three years (+172% vs. 103%), fueled by e-commerce recovery.

Shopify Posts Q4 Results

Shopify released fourth-quarter 2025 results on Feb. 11, 2026, with revenue exploding 30% year-over-year (YoY) to $3.67 billion from $2.81 billion, beating Wall Street's $3.58 billion forecast by 2.5%. This marked Shopify's strongest quarterly growth in years, driven by holiday shopping surges, enterprise wins, and AI-powered merchant tools. Gross profit climbed 31% to $2.81 billion, reflecting pricing power and higher-value services. However, EPS disappointed at $0.46 (up from $0.44 YoY), missing the $0.50 consensus by 8%, primarily due to heavy investments in growth initiatives that pressured short-term profitability.

Key metrics shone brightly: Gross Merchandise Volume (GMV) soared 29% to a record $123.8 billion, exceeding estimates as more merchants scaled operations. Merchant solutions revenue jumped 31% while subscriptions grew 27%, showing balanced expansion across payment processing, themes, and apps. Free cash flow hit an impressive $715 million (19% margin), up dramatically YoY, underscoring operating leverage from cost discipline. Operating expenses rose moderately despite hiring for AI and global expansion, with cash reserves remaining healthy to fuel innovation.

Looking ahead, Q1 2026 guidance projects revenue growth in the low 30s percentage range, well above the Street's 25% estimate, alongside high-20s gross profit growth and low-to-mid teens free cash flow margin. Management emphasized sustained e-commerce momentum, Shopify Magic AI adoption, and international merchant gains.

To boost shareholder value, Shopify authorized a massive $2 billion share buyback program, signaling confidence in long-term undervaluation and commitment to returning capital amid robust fundamentals. Shares dipped initially on the EPS miss but rebounded on the upbeat guidance and repurchase news.

Should You Buy SHOP Stock?

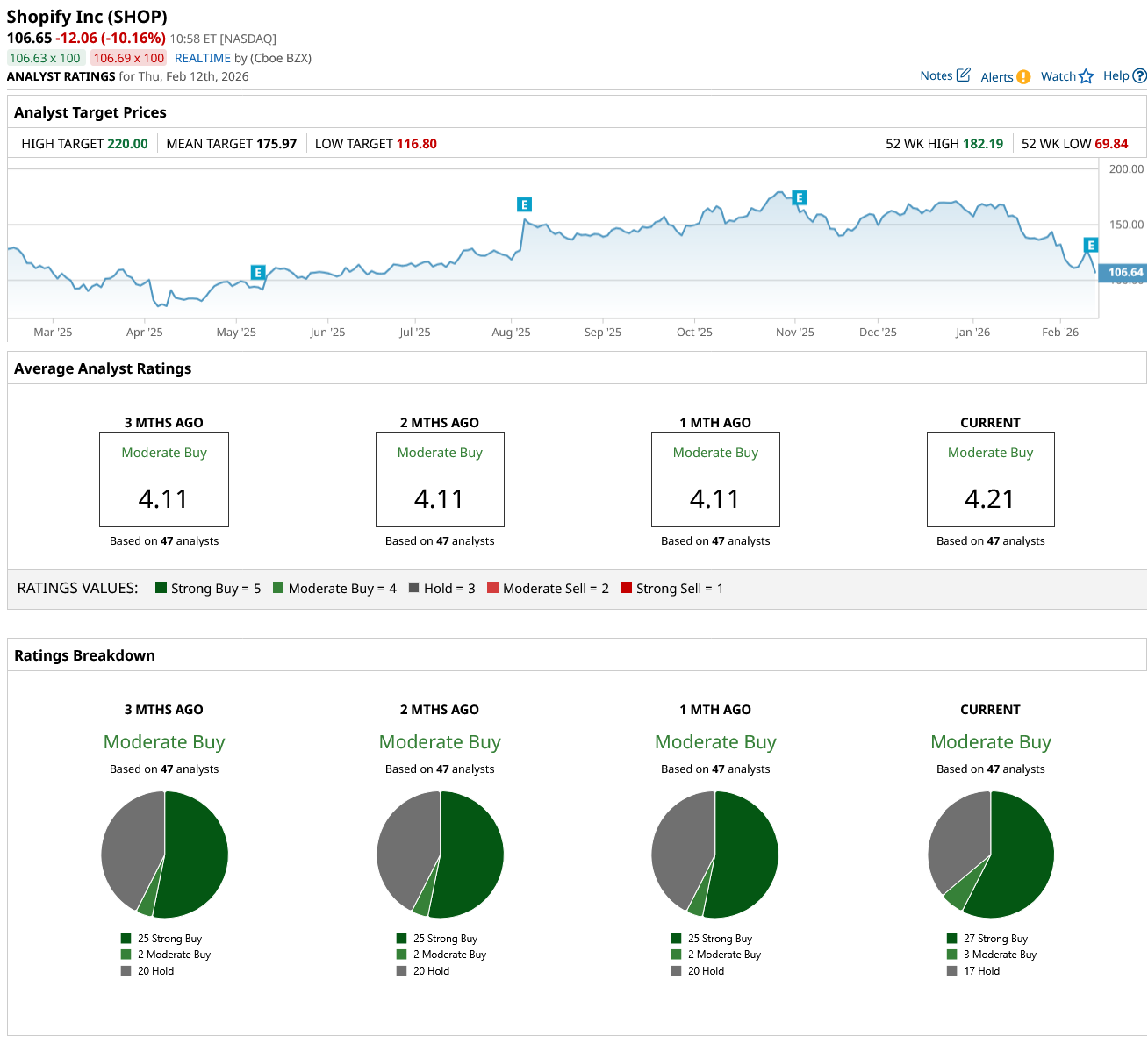

Shopify has received a consensus rating of “Moderate Buy” from analysts with a mean price target of $175.97, reflecting an upside potential of 65% from the market rate.

SHOP stock has been rated by 47 analysts with 27 “Strong Buy” ratings, three “Moderate Buy” ratings, and 17 “Hold” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Bet on a Short Squeeze in Under Armour Stock?

- What Does Alphabet’s $31.5 Billion Bond Sale Really Mean for GOOGL Stock Investors?

- As Salesforce Acquires AI Startup Cimulate, Should You Buy, Sell, or Hold CRM Stock?

- Investors in Search of Alpha Are Fleeing Tech Stocks for These 3 High-Yield Sectors Instead