Hasbro, Inc. (HAS), headquartered in Pawtucket, Rhode Island, functions as a toy and game company. Valued at $14.3 billion by market cap, the company offers a diverse range of toys, games, interactive software, puzzles, and infant products through popular brands like MAGIC: THE GATHERING, Hasbro Gaming, PLAY-DOH, NERF, TRANSFORMERS, DUNGEONS & DRAGONS, PEPPA PIG, and more.

Shares of this toy giant have outperformed the broader market over the past year. HAS has gained 69.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 12.9%. In 2026, HAS stock is up 24.4%, surpassing the SPX’s marginal fall on a YTD basis.

Zooming in further, HAS’ outperformance is also apparent compared to the Consumer Discretionary Select Sector SPDR Fund (XLY). The exchange-traded fund has gained about 3.8% over the past year. Moreover, HAS’ double-digit returns on a YTD basis outshine the ETF’s 2.8% losses over the same time frame.

Hasbro's Q4 results were strong, driven by massive growth in MONOPOLY, Peppa Pig, Marvel, and Wizards of the Coast's Magic: The Gathering. The consumer products division returned to growth, and new licensing deals with Warner Bros. Discovery, Inc. (WBD), The Walt Disney Company (DIS), and Amazon.com, Inc. (AMZN) are expected to fuel future launches.

On Feb. 10, HAS shares closed up by 7.5% after reporting its Q4 results. Its adjusted EPS of $1.51 exceeded Wall Street expectations of $0.99. The company’s revenue was $1.4 billion, exceeding Wall Street forecasts of $1.3 billion.

For fiscal 2026, ending in December, analysts expect HAS’ EPS to grow marginally to $5.59 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

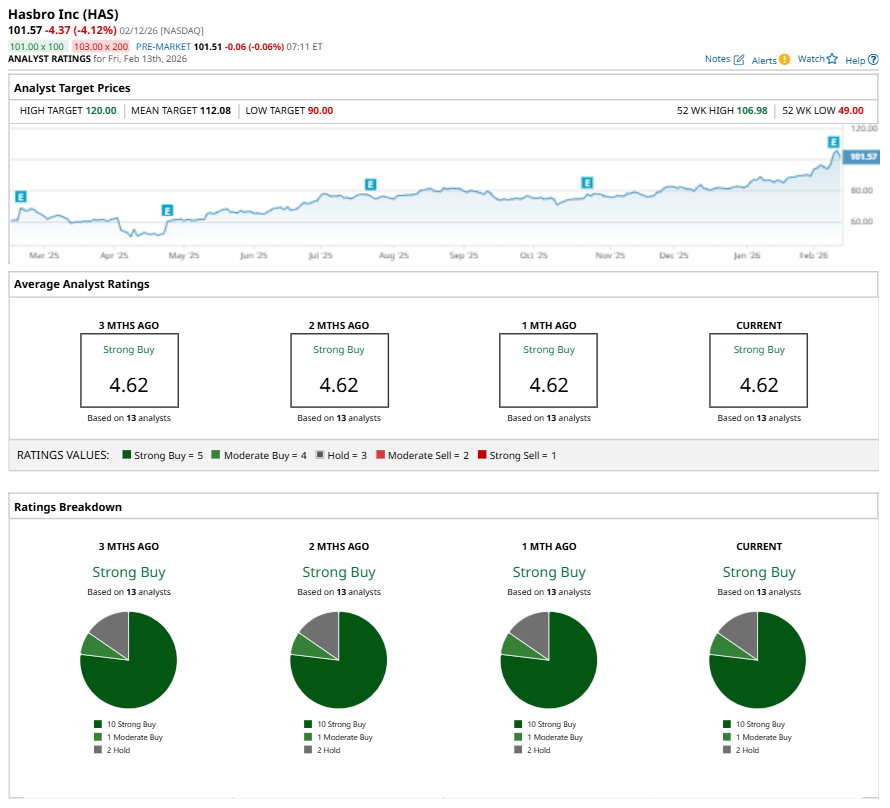

Among the 13 analysts covering HAS stock, the consensus is a “Strong Buy.” That’s based on 10 “Strong Buy” ratings, one “Moderate Buy,” and two “Holds.”

The configuration has been consistent over the past three months.

On Feb. 11, Morgan Stanley (MS) kept an “Overweight” rating on HAS and raised the price target to $119, implying a potential upside of 17.2% from current levels.

The mean price target of $112.08 represents a 10.3% premium to HAS’ current price levels. The Street-high price target of $120 suggests an upside potential of 18.1%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Warren Buffett Warns Not To Chase Trendy Stocks, ‘I Would Rather Be Certain of a Good Result Than Hopeful of a Great One’

- Down 33% YTD, Should You Buy the Dip in Robinhood Stock in February 2026?

- Billionaire Bill Ackman Is Betting Big on Meta Platforms Stock. Should You?

- As Oracle Lands a New Air Force Win, Should You Buy, Sell, or Hold ORCL Stock?