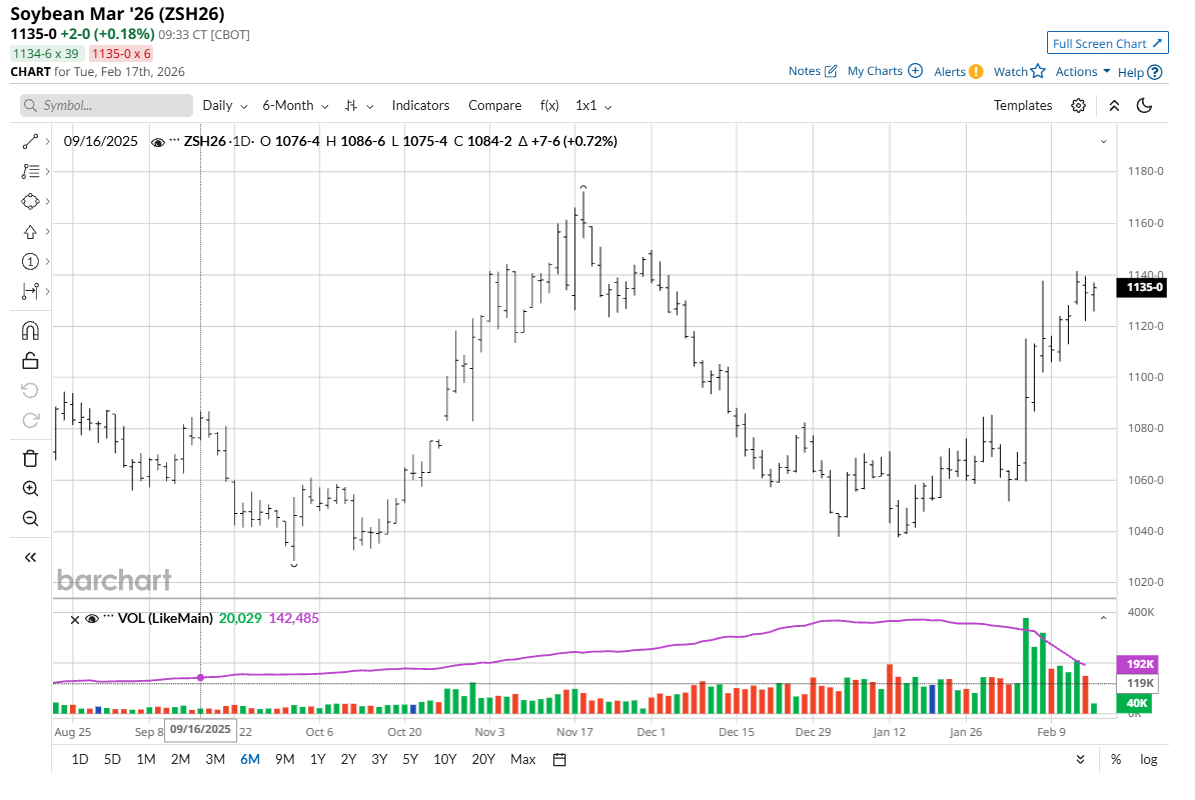

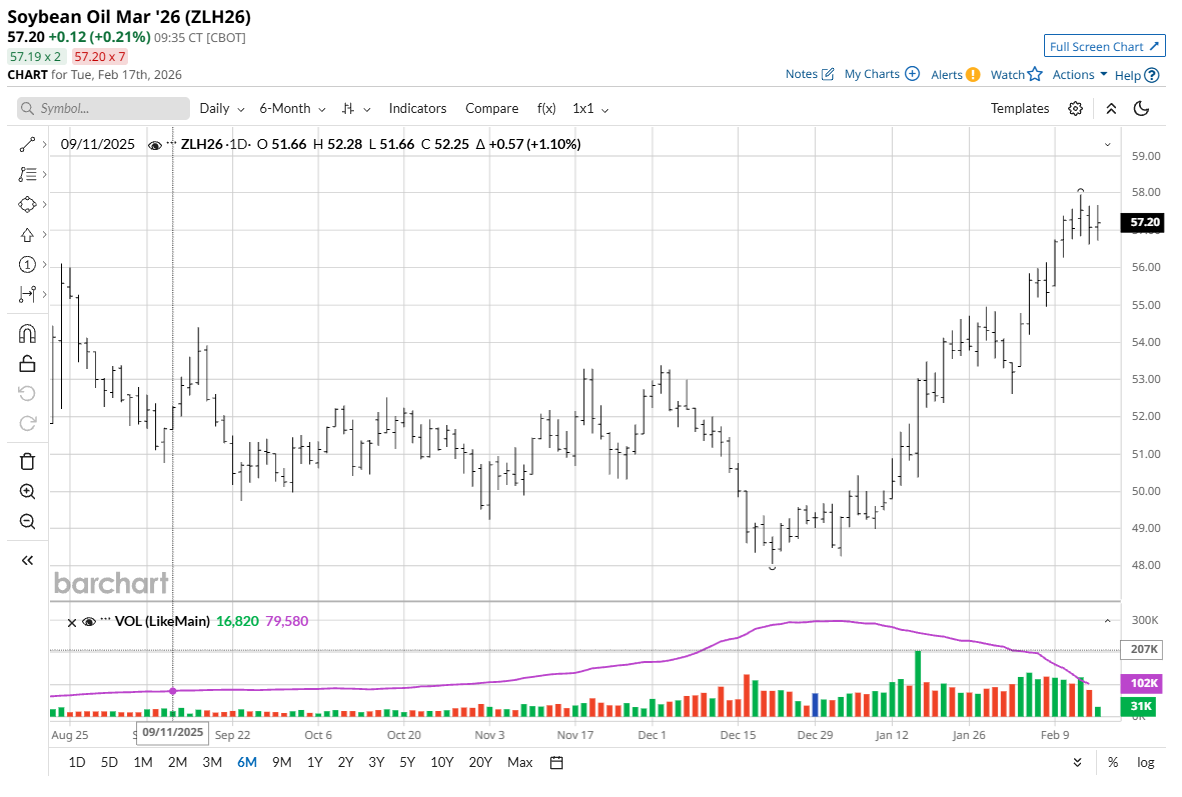

March corn (ZCH26) futures last week saw a meager gain of 1 1/2 cents. However, last Friday’s technically bullish weekly high close suggested some follow-through price strength when trading resumes after a three-day U.S. holiday weekend. March soybeans (ZSH26) on the week were up 17 3/4 cents. March soybean meal (ZMH26) on Friday closed at a two-month high and for the week rose $5.60. March bean oil (ZLH26) futures last week gained 175 points. March soft red winter wheat (ZWH26) for the week was up 19 cents. March hard red winter wheat (KEH26) gained 11 1/4 cents for the week.

U.S. Corn Sees Solid Export Demand

USDA’s 100 million-bu. increase to U.S. corn exports in its February supply and demand report early last week halted selling pressure in futures.

However, the corn futures market’s response to the record U.S. export demand was only tepid. Hefty domestic supplies, a corrective pullback in crude oil, and technical resistance levels above current prices have all crimped buyer interest recently.

Corn futures traders remain focused on second safrinha corn planting in Brazil, with the ideal planting window closing in rapidly. As springtime comes into view, grain trader focus will shift from South American weather to U.S. weather. The USDA’s late-March Prospective Plantings Report and its results will also be a next major market driver.

Soybean Bulls Shift into Higher Gear

The soybean futures market on Friday saw some mild corrective selling and profit taking from the shorter-term futures traders, but the bulls had a very good week, overall. Importantly, soybean meal futures posting a technically bullish weekly high close last Friday gives the soybean and meal bulls better momentum when trader resumes this week, after the three-day holiday weekend. Soybean complex traders will also keep a closer eye on the wheat futures markets this week, given their recent price rallies.

China-U.S. trade relations appear to be on the upswing, which is price-friendly for the soy complex futures. President Donald Trump last week said he will meet in person with Chinese President Xi Jinping in April — possibly to extend the present U.S.-China trade truce. Soybean bulls are hoping better U.S.-China relations will translate into more Chinese purchases of U.S. soybeans in the coming months.

Soybean traders are also closely watching weather conditions in South American bean-growing regions. There are some dry spots in Brazil and Argentina. However, the concern is not serious enough to spark a weather-market rally in soybeans.

Winter Wheat Market Bulls Come to Life

The winter wheat futures markets on Friday sold off on some routine profit-taking pressure and corrective price action after good gains posted last Wednesday and Thursday.

Weather in the U.S. and other global wheat-growing areas is being closely monitored by wheat traders. Rain is needed in U.S. hard red winter areas and in Canada’s Prairies. Meantime, soil moisture has improved in southern Europe. Much of France’s wheat regions are also seeing improved soil moisture. A recent cold snap in Russia and Ukraine has also prompted concerns of some winterkill.

Better U.S.-Global Trade Relations Are Positive for Wheat Markets

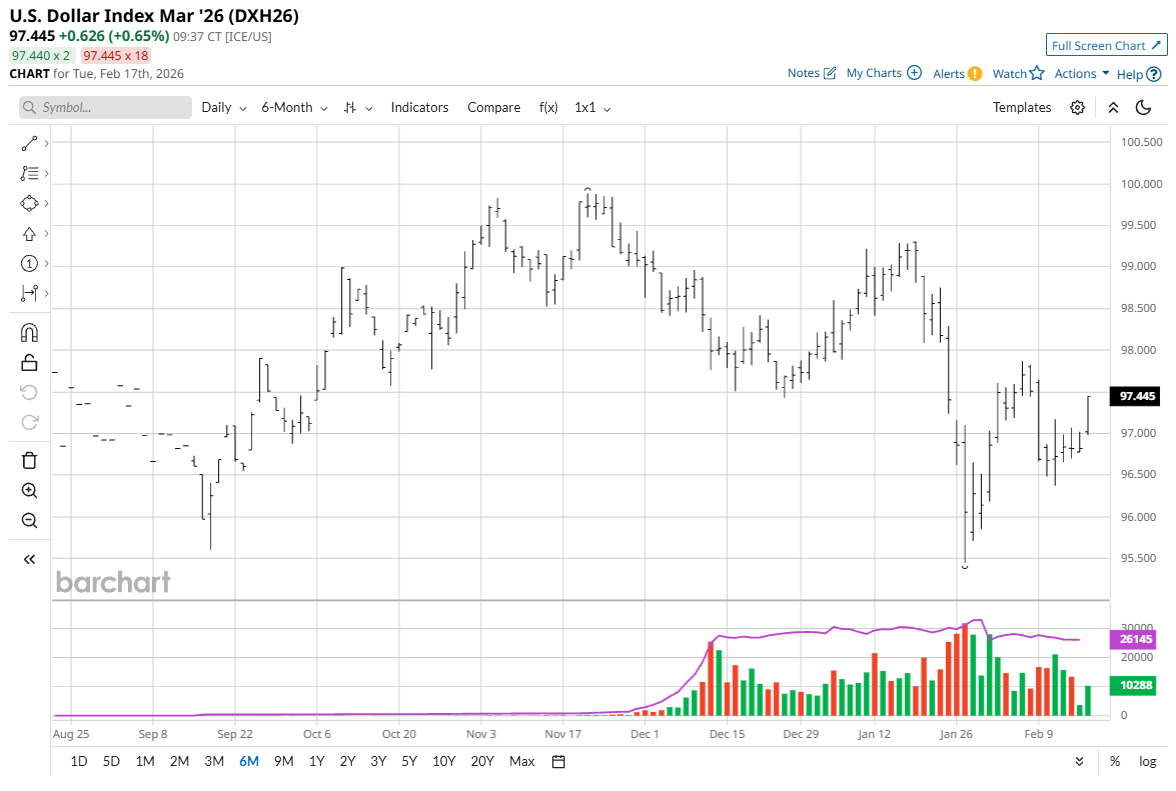

Wheat market bulls have taken note of the improving trade relations between the U.S. and its global counterparts, including the U.S. making trade deals recently that highlight more purchases of U.S. ag products.

The U.S. dollar index ($DXY) has moved well down from its late-2025 high, which is also a positive for better global demand for U.S. wheat — making it more price-competitive on world trade markets.

Tell me what you think. I read every one of your emails. My email address is jim@jimwyckoff.com. I enjoy getting feedback from all of you, my valued Barchart readers.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.