During earnings season, serious investors like Cathie Wood often rebalance their portfolios to add or trim shares of companies based on their performance and long-term growth prospects. Last week, while Wood added 210,000 shares of Tempus AI (TEM) and some other stocks, ARK Invest reduced its exposure to test-equipment maker Teradyne (TER) and social media company Pinterest (PINS).

The question now is whether this move signals caution or simply portfolio rebalancing. Let’s take a closer look.

Tech Stock #1: Teradyne

Valued at $49 billion, Teradyne is a tech company that makes automated testing equipment used to ensure that chips and electrical devices operate properly before shipping. On Feb. 12, Wood’s portfolio dumped 13,992 shares of Teradyne, totaling $4.35 million. Nonetheless, Teradyne remains a significant holding, still accounting for 10.6% of the ARK Autonomous Technology & Robotics ETF (ARKQ).

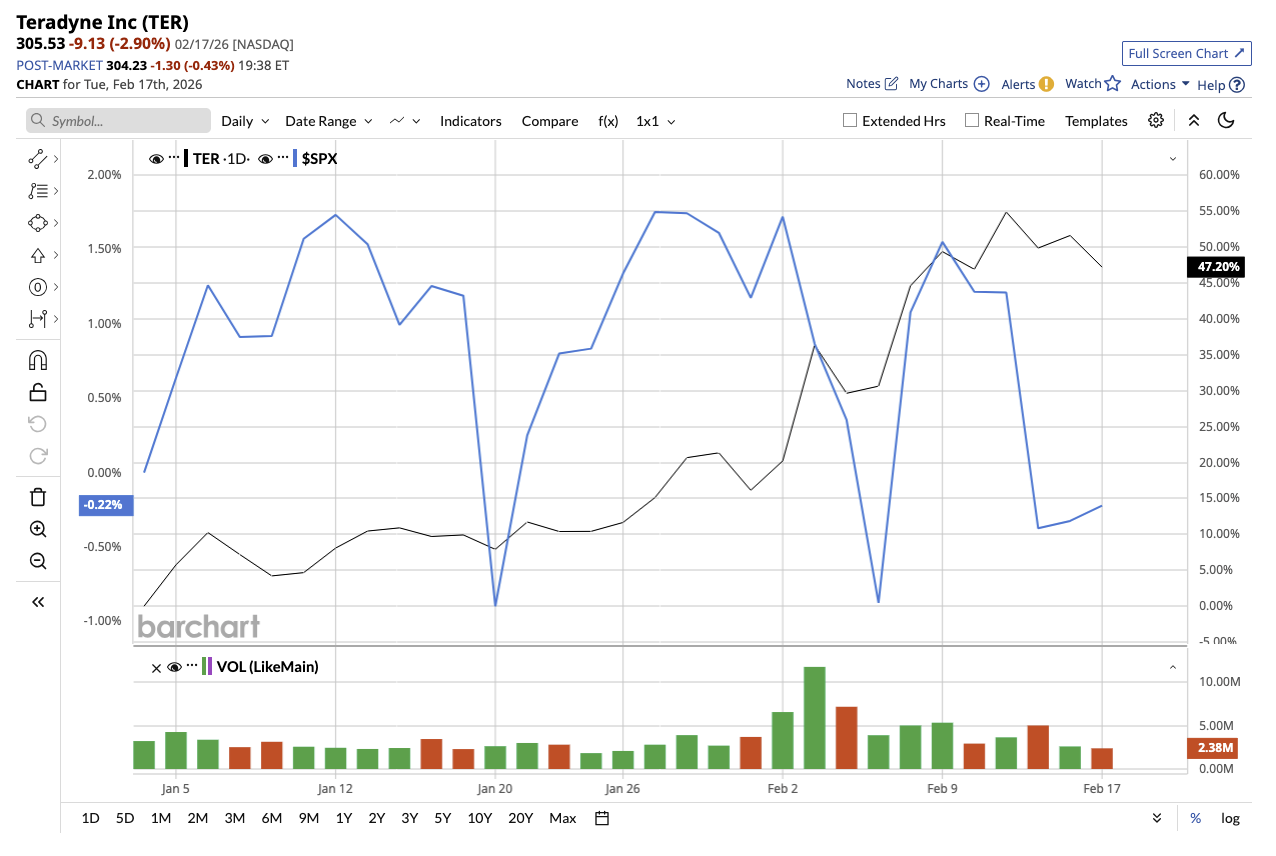

Teradyne shares are up 62% so far this year, outperforming the broader market.

Recently, Teradyne reported its fourth-quarter and full-year results. The company reported strong growth across Semiconductor Test, Product Test, and Robotics, with AI-related demand becoming a dominant driver of revenue. Notably, AI-driven applications accounted for more than 60% of revenue in Q4, and it is expected to account for 70% by early 2026. As AI adoption develops, management anticipates this growth to be driven primarily by increased demand for compute, memory, networking, and data center infrastructure.

Compute, in fact, increased by 90% year-over-year (YOY) in 2025. Management pointed out that investments made in previous years are currently generating profits. In 2023, computation accounted for approximately 10% of SoC revenue, with mobile and auto/industrial dominating. Fast forward to 2025, and computing now accounts for about half of SoC revenue, with mobile and auto/industrial each accounting for roughly 25%. The change reflects the fact that compute is now the major contributor to revenue.

For the full year, revenue jumped 13% to $3.2 billion, while adjusted earnings increased 23% to $3.96 per share. The company generated $450 million in free cash flow and distributed $785 million to shareholders through share repurchases and dividends. Management highlighted that the company’s new target earnings model is based on automated test equipment’s (ATE) total addressable market of $12 billion to $14 billion. Looking ahead, this could lead to the company generating roughly $6 billion in revenue (double of 2025 revenue), gross margins between 59% and 61%, and adjusted earnings of $9.50 to $11 per share.

Cathie Wood’s decision to trim shares of Teradyne does not imply that she has lost faith in the company's long-term prospects. In fact, the company continues to profit from rising AI demand, increased compute exposure, and expansion into the testing and robotics markets. Analysts predict Teradyne's earnings will rise by 58% in 2026, followed by another 28% in 2027. Here, reducing TER stock exposure merely suggests a strategic move from Wood to manage risk by rebalancing the portfolio.

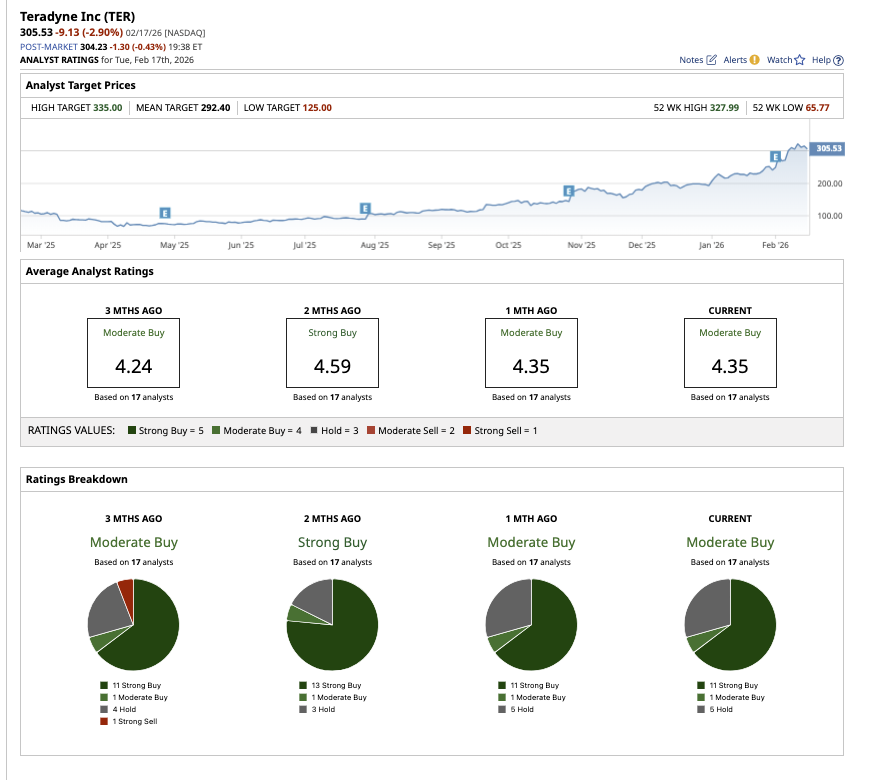

Overall, analysts also remain optimistic about Teradyne’s long-term potential, with an overall “Moderate Buy” consensus rating. Of the 17 analysts covering TER stock, 11 rate it a “Strong Buy,” one has a “Moderate Buy,” and five have a “Hold" rating. TER stock has surpassed its average target price of $292.40. However, the Street-high estimate of $335 implies that the stock can climb 7% from current levels.

Tech Stock #2: Pinterest

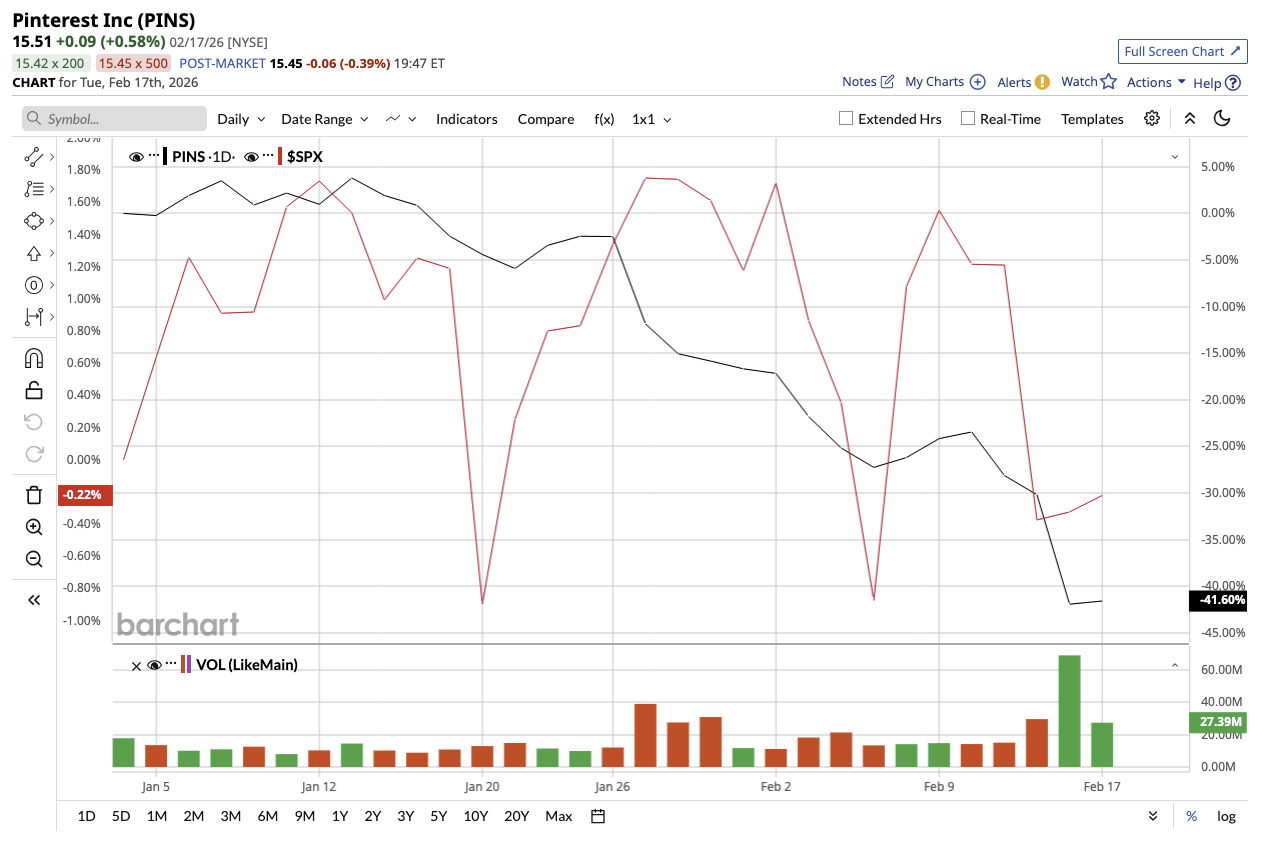

Valued at $11 billion, Pinterest uses its platform to help people visually find ideas and turn inspiration into action, while also earning money through advertising and shopping features. As the company continues to position itself around AI, visual discovery, and e-commerce-driven engagement to return to its pandemic-era glory, Wood trimmed exposure to PINS stock. On Feb. 12, as Pinterest reported its Q4 and full-year earnings, Wood dumped 214,000 shares of Pinterest worth $3.96 million. PINS stock is down 35% so far this year, underperforming the broader market.

PINS stock now holds a small weight of 0.18% in Wood’s ARK Next Generation Internet ETF (ARKW).

Pinterest is undergoing a huge transition. From declining user patterns, it has transformed into an AI-powered, visual-first shopping and discovery platform. At the end of 2025, the company had 619 million global monthly active users, a 12% increase from 2024. The company is using AI to improve visual search, personalization, and discovery, resulting in about 1.7 billion monthly outbound clicks, indicating increased engagement and commercial intent on the platform. Revenue grew 14% in Q4 to $1.3 billion and 16% for the full year to $4.2 billion. Adjusted net income rose 17% for the quarter and 22% for the full year.

Pinterest is also looking into methods to increase monetization options beyond its own platform. It intends to acquire tvScientific, a linked TV performance advertising platform that will enable it to expand its advertiser reach and access new marketing resources. Looking ahead to Q1 2026, the company expects revenue between $951 million and $971 million, an increase of between 11% and 14% YOY.

Pinterest continues to lean heavily on AI to broaden its advertiser base and accelerate revenue growth. Wood’s decision to trim shares looks more like a rebalancing strategy rather than a lack of confidence in the company's long-term prospects. However, given that that company is in a transformation stage, investors must decide whether they are ready to face short-term risks while waiting for Pinterest's long-term AI and commerce-driven strategy to pay off.

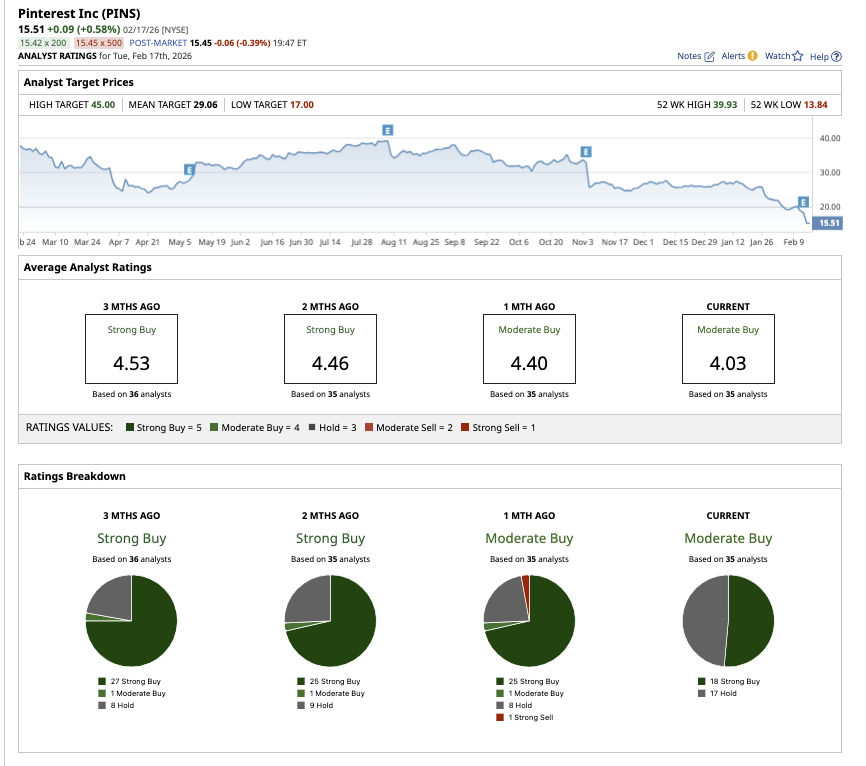

Overall, analysts rate Pinterest stock as a consensus “Moderate Buy.” Of the 35 analysts covering the stock, 18 rate it as a “Strong Buy” while 17 have a “Hold" rating. The average target price of $24.77 suggests potential upside of 49% from current levels. However, the Street-high estimate of $45 implies that the stock could climb as much as 170% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia Dumped Recursion Pharmaceuticals Stock. Should You?

- Etsy Stock Breaks Above Its 20-Day Moving Average on Depop Sale. Does That Make ETSY a Buy Here?

- As Apple Tests AI Devices, Should You Buy AAPL Stock Here?

- Klarna Stock Is Deeply Oversold After Ugly Earnings Plunge. Should You Buy the Dip in KLAR Here?