Gaxos.ai (GXAI) closed more than 40% higher today after Amazon Web Services (AWS) committed to funding preliminary development of its real-time sales coaching platform.

The agreement named cloud services provider Caylent as partner and it focuses on developing Gaxos Labs — an enterprise-scale platform featuring live call transcription, automated coaching intelligence, and post-call analytics built on AWS-native infrastructure.

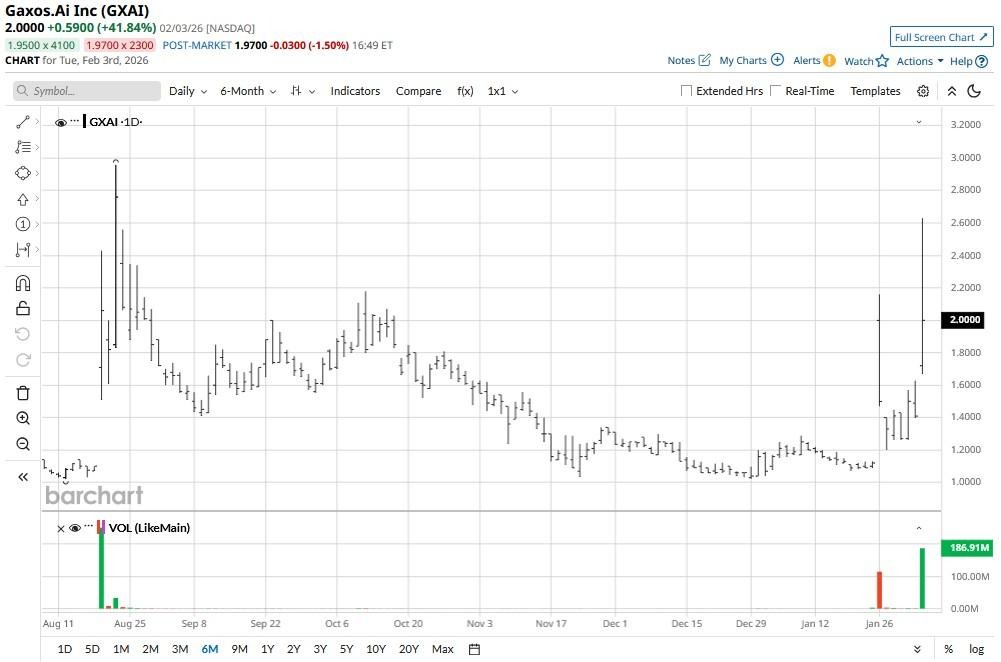

Following the post-announcement surge, GXAI stock is trading at nearly twice its price in late January.

Should You Chase the Momentum in GXAI Stock?

Retail investors cheered the Amazon news on Feb. 3, primarily because it boosts GXAI’s credibility in pursuing large-scale commercial opportunities.

More broadly, the deal confirms Gaxos’ tech has passed some level of due diligence by a world-class player, positioning the small-cap artificial intelligence (AI) firm strongly for future revenue generation.

Still, investors are cautioned against chasing the momentum in GXAI shares since execution risks remain, especially given the company’s limited track record in scaling enterprise applications.

Additionally, Gaxos’ relative strength index (14-day) climbed past 70 today, signaling overbought conditions that often precede a sharp pullback.

Why Gaxos Shares Remain Super Risky to Own

Investors must also appreciate that Gaxos shares up roughly 100% versus their year-to-date low already bakes in significant expectations about future performance.

Plus, even after the recent meteoric rally, GXAI remains a penny stock, which makes it vulnerable to unusually high volatility and liquidity risks.

These are particularly significant negatives since President Donald Trump has nominated Kevin Warsh to be the next chairman of the Federal Reserve.

His valuation-over-liquidity framework means speculative names that thrive solely on excessive liquidity may face a harsh reckoning in 2026.

Gaxos.ai Doesn’t Receive Wall Street Coverage

Finally, Gaxos stock is a no-go also because it doesn’t currently receive Wall Street coverage. Absence of analyst coverage is a glaring red flag, as it means few institutional watchdogs are vetting the financials.

Without professional oversight, investors are flying blind, relying solely on company PR. This lack of transparency often hides structural weaknesses that only surface after a devastating crash.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Amazon Just Gave This Little-Known AI Stock a Huge Boost. Should You Buy Shares Now?

- As Novo Nordisk Stock Breaks Below Key Support Levels, Should You Buy the Dip?

- 4 Reasons To Buy the Dip in SoFi Stock Right Now

- PayPal Stock Is Now Deep in Oversold Territory. Should You Buy the Dip After 8-Day Losing Streak?