Alphabet (GOOGL) recently posted robust fourth-quarter and full-year results, with its annual revenue surpassing the $400 billion mark for the first time in its history. Growth accelerated across Alphabet’s core businesses, driven largely by artificial intelligence (AI)-led capabilities, while its backlog expanded meaningfully.

While its strong Q4 performance should have propelled the stock higher, Alphabet’s share price instead lost steam. The primary reason is due to investor concern over capital expenditures (capex). As Alphabet continues to deepen its AI capabilities and scale infrastructure to meet rising demand, management has guided for a substantial increase in spending. Capex is expected to reach between $175 billion and $185 billion in 2026, nearly double the $91.5 billion invested in 2025, with spending set to ramp up as the year progresses.

Higher capex will drive faster depreciation growth, beginning in the first quarter of 2026 and increasing meaningfully over the full year. As a result, free cash flow is likely to come under pressure, creating a headwind that the market is already factoring into the stock’s valuation.

The muted reaction post Alphabet’s solid Q4 results suggests that investors were not comfortable with the scale of the spending increase. However, this pushback does not undermine the long-term investment thesis. The elevated capex is due to Alphabet’s strategy to defend and expand its leadership in AI, cloud computing, and digital advertising, areas that continue to show strong demand and long-term growth potential.

While the near-term impact on free cash flow may weigh on sentiment, Alphabet’s underlying business strength, accelerating growth, and strategic positioning in AI support its investment case.

Alphabet to Sustain Strong Growth in 2026

Alphabet has faced investor skepticism about its high capex guidance for 2026. Yet, the company’s latest results and outlook suggest GOOGL stock remains a compelling investment.

Its aggressive investment in AI is already translating into tangible business momentum. In the fourth quarter of 2025, Alphabet delivered robust financial performance, with consolidated revenue rising 18% year-over-year (YOY) to $113.8 billion. Growth was broad-based, led by acceleration in Search and Google Cloud. These results highlight AI as becoming a meaningful growth engine across Alphabet’s core businesses.

Google Services, which includes Search, YouTube, and subscriptions, generated $95.9 billion in revenue, up 14% from the prior year. Search and other advertising revenues climbed 17% to $63.1 billion, reflecting stronger engagement and improved monetization driven by AI-powered enhancements. YouTube advertising revenue increased 9% to $11.4 billion, supported by solid direct-response advertising demand despite difficult YOY comparisons.

Google Cloud once again delivered exceptional growth, with revenue surging 48% to $17.7 billion in the quarter. This acceleration was driven by strong enterprise demand for AI-related offerings, particularly within Google Cloud Platform (GCP). GCP continues to outperform the broader cloud business, benefiting from higher win rates with new customers, larger long-term customer commitments, and increased spending from existing clients. Enterprise AI products are now generating billions in quarterly revenue, reflecting their growing importance to Alphabet’s overall growth profile.

This momentum is being driven by strength across both AI infrastructure and AI solutions. Demand for enterprise-grade infrastructure, including TPUs and GPUs, has been robust as customers scale AI workloads. At the same time, Alphabet’s proprietary models, including Gemini 3, are gaining traction across industries.

Google Cloud’s backlog rose 55% sequentially and more than doubled YOY, reaching $240 billion by the end of the fourth quarter. This sharp increase reflects strong multi-year demand, led primarily by enterprise AI contracts from a diverse customer base.

Looking ahead, Alphabet’s continued investment in AI compute capacity, even at the cost of higher near-term capex, positions the company for faster growth in 2026 and beyond. The rapidly expanding cloud backlog provides further confidence that revenue momentum is sustainable.

Why Alphabet Stock is a Buy

Alphabet is converting its AI investments into real revenue. Moreover, a $240 billion backlog and growing billion-dollar deals suggest that its AI strategy is gaining traction. Short-term free cash flow pressure may persist, but it does not outweigh the durability and scalability of Alphabet’s growth engine.

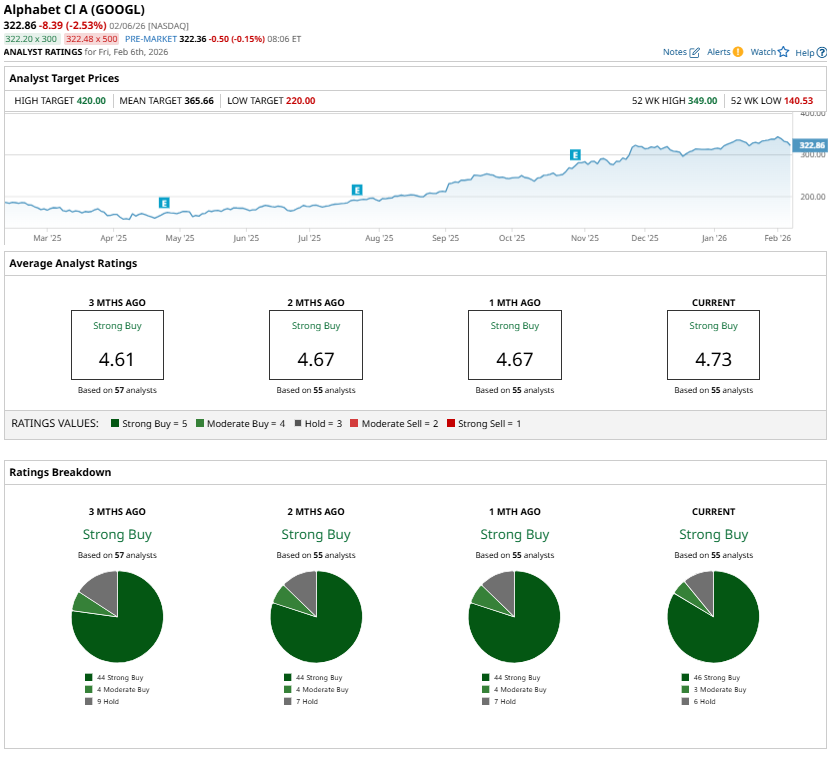

Wall Street analysts also maintain a “Strong Buy” consensus rating on GOOGL despite concerns about capex.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Palantir Bets on 61% Revenue Growth in 2026, Should You Buy Palantir Stock?

- Amid Capex Concerns, Should You Buy, Sell, or Hold Alphabet Stock?

- QuantumScape Just Broke Through Its 200-Day Moving Average. Should You Buy QS Stock Before Earnings?

- Oracle Heads Toward Key Resistance Levels After Analyst Upgrade. Should You Buy ORCL Stock Here?