Issaquah, Washington-based Costco Wholesale Corporation (COST) is a retail company that operates a global chain of membership-only warehouse club stores. Valued at a market cap of $444.4 billion, the company offers bulk quantities of food, household goods, electronics, apparel and other merchandise at low prices to members.

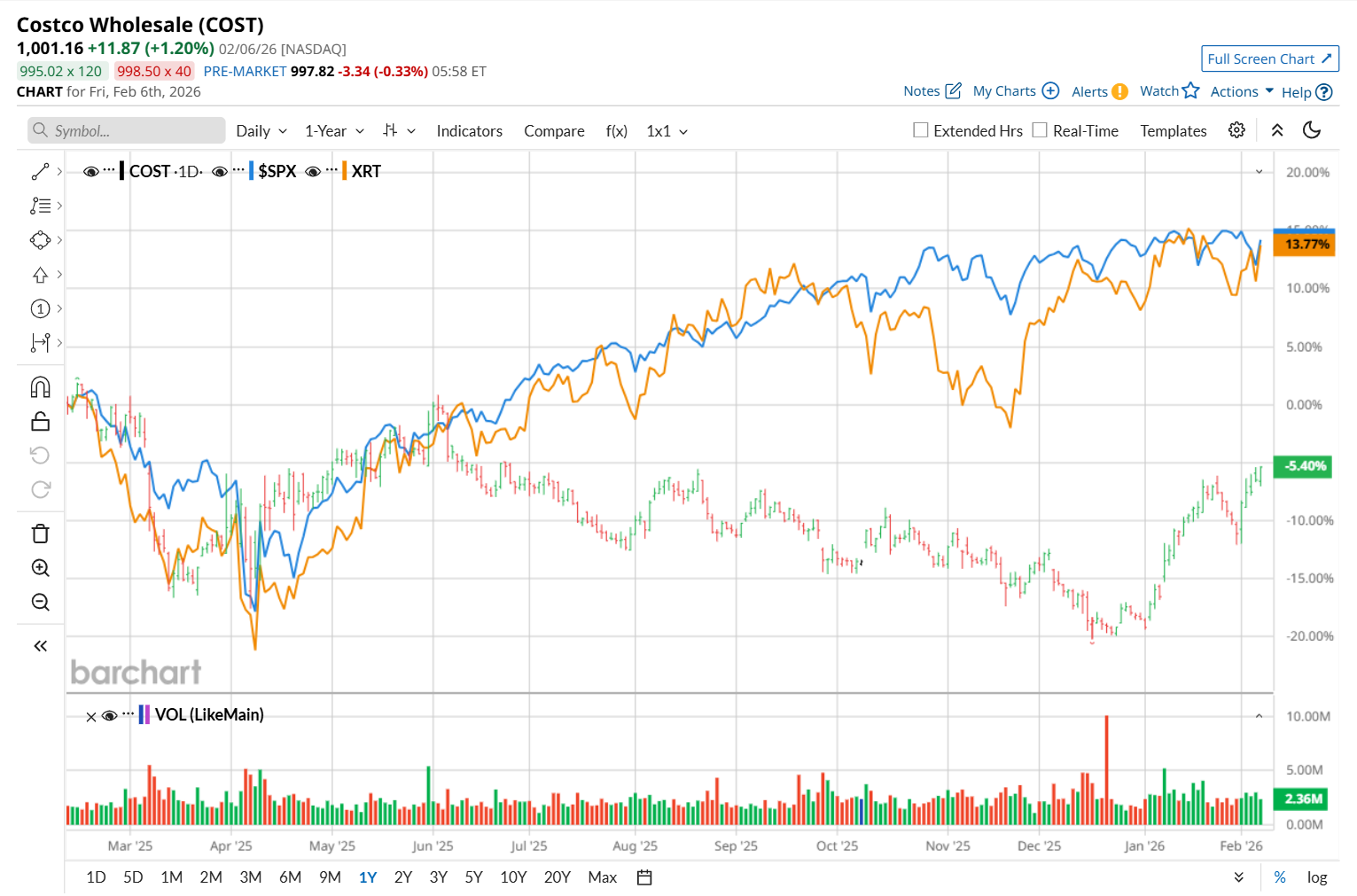

This retail company has underperformed the broader market over the past 52 weeks. Shares of COST have declined 4.7% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14%. However, on a YTD basis, the stock is up 16.1%, outpacing SPX’s 1.3% rise.

Narrowing the focus, COST has underperformed the State Street SPDR S&P Retail ETF’s (XRT) 12.1% rise over the past 52 weeks. Nonetheless, it has outperformed XRT’s 5.2% YTD growth.

On Dec. 11, COST posted its Q1 results. The company’s total revenue increased 8.3% year-over-year to $67.3 billion, supported by new warehouse openings, higher membership fee income, productivity improvements, and greater use of digital tools. Moreover, its net income per share came in at $4.50, up 11.4% from the prior-year quarter. However, despite the strong operating performance, its shares remained muted in the subsequent trading session.

For fiscal 2026, ending in August, analysts expect COST’s EPS to grow 12.2% year over year to $20.18. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in three of the last four quarters, while missing on another occasion.

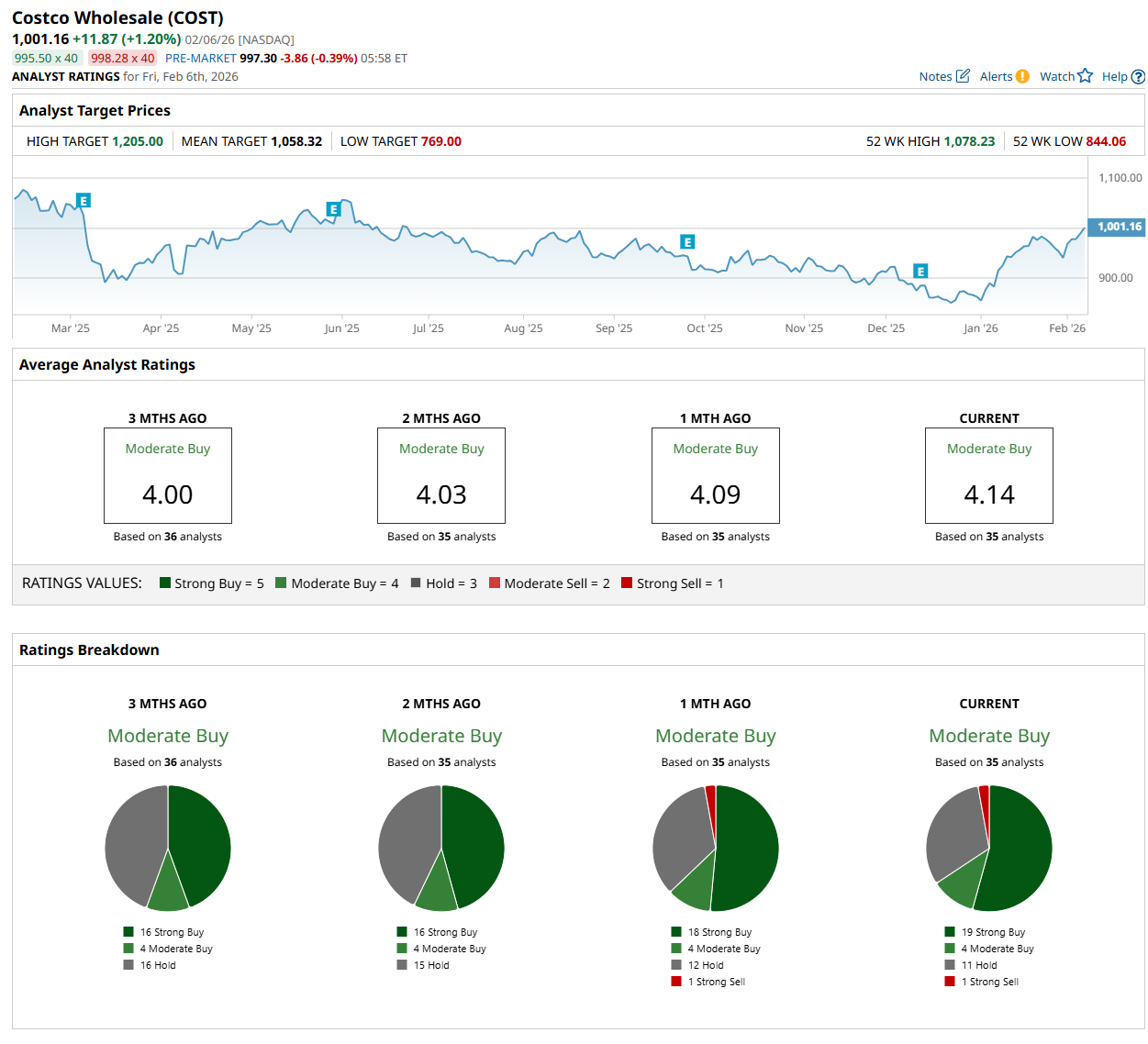

Among the 35 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 19 “Strong Buy,” four "Moderate Buy,” 11 "Hold,” and one “Strong Sell” rating.

The configuration is more bullish than a month ago, with 18 analysts suggesting a “Strong Buy” rating.

On Feb. 4, D.A. Davidson analyst Michael Baker maintained a “Hold” rating on COST and set a price target of $1,000.

The mean price target of $1,058.32 represents a 5.7% premium from COST’s current price levels, while the Street-high price target of $1,205 suggests a 20.4% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart