The semiconductor industry’s undisputed leader, Nvidia (NVDA) is reportedly facing delays in releasing its new gaming GPUs. The GPUs were scheduled for release this year, but that has been delayed due to an ongoing supply crunch in the memory segment. If a new gaming GPU is not released this year, it would be the first time in three decades.

The company has chosen to focus on memory supply, which is facing a crisis driven by demand for artificial intelligence (AI) accelerators. Nvidia is also cutting production of its gaming GPU lineup for the same reason.

The company is facing some hurdles, primarily due to geopolitical tensions. Nvidia’s H200 AI chip sales in China have been stalled for nearly two months, pending a U.S. national security review. Facing this regulatory dilemma, Chinese customers have also become cautious about placing H200 orders until they receive confirmation that the company can secure the required licenses.

While the current administration is willing to approve the purchase of the chips in question by TikTok owner ByteDance, Nvidia has reportedly not agreed to the U.S. government's Know Your Customer (KYC) requirement. Hence, the deal now hinges on the company's acceptance of the conditions.

On top of that, Nvidia's plan to invest $100 billion to train and run OpenAI’s newest AI models has also stalled, with both sides reconsidering the partnership. Now, the discussions include a smaller equity investment worth tens of billions of dollars.

Amid this situation, has the bull case for Nvidia weakened?

About Nvidia Stock

Nvidia leads accelerated computing with GPUs powering AI, gaming, data centers, and autonomous vehicles. It dominates the AI accelerator and discrete GPU markets through brands like GeForce for gamers and RTX for professionals. The company has a massive capitalization of $4.5 trillion.

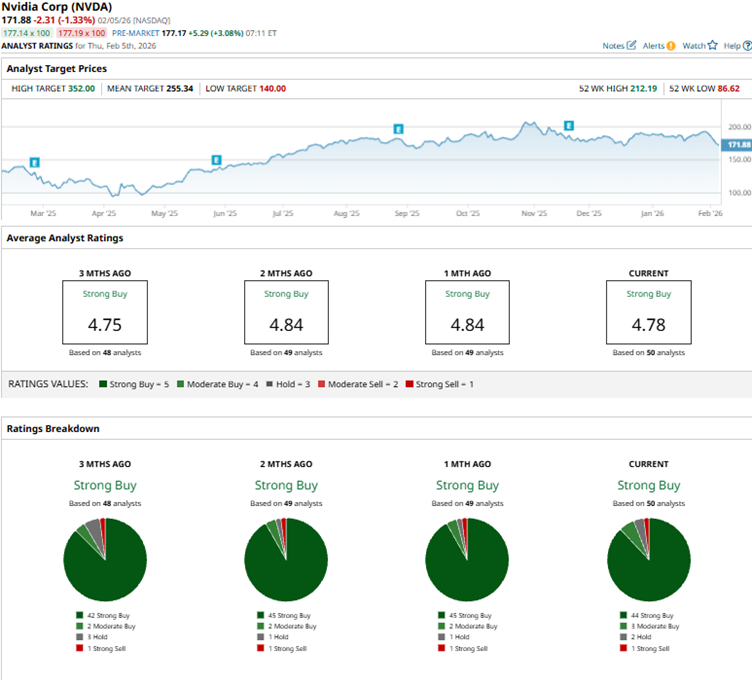

NVDA stock is a Wall Street darling, as evidenced by the stock’s 47% gain over the past 52 weeks, while the broader S&P 500 Index ($SPX) has increased 16% over the same period. However, with concerns about an AI bubble, NVDA stock is up just 2% year-to-date (YTD). The shares had reached a 52-week high of $212.19 in late October, but are down 10% from that level.

On a forward-adjusted basis, NVDA stock is trading at a price-to-earnings (P/E) ratio of 44 times, higher than the industry average.

Nvidia Continues to Report Strong Growth

Nvidia's third-quarter fiscal 2026 results recorded solid growth and surpassed expectations, exhibiting that the firm remains a financial growth giant. The company’s quarterly revenue increased 62% year-over-year (YOY) to $57.01 billion, which was higher than the $54.74 billion that Wall Street analysts had expected.

CEO Jensen Huang stated that Nvidia’s Blackwell infrastructure sales were “off the charts” and its cloud GPUs had sold out. The company’s Q3 data center revenues increased by 66% YOY to a record $51.2 billion. Gaming revenue for the quarter was $4.3 billion, up 30% YOY.

Nvidia's bottom-line financials are also growing at a robust pace. The company’s non-GAAP EPS grew by 60% annually to $1.30, exceeding Wall Street analysts’ $1.24 expected figure. Given its financial strength, Nvidia rewarded investors with cash dividends and share repurchases.

Wall Street analysts are robustly optimistic about Nvidia’s future earnings. They expect EPS to climb by 70% YOY to $1.45 for Q4 fiscal 2026 (to be reported on Feb. 25 after the market closes). For full-year fiscal 2026, EPS is projected to surge 51% annually to $4.43, followed by 59% growth to $7.03 in fiscal 2027.

Here’s What Analysts Think About NVDA Stock

Last month, Jefferies analysts raised the price target on NVDA stock from $250 to $275 while maintaining a “Buy” rating, believing the stock to be “pretty cheap.” RBC Capital analyst Srini Pajjuri initiated coverage with an “Outperform” rating and a price target of $240, highlighting robust AI demand and Nvidia’s backlog exceeding $500 billion.

Nvidia has been in the spotlight on Wall Street for some time now, with analysts awarding NVDA stock a consensus “Strong Buy” rating overall. Of the 50 analysts rating the stock, a majority of 44 analysts have a “Strong Buy,” three analysts suggest a “Moderate Buy,” two analysts play it safe with a “Hold” rating, and one analyst offers a “Strong Sell” rating. The consensus price target of $255.34 represents 34% potential upside from current levels. Moreover, the Street-high price target of $352 points to 84% potential upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Analyst Has Finally Had Enough of AI CapEx at Microsoft. Should You Be Done with MSFT Stock Too?

- The Shocking Reason This Analyst Says Michael Saylor and MicroStrategy Stock Will Take Bitcoin Prices to $0

- Google Gemini Is Just Getting More Popular. Does That Make GOOGL Stock a Buy Here?

- Should You Buy the Post-Earnings Dip in Amazon Stock?