E-commerce leader Amazon.com (AMZN) saw its stock drop 5.6% intraday on Feb. 6 after reporting its fourth-quarter earnings on Feb. 5. The reason for this post-earnings dip was due to the company’s increasing CapEx, which is expected to climb to $200 billion in 2026, as Amazon scales its artificial intelligence (AI) aspirations.

However, the AI boom is at risk of becoming a bubble, raising concern among investors that it's about to burst. Amazon has already shed about $300 billion in market capitalization as investors have reacted pessimistically to rising AI costs. Analysts at D.A. Davidson downgraded the stock to “Neutral” post the earnings release, citing concerns related to its spending plans and the potential for AI to erode its retail business.

Should you consider capitalizing on Amazon’s stock now?

About Amazon Stock

Headquartered in Seattle, Washington, Amazon is a leader in e-commerce and cloud computing through AWS. Its vast operations serve millions globally, dominating online retail. The company has a market capitalization of $2.25 trillion.

Slow AWS growth fueled concerns that it was missing AI opportunities amid rising competition. E-commerce faced stiff competition from Walmart. The company is also reducing jobs and pushing for organizational changes. As a result, Amazon’s shares have been hit with a bout of volatility.

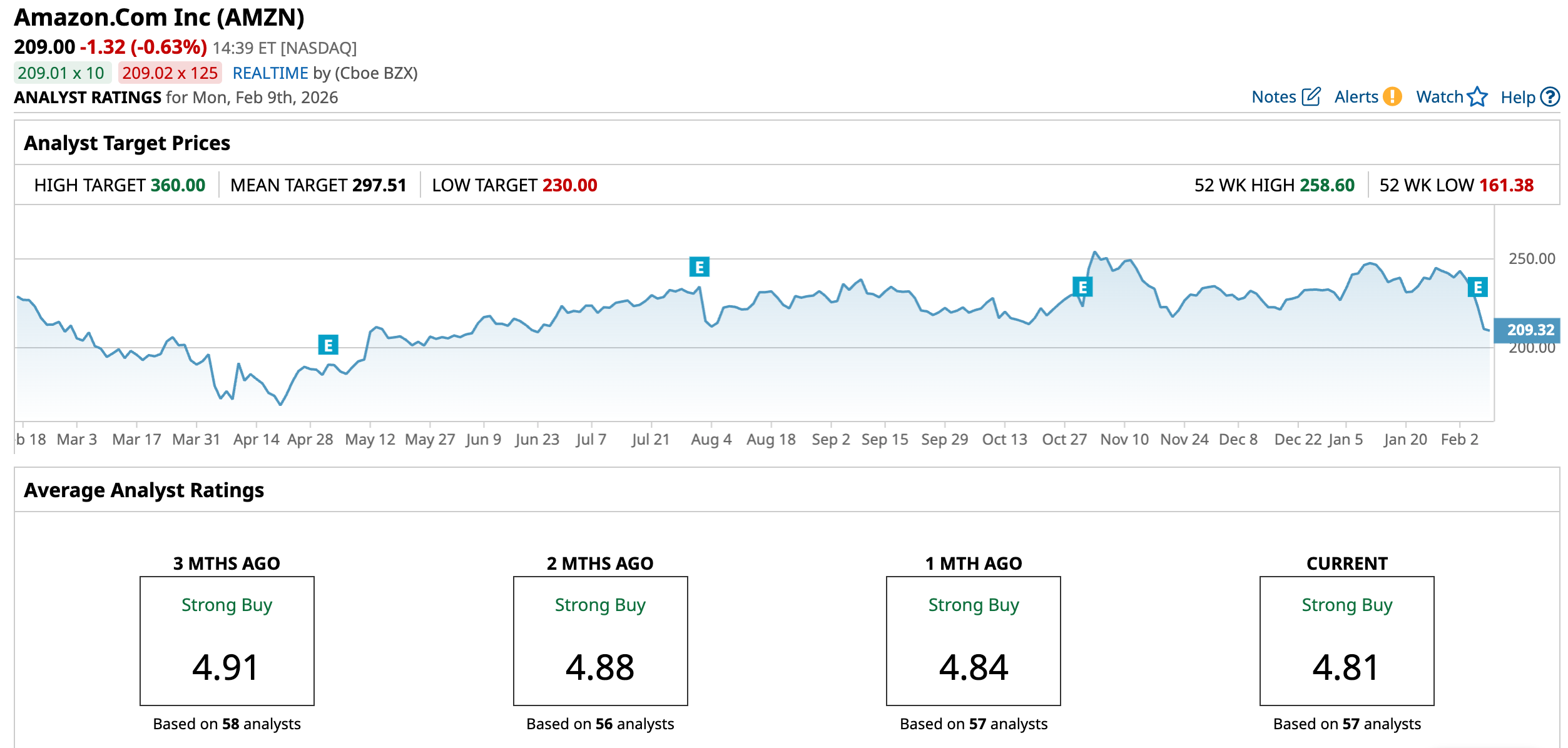

Over the past 52 weeks, the stock has declined 8.48%, and it is down 9.14% year-to-date (YTD). The stock reached a 52-week high of $258.60 in November but is down 19% from that level.

On a forward-adjusted basis, Amazon’s stock is trading at 27.40x, higher than the industry average of 17.94x.

Amazon’s Q4 Earnings Snapshot

Despite a sharp post-Q4 stock drop, Amazon’s results showed broad-based growth. The company’s total net sales increased 14% year-over-year (YOY) to $213.39 billion, exceeding the $211.46 billion that Wall Street analysts had expected. This growth was driven by expansion across both product and service sales. Excluding a favorable impact from YOY changes in foreign exchange rates throughout the quarter, net sales increased 12%.

The company continues to enjoy significant leverage in the e-commerce space. For instance, Amazon’s online store sales increased by 10% from the prior-year period to $82.99 billion, while it was named as the lowest-priced U.S. retailer by Profitero for the ninth year in a row, as its online prices are on average 14% lower than those of other major U.S. retailers.

The AWS segment grew the fastest in 13 quarters, increasing by 24% YOY to $35.58 billion. The segment also reported a high operating income of $12.47 billion during the quarter.

Overall, Amazon’s operating income increased by 18% from its year-ago value to $24.98 billion. However, the company’s operating income included three one-time charges totaling approximately $2.44 billion for tax disputes related to Italian stores, severance, store-related asset impairments, and a lawsuit settlement. Excluding them, it would have reached $27.40 billion.

However, Amazon’s bottom line grew more slowly than the top line growth for the quarter. Its EPS for Q4 was $1.95, on a diluted basis, which was 5% higher YOY. However, the figure missed the $1.98 Wall Street analysts’ expected figure.

For the first quarter, Amazon expects net sales to be in the range of $173.50 billion to $178.50 billion, implying a growth of 11% to 15% YOY. Operating income is projected to be between $16.50 billion and $21.50 billion, compared to $18.40 billion in the prior-year period. The operating income guidance includes a $1 billion increase in costs YOY, primarily related to Amazon Leo, the company’s low-earth orbit satellite network.

Wall Street analysts have a positive view about Amazon’s bottom line trajectory. For the current quarter, its EPS is expected to grow by 6.3% YOY to $1.69. For fiscal 2026, the company’s EPS is projected to increase by 9.8% annually to $7.87, followed by a 21.7% increase to $9.58 in fiscal 2027.

What Do Analysts Think About Amazon’s Stock?

Post the Q4 results, analysts have mostly reaffirmed their ratings on Amazon’s stock. Wells Fargo analysts maintained an “Overweight” rating and raised the price target from $301 to $305. Steven Forbes from Guggenheim also maintained a “Buy” rating on Amazon, with a price target of $300.

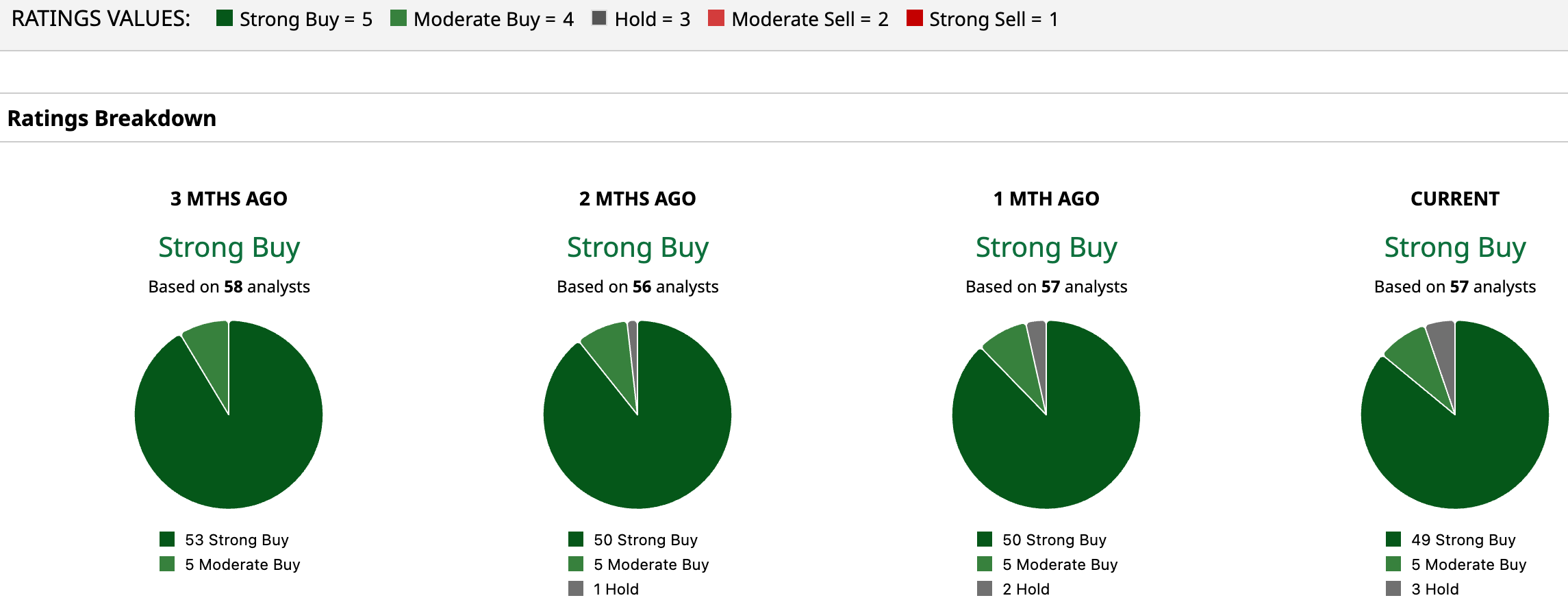

Amazon has been a Wall Street favorite for quite some time now, with analysts awarding it a consensus “Strong Buy” rating overall. Of the 57 analysts rating the stock, a majority of 49 analysts have rated it a “Strong Buy,” five analysts suggest a “Moderate Buy,” while three analysts are playing it safe with a “Hold” rating. The consensus price target of $297.51 represents 42.4% upside from current levels. Moreover, the Street-high price target of $360 indicates a 72.3% upside.

Key Takeaways

Despite valid concerns that an AI bubble burst could affect Amazon’s stock, the company’s retail business continues to grow, which may be the moat that offsets potential losses from its AI ambitions. With Wall Street analysts still bullish on the stock, it might be worth capitalizing on Amazon’s dip.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Analyst Has Finally Had Enough of AI CapEx at Microsoft. Should You Be Done with MSFT Stock Too?

- The Shocking Reason This Analyst Says Michael Saylor and MicroStrategy Stock Will Take Bitcoin Prices to $0

- Google Gemini Is Just Getting More Popular. Does That Make GOOGL Stock a Buy Here?

- Should You Buy the Post-Earnings Dip in Amazon Stock?