Bitcoin (BTCUSD) just lost more than 50% of its value in a matter of months and is getting analyst attention again, albeit for all the wrong reasons. Richard Farr, who is the chief market strategist and partner at Pivotus Partners, just lowered his price target on the cryptocurrency to zero. His reasons: Bitcoin fails as a medium of exchange due to its environmental impact and faces multiple hurdles in institutional adoption.

"No serious central bank will ever own something where Michael Saylor controls the float."

Join 200K+ Subscribers: Find out why the midday Barchart Brief newsletter is a must-read for thousands daily.

This isn’t the first time someone has expressed his bearish sentiments on Bitcoin. In the recent past, Michael Burry has also criticized it, pointing out Strategy’s (MSTR), formerly known as MicroStrategy, speculative bets on the cryptocurrency. Michael Saylor’s company has been buying Bitcoin for some time now and is currently in the red on its investments. Burry warned that another 10% crash could spell trouble for MSTR, but a strong finish on Friday suggests investors are still very much interested in the stock.

About Strategy Stock

Strategy is a company involved in the purchase of Bitcoin through proceeds from the issuance of equity and debt financings. Through its stock, investors can gain exposure to the cryptocurrency. It is led by Michael Saylor and is headquartered in Tysons Corner, Virginia.

While Bitcoin has lost half its value in over six months, MSTR has fared much worse. The stock is down over 70% from its 52-week high, a massive drop that hasn’t pleased investors one bit.

Strategy has a total debt of $8.2 billion and cash in hand of about $2.3 billion. The company uses this cash to buy more Bitcoin, and when it runs out of money, it raises further cash either through at-the-market offerings or convertible notes. It also maintains a small software business, but the market judges it purely on its Bitcoin ventures. The company’s prospects are therefore the same as those of Bitcoin, which aren’t very positive if recent analyst sentiment is anything to go by. Richard Farr's price target of $0 doesn't help either.

One could argue that Strategy has lost nearly 80%, while Bitcoin has only lost 50%. However, the added risk of the stock market probably justifies this difference and doesn’t necessarily make the stock a better buy than Bitcoin itself.

Strategy's Earnings

Strategy reported a -193% drop in EPS in the last quarter, announced earlier last week on Feb 6. The reason for this drop is the way the company books profit and loss. If the Bitcoin price goes up, the company reports it as profit by the quarter's end. If it goes down, it counts as a loss. There isn’t any cash flow involved. Considering the fact that Bitcoin is taking a beating in the ongoing quarter as well, one can expect another quarter with a big loss. At the end of the day, it all comes back to the price of Bitcoin as far as investors are concerned.

As of Feb 1, the company holds 713,502 Bitcoins on its balance sheet, with an average cost per Bitcoin of about $76,000. Since Bitcoin is trading at a lower price, the company is in the red as far as its Bitcoin investments are concerned.

What Are Analysts Saying About MSTR Stock?

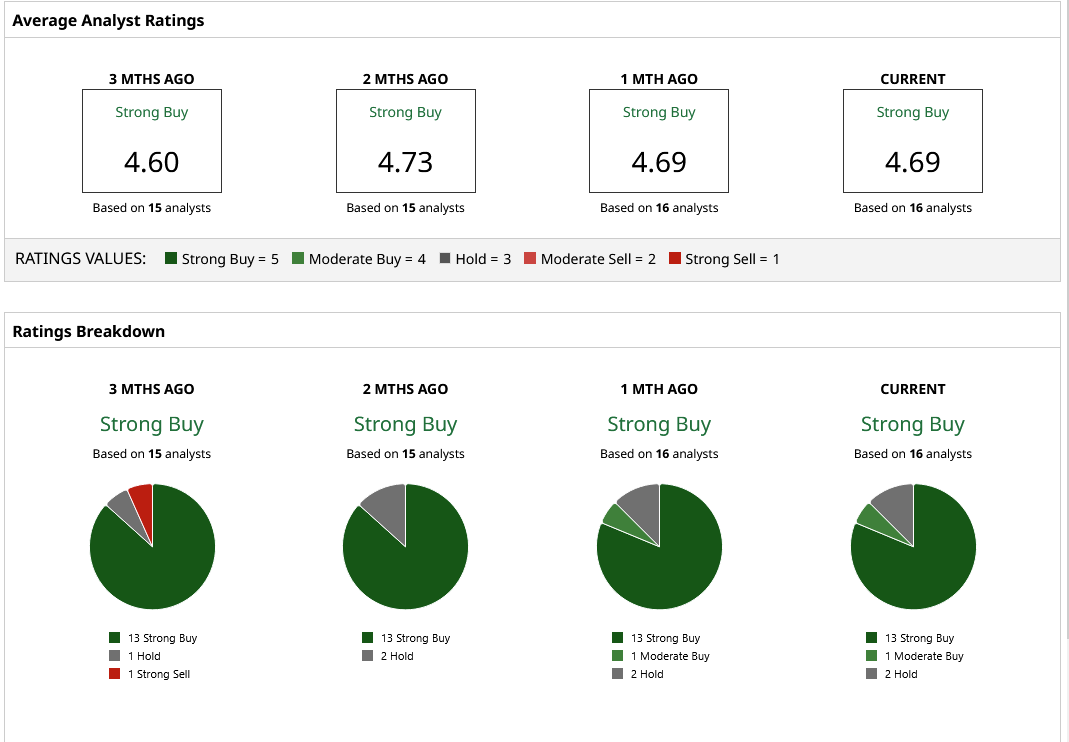

On Feb. 6, H.C. Wainwright raised its target price on MSTR stock from $500 to $540. Clearly, many analysts are still bullish on the stock. Of the 16 analysts who cover it on Wall Street, 13 have a “Strong Buy” rating.

Three months ago, the sentiment was similar. This is incredible for a stock that has lost half its value in the same period. H.C. Wainwright's target price upgrade shows how Wall Street is ready to double down on its bullish stance on a stock that has performed poorly.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Shocking Reason This Analyst Says Michael Saylor and MicroStrategy Stock Will Take Bitcoin Prices to $0

- Bitcoin Prices Are Deeply Oversold. What Crypto Price Predictions Say Could Come Next.

- Michael Saylor's Strategy Is Now Underwater on Bitcoin. Is The Dam Breaking Open?

- 2 Ways to Trade Falling Bitcoin Prices as Wall Street Turns to Gold, Silver Instead