Doubts are mounting about the business relevance of Customer Experience Management, while long-term stock returns on customer satisfaction spectacularly outperform market indices. What gives?

American Customer Satisfaction Index:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250211643621/en/

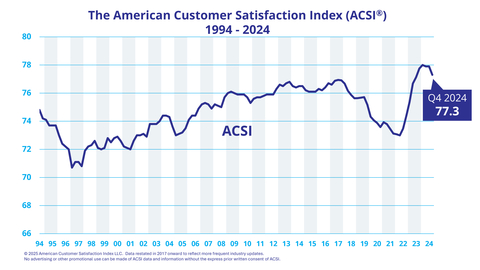

ACSI 1994-2024 (Graphic: Business Wire)

The American Customer Satisfaction Index was developed at the University of Michigan by a prominent group of scientists under the leadership of Claes Fornell, the Distinguished Donald C. Cook Professor of Business (Emeritus). Dr. Fornell is a world-leading scholar in multivariate statistical models with latent variables and in customer satisfaction measurement and analysis. The group includes former University of Michigan faculty, Michael D. Johnson, now Professor and Marketing Department Chair, University of Wisconsin, and Gene Anderson, now Dean of the Pittsburgh School of Business. Important research contributions were also provided by David F. Larcker, the James Irvin Miller Professor of Accounting at Stanford University, and former University of Michigan faculty, Birger Wernerfelt, now the JC Penney Professor of Management at MIT. Due to the commercial applicability of ACSI, the University of Michigan’s Technology Transfer Unit later shifted its ownership to its developer, Dr. Fornell. |

U.S. overall customer satisfaction drops slightly in the fourth quarter of 2024, down 0.8% to 77.3 on a scale of 0 to 100, according to the American Customer Satisfaction Index (ACSI®).1

In order to improve the satisfaction of their customers, U.S. companies have invested billions of dollars in Customer Experience Management (CXM). There are now doubts about the return on that investment. Forrester’s CX index is at an all-time low. Qualtrics, the largest supplier of CX analytics tools and software, says that the opportunity cost of CX failure (to satisfy customers) is at a record high. ACSI registered a small drop in the fourth quarter of 2024 but remains near a record high.

Over the long term, what is the stock return for companies with higher levels and greater improvements in customer satisfaction, relative to competition? ACSI researchers analyzed this using ACSI scores and stock prices of those companies from 2006 through the first month of 2025. The number of holdings varied from 25-35. Each holding was re-assessed annually. When a company no longer qualified (lower ACSI scores than its competitors), it was replaced. The cumulative return over this time period was 2,265% for the leading ACSI companies vs. 605% for the S&P 500. The annualized returns were 18.03% and 10.78%, respectively. Around 5% of actively managed funds outperformed the S&P 500 over that period of time, with even fewer achieving higher annualized returns compared to those on customer satisfaction.

While CX has been unable to demonstrate business relevance, the opposite is true for customer satisfaction as evident from the mathematics of customer retention: Its rate of growth has an exponentially escalating effect on revenue and profit margins, since customer acquisition is more costly than customer retention. The ACSI analytics technology is designed to capture this effect by calibrating the measurement instrument of customer satisfaction to maximize its impact on customer retention. Accordingly, at high levels of retention, the revenue/earnings increase becomes very large, turning the dogma of “high risk/high return” on its head. That is, high customer retention, by definition, reduces the risk of customer churn — with low risk/high return as a result. The operating mechanism in this context with respect to the stock market appears to emanate from earnings surprises, caused by changes in customer satisfaction while unobserved by the market.

“There are, nevertheless, certain necessary conditions for these returns to occur. Absence of (or at least weak) monopoly power is one of them,” said Claes Fornell, founder of the ACSI and the Distinguished Donald C. Cook Professor (emeritus) of Business Administration at the University of Michigan. “In well-functioning consumer markets, companies are financially rewarded for treating their customers well and penalized for treating them poorly. That is how capitalistic free markets are supposed to work. Over the past couple of decades, there have been periods when these requirements were not met and, as a result, customer satisfaction produced relatively weaker returns.”

From 2021 to early 2024, the COVID-19 pandemic contributed to supply chain obstacles, increasing inflation, and consumer markets in which demand exceeded supply. Data from the Bureau of Economic Analysis (BEA) and the National Income and Product Accounts (NIPA) show that profit margins increased as inflation rose. Accordingly, pricing power strengthened, and stock returns were high. Consumers had money to spend, but they were unhappy with prices, product quality, and services. Customer satisfaction, as measured by ACSI, fell sharply but it did not matter for the stock market. As a result, stock returns on customer satisfaction underperformed the market. While customer satisfaction returned 31% in 2020 (versus 26% for the S&P 500), the subsequent 3.5 years were a period of relative underperformance. Yet, except for 2022, the customer satisfaction returns remained positive and higher than the long-term S&P 500 average. Over the past 12 months (February 2024–February 2025), customer satisfaction increased (save small dips in Q2 and Q4 of 2024) and its stock returns regained their market superiority (31.2% versus 26.4%).

Nevertheless, the risk of malfunctioning markets may not have evaporated. This time, it may be the equity markets that could be a cause for alarm. An enormous growth in passive investing has led to greater market concentration: 2% of the companies in the S&P 500 now account for about 40% of the index. Unless a stock portfolio includes at least some of these companies, the probability of it beating the S&P 500 is infinitely small. However, the opposite is obviously true if the stock price falls for the 2%, but that might also indicate some sort of change from passive to active investing.

Much of the reason for CX’s failure in improving customer satisfaction and for its lack of business relevance is due to the shortcomings of its analytics technology. The most frequently used CX performance metric is constructed in such a manner that it amplifies noise instead of minimizing it, which is particularly problematic for benchmarking and making comparisons over time, as the noise levels multiply. The CX analytics methods are ill-suited with respect to the properties of the customer data, which are characterized by very high multicollinearity, extremely skewed frequency distributions, and a great deal of measurement error. They are also limited in their ability to produce causal inference — which, at some point or another, is essential for the efficient allocation of resources to improve customer satisfaction (and the financial results that emanate from it).

For more, follow the American Customer Satisfaction Index on LinkedIn and X at @theACSI or visit www.theacsi.org.

No advertising or other promotional use can be made of the data and information in this release without the express prior written consent of ACSI LLC.

1The ACSI score of 77.3 for Q4 represents four rolling quarters of data from Q1 through Q4 of 2024. It is based on 233,268 completed surveys across 428 companies, covering 45 industries and 10 economic sectors.

About the ACSI

The American Customer Satisfaction Index (ACSI®) has been a national economic indicator for over 25 years. It measures and analyzes customer satisfaction with approximately 400 companies in about 40 industries and 10 economic sectors, including various services of federal and local government agencies. Reported on a scale of 0 to 100, scores are based on data from interviews with roughly 200,000 responses annually. For more information, visit www.theacsi.org.

ACSI and its logo are Registered Marks of American Customer Satisfaction Index LLC.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250211643621/en/

Contacts

FOR MORE INFORMATION

Christian Rizzo

christian@gregoryfca.com