Solar panel manufacturer First Solar (NASDAQ: FSLR) missed Wall Street’s revenue expectations in Q3 CY2024, but sales rose 10.8% year on year to $887.7 million. The company’s full-year revenue guidance of $4.18 billion at the midpoint came in 6.2% below analysts’ estimates. Its GAAP profit of $2.91 per share was also 6.9% below analysts’ consensus estimates.

Is now the time to buy First Solar? Find out by accessing our full research report, it’s free.

First Solar (FSLR) Q3 CY2024 Highlights:

- Revenue: $887.7 million vs analyst estimates of $1.08 billion (17.6% miss)

- EPS: $2.91 vs analyst expectations of $3.13 (6.9% miss)

- EBITDA: $455.1 million vs analyst estimates of $459.9 million (1% miss)

- The company dropped its revenue guidance for the full year to $4.18 billion at the midpoint from $4.5 billion, a 7.2% decrease

- EPS (GAAP) guidance for the full year is $13.25 at the midpoint, missing analyst estimates by 2%

- Gross Margin (GAAP): 50.2%, up from 47% in the same quarter last year

- Operating Margin: 36.3%, up from 34.1% in the same quarter last year

- EBITDA Margin: 51.3%, up from 18.2% in the same quarter last year

- Free Cash Flow was -$487.7 million compared to -$120.8 million in the same quarter last year

- Market Capitalization: $21.95 billion

“As we approach the end of 2024, we remain pleased with the progress made across our business, navigating against a backdrop of industry volatility and political uncertainty, with a continued focus on balancing growth, profitability, and liquidity,” said Mark Widmar, CEO of First Solar.

Company Overview

Headquartered in Arizona, First Solar (NASDAQ: FSLR) specializes in manufacturing solar panels and providing photovoltaic solar energy solutions.

Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

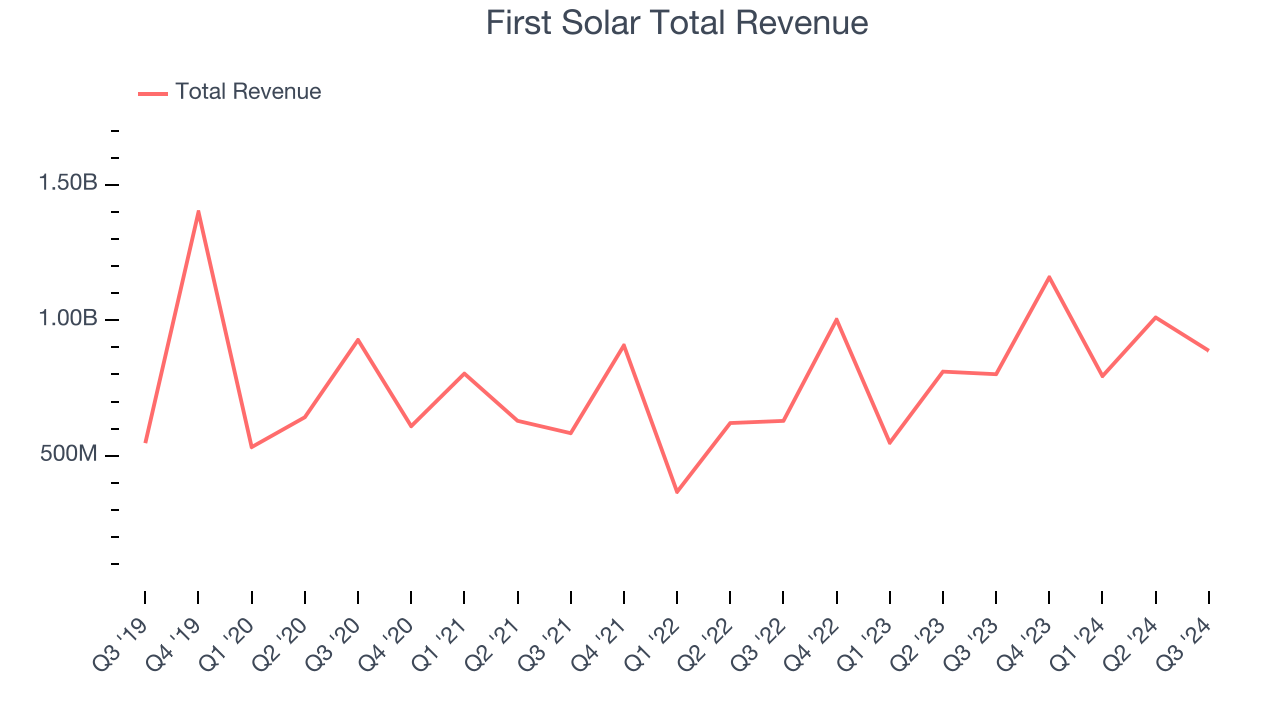

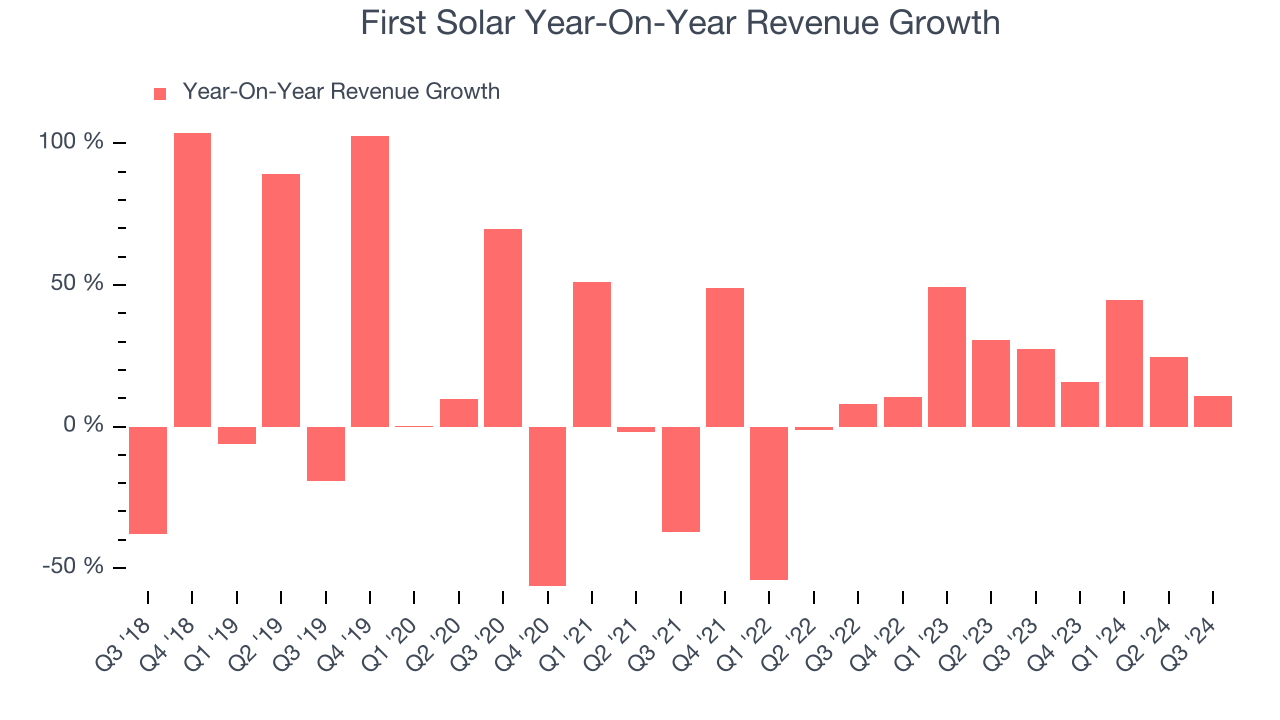

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, First Solar grew its sales at a solid 10.3% compounded annual growth rate. This is encouraging because it shows First Solar was more successful in expanding than most industrials companies.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. First Solar’s annualized revenue growth of 23.5% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated. First Solar’s recent history shows it’s one of the better Renewable Energy businesses as many of its peers faced declining sales because of cyclical headwinds.

This quarter, First Solar’s revenue grew 10.8% year on year to $887.7 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 43.7% over the next 12 months, an improvement versus the last two years. This projection is commendable and shows the market thinks its newer products and services will fuel higher growth rates.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

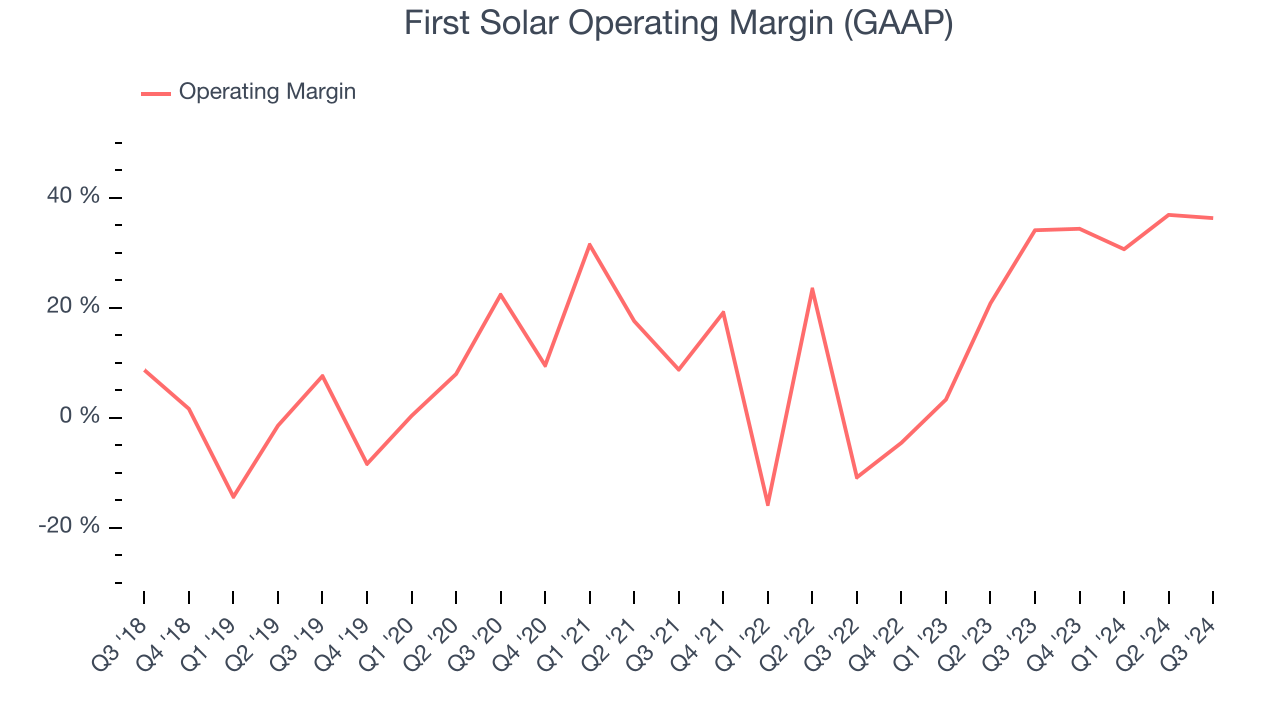

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

First Solar has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 16.3%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, First Solar’s annual operating margin rose by 30.6 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q3, First Solar generated an operating profit margin of 36.3%, up 2.2 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

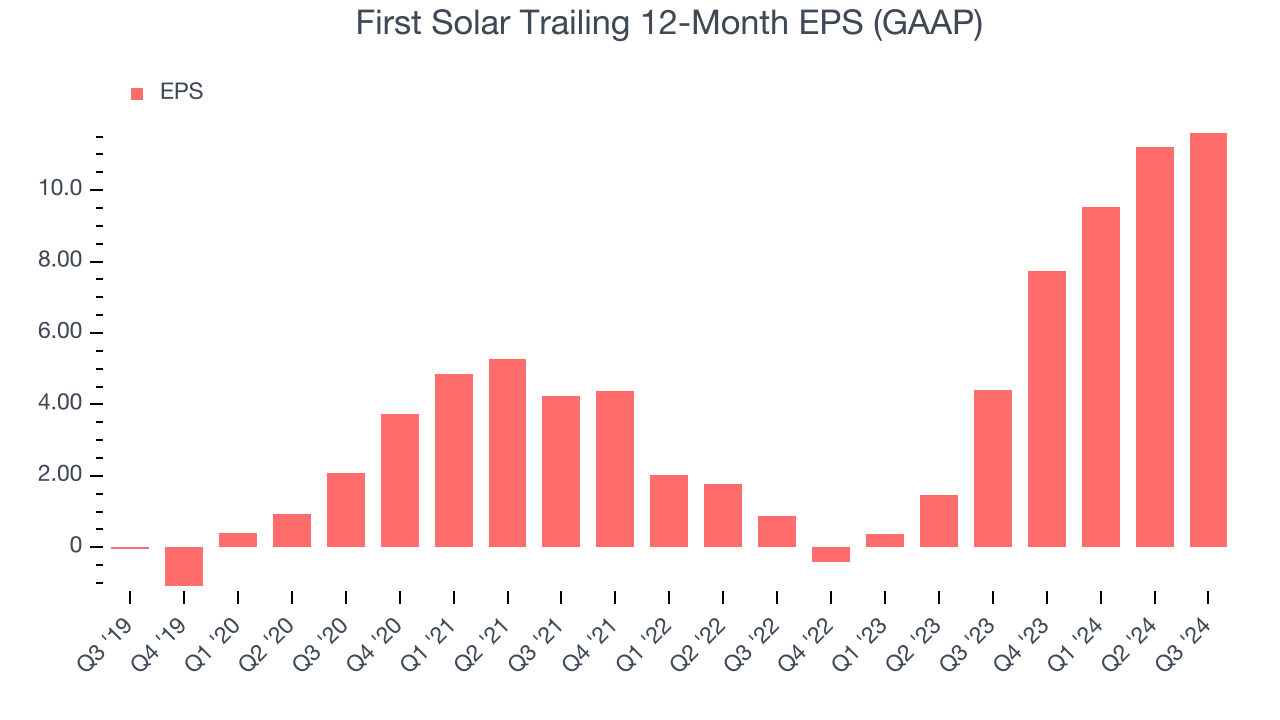

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

First Solar’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. First Solar’s EPS grew at an astounding 263% compounded annual growth rate over the last two years, higher than its 23.5% annualized revenue growth. This tells us the company became more profitable as it expanded.

Diving into First Solar’s quality of earnings can give us a better understanding of its performance. First Solar’s operating margin has expanded by 47.1 percentage points over the last two years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, First Solar reported EPS at $2.91, up from $2.50 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects First Solar’s full-year EPS of $11.61 to grow by 67.2%.

Key Takeaways from First Solar’s Q3 Results

We struggled to find many strong positives in these results as its revenue, EBITDA, and EPS missed Wall Street's estimates. Furthermore, the company lowered its full-year revenue and earnings guidance due to weak industry demand. Overall, this was a softer quarter. The stock traded down 6.9% to $186 immediately after reporting.

First Solar’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.