Pinterest has gotten torched over the last six months - since June 2024, its stock price has dropped 32.7% to $29.60 per share. This might have investors contemplating their next move.

Given the weaker price action, is now the time to buy PINS? Find out in our full research report, it’s free.

Why Does Pinterest Spark Debate?

Created with the idea of virtually replacing paper catalogues, Pinterest (NYSE: PINS) is an online image and social discovery platform.

Two Things to Like:

1. Monthly Active Users Drive Additional Growth Opportunities

As a social network, Pinterest generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

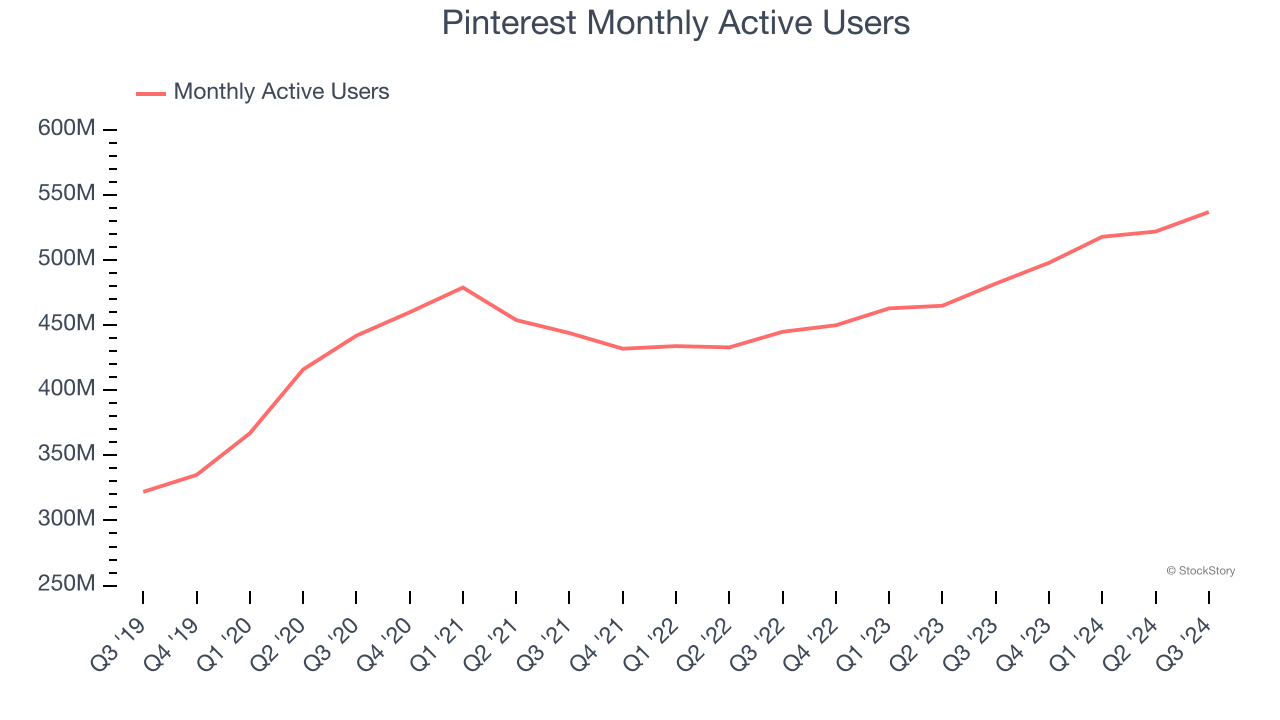

Over the last two years, Pinterest’s monthly active users, a key performance metric for the company, increased by 9.1% annually to 537 million in the latest quarter. This growth rate is solid for a consumer internet business and indicates people are excited about its offerings.

2. EBITDA Margin Reveals a Well-Run Organization

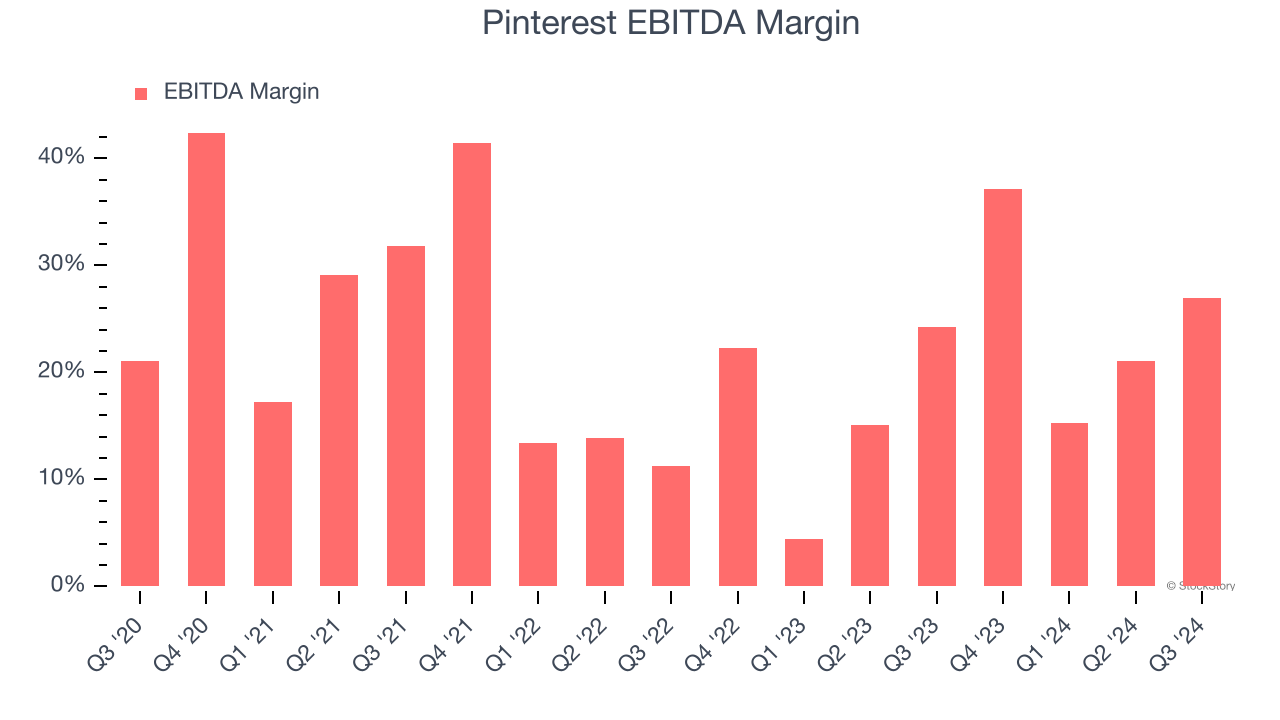

EBITDA is a good way of judging operating profitability for consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a more standardized view of the business’s profit potential.

Pinterest has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 22%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

One Reason to be Careful:

Growth in Customer Spending Lags Peers

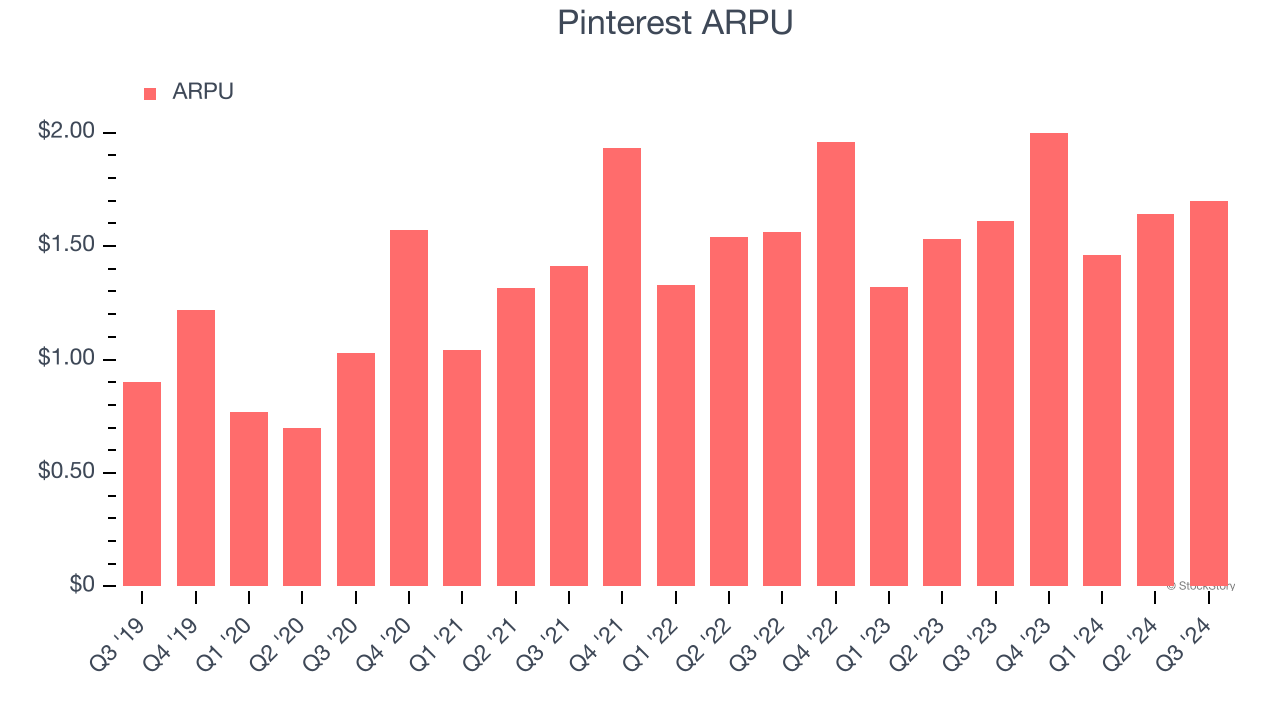

Average revenue per user (ARPU) is a critical metric to track for social networking businesses like Pinterest because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Pinterest’s audience and its ad-targeting capabilities.

Pinterest’s ARPU growth has been mediocre over the last two years, averaging 3.6%. This isn’t great, but the increase in monthly active users is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Pinterest tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

Final Judgment

Pinterest has huge potential even though it has some open questions. After the recent drawdown, the stock trades at 18.6× forward EV-to-EBITDA (or $29.60 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Pinterest

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.