Video game retailer GameStop (NYSE: GME) fell short of the market’s revenue expectations in Q4 CY2024, with sales falling 28.5% year on year to $1.28 billion. Its non-GAAP profit of $0.30 per share was significantly above analysts’ consensus estimates.

Is now the time to buy GameStop? Find out by accessing our full research report, it’s free.

GameStop (GME) Q4 CY2024 Highlights:

- Revenue: $1.28 billion vs analyst estimates of $1.48 billion (28.5% year-on-year decline, 13.2% miss)

- Adjusted EPS: $0.30 vs analyst estimates of $0.08 (significant beat)

- Operating Margin: 6.2%, in line with the same quarter last year

- Free Cash Flow was $158.8 million, up from -$18.7 million in the same quarter last year

- Market Capitalization: $11.44 billion

Company Overview

Drawing gaming fans with demo units set up with the latest releases, GameStop (NYSE: GME) sells new and used video games, consoles, and accessories, as well as pop culture merchandise.

Electronics & Gaming Retailer

After a long day, some of us want to just watch TV, play video games, listen to music, or scroll through our phones; electronics and gaming retailers sell the technology that makes this possible, plus more. Shoppers can find everything from surround-sound speakers to gaming controllers to home appliances in their stores. Competitive prices and helpful store associates that can talk through topics like the latest technology in gaming and installation keep customers coming back. This is a category that has moved rapidly online over the last few decades, so these electronics and gaming retailers have needed to be nimble and aggressive with their e-commerce and omnichannel investments.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $3.82 billion in revenue over the past 12 months, GameStop is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

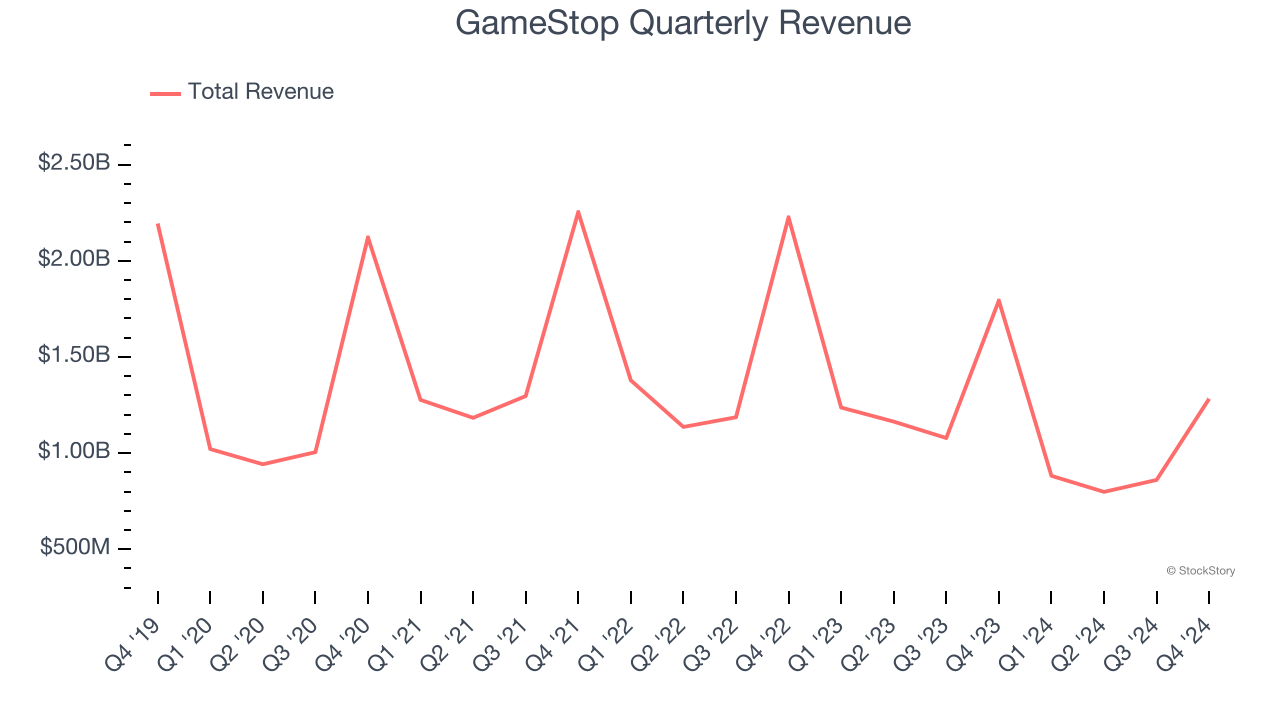

As you can see below, GameStop struggled to generate demand over the last five years (we compare to 2019 to normalize for COVID-19 impacts). Its sales dropped by 10% annually, a poor baseline for our analysis.

This quarter, GameStop missed Wall Street’s estimates and reported a rather uninspiring 28.5% year-on-year revenue decline, generating $1.28 billion of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 1.9% over the next 12 months. While this projection is better than its five-year trend, it's hard to get excited about a company that is struggling with demand.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

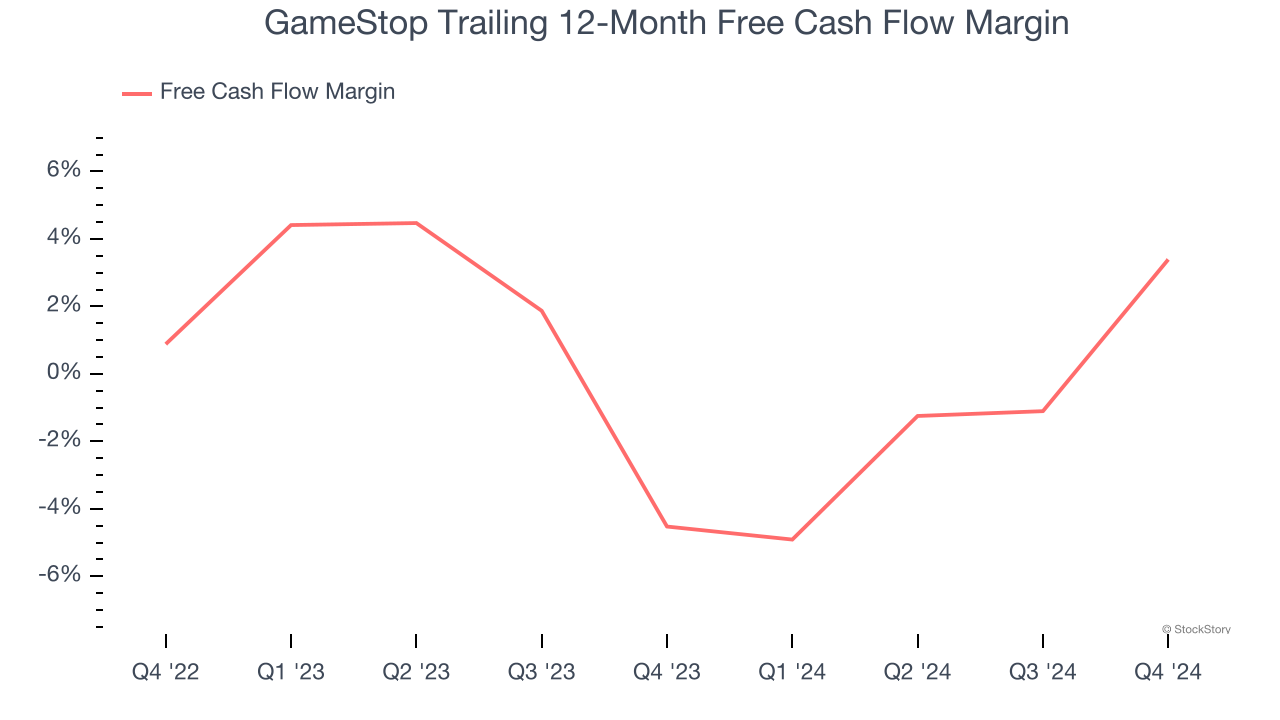

While GameStop posted positive free cash flow this quarter, the broader story hasn’t been so clean. GameStop’s demanding reinvestments have consumed many resources over the last two years, contributing to an average free cash flow margin of negative 1.2%. This means it lit $1.20 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that GameStop’s margin expanded by 7.9 percentage points over the last year. Despite its improvement and recent free cash flow generation, we’d like to see more quarters of positive cash flow before recommending the stock.

GameStop’s free cash flow clocked in at $158.8 million in Q4, equivalent to a 12.4% margin. Its cash flow turned positive after being negative in the same quarter last year, marking a potential inflection point.

Key Takeaways from GameStop’s Q4 Results

We were impressed by how significantly GameStop blew past analysts’ EPS expectations this quarter. We were also excited its gross margin outperformed Wall Street’s estimates by a wide margin. On the other hand, its revenue missed significantly. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock traded up 6.1% to $27 immediately after reporting.

Big picture, is GameStop a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.