Over the last six months, Ducommun’s shares have sunk to $60.09, producing a disappointing 7.4% loss while the S&P 500 was flat. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Ducommun, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Despite the more favorable entry price, we're cautious about Ducommun. Here are three reasons why there are better opportunities than DCO and a stock we'd rather own.

Why Do We Think Ducommun Will Underperform?

California’s oldest company, Ducommun (NYSE: DCO) is a provider of engineering and manufacturing services for high-performance products primarily within the aerospace and defense industries.

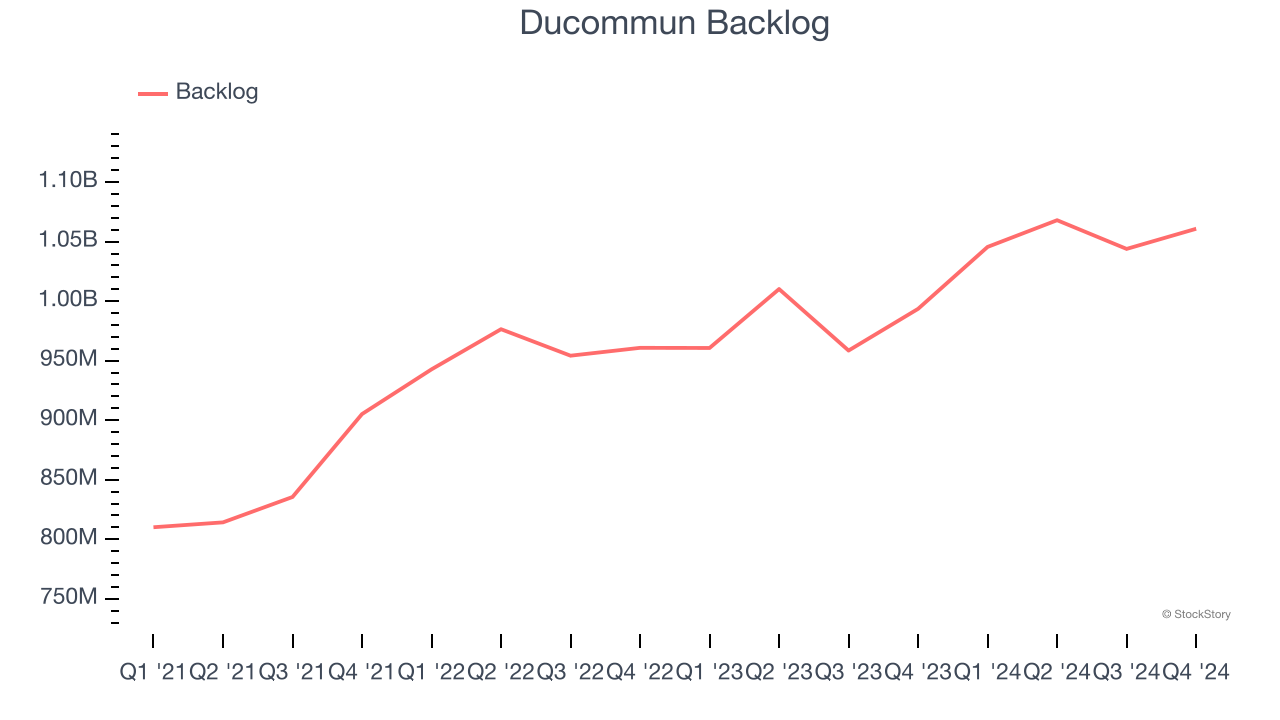

1. Weak Backlog Growth Points to Soft Demand

We can better understand Aerospace companies by analyzing their backlog. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Ducommun’s future revenue streams.

Ducommun’s backlog came in at $1.06 billion in the latest quarter, and over the last two years, its year-on-year growth averaged 4.9%. This performance was underwhelming and suggests that increasing competition is causing challenges in winning new orders.

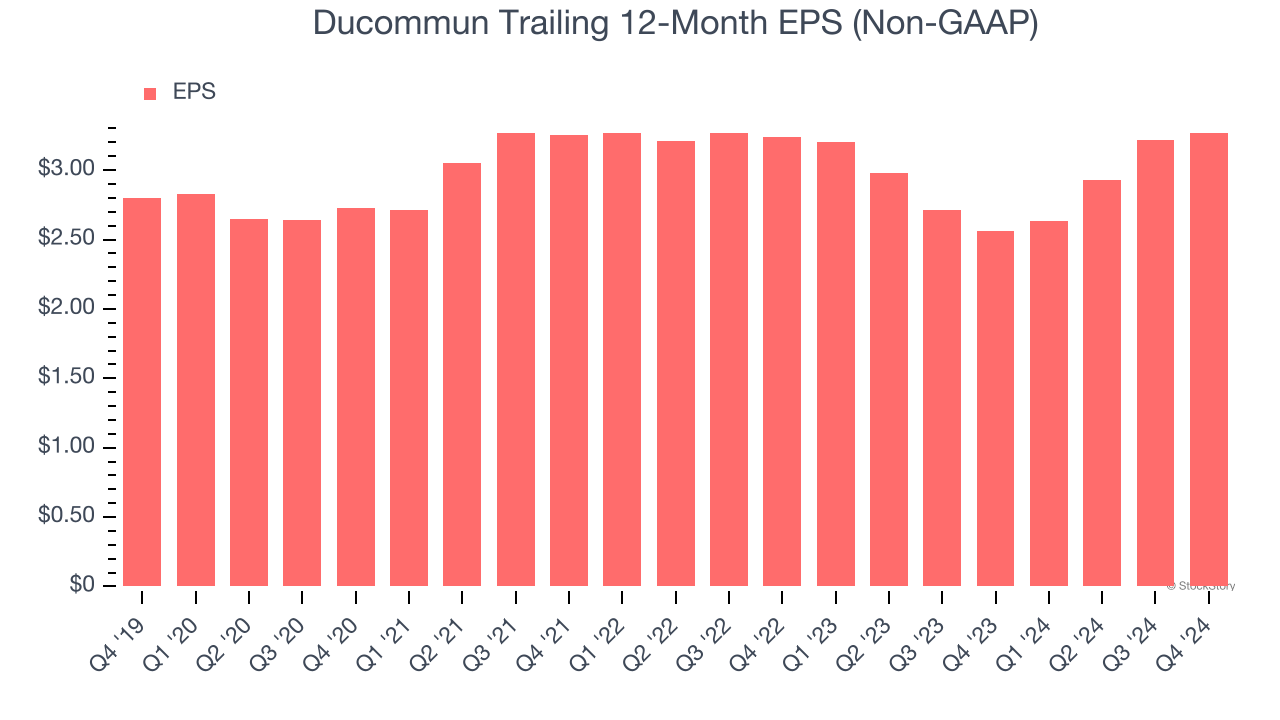

2. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Ducommun’s EPS grew at a weak 3.2% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 1.8% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

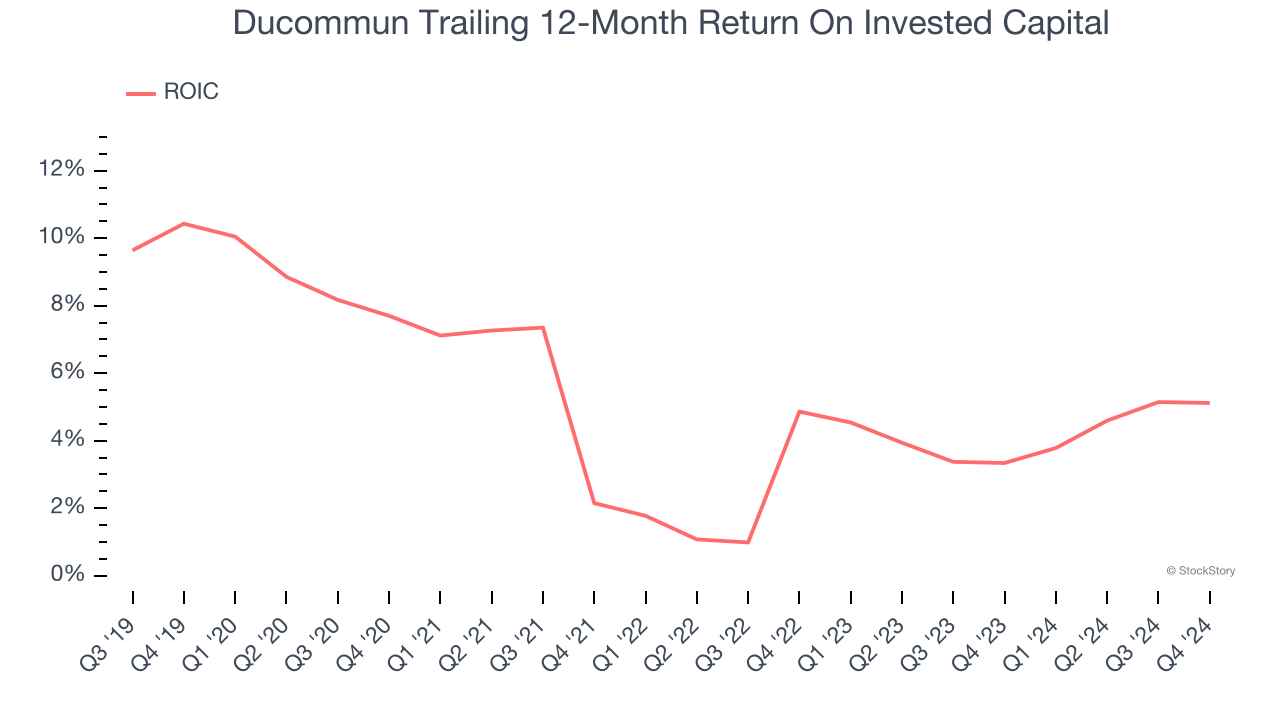

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Ducommun historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4.6%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

Final Judgment

We see the value of companies helping their customers, but in the case of Ducommun, we’re out. Following the recent decline, the stock trades at 15.1× forward price-to-earnings (or $60.09 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are more exciting stocks to buy at the moment. We’d suggest looking at the Amazon and PayPal of Latin America.

Stocks We Like More Than Ducommun

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.