Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Organon (NYSE: OGN) and the best and worst performers in the branded pharmaceuticals industry.

The branded pharmaceutical industry relies on a high-cost, high-reward business model, driven by substantial investments in research and development to create innovative, patent-protected drugs. Successful products can generate significant revenue streams over their patent life, and the larger a roster of drugs, the stronger a moat a company enjoys. However, the business model is inherently risky, with high failure rates during clinical trials, lengthy regulatory approval processes, and intense competition from generic and biosimilar manufacturers once patents expire. These challenges, combined with scrutiny over drug pricing, create a complex operating environment. Looking ahead, the industry is positioned for tailwinds from advancements in precision medicine, increasing adoption of AI to enhance drug development efficiency, and growing global demand for treatments addressing chronic and rare diseases. However, headwinds include heightened regulatory scrutiny, pricing pressures from governments and insurers, and the looming patent cliffs for key blockbuster drugs. Patent cliffs bring about competition from generics, forcing branded pharmaceutical companies back to the drawing board to find the next big thing.

The 11 branded pharmaceuticals stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.3%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.7% since the latest earnings results.

Organon (NYSE: OGN)

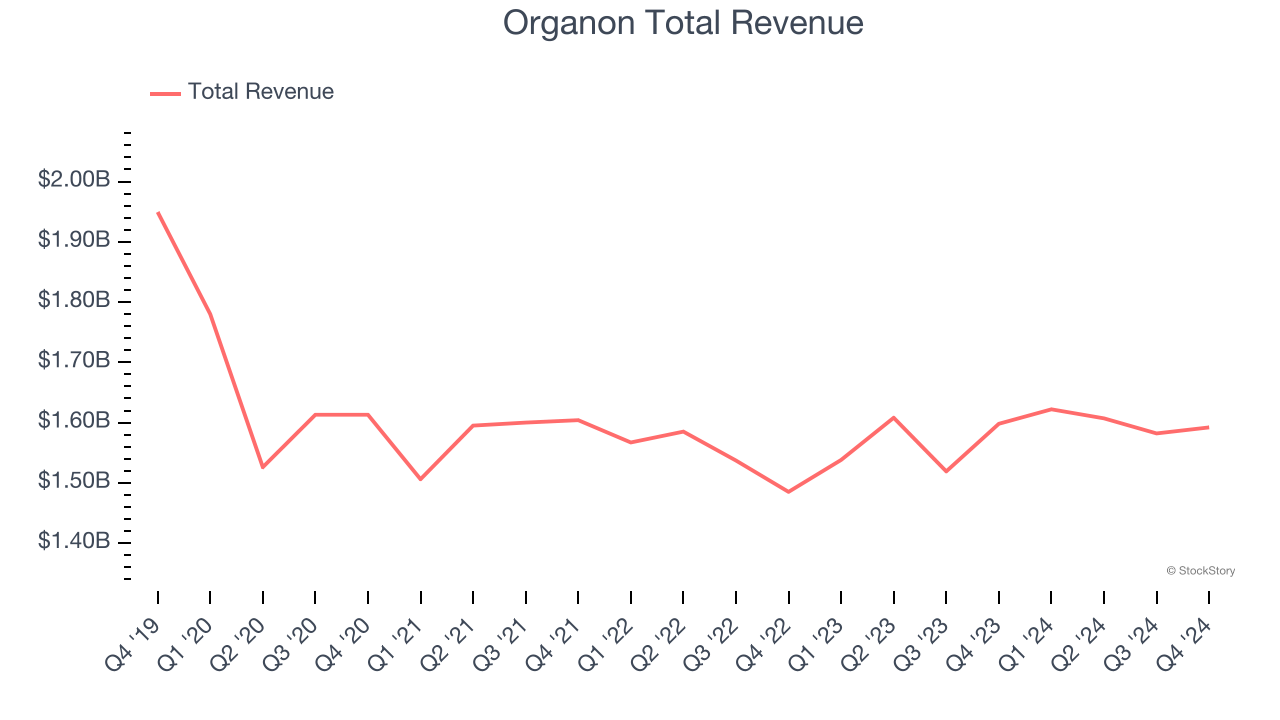

Spun off from Merck in 2021 to create a company dedicated to addressing unmet needs in women's health, Organon (NYSE: OGN) is a global healthcare company focused on improving women's health through prescription therapies, medical devices, biosimilars, and established medicines.

Organon reported revenues of $1.59 billion, flat year on year. This print exceeded analysts’ expectations by 0.9%. Despite the top-line beat, it was still a slower quarter for the company with full-year revenue guidance missing analysts’ expectations significantly.

“In 2024 we achieved our third year of constant currency revenue growth and delivered Adjusted EBITDA margin expansion ex-IPR&D,” said Kevin Ali, Organon's chief executive officer.

Organon delivered the slowest revenue growth of the whole group. The stock is down 13.6% since reporting and currently trades at $12.69.

Read our full report on Organon here, it’s free.

Best Q4: Supernus Pharmaceuticals (NASDAQ: SUPN)

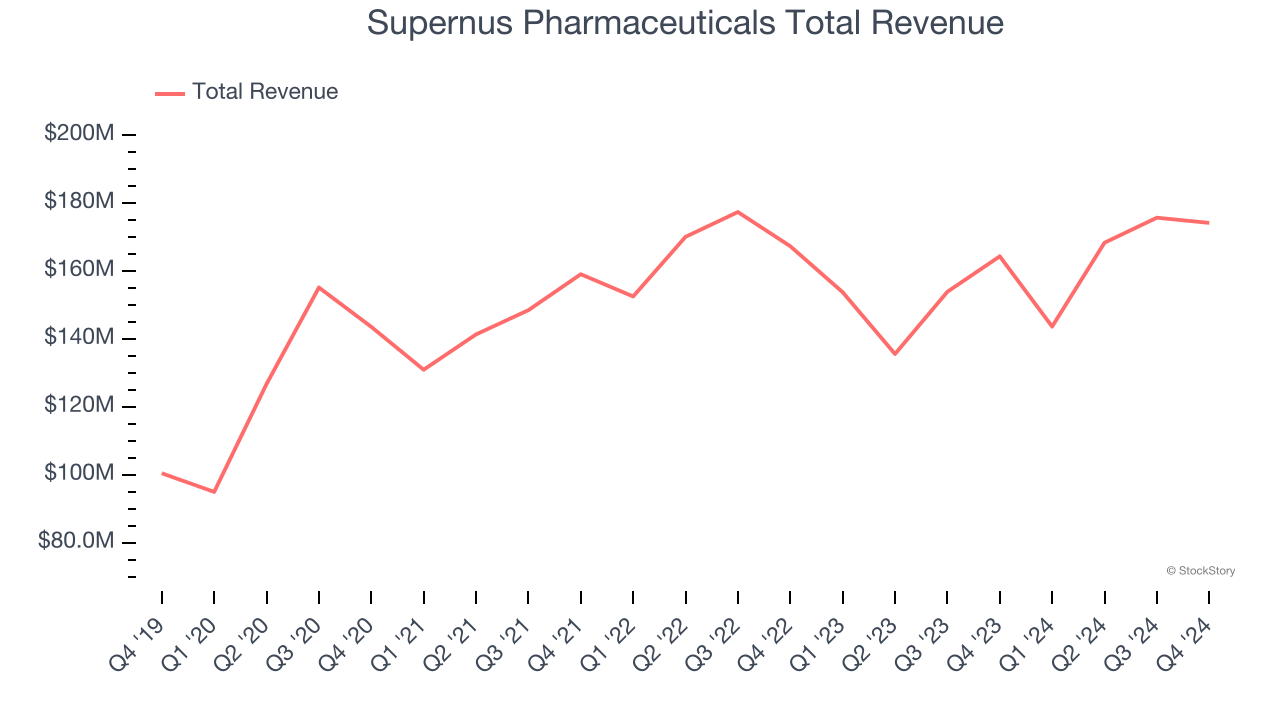

With a diverse portfolio of eight FDA-approved medications targeting neurological conditions, Supernus Pharmaceuticals (NASDAQ: SUPN) develops and markets treatments for central nervous system disorders including epilepsy, ADHD, Parkinson's disease, and migraine.

Supernus Pharmaceuticals reported revenues of $174.2 million, up 6% year on year, outperforming analysts’ expectations by 12.2%. The business had a very strong quarter with a solid beat of analysts’ EPS estimates and full-year operating income guidance topping analysts’ expectations.

Supernus Pharmaceuticals pulled off the biggest analyst estimates beat among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $32.82.

Is now the time to buy Supernus Pharmaceuticals? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Zoetis (NYSE: ZTS)

Originally spun off from Pfizer in 2013 as the world's largest pure-play animal health company, Zoetis (NYSE: ZTS) discovers, develops, and sells medicines, vaccines, diagnostic products, and services for pets and livestock animals worldwide.

Zoetis reported revenues of $2.32 billion, up 4.7% year on year, in line with analysts’ expectations. It was a softer quarter as it posted a significant miss of analysts’ full-year EPS guidance estimates.

As expected, the stock is down 12.6% since the results and currently trades at $152.

Read our full analysis of Zoetis’s results here.

Corcept (NASDAQ: CORT)

Focusing on the powerful stress hormone that affects everything from metabolism to immune function, Corcept Therapeutics (NASDAQ: CORT) develops and markets medications that modulate cortisol to treat endocrine disorders, cancer, and neurological diseases.

Corcept reported revenues of $181.9 million, up 34.3% year on year. This number lagged analysts' expectations by 8.5%. It was a slower quarter as it also recorded a significant miss of analysts’ EPS estimates.

Corcept delivered the highest full-year guidance raise but had the weakest performance against analyst estimates among its peers. The stock is up 21.2% since reporting and currently trades at $76.88.

Read our full, actionable report on Corcept here, it’s free.

Merck (NYSE: MRK)

With roots dating back to 1891 and a portfolio that includes the blockbuster cancer immunotherapy Keytruda, Merck (NYSE: MRK) develops and sells prescription medicines, vaccines, and animal health products across oncology, infectious diseases, cardiovascular, and other therapeutic areas.

Merck reported revenues of $15.62 billion, up 6.8% year on year. This print beat analysts’ expectations by 1.3%. Zooming out, it was a slower quarter as it produced full-year revenue guidance missing analysts’ expectations.

Merck had the weakest full-year guidance update among its peers. The stock is down 16.2% since reporting and currently trades at $83.61.

Read our full, actionable report on Merck here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.