Business communications software company 8x8 (NYSE: EGHT) met Wall Street’s revenue expectations in Q1 CY2025, but sales fell by 1.3% year on year to $177 million. The company expects next quarter’s revenue to be around $178.5 million, close to analysts’ estimates. Its non-GAAP profit of $0.08 per share was in line with analysts’ consensus estimates.

Is now the time to buy 8x8? Find out by accessing our full research report, it’s free.

8x8 (EGHT) Q1 CY2025 Highlights:

- Revenue: $177 million vs analyst estimates of $177.9 million (1.3% year-on-year decline, in line)

- Adjusted EPS: $0.08 vs analyst estimates of $0.08 (in line)

- Adjusted Operating Income: $17.71 million vs analyst estimates of $16.91 million (10% margin, 4.7% beat)

- Management’s revenue guidance for the upcoming financial year 2026 is $713 million at the midpoint, missing analyst estimates by 0.6% and implying -0.3% growth (vs -1.9% in FY2025)

- Operating Margin: 0.2%, up from -7.9% in the same quarter last year

- Free Cash Flow Margin: 1.6%, down from 13.5% in the previous quarter

- Billings: $176.4 million at quarter end, down 1.8% year on year

- Market Capitalization: $238.4 million

"Our results in the fourth quarter and fiscal 2025 reflect multiple transitions as we build a foundation for durable growth and profitability. Reported service revenue declined 1% in the fourth quarter due to a decline in revenue from former Fuze customers. Excluding revenue from former Fuze customers, 8x8 service revenue growth accelerated to nearly 5% year-over-year. We are making progress upgrading the remaining customers on the Fuze service platform, and expect to complete all upgrades by the end of calendar year 2025," said Samuel Wilson, Chief Executive Officer at 8x8, Inc.

Company Overview

Founded in 1987, 8x8 (NYSE: EGHT) provides software for organizations to efficiently communicate and collaborate with their customers, employees, and partners.

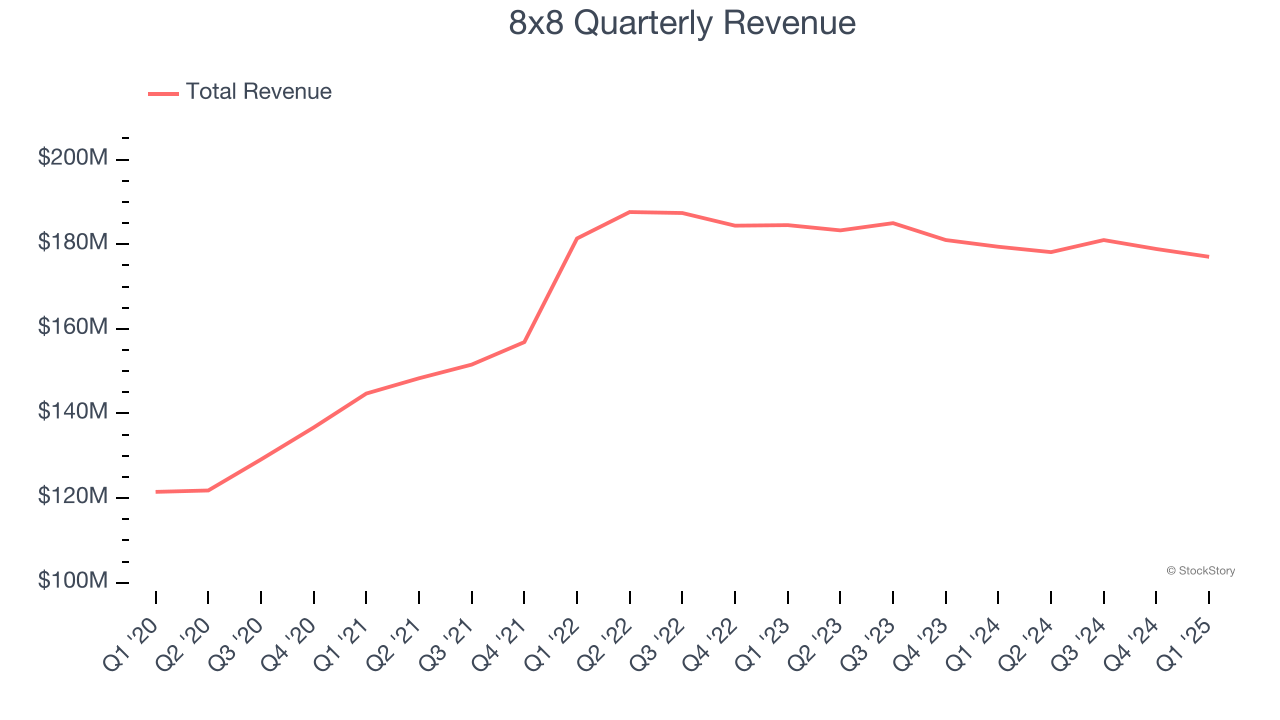

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, 8x8’s sales grew at a weak 3.9% compounded annual growth rate over the last three years. This fell short of our benchmark for the software sector and is a poor baseline for our analysis.

This quarter, 8x8 reported a rather uninspiring 1.3% year-on-year revenue decline to $177 million of revenue, in line with Wall Street’s estimates. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and implies its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

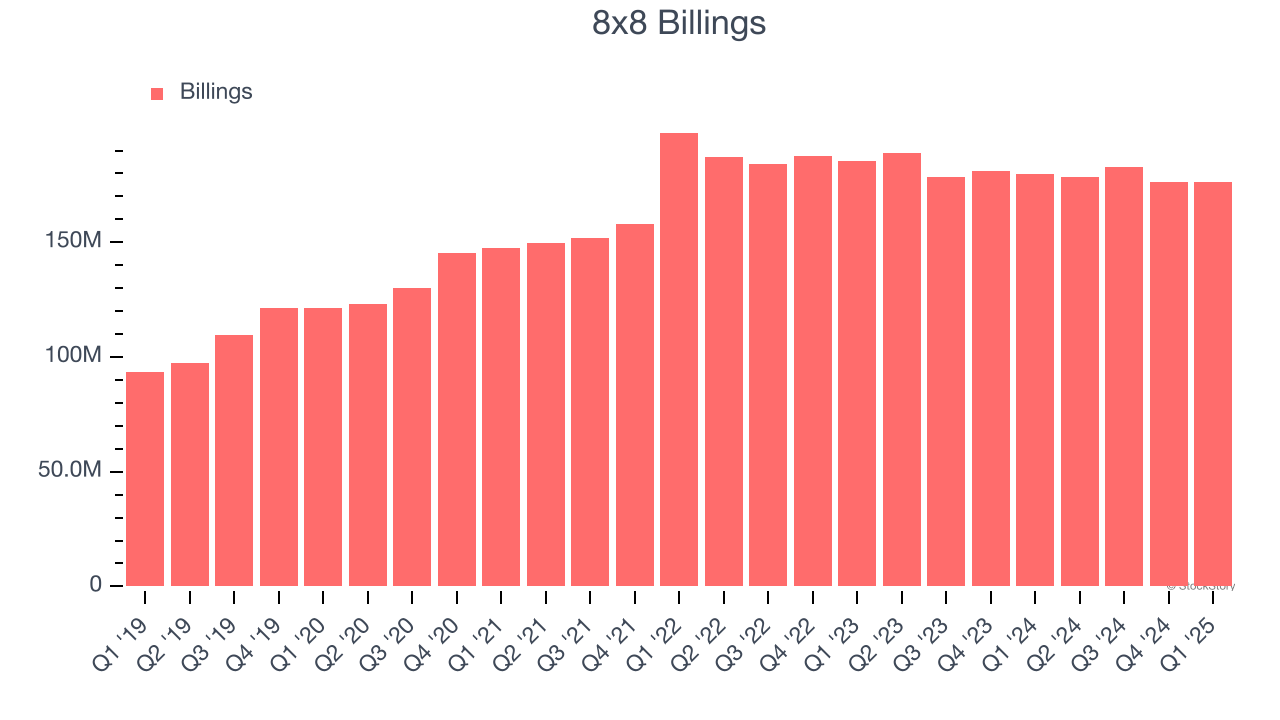

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

8x8’s billings came in at $176.4 million in Q1, and it averaged 1.8% year-on-year declines over the last four quarters. This performance mirrored its total sales and shows the company faced challenges in acquiring and retaining customers. It also suggests there may be increasing competition or market saturation.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

8x8’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between 8x8’s products and its peers.

Key Takeaways from 8x8’s Q1 Results

It was great to see 8x8 expecting revenue growth to accelerate next year. Operating income in the quarter also exceeded expectations. On the other hand, its full-year revenue guidance fell slightly short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock traded up 3.8% to $1.86 immediately after reporting.

Is 8x8 an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.