Looking back on specialty equipment distributors stocks’ Q1 earnings, we examine this quarter’s best and worst performers, including Hudson Technologies (NASDAQ: HDSN) and its peers.

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

The 9 specialty equipment distributors stocks we track reported a satisfactory Q1. As a group, revenues missed analysts’ consensus estimates by 0.8% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 9.2% on average since the latest earnings results.

Best Q1: Hudson Technologies (NASDAQ: HDSN)

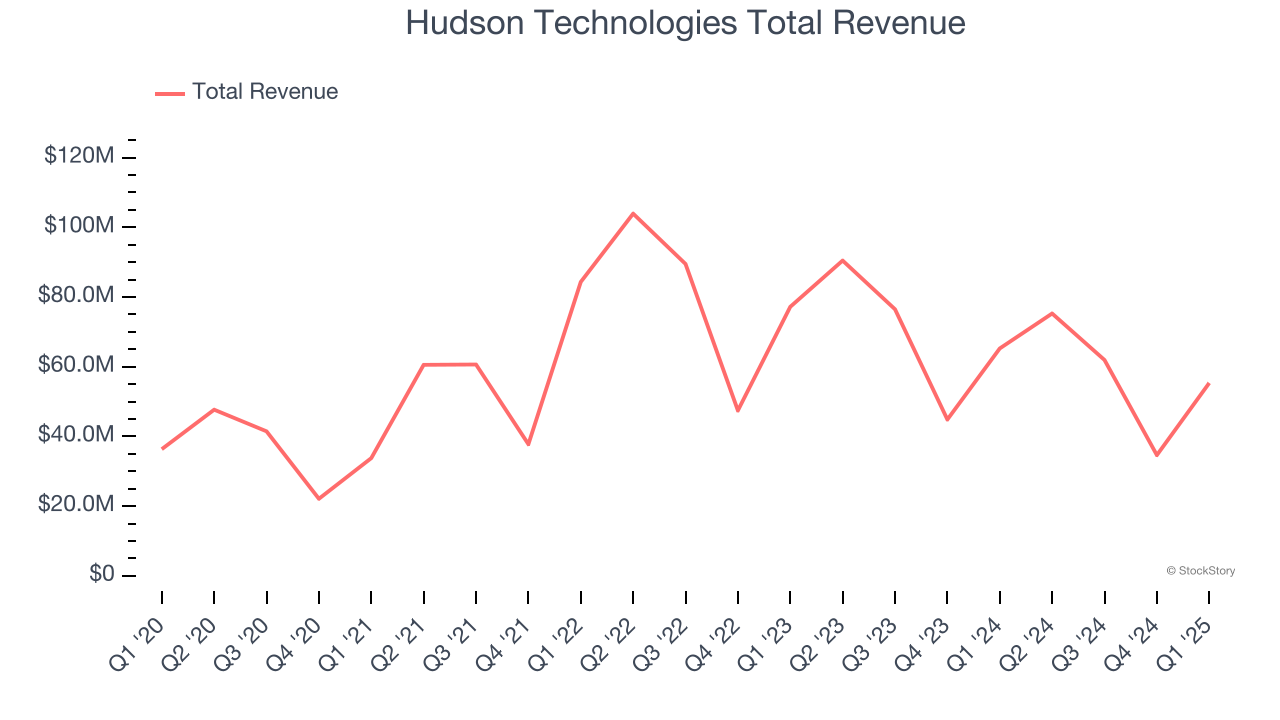

Founded in 1991, Hudson Technologies (NASDAQ: HDSN) specializes in refrigerant services and solutions, providing refrigerant sales, reclamation, and recycling.

Hudson Technologies reported revenues of $55.34 million, down 15.2% year on year. This print exceeded analysts’ expectations by 6%. Overall, it was an incredible quarter for the company with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Brian F. Coleman, President and Chief Executive Officer of Hudson Technologies commented, “First quarter 2025 revenue reflected a slight increase in refrigerant sales volume, which was more than offset by lower overall refrigerant market pricing as compared to last year’s first quarter. First quarter 2025 sequential market pricing declined slightly from the fourth quarter of 2024, contributing to gross margin of 22%. We expect to be on track for our mid-twenty percent expected gross margin as we move through the core portion of the nine-month selling season. Additionally, we saw continued strength in the refrigerant recovery activities that feed our reclamation business, bolstered by our strengthened capabilities from the strategic acquisition of USA Refrigerants last year. We are pleased with the start to 2025 and remain focused on successfully executing on the elements of our business that we can control – most importantly by ensuring that our customers have the refrigerants they need as the weather turns warmer and the cooling season gets fully underway."

Hudson Technologies achieved the biggest analyst estimates beat but had the slowest revenue growth of the whole group. The stock is up 8% since reporting and currently trades at $7.25.

Is now the time to buy Hudson Technologies? Access our full analysis of the earnings results here, it’s free.

Karat Packaging (NASDAQ: KRT)

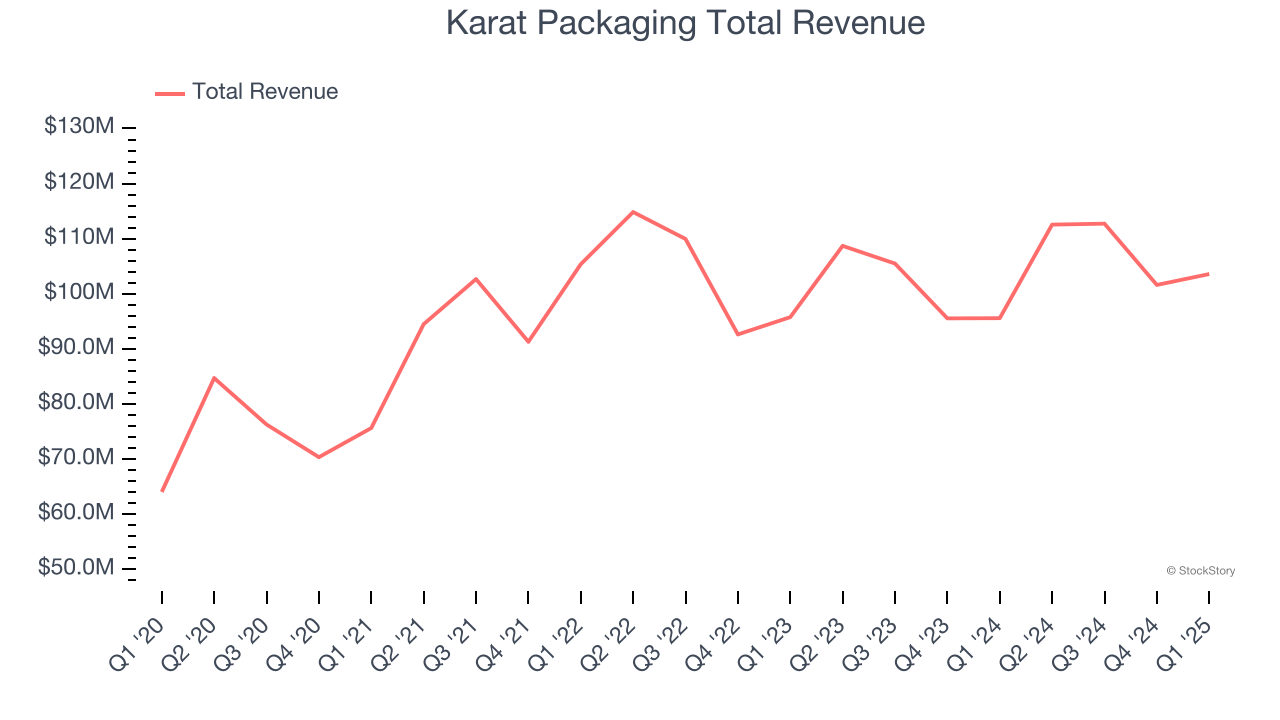

Founded as Lollicup, Karat Packaging (NASDAQ: KRT) distributes and manufactures environmentally-friendly disposable foodservice packaging solutions.

Karat Packaging reported revenues of $103.6 million, up 8.4% year on year, outperforming analysts’ expectations by 1.3%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates.

Karat Packaging achieved the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 14.5% since reporting. It currently trades at $31.30.

Is now the time to buy Karat Packaging? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: H&E Equipment Services (NASDAQ: HEES)

Founded after recognizing a growth trend along the Mississippi River and opportunities developing in the earthmoving and construction equipment business, H&E (NASDAQ: HEES) offers machinery for companies to purchase or rent.

H&E Equipment Services reported revenues of $319.5 million, down 14% year on year, falling short of analysts’ expectations by 11.9%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

H&E Equipment Services delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 4.6% since the results and currently trades at $94.50.

Read our full analysis of H&E Equipment Services’s results here.

Custom Truck One Source (NYSE: CTOS)

Inspired by a family gas station, Custom Truck One Source (NYSE: CTOS) is a distributor of trucks and heavy equipment.

Custom Truck One Source reported revenues of $422.2 million, up 2.7% year on year. This number lagged analysts' expectations by 3%. It was a slower quarter as it also logged a significant miss of analysts’ adjusted operating income estimates.

Custom Truck One Source delivered the highest full-year guidance raise among its peers. The stock is up 12.2% since reporting and currently trades at $4.50.

Read our full, actionable report on Custom Truck One Source here, it’s free.

Alta (NYSE: ALTG)

Founded in 1984, Alta Equipment Group (NYSE: ALTG) is a provider of industrial and construction equipment and services across the Midwest and Northeast United States.

Alta reported revenues of $423 million, down 4.2% year on year. This print came in 2.3% below analysts' expectations. Taking a step back, it was a satisfactory quarter as it also recorded an impressive beat of analysts’ EBITDA estimates.

The stock is up 22.5% since reporting and currently trades at $5.55.

Read our full, actionable report on Alta here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.