Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at AXIS Capital (NYSE: AXS) and its peers.

This is a cyclical industry, and the sector benefits when there is 'hard market', characterized by strong premium rate increases that outpace loss and cost inflation, resulting in robust underwriting margins. The opposite is true in a 'soft market'. Interest rates also matter, as they determine the yields earned on fixed-income portfolios. The primary headwind remains the immense and concentrated exposure to large-scale catastrophe losses, as the growing impact of climate change challenges traditional risk models and creates significant earnings volatility. Additionally, they face the risk of adverse prior-year reserve development, where claims prove more costly than anticipated, while the eventual influx of new capital from alternative sources threatens to soften the market and compress future returns.

The 6 reinsurance stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 4.1%.

In light of this news, share prices of the companies have held steady as they are up 3.2% on average since the latest earnings results.

AXIS Capital (NYSE: AXS)

Founded in the aftermath of the 9/11 attacks when insurance capacity was scarce, AXIS Capital Holdings Limited (NYSE: AXS) is a global specialty insurer and reinsurer that provides coverage for complex risks across property, liability, professional lines, cyber, and other specialty markets.

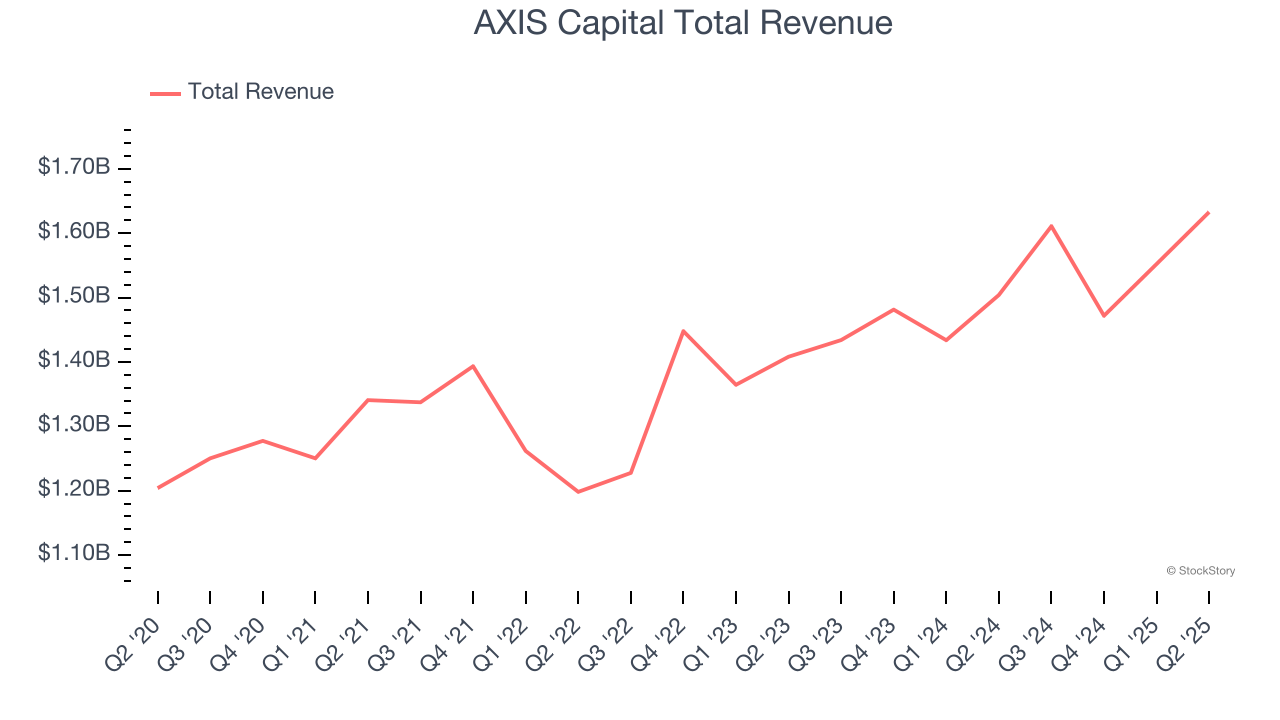

AXIS Capital reported revenues of $1.63 billion, up 8.6% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a beat of analysts’ EPS estimates but a significant miss of analysts’ net premiums earned estimates.

Interestingly, the stock is up 1.6% since reporting and currently trades at $98.71.

Is now the time to buy AXIS Capital? Access our full analysis of the earnings results here, it’s free.

Best Q2: Hamilton Insurance Group (NYSE: HG)

Founded in 2013 and operating through three distinct underwriting platforms across four countries, Hamilton Insurance Group (NYSE: HG) operates global specialty insurance and reinsurance platforms across Lloyd's, Ireland, Bermuda, and the United States.

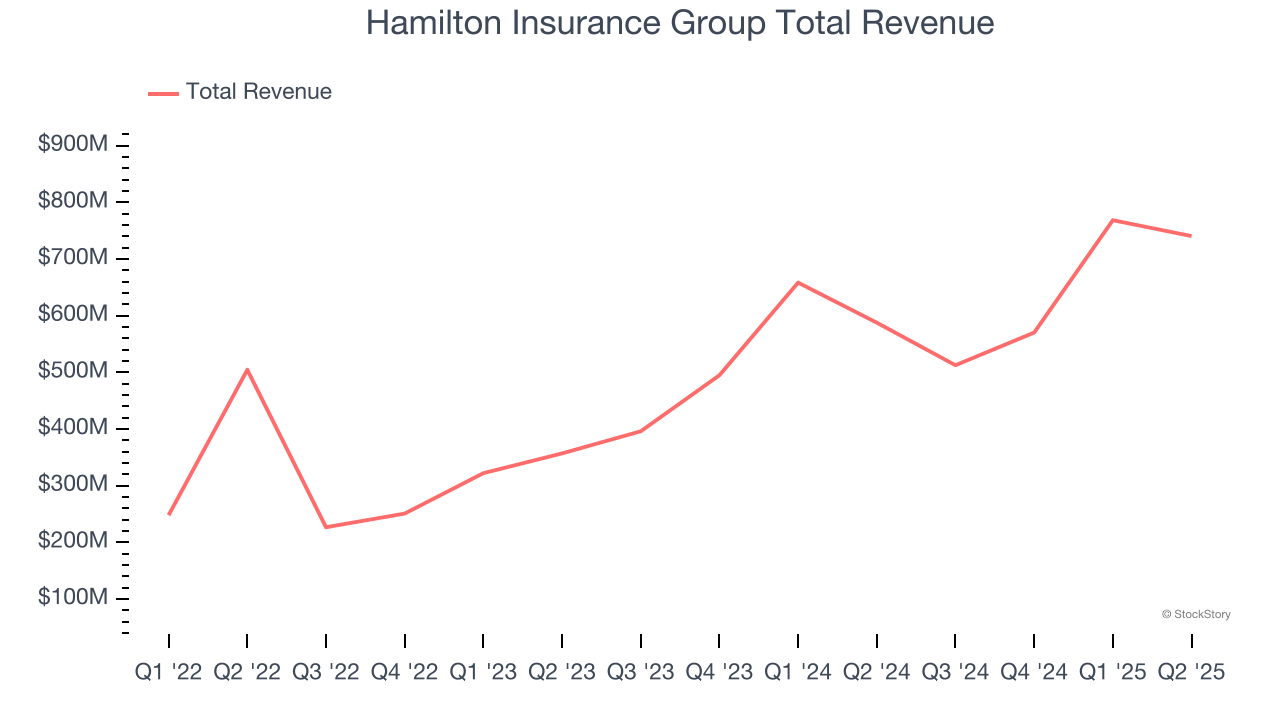

Hamilton Insurance Group reported revenues of $740.8 million, up 26% year on year, outperforming analysts’ expectations by 22.1%. The business had an exceptional quarter with a beat of analysts’ EPS and book value per share estimates.

Hamilton Insurance Group scored the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 10% since reporting. It currently trades at $23.70.

Is now the time to buy Hamilton Insurance Group? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Reinsurance Group of America (NYSE: RGA)

Operating behind the scenes of the insurance industry since 1973, Reinsurance Group of America (NYSE: RGA) provides life and health reinsurance services to insurance companies, helping them manage risk and meet regulatory requirements.

Reinsurance Group of America reported revenues of $5.68 billion, up 10.9% year on year, exceeding analysts’ expectations by 1.1%. Still, it was a slower quarter as it posted a significant miss of analysts’ net premiums and EPS estimates.

Interestingly, the stock is up 1.2% since the results and currently trades at $194.71.

Read our full analysis of Reinsurance Group of America’s results here.

RenaissanceRe (NYSE: RNR)

Born in Bermuda after the devastating Hurricane Andrew created a crisis in the catastrophe insurance market, RenaissanceRe (NYSE: RNR) provides property, casualty, and specialty reinsurance and insurance solutions to customers worldwide, primarily through intermediaries.

RenaissanceRe reported revenues of $3.21 billion, up 13.4% year on year. This print beat analysts’ expectations by 8.7%. It was an exceptional quarter as it also put up a beat of analysts’ EPS estimates and a solid beat of analysts’ book value per share estimates.

The stock is up 2.9% since reporting and currently trades at $244.44.

Read our full, actionable report on RenaissanceRe here, it’s free.

Everest Group (NYSE: EG)

Rebranded from Everest Re in 2023 to reflect its evolution beyond just reinsurance, Everest Group (NYSE: EG) underwrites property and casualty reinsurance and insurance worldwide, serving insurance companies, corporations, and other clients across six continents.

Everest Group reported revenues of $4.49 billion, up 6.2% year on year. This result surpassed analysts’ expectations by 1.7%. Overall, it was a strong quarter as it also logged a solid beat of analysts’ net premiums earned estimates and a beat of analysts’ EPS estimates.

Everest Group had the slowest revenue growth among its peers. The stock is up 3.2% since reporting and currently trades at $345.35.

Read our full, actionable report on Everest Group here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.