Packaging Corporation of America (NYSE: PKG) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 10.1% year on year to $2.36 billion. Its non-GAAP profit of $2.32 per share was 3.9% below analysts’ consensus estimates.

Is now the time to buy Packaging Corporation of America? Find out by accessing our full research report, it’s free.

Packaging Corporation of America (PKG) Q4 CY2025 Highlights:

- Revenue: $2.36 billion vs analyst estimates of $2.44 billion (10.1% year-on-year growth, 2.9% miss)

- Adjusted EPS: $2.32 vs analyst expectations of $2.41 (3.9% miss)

- Adjusted EBITDA: $486.3 million vs analyst estimates of $503.7 million (20.6% margin, 3.5% miss)

- Operating Margin: 7.1%, down from 14.1% in the same quarter last year

- Sales Volumes rose 7.4% year on year, in line with the same quarter last year

- Market Capitalization: $19.83 billion

Commenting on reported results, Mark W. Kowlzan, Chairman and CEO, said, “Corrugated shipments during the quarter were slightly down from record 2024 levels, and our results reflected a seasonally less rich mix with strong e-commerce volume through the holiday season and continued inventory management from other customers. Our order book strengthened as the fourth quarter progressed and we’ve seen significantly improved demand throughout our customer base so far in January. We made tremendous progress on the integration of the Greif business and have no planned outages at the acquired mills during the first half of the year. Our paper business performed well, with higher year-over-year volumes, strong price realization and exceptional customer service. We repurchased 760,000 shares during the quarter at an average price of $201 per share. On the whole, we had a very strong year with growth in our earnings excluding special items and operating cash flows, driven by the tremendous efforts of our employees and the benefits of our capital investments across our business and we are well positioned for continued profitable growth.”

Company Overview

Founded in 1959, Packaging Corporation of America (NYSE: PKG) produces containerboard and corrugated packaging products as well as displays and package protection.

Revenue Growth

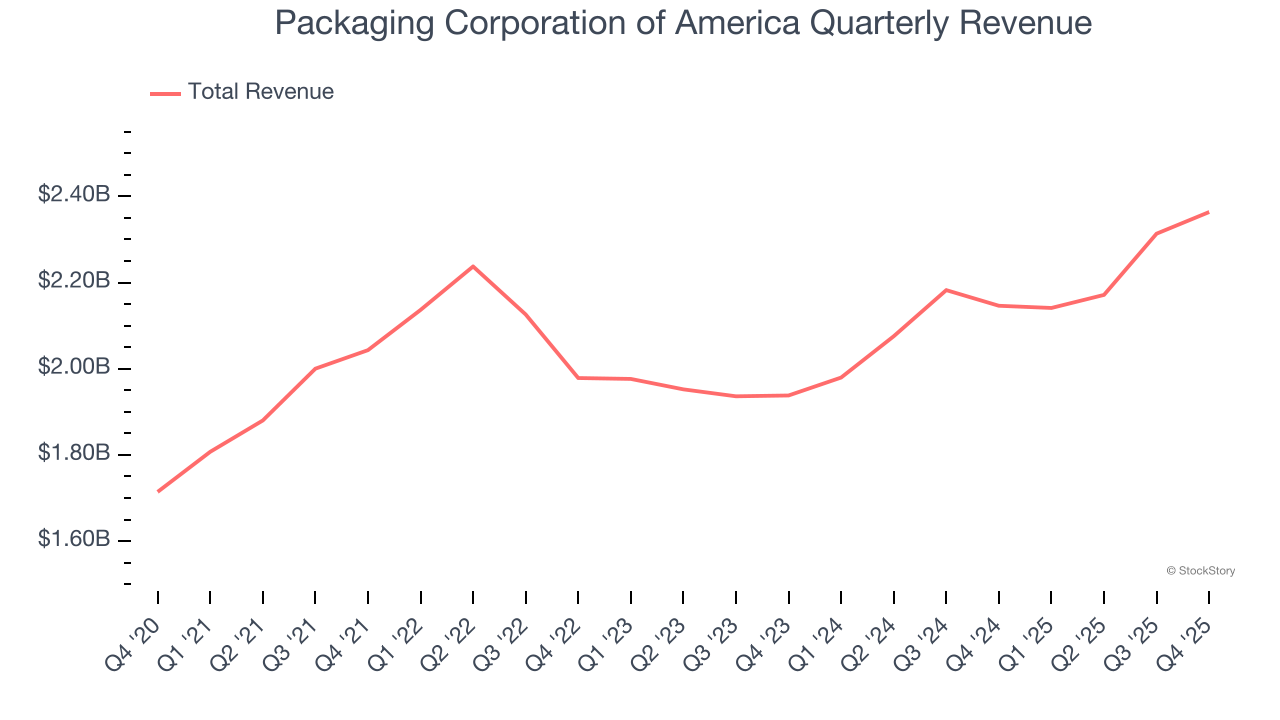

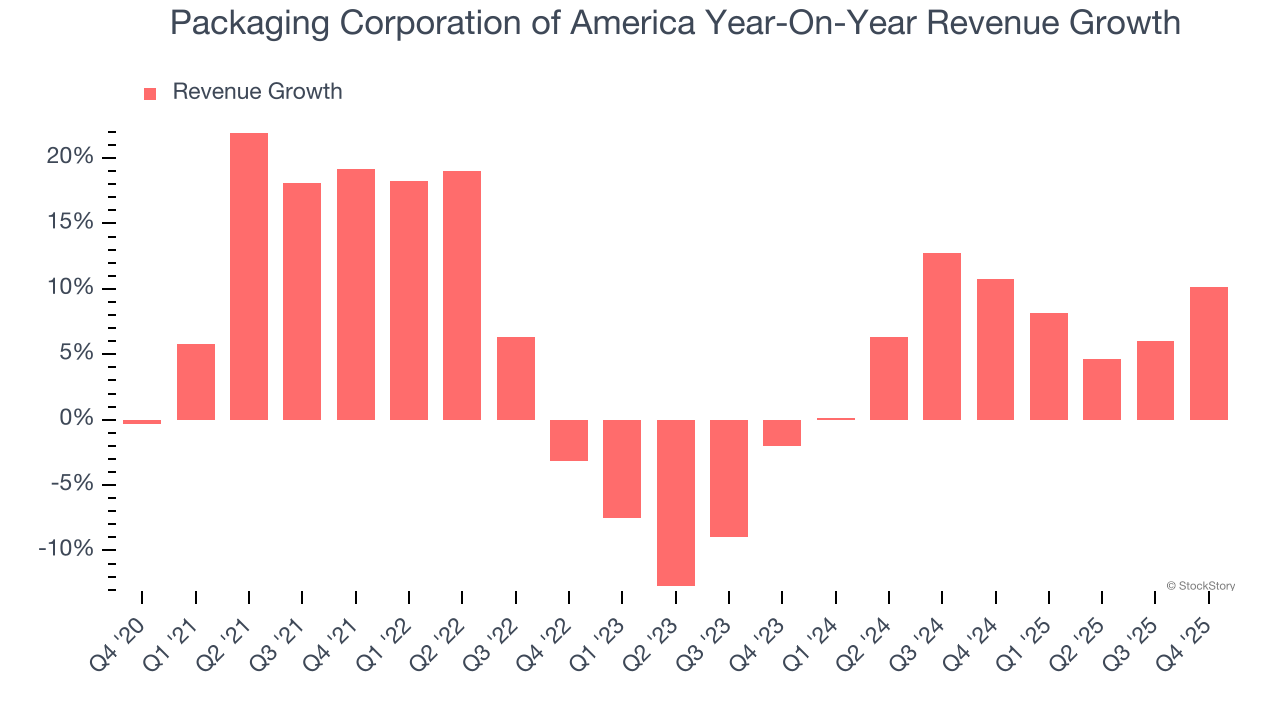

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Packaging Corporation of America grew its sales at a mediocre 6.2% compounded annual growth rate. This fell short of our benchmark for the industrials sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Packaging Corporation of America’s annualized revenue growth of 7.3% over the last two years is above its five-year trend, but we were still disappointed by the results.

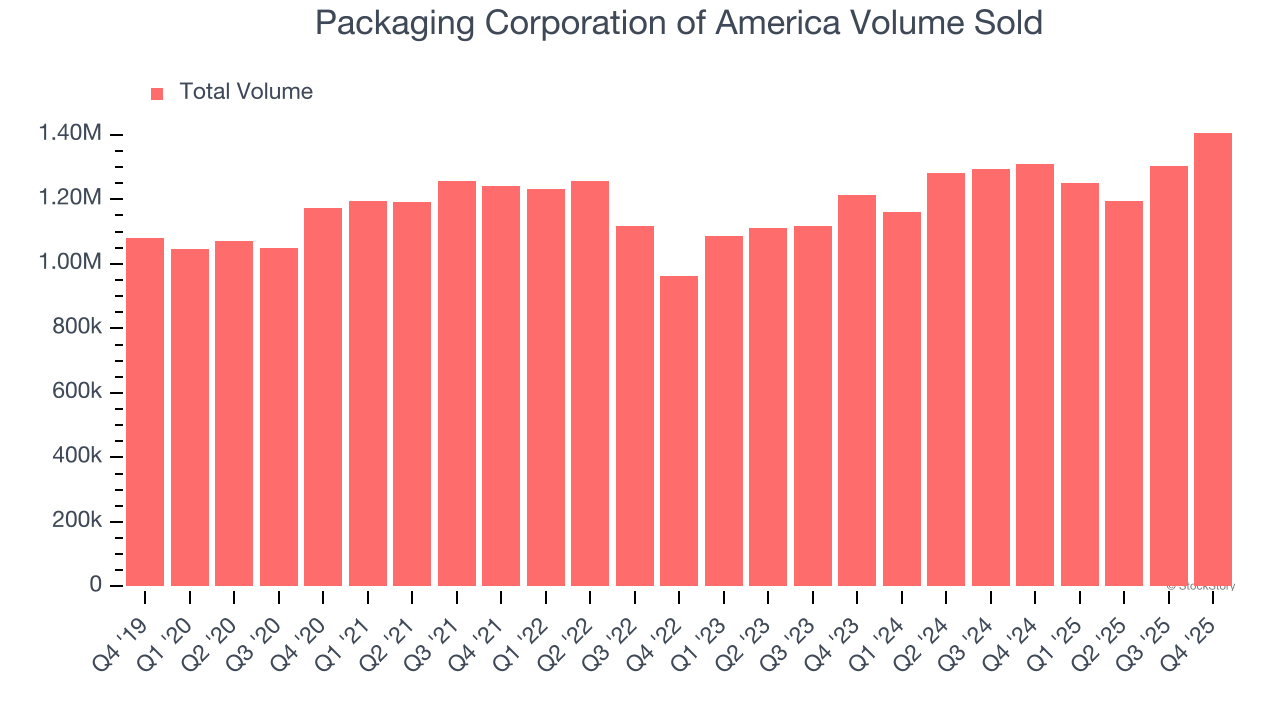

Packaging Corporation of America also reports its number of units sold, which reached 1.41 million in the latest quarter. Over the last two years, Packaging Corporation of America’s units sold averaged 6.9% year-on-year growth. Because this number is in line with its revenue growth, we can see the company kept its prices fairly consistent.

This quarter, Packaging Corporation of America’s revenue grew by 10.1% year on year to $2.36 billion but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 13% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and implies its newer products and services will fuel better top-line performance.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

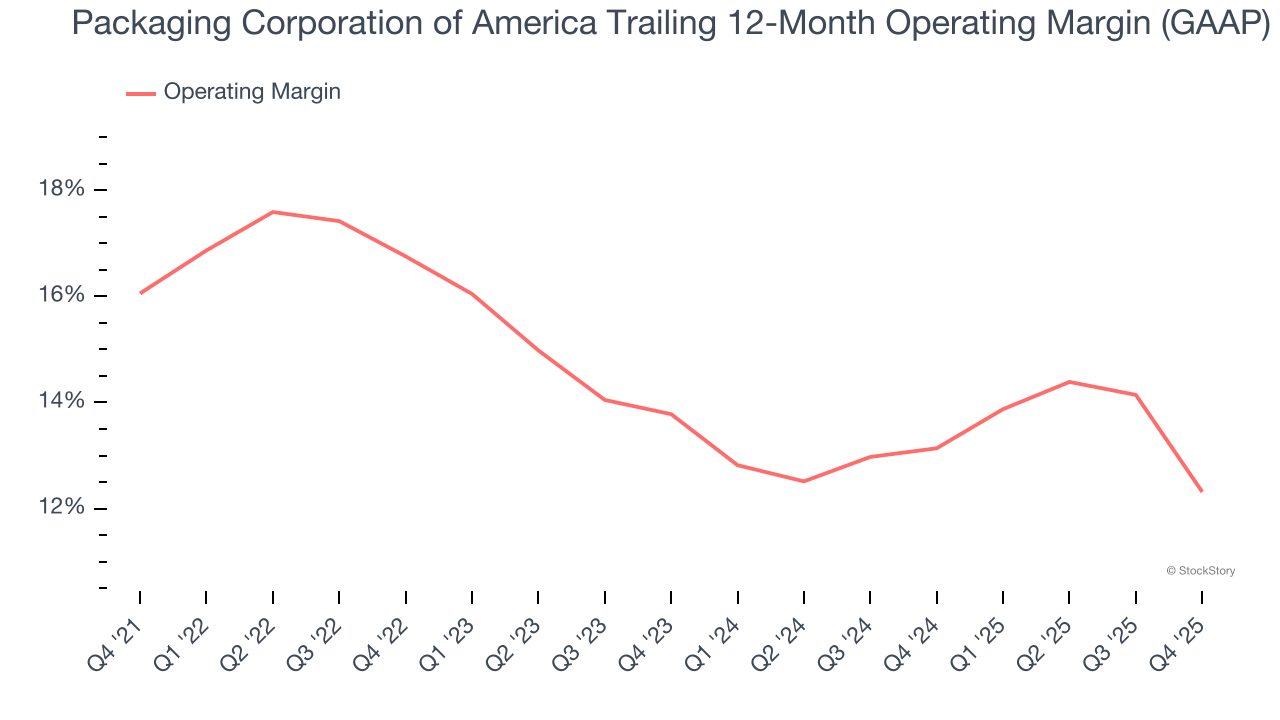

Packaging Corporation of America has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 14.4%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Packaging Corporation of America’s operating margin decreased by 3.7 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Packaging Corporation of America generated an operating margin profit margin of 7.1%, down 7 percentage points year on year. Since Packaging Corporation of America’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

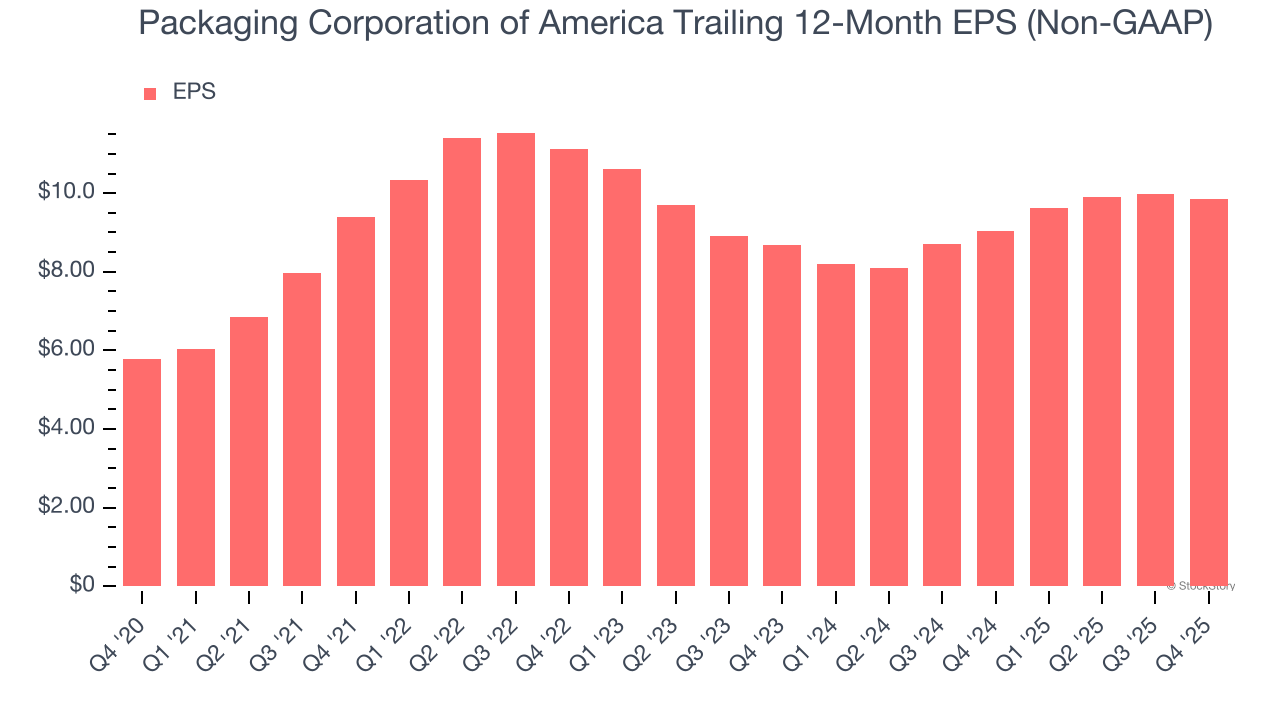

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Packaging Corporation of America’s EPS grew at a solid 11.2% compounded annual growth rate over the last five years, higher than its 6.2% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

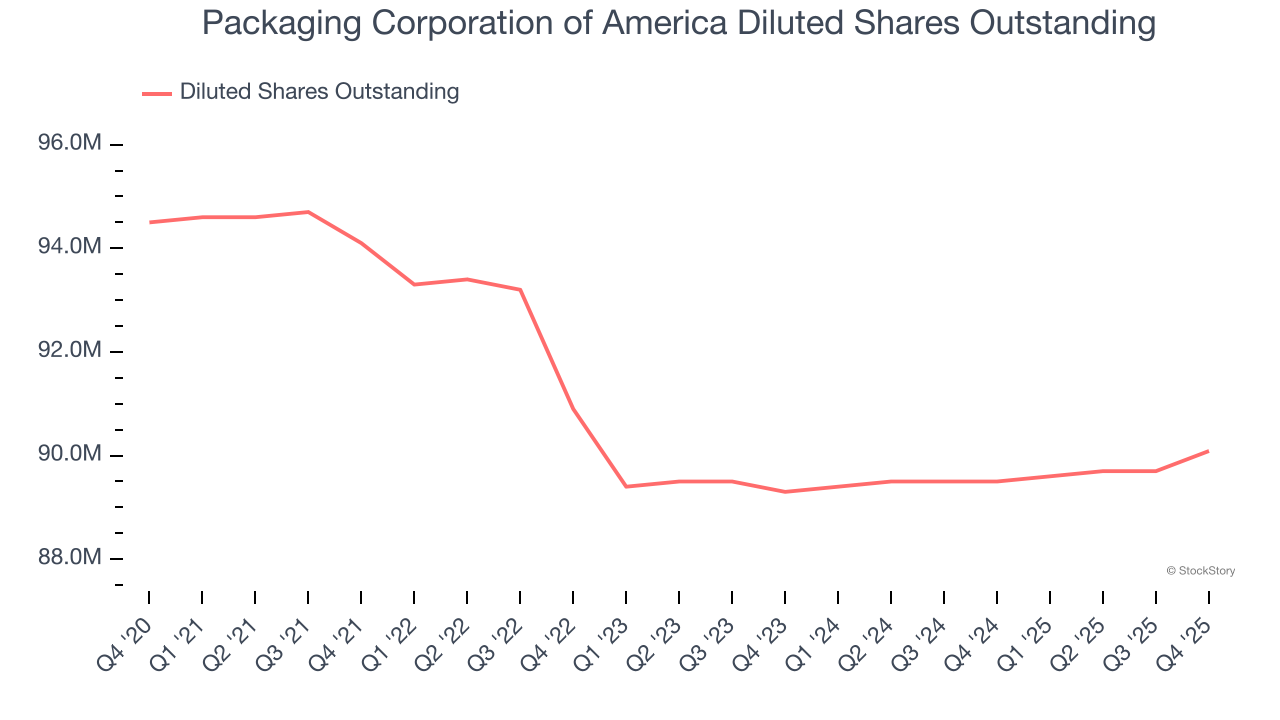

We can take a deeper look into Packaging Corporation of America’s earnings quality to better understand the drivers of its performance. A five-year view shows that Packaging Corporation of America has repurchased its stock, shrinking its share count by 4.7%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Packaging Corporation of America, its two-year annual EPS growth of 6.4% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Packaging Corporation of America reported adjusted EPS of $2.32, down from $2.47 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Packaging Corporation of America’s full-year EPS of $9.84 to grow 12.2%.

Key Takeaways from Packaging Corporation of America’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 2.2% to $218.76 immediately following the results.

The latest quarter from Packaging Corporation of America’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).