Carvana has had an impressive run over the past six months as its shares have beaten the S&P 500 by 12.5%. The stock now trades at $440.62, marking a 23.3% gain. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Following the strength, is CVNA a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free for active Edge members.

Why Does CVNA Stock Spark Debate?

Known for its glass tower car vending machines, Carvana (NYSE: CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

Two Things to Like:

1. Retail Units Sold Skyrocket, Fueling Growth Opportunities

As an online retailer, Carvana generates revenue growth by expanding its number of users and the average order size in dollars.

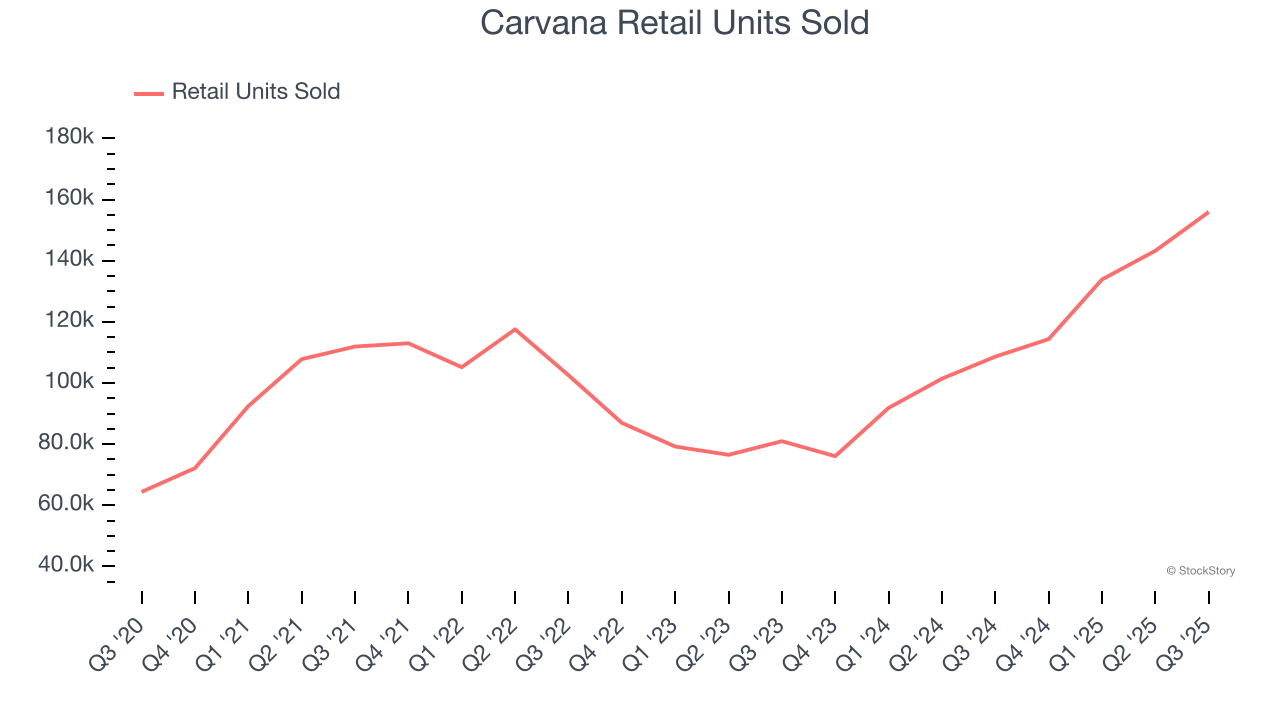

Over the last two years, Carvana’s retail units sold, a key performance metric for the company, increased by 31.4% annually to 155,941 in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

2. Increasing Free Cash Flow Margin Juices Financials

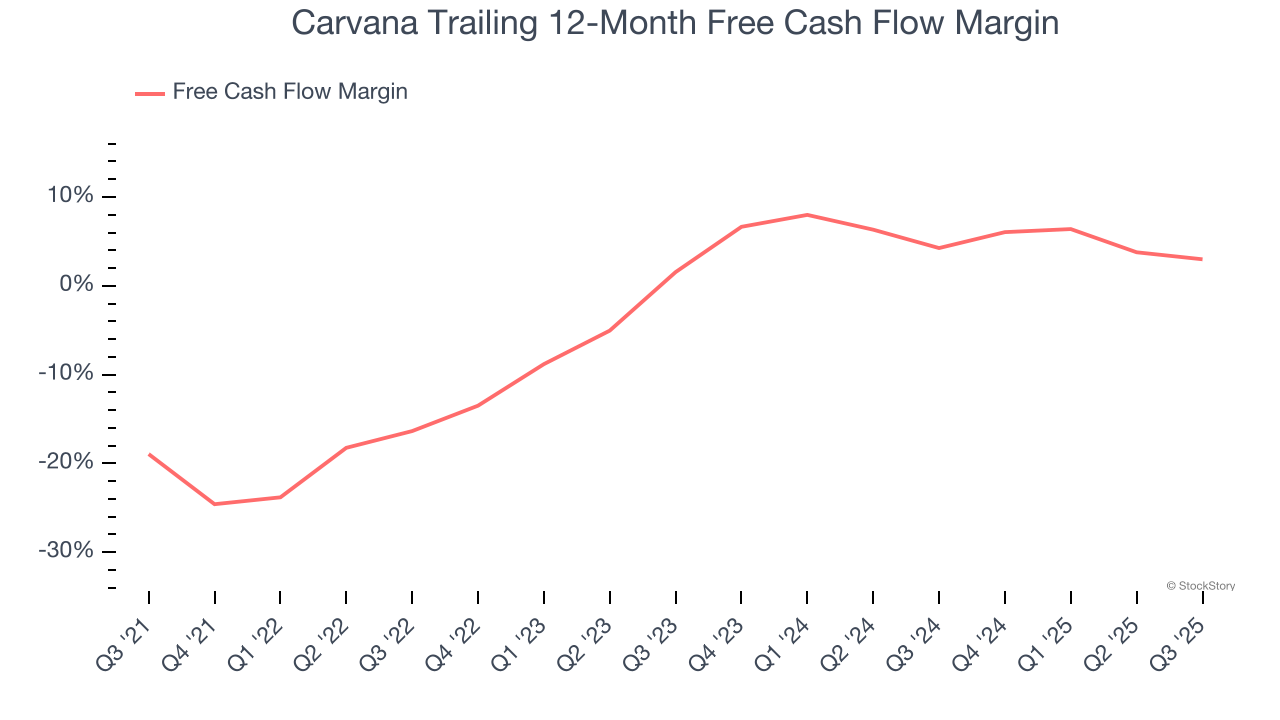

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Carvana’s margin expanded by 19.3 percentage points over the last few years. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Carvana’s free cash flow margin for the trailing 12 months was 3%.

One Reason to be Careful:

Customer Spending Decreases, Engagement Falling?

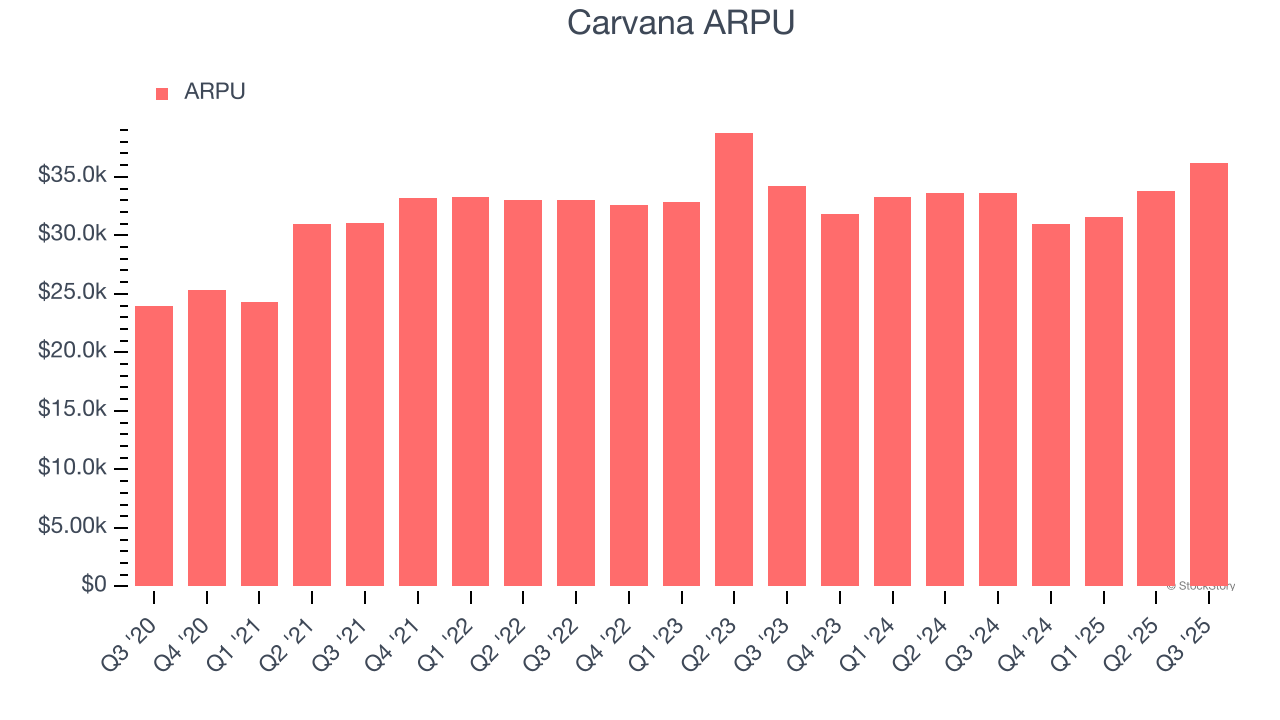

Average revenue per unit (ARPU) is a critical metric to track because it measures how much customers spend per order.

Carvana’s ARPU fell over the last two years, averaging 2% annual declines. This isn’t great, but the increase in retail units sold is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Carvana tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether units can continue growing at the current pace.

Final Judgment

Carvana has huge potential even though it has some open questions, and with its shares outperforming the market lately, the stock trades at 24.3× forward EV/EBITDA (or $440.62 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free for active Edge members.

Stocks We Like Even More Than Carvana

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.