What a brutal six months it’s been for The Honest Company. The stock has dropped 43.5% and now trades at $2.26, rattling many shareholders. This may have investors wondering how to approach the situation.

Is now the time to buy The Honest Company, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think The Honest Company Will Underperform?

Even though the stock has become cheaper, we're cautious about The Honest Company. Here are three reasons we avoid HNST and a stock we'd rather own.

1. Fewer Distribution Channels Limit its Ceiling

With $383.1 million in revenue over the past 12 months, The Honest Company is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, The Honest Company’s margin dropped by 13.2 percentage points over the last year. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business. The Honest Company’s free cash flow margin for the trailing 12 months was negative 5.6%.

3. Previous Growth Initiatives Have Lost Money

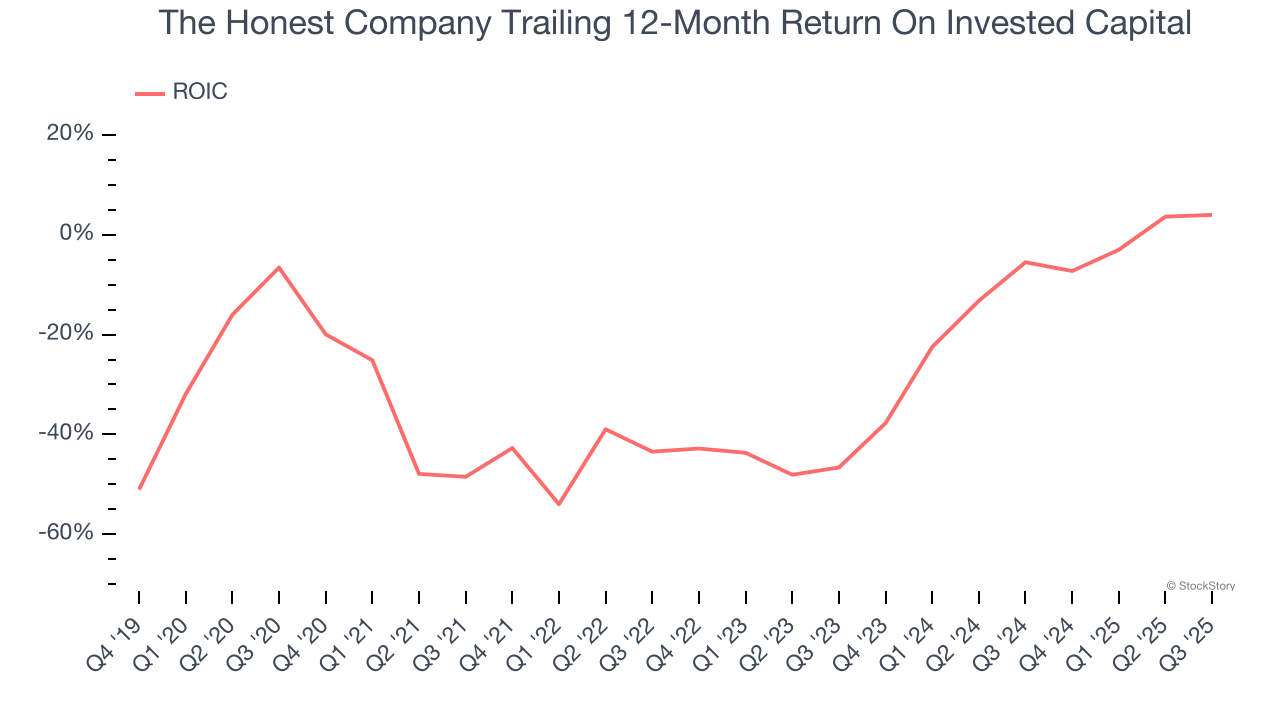

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

The Honest Company’s five-year average ROIC was negative 28%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer staples sector.

Final Judgment

The Honest Company falls short of our quality standards. After the recent drawdown, the stock trades at 19× forward P/E (or $2.26 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now. We’d suggest looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than The Honest Company

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.