Health insurance company Humana (NYSE: HUM) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 11.4% year on year to $32.52 billion. Its GAAP loss of $6.61 per share was 62.2% below analysts’ consensus estimates.

Is now the time to buy Humana? Find out by accessing our full research report, it’s free.

Humana (HUM) Q4 CY2025 Highlights:

- Revenue: $32.52 billion vs analyst estimates of $32.06 billion (11.4% year-on-year growth, 1.4% beat)

- EPS (GAAP): -$6.61 vs analyst expectations of -$4.08 (62.2% miss)

- Expects full-year 2026 EPS to be at least $9 per share, compared with analysts' estimate of $11.92 per share

- Adjusted EBITDA: $1.50 billion (4.6% margin, 2,256% year-on-year growth)

- Operating Margin: 4.1%, up from -1.9% in the same quarter last year

- Free Cash Flow was -$1.85 billion compared to -$675 million in the same quarter last year

- Customers: 15 million, up from 14.99 million in the previous quarter

- Market Capitalization: $21.81 billion

Company Overview

With over 80% of its revenue derived from federal government contracts, Humana (NYSE: HUM) provides health insurance plans and healthcare services to approximately 17 million members, with a strong focus on Medicare Advantage plans for seniors.

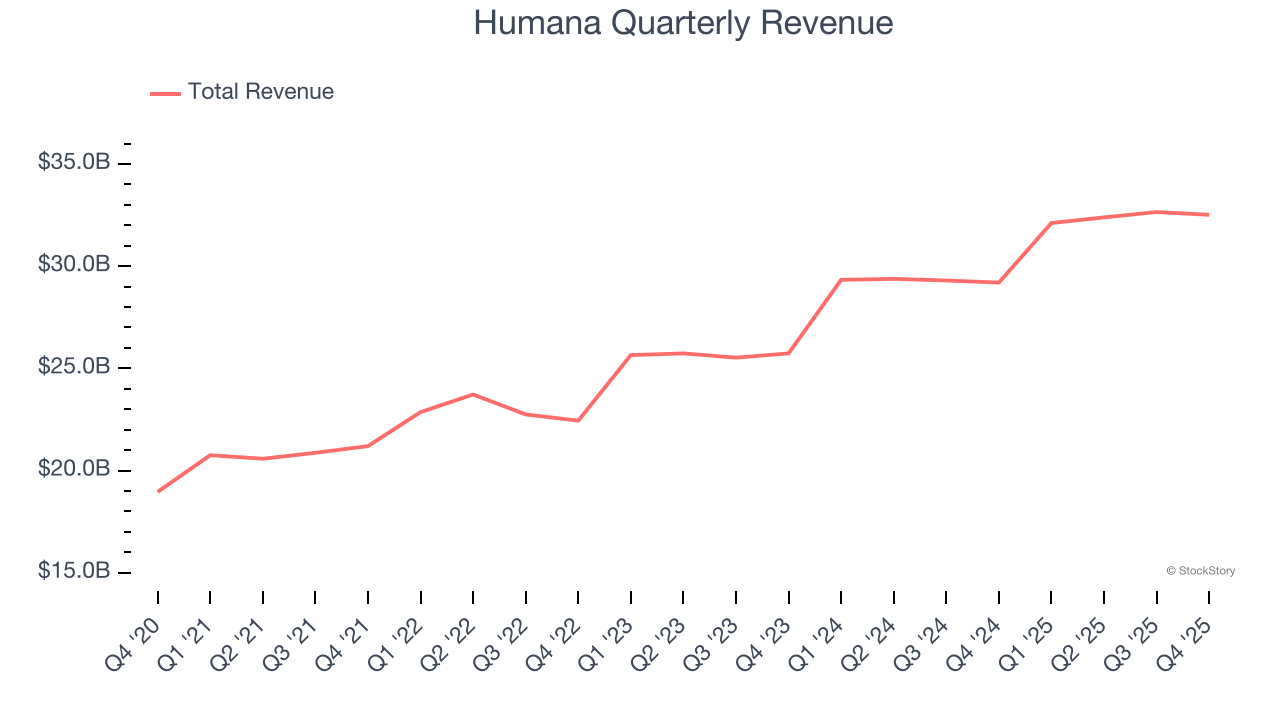

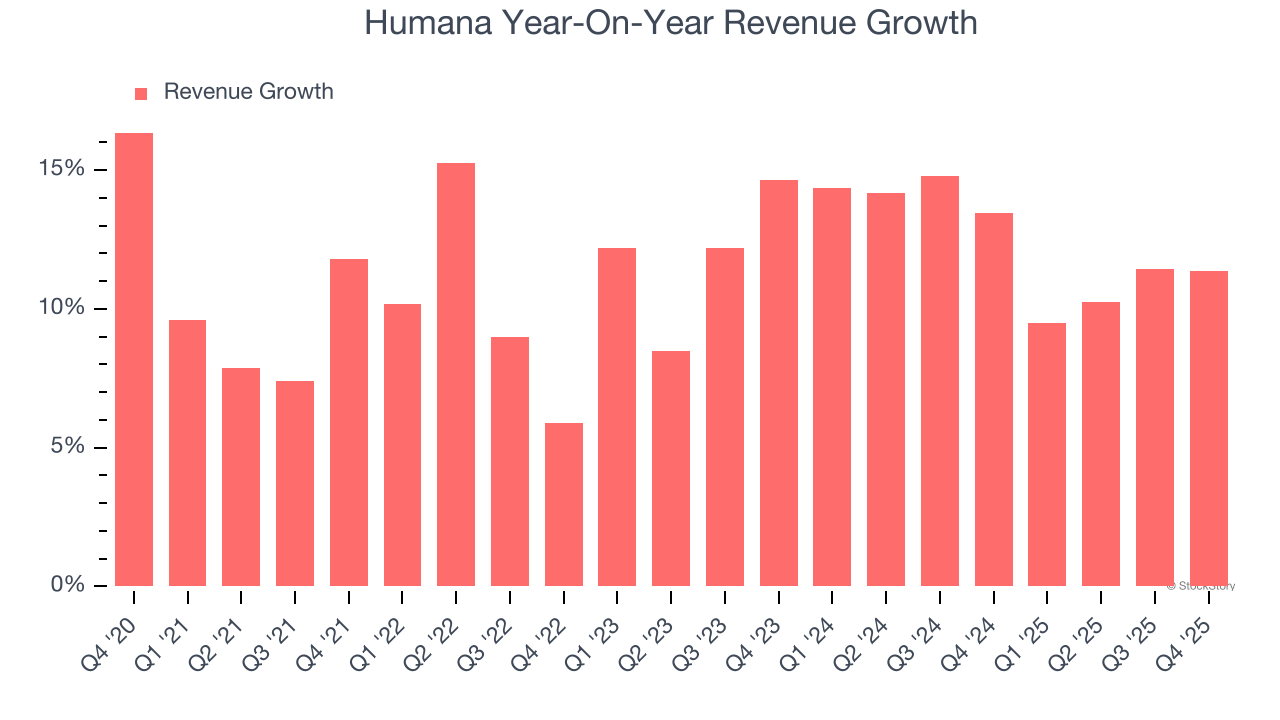

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Humana’s sales grew at a decent 11.2% compounded annual growth rate over the last five years. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Humana’s annualized revenue growth of 12.4% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

Humana also reports its number of customers, which reached 15 million in the latest quarter. Over the last two years, Humana’s customer base averaged 8.3% year-on-year declines. Because this number is lower than its revenue growth, we can see the average customer spent more money each year on the company’s products and services.

This quarter, Humana reported year-on-year revenue growth of 11.4%, and its $32.52 billion of revenue exceeded Wall Street’s estimates by 1.4%.

Looking ahead, sell-side analysts expect revenue to grow 12.6% over the next 12 months, similar to its two-year rate. This projection is particularly noteworthy for a company of its scale and suggests the market is baking in success for its products and services.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

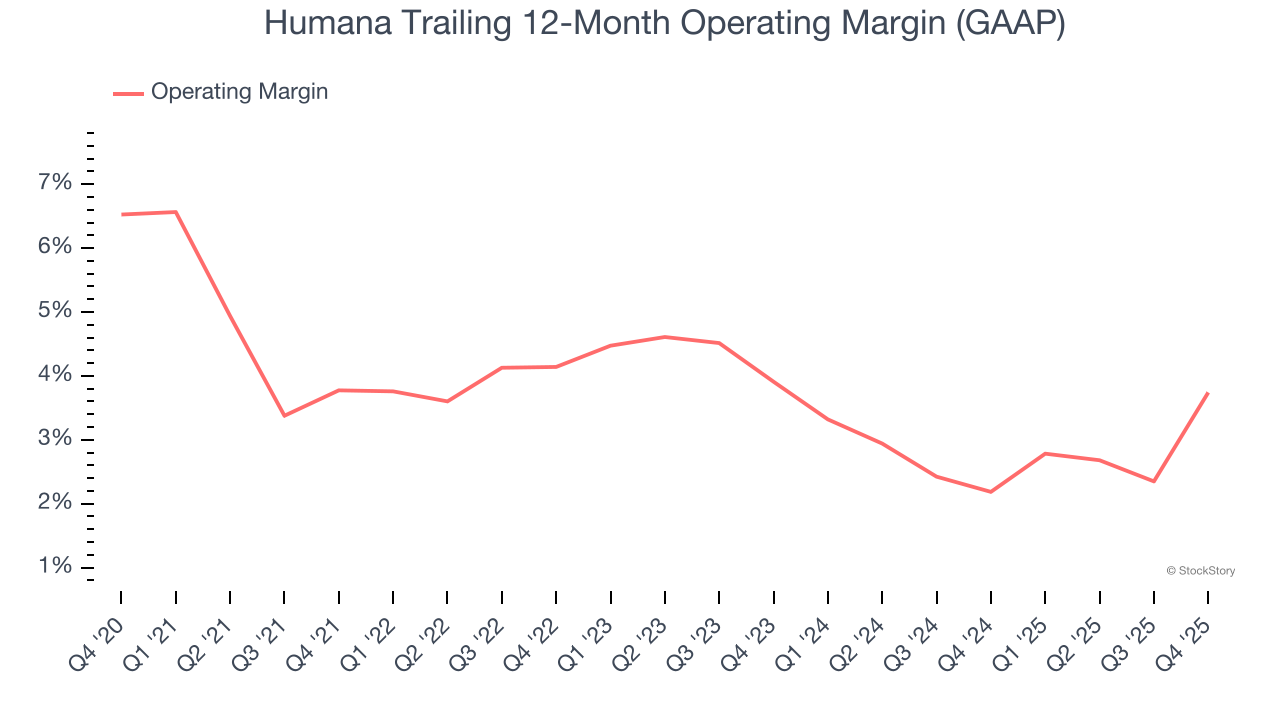

Operating Margin

Humana’s operating margin has been trending up over the last 12 months and averaged 3.5% over the last five years. Although its profitability is still paltry, we can see its decent revenue growth is giving it operating leverage as it scales. This gives it a shot at higher long-term profits if it can keep expanding.

Analyzing the trend in its profitability, Humana’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Humana generated an operating margin profit margin of 4.1%, up 6 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

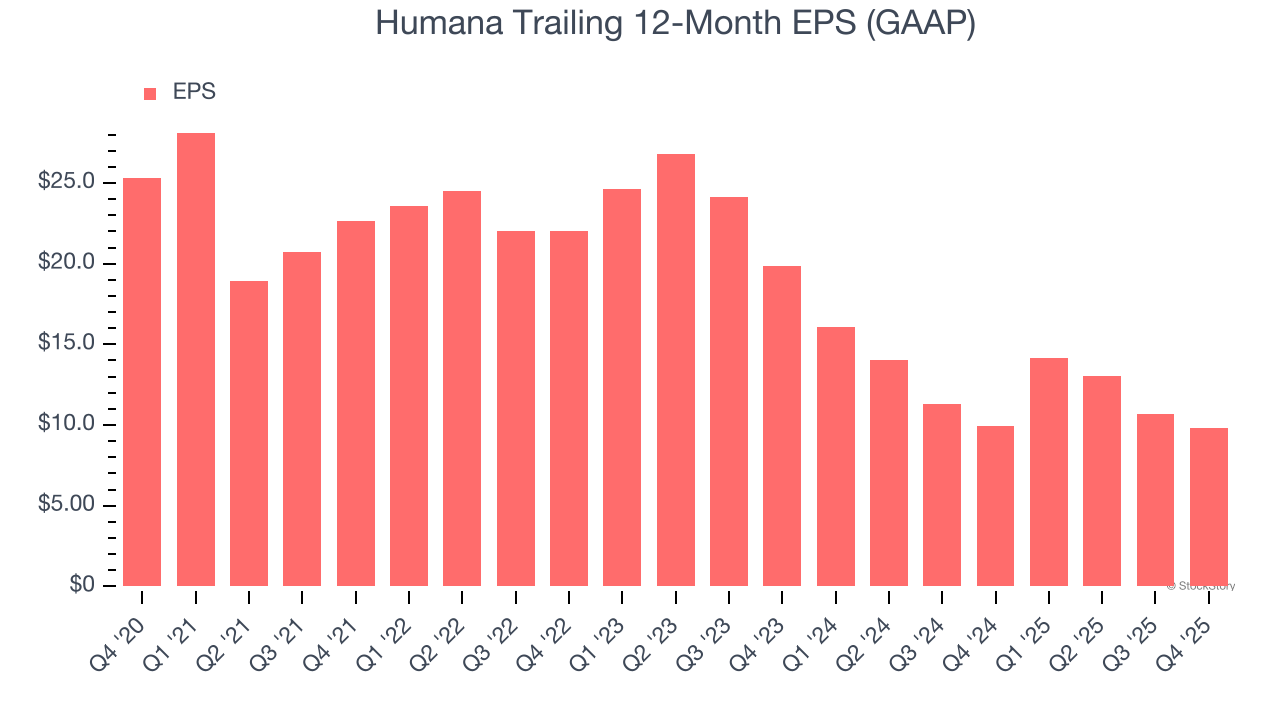

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Humana, its EPS declined by 17.3% annually over the last five years while its revenue grew by 11.2%. We can see the difference stemmed from higher interest expenses or taxes as the company actually improved its operating margin and repurchased its shares during this time.

In Q4, Humana reported EPS of negative $6.61, down from negative $5.75 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Humana’s full-year EPS of $9.80 to grow 23.1%.

Key Takeaways from Humana’s Q4 Results

It was good to see Humana narrowly top analysts’ revenue expectations this quarter. On the other hand, its EPS missed. EPS guidance for the full year also came in well below Wall Street's estimate as lower quality ratings for its Medicare Advantage plans for older adults present a major headwind for the company. Overall, this was a weaker quarter. The stock traded down 8.1% to $166.67 immediately following the results.

Humana underperformed this quarter, but does that create an opportunity to invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).