Rollins has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 7.7% to $62.98 per share while the index has gained 10.2%.

Is now the time to buy ROL? Find out in our full research report, it’s free.

Why Are We Positive On ROL?

Operating under multiple brands like Orkin and HomeTeam Pest Defense, Rollins (NYSE: ROL) provides pest and wildlife control services to residential and commercial customers.

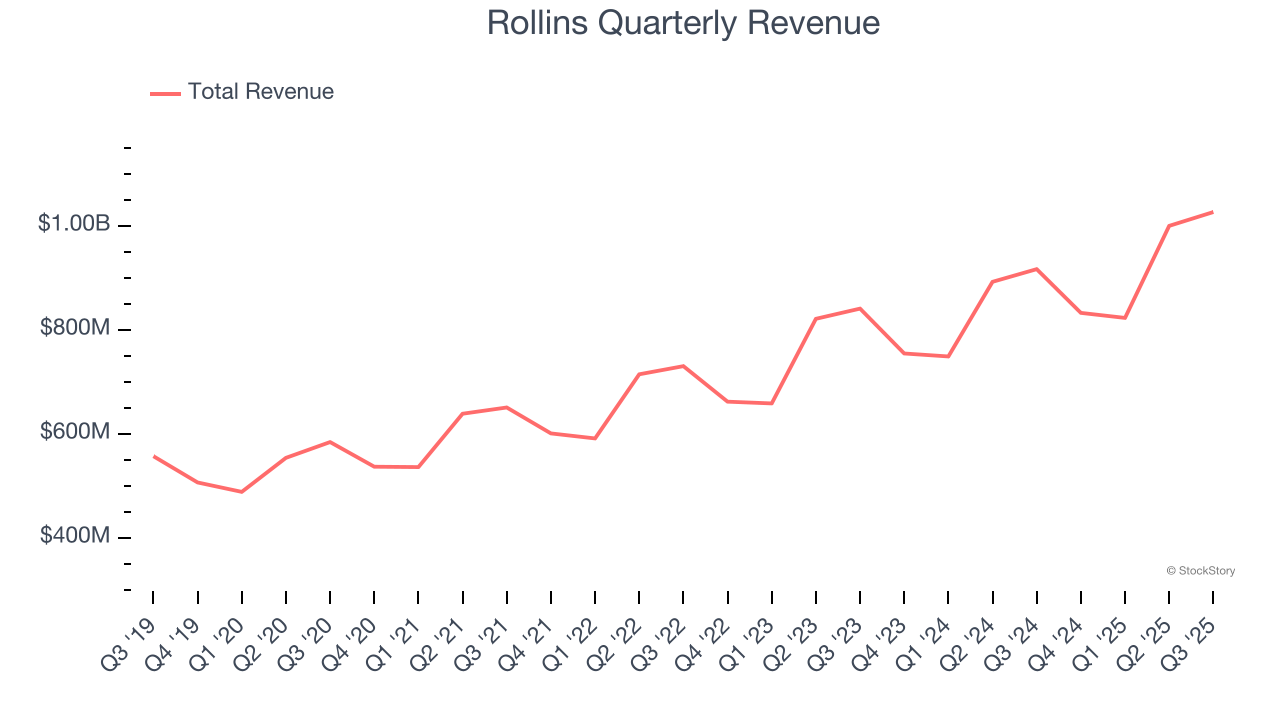

1. Skyrocketing Revenue Shows Strong Momentum

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Rollins grew its sales at an impressive 11.5% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

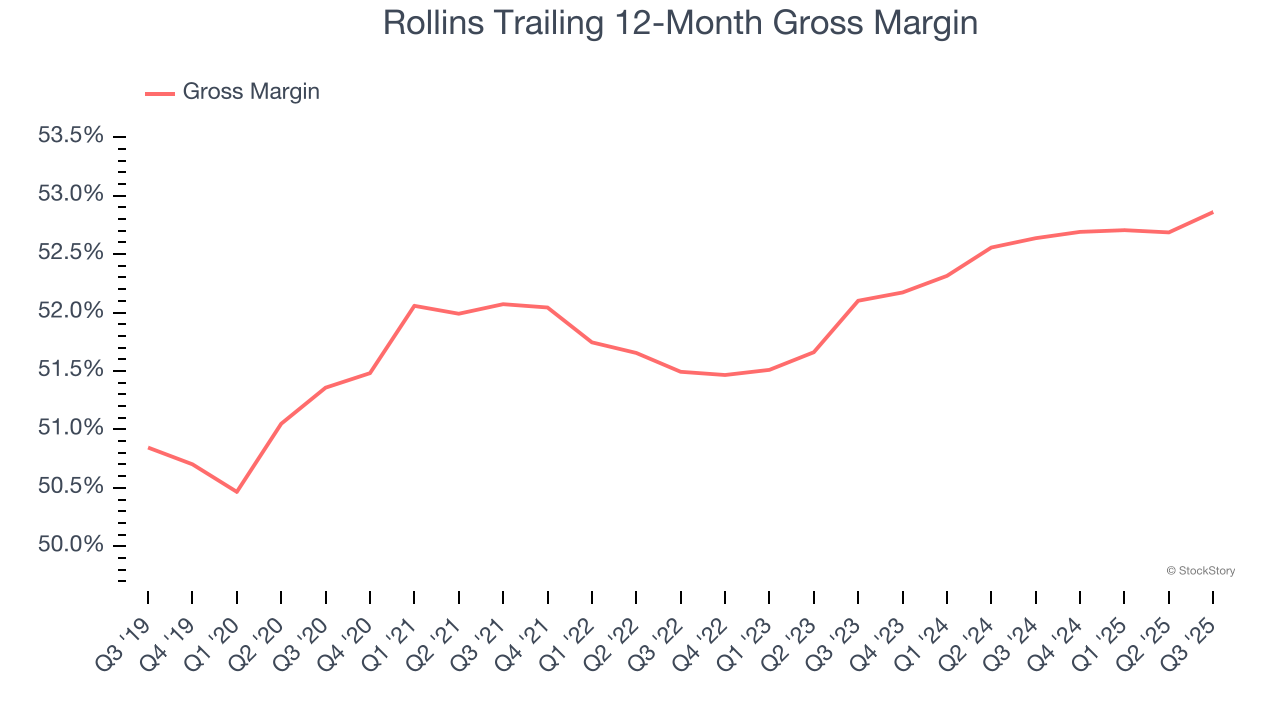

2. Elite Gross Margin Powers Best-In-Class Business Model

Cost of sales for an industrials business is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics.

Rollins has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 52.3% gross margin over the last five years. That means Rollins only paid its suppliers $47.71 for every $100 in revenue.

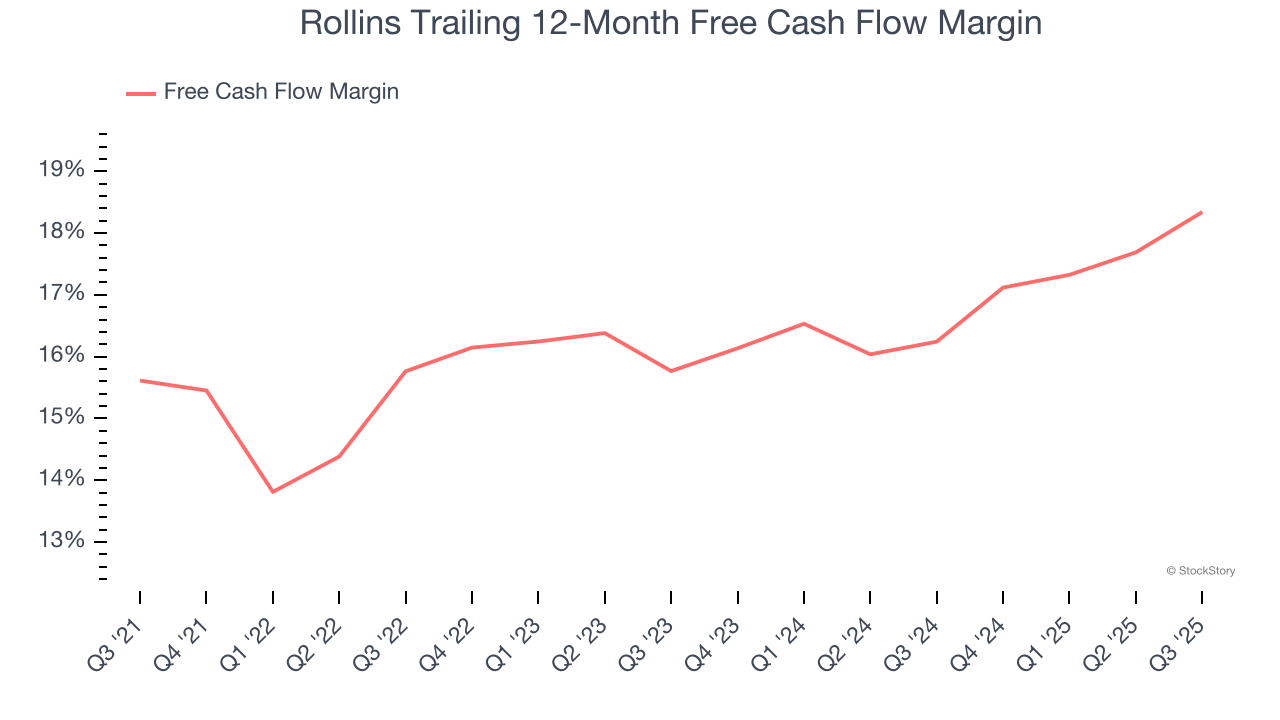

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Rollins has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 16.5% over the last five years.

Final Judgment

These are just a few reasons why Rollins ranks highly on our list, but at $62.98 per share (or 51.1× forward P/E), is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.