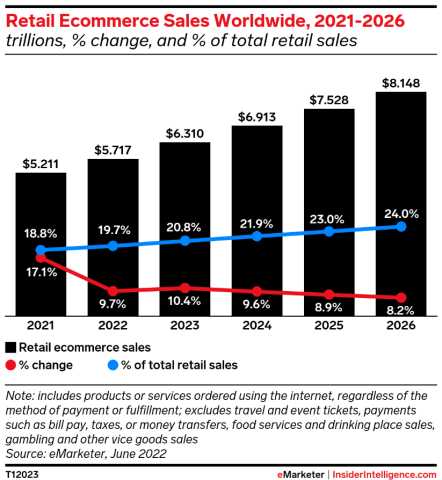

Total annual retail e-commerce sales in the US are slated to surpass the $1 trillion mark for the first time, in 2022. And that’s just the beginning. According to eMarketer, that figure will reach the $1.67 trillion level by 2026, a roughly 61% jump! The global market is projected to grow at a solid 42% rate from 2022 to 2026 as well, with forecasts suggesting global retail e-commerce sales will grow from $5.7 trillion to $8.15 trillion.

One of the reasons for the expected growth is directly related to the role influencers now play in retail e-commerce. According to a Shopify E-Commerce Trends 2023 report, “…more than 7 out of 10 businesses expect online influencers to become even more important in the future.” It is estimated that even a micro-influencer, with just 10,000 – 50,000 followers, can earn between $40,000 and $100,000 each year. They generate income through social media posts, content production, and other methods. Affiliate marketers also generate meaningful income via their work with brands of all sizes, whereby products and services are procured through their websites or via their links.

Most industry observers would admit that retailers routinely spend large sums on online ad/marketing campaigns and engage in loyalty/reward programs. Unfortunately, these approaches lead to few consistent, tangible methods of tracking monetization successes or their returns on investment. The recent Shopify report also notes that “Already-high customer acquisition costs are on the rise as return on ad dollar spend declines.” As a result, the billions of dollars brands currently spend on e-commerce ad/marketing campaigns fall short of optimum effectiveness and sales conversion.

While influencer, affiliate marketing and total e-commerce sales figures are not too shabby, the current outmoded payment format is fraught with income limitations for influencers of all sizes. These groups are only paid on a direct basis by brands or third parties, thereby limiting earning potential.

Interestingly, the enviable expected industry growth rates and influencer income levels could be dwarfed if the current process and ecosystem change for both retailers and influencers alike.

Enter KwikClick.

The View from 30,000 Feet

This innovative upstart may not be a household name today but it most assuredly soon will be as it enjoys the typical viral sign-up growth that follows word-of-mouth successes. KwikClick Inc. (OTCQB: KWIK) is a publicly traded company that has introduced the e-commerce industry’s first consolidated platform that combines brands’ customer acquisition and engagement campaigns with loyalty, rewards, influencer, and affiliate programs.

The platform is designed to solve the current issues limiting the potentially meteoric e-commerce ecosystem’s growth. For brands, KWIK can ensure that their KWIK-centric online marketing spend will only occur when an influencer or affiliate-driven sale is transacted. Plus, KWIK provides ongoing, detailed monitoring and reporting capabilities. As a result, brands’ ROI should be favorably impacted. For influencers and affiliates, income potential increases exponentially. The KWIK platform typically fosters above-industry average commission payment rates. Plus, not only does it enable affiliate marketers or influencers to generate income when a follower clicks a direct link but if the follower chooses to become an influencer and converts a fellow follower, he/she gets paid as well. This path continues as long as that link is utilized by additional followers.

This novel approach is a win-win for retailers, sellers, and even buyers, who themselves can evolve into micro-influencers. And it is done for free for all parties. All that is required is a sign-up to the platform and implement the appropriate program via the integration of KWIK’s proprietary APIs.

Against this backdrop, the Company appears on pace to sign on a substantial number of brands and influencers in 2023 and beyond. Leveraging its patented technology, novel approach, and business development activity, KWIK management has identified a “hit list” that could result in obtaining a large number of brands, consumers, and influencers in the coming quarters.

For example, KWIK's management team is working with a sizeable cloud-based commerce company in which KWIK is developing, modifying, and testing a platform specifically designed for their uses. Once thoroughly evaluated and approved, KWIK would have exposure to approximately 2,000,000 online stores and over 80,000,000 products, as well as to all of the consumers of these products.

In addition, KWIK is entertaining interest from a significantly sized organization to build a specific platform to facilitate its approximately 800,000 influencers to manage and effectively monetize their business models as affiliates to this organization. It is expected that the evaluation and resultant negotiations regarding these opportunities could occur by the end of 1Q23.

KWIK’s API's and customized proprietary software creates an application that brands, without the necessity of any I.T. programming on their side, can offer loyalty, reward, and affiliate programs to their customers and the data necessary to manage these programs. The first application developed under the KWIK platform utilizing these API's will be an integrated application with Shopify, closely followed with Woo Commerce and Magento marketing platforms utilizing widgets designed to automate the process of turning customers in to ambassadors in a natural way.

Given that e-commerce platform leader Shopify services over 4 million e-commerce sites and nearly half a trillion in total sales are executed through its platform, KWIK is in a great position to capture corporate customers, beginning next year. Moreover, this opportunity could serve as a significant sign-up catalyst for both brands and influencers.

KWIK Potential Sales and Market Value

As a disruptive new entrant into the e-commerce arena, it can be difficult to project sales and EBITDA results. After all, the very nature of the model is to foster exponential growth. Therefore, this under-the-radar potential unicorn is poised to enjoy its early growth in 2023 by early adopter sign-ups from micro-mid-tier sized influencers and small – medium sized businesses. Given the current economic environment, KWIK could enjoy a slew of new influencer sign-ups from consumers seeking a side hustle as well, thereby becoming micro-influencers and generating residual income.

Sometime during mid-2023, it is likely that the Company begins to win large brands as clients, along with word-of-mouth spikes in affiliate and influencer sign-ups. Once a major brand signs on all bets are off—as others could quickly fall in line, particularly in the same industry. Plus, the Shopify channel could begin to bear meaningful fruit. Based on this analysis, it is reasonable to expect that KWIK could generate revenue from $12 million up to the tens of millions in 2023. And this forecast could be considered low, by some standards, considering that total e-commerce sales are slated to reach $6.3 trillion on a global basis.

The Company’s revenue model is straightforward and built for scale as it used blockchain technologies to track transactions. Brands offer targeted products at a discount as part of marketing campaigns, which is a standard practice. The spread between the sale price and discount is made available to KWIK and the influencers and affiliates on the platform. Specifically, KWIK’s SaaS (Software as a Service) model results in a typical 20% fee on all sales through its platform. Therefore, for each $10 million in KWIK revenue, $50M in goods and services would be transacted, a relatively small sum, given the ad/marketing spend by brands each year. Given the typical low-cost structure of KWIK’s SaaS model, it is reasonable to assume operating profit could be recorded beginning in the sales-heavy fourth quarter of 2023.

The 1-2 year period following early adopter usage tends to be the years in which companies enjoy the greatest growth. Given that KWIK’s platform is all about improving brand marketing spend by making it more tactical and profitable, and improving current and new influencer income generation, it is not unreasonable to project a 10x increase in sales. For example, a (low) $12M sales figure for 2023 could reach over $124M in 2024, and still represent only .009% of all global e-commerce sales.

If this forecast is generally accurate, assigning an 8x 2024 estimated revenue multiple next year is pretty average for a SaaS company. Therefore, achieving a $1 billion+ market value sometimes in 2023, which is a 4x jump from current levels, appears to be in the cards. In 2025, a roughly 5x top-line growth rate would result in $600M in KWIK revenue, reflecting .04% of all global e-commerce sales. At that time, if a sale of the company has not already occurred, leadership could consider M&A to add new tech or customers.

The KWIK Difference

KWIK’s approach is transformative for the e-commerce industry because it improves outcomes for brands and influencers. Brands reward their influencer/customer base which fosters unmatched loyalty rather than spending huge sums to advertising agencies that offer vague returns on investment. By employing a system whereby influencers/customers can earn a commission when they influence their followers’ friends and contacts, retail’s spheres of influence can maximize their earning potential. This compelling business model design has few direct comparables or peers and KWIK has already signed up roughly 200 companies and influencers of all sizes and interests.

The most direct comparable to KWIK is Yotpo, which offers brands a comprehensive suite of e-commerce marketing tools that leverage various forms of content to foster consumer engagement and retention. Yotpo is a leading player in the space as it is a key platform used by Shopify clients. However, while KWIK’s platform is free to brands and influencers, aside from a free “start-up” type of offering, Yotpo’s services are assessed monthly fees, depending on the service tier. As a result, it is possible that fee-paying Yotpo -clients may be low-hanging fruit for KWIK which could potentially lead to future, near term business for the Company, even if early usage is on a trial basis.

To date, Yotpo has raised over $436M with a 2021 valuation of $1.4 billion. These figures confirm the industry’s promise and positioning while the compelling KWIK approach affirms KWIK’s outsized future potential.

How it Works: Brands

As a free, API-integrated, offering with real-time reporting, KWIK offers a risk-free e-commerce platform that incentivizes customers by turning them into not just ordinary affiliate marketers and influencers, but true brand ambassadors. KWIK’s approach is designed to generate referred customers which can lead to a three-pronged customer engagement and retention engine. The KWIK platform leads to initial horizontal customer capture through trusted referral which leads to additional, new customer captures as more referrals commence. This approach then leads to vertical repeat customer transactions from referrers and pure customers alike. Finally, these active referrers evolve into a role or community recognition as an active, brand’s ambassador.

Brands do no incur costs unless a sale is executed and enjoy customized back-end affiliate, product information, detailed reporting, and total platform implementation and integration. By utilizing a targeted and tactical approach that can be monetized and tracked, brands can smartly manage their marketing budgets. Moreover, as a brand member of KWIK, which can pay customers/influencers above-average commissions (or fees), greater and more consistent brand loyalty can be achieved.

How it Works: Influencers

One concept that KWIK promotes is “Waves”. Under typical affiliate and influencer programs, one’s earning potential is solely peer-to-peer based. With the use of the Company’s sophisticated blockchain technology, influencers and affiliates can earn multiples of their current earnings via the referral/promotion process.

In addition to waves of earning, Kwik offers cashback rewards (Kwikcash) for every purchase made through the platform. This cashback offer also applies to anyone who makes a purchase through a product link. When one earns cash back on a purchase, or shares a favorite product and earn a commission, that money will be added to the account in the form of Kwikcash, which can be used for purchases or converted to cash. All transactions can be viewed or accessed in real-time via a personalized Data Dashboard.

The Process:

Referrer A buys and then promotes/refers product via a custom link.

B likes it and buys it. A receives commission

B promotes/refers his purchase

C likes it and buys it.

A & B receive commissions (B receives lower fee)

And so on…

The Future E-Commerce Industry Standard

KWIK is well-positioned to leverage its platform and potentially emerge as the e-commerce industry’s marketing standard. However, as an early stage company offering a new approach, there could be some speed bumps along the growth path. It is not uncommon for new, disruptive firms to take time to educate the market---in this case both brands and influencers. Brand API-integration times could be elongated as well. Conversely, growth could be fast and furious, requiring management to hire more online technical and client support than they have currently planned. Still, all of these risks are commensurate with companies of KWIK’s size and standing.

The key going forward is the leverage of competitive advantages including its blockchain technology and platform agnostic architecture which fosters swift API-based integration with prospective brands. The free platform offering with its feature-rich reporting for brands and influencers are a hidden asset as well, and could serve as a differentiator. As a result, meaningful revenue can be recorded as influencers generate income as they inform, inspire, recruit, and convert additional affiliates and influencers within their respective communities.

As brands are on-boarded and sales occur, this SaaS-model based publicly-traded company should begin to attract opportunistic investors that recognize the huge opportunity and KWIK’s low-cost model. Investors may also witness meaningful international revenue, where referral and influencer-derived online business can be even greater than the US. As a result, greater per brand sales and overall operating profit may be a more near-term event for KWIK, favorably impacting the Company’s stock in the first half of 2023 and beyond.

Disclaimers: Hawk Point Media Group, Llc. is providing syndication and distribution services for this content. Hawk Point Media Group, Llc. is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by Hawk Point Media Group, Llc. is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall Hawk Point Media Group, Llc. be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by Hawk Point Media Group, Llc., including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. Hawk Point Media Group, Llc. strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, Hawk Point Media Group, Llc., its authors, contributors, or its agents, have not been compensated for preparing research, video graphics, and editorial content. for KwikClick, Inc. As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website.

The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

Media Contact

Company Name: Hawk Point Media

Contact Person: Ken Ellis

Email: info@hawkpointmedia.com

Phone: 3057806988

City: Miami Beach

State: Florida

Country: United States

Website: https://hawkpointmedia.com/