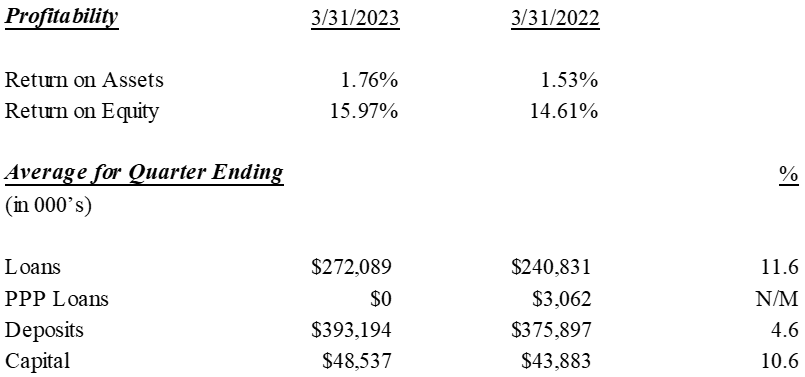

Return on Assets 1.76% And Return on Equity 15.97%

FORT WORTH, TX / ACCESSWIRE / May 3, 2023 / Trinity Bank N.A. (OTC PINK:TYBT) today announced operating results for the three months ending March 31, 2023.

Results of Operations

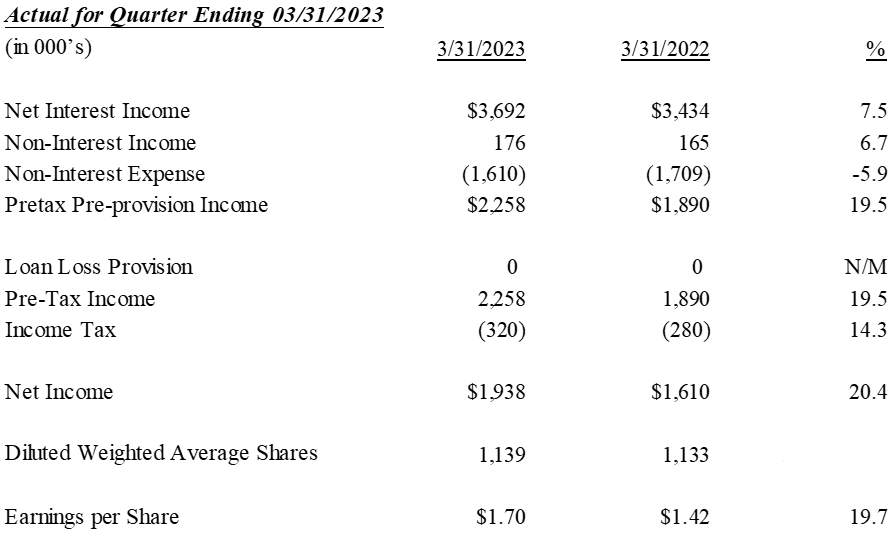

Trinity Bank, N.A. reported Net Income after Taxes of $1,938,000 or $1.70 per diluted common share for the first quarter of 2023, compared to $1,610,000 or $1.42 per diluted common share for the first quarter of 2022, an increase of 19.7%.

President Barney Wiley stated, "We are pleased with our first quarter results. Growth in Earnings, Loans, Deposits, and Capital are indicative of a good market. Our strong and diversified customer base, competitive interest rates, and exceptional customer service have made our continued growth possible. We appreciate our customers and continue to look for long-term relationships with quality people who are looking for a quality local bank."

On May 28, 2023, Trinity will observe its 20-year anniversary. To express their thanks, the bank will be hosting Customer Appreciation Days each Friday in May and invite all customers to drop by the lobby. According to Wiley, "We are proud of our performance and continue to be grateful for our shareholders' trust and their investment in Trinity Bank."

Trinity also announced that its 22nd consecutive increase in its semiannual dividend was paid in late April to shareholders. The April 2023 dividend of $0.81 per share also represents an increase of 8.7% over the April 2022 dividend of $0.75 per share."

Trinity Bank, N.A. is a commercial bank that began operations May 28, 2003. For a full financial statement or for monthly updates on deposit rates and liquidity position visit Trinity Bank's website: www.trinitybk.com. Regulatory reporting format is also available at www.fdic.gov.

###

For information contact:

Richard Burt

Executive Vice President

Trinity Bank

817-763-9966

This Press Release may contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 regarding future financial conditions, results of operations and the Bank's business operations. Such forward-looking statements involve risks, uncertainties and assumptions, including, but not limited to, monetary policy and general economic conditions in Texas and the greater Dallas-Fort Worth metropolitan area, the risks of changes in interest rates on the level and composition of deposits, loan demand and the values of loan collateral, securities and interest rate protection agreements, the actions of competitors and customers, the success of the Bank in implementing its strategic plan, the failure of the assumptions underlying the reserves for loan losses and the estimations of values of collateral and various financial assets and liabilities, that the costs of technological changes are more difficult or expensive than anticipated, the effects of regulatory restrictions imposed on banks generally, any changes in fiscal, monetary or regulatory policies and other uncertainties as discussed in the Bank's Registration Statement on Form SB‑1 filed with the Office of the Comptroller of the Currency. Should one or more of these risks or uncertainties materialize, or should these underlying assumptions prove incorrect, actual outcomes may vary materially from outcomes expected or anticipated by the Bank. A forward-looking statement may include a statement of the assumptions or bases underlying the forward‑looking statement. The Bank believes it has chosen these assumptions or bases in good faith and that they are reasonable. However, the Bank cautions you that assumptions or bases almost always vary from actual results, and the differences between assumptions or bases and actual results can be material. The Bank undertakes no obligation to publicly update or otherwise revise any forward‑looking statements, whether as a result of new information, future events or otherwise, unless the securities laws require the Bank to do so.

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| Quarter Ended | ||||||||||

| March 31 | % | |||||||||

EARNINGS SUMMARY |

2023 | 2022 | Change | |||||||

Interest income |

$ | 5,264 | $ | 3,599 | 46.3% | |||||

Interest expense |

1,572 | 165 | 852.7% | |||||||

Net Interest Income |

3,692 | 3,434 | 7.5% | |||||||

Service charges on deposits |

61 | 59 | 3.4% | |||||||

Other income |

115 | 106 | 8.5% | |||||||

Total Non Interest Income |

176 | 165 | 6.7% | |||||||

Salaries and benefits expense |

1,068 | 999 | 6.9% | |||||||

Occupancy and equipment expense |

108 | 110 | -1.8% | |||||||

Other expense |

433 | 600 | -27.8% | |||||||

Total Non Interest Expense |

1,609 | 1,709 | -5.9% | |||||||

Pretax pre-provision income |

2,259 | 1,890 | 19.5% | |||||||

Gain on sale of securities |

(1) | 0 | N/M | |||||||

Provision for Loan Losses |

0 | 0 | N/M | |||||||

Earnings before income taxes |

2,258 | 1,890 | 19.5% | |||||||

Provision for income taxes |

320 | 280 | 14.3% | |||||||

Net Earnings |

$ | 1,938 | $ | 1,610 | 20.4% | |||||

Basic earnings per share |

1.78 | 1.48 | 20.3% | |||||||

Basic weighted average shares |

1,090 | 1,087 | ||||||||

outstanding |

||||||||||

Diluted earnings per share - estimate |

1.70 | 1.42 | 19.7% | |||||||

Diluted weighted average shares outstanding |

1,139 | 1,133 | ||||||||

| Average for Quarter | ||||||||||

| March 31 | % | |||||||||

BALANCE SHEET SUMMARY |

2023 | 2022 | Change | |||||||

Total loans |

$ | 272,089 | $ | 243,893 | 11.6% | |||||

Total short term investments |

22,733 | 28,809 | -21.1% | |||||||

Total investment securities |

136,288 | 142,753 | -4.5% | |||||||

Earning assets |

431,110 | 415,455 | 3.8% | |||||||

Total assets |

439,725 | 421,745 | 4.3% | |||||||

Noninterest bearing deposits |

146,909 | 154,029 | -4.6% | |||||||

Interest bearing deposits |

246,285 | 221,868 | 11.0% | |||||||

Total deposits |

393,194 | 375,897 | 4.6% | |||||||

Fed Funds Purchased and Repurchase Agreements |

0 | 0 | N/M | |||||||

Shareholders' equity |

$ | 48,537 | $ | 43,883 | 10.6% | |||||

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| Average for Quarter Ending | ||||||||||||||||||

| March 31, | Dec 31, | Sept. 30, | June 30, | March 31, | ||||||||||||||

BALANCE SHEET SUMMARY |

2023 | 2022 | 2022 | 2022 | 2022 | |||||||||||||

Total loans |

$ | 272,089 | $ | 268,908 | $ | 266,041 | $ | 255,951 | $ | 240,831 | ||||||||

Total PPP loans |

$ | 0 | 0 | 0 | 0 | 3,062 | ||||||||||||

Total short term investments |

22,733 | 39,334 | 50,091 | 30,574 | 28,809 | |||||||||||||

Total investment securities |

136,288 | 138,049 | 144,170 | 143,142 | 142,753 | |||||||||||||

Earning assets |

431,110 | 446,291 | 460,302 | 429,687 | 415,455 | |||||||||||||

Total assets |

439,725 | 455,683 | 467,859 | 437,237 | 421,745 | |||||||||||||

Noninterest bearing deposits |

146,909 | 167,630 | 177,293 | 164,965 | 154,029 | |||||||||||||

Interest bearing deposits |

246,285 | 246,989 | 246,907 | 229,986 | 221,868 | |||||||||||||

Total deposits |

393,194 | 414,618 | 424,200 | 394,951 | 375,897 | |||||||||||||

Fed Funds Purchased and Repurchase Agreements |

0 | 0 | 0 | 0 | 0 | |||||||||||||

Shareholders' equity |

$ | 48,537 | $ | 47,713 | $ | 46,676 | $ | 45,059 | $ | 43,883 | ||||||||

| Quarter Ended | ||||||||||||||||||

| March 31, | Dec 31, | Sept. 30, | June 30, | March 31, | ||||||||||||||

HISTORICAL EARNINGS SUMMARY |

2023 | 2022 | 2022 | 2022 | 2022 | |||||||||||||

Interest income less PPP |

$ | 5,264 | $ | 5,173 | $ | 4,588 | $ | 3,763 | $ | 3,321 | ||||||||

PPP interest and fees |

0 | 0 | 0 | 0 | 278 | |||||||||||||

Interest expense |

1,572 | 1,022 | 607 | 248 | 165 | |||||||||||||

Net Interest Income |

3,692 | 4,151 | 3,981 | 3,515 | 3,434 | |||||||||||||

Service charges on deposits |

61 | 59 | 58 | 62 | 59 | |||||||||||||

Other income |

115 | 113 | 114 | 126 | 106 | |||||||||||||

Total Non Interest Income |

176 | 172 | 172 | 188 | 165 | |||||||||||||

Salaries and benefits expense |

1,068 | 1,141 | 1,290 | 1,096 | 999 | |||||||||||||

Occupancy and equipment expense |

108 | 106 | 163 | 111 | 110 | |||||||||||||

Other expense |

433 | 399 | 495 | 536 | 600 | |||||||||||||

Total Non Interest Expense |

1,609 | 1,646 | 1,948 | 1,743 | 1,709 | |||||||||||||

Pretax pre-provision income |

2,259 | 2,677 | 2,205 | 1,960 | 1,890 | |||||||||||||

Gain on sale of securities |

(1) | (164) | (19) | 0 | 0 | |||||||||||||

Provision for Loan Losses |

0 | 0 | 0 | 0 | 0 | |||||||||||||

Earnings before income taxes |

2,258 | 2,513 | 2,186 | 1,960 | 1,890 | |||||||||||||

Provision for income taxes |

320 | 400 | 320 | 280 | 280 | |||||||||||||

Net Earnings |

$ | 1,938 | $ | 2,113 | $ | 1,866 | $ | 1,680 | $ | 1,610 | ||||||||

Diluted earnings per share |

$ | 1.70 | $ | 1.86 | $ | 1.64 | $ | 1.47 | $ | 1.42 | ||||||||

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| Ending Balance | ||||||||||||||||||

| March 31, | Dec 31, | Sept. 30, | June 30, | March 31, | ||||||||||||||

HISTORICAL BALANCE SHEET |

2023 | 2022 | 2022 | 2022 | 2022 | |||||||||||||

Total loans |

$ | 270,530 | $ | 281,857 | $ | 265,811 | $ | 267,163 | $ | 247,358 | ||||||||

Total short term investments |

37,656 | 19,893 | 58,084 | 19,635 | 39,776 | |||||||||||||

Total investment securities |

136,407 | 134,628 | 136,114 | 142,834 | 138,793 | |||||||||||||

Total earning assets |

444,593 | 436,378 | 460,009 | 429,632 | 425,927 | |||||||||||||

Allowance for loan losses |

(5,344) | (4,323) | (4,314) | (4,314) | (4,314) | |||||||||||||

Premises and equipment |

2,337 | 2,196 | 1,976 | 2,019 | 2,065 | |||||||||||||

Other Assets |

9,381 | 11,030 | 11,957 | 11,260 | 10,557 | |||||||||||||

Total assets |

450,967 | 445,281 | 469,628 | 438,597 | 434,235 | |||||||||||||

Noninterest bearing deposits |

151,010 | 159,568 | 181,436 | 170,661 | 158,072 | |||||||||||||

Interest bearing deposits |

252,164 | 240,883 | 248,475 | 226,141 | 233,142 | |||||||||||||

Total deposits |

403,174 | 400,451 | 429,911 | 396,802 | 391,214 | |||||||||||||

Fed Funds Purchased and Repurchase Agreements |

0 | 0 | 0 | 0 | 0 | |||||||||||||

Other Liabilities |

2,936 | 1,779 | 2,794 | 1,474 | 2,033 | |||||||||||||

Total liabilities |

406,110 | 402,230 | 432,705 | 398,276 | 393,247 | |||||||||||||

Shareholders' Equity Actual |

48,537 | 48,871 | 46,712 | 45,830 | 44,093 | |||||||||||||

Unrealized Gain/Loss - AFS |

(3,680) | (5,820) | (9,789) | (5,509) | (3,105) | |||||||||||||

Total Equity |

$ | 44,857 | $ | 43,051 | $ | 36,923 | $ | 40,321 | $ | 40,988 | ||||||||

| Quarter Ending | ||||||||||||||||||

| March 31, | Dec 31, | Sept. 30, | June 30, | March 31, | ||||||||||||||

NONPERFORMING ASSETS |

2023 | 2022 | 2022 | 2022 | 2022 | |||||||||||||

Nonaccrual loans |

$ | 159 | $ | 171 | $ | 195 | $ | 211 | $ | 239 | ||||||||

Restructured loans |

$ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | ||||||||

Other real estate & foreclosed assets |

$ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | ||||||||

Accruing loans past due 90 days or more |

$ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | ||||||||

Total nonperforming assets |

$ | 159 | $ | 171 | $ | 195 | $ | 211 | $ | 239 | ||||||||

Accruing loans past due 30-89 days |

$ | 407 | $ | 3 | $ | 0 | $ | 0 | $ | 0 | ||||||||

Total nonperforming assets as a percentage |

||||||||||||||||||

of loans and foreclosed assets |

0.06% | 0.06% | 0.07% | 0.08% | 0.10% | |||||||||||||

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| Quarter Ending | ||||||||||||||||||

ALLOWANCE FOR |

March 31, | Dec 31, | Sept. 30, | June 30, | March 31, | |||||||||||||

LOAN LOSSES |

2023 | 2022 | 2022 | 2022 | 2022 | |||||||||||||

Balance at beginning of period |

$ | 4,324 | $ | 4,314 | $ | 4,314 | $ | 4,314 | $ | 4,306 | ||||||||

Loans charged off |

0 | 0 | 0 | 0 | 0 | |||||||||||||

Loan recoveries |

0 | 10 | 0 | 0 | 8 | |||||||||||||

Net (charge-offs) recoveries |

0 | 10 | 0 | 0 | 8 | |||||||||||||

Provision for loan losses (One time CECL adjustment) |

1,020 | 0 | 0 | 0 | 0 | |||||||||||||

Balance at end of period |

$ | 5,344 | $ | 4,324 | $ | 4,314 | $ | 4,314 | $ | 4,314 | ||||||||

Allowance for loan losses |

||||||||||||||||||

as a percentage of total loans |

1.98% | 1.53% | 1.62% | 1.61% | 1.74% | |||||||||||||

Allowance for loan losses |

||||||||||||||||||

as a percentage of nonperforming assets |

3361% | 2528% | 2212% | 2045% | 1805% | |||||||||||||

Net charge-offs (recoveries) as a |

||||||||||||||||||

percentage of average loans |

0.00% | 0.00% | 0.00% | 0.00% | 0.00% | |||||||||||||

Provision for loan losses |

||||||||||||||||||

as a percentage of average loans |

0.37% | 0.00% | 0.00% | 0.00% | 0.00% | |||||||||||||

| Quarter Ending | ||||||||||||||||||

| March 31, | Dec 31, | Sept. 30, | June 30, | March 31, | ||||||||||||||

SELECTED RATIOS |

2023 | 2022 | 2022 | 2022 | 2022 | |||||||||||||

Return on average assets (annualized) |

1.76% | 1.85% | 1.60% | 1.54% | 1.53% | |||||||||||||

Return on average equity (annualized) |

17.28% | 19.63% | 17.68% | 15.92% | 15.71% | |||||||||||||

Return on average equity (excluding unrealized gain on investments) |

15.97% | 17.71% | 15.99% | 14.91% | 14.61% | |||||||||||||

Average shareholders' equity to average assets |

11.04% | 10.47% | 9.98% | 10.31% | 10.54% | |||||||||||||

Yield on earning assets (tax equivalent) |

5.09% | 4.84% | 4.17% | 3.68% | 3.64% | |||||||||||||

Effective Cost of Funds |

1.46% | 0.92% | 0.53% | 0.23% | 0.16% | |||||||||||||

Net interest margin (tax equivalent) |

3.63% | 3.92% | 3.64% | 3.45% | 3.48% | |||||||||||||

Efficiency ratio (tax equivalent) |

39.4% | 36.2% | 44.7% | 44.9% | 45.2% | |||||||||||||

End of period book value per common share |

$ | 41.12 | $ | 39.42 | $ | 33.78 | $ | 36.89 | $ | 37.50 | ||||||||

End of period book value (excluding unrealized gain/loss on investments) |

$ | 44.49 | $ | 44.75 | $ | 42.74 | $ | 41.93 | $ | 40.34 | ||||||||

End of period common shares outstanding (in 000's) |

1,091 | 1,092 | 1,093 | 1,093 | 1,093 | |||||||||||||

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| 3 Months Ending | ||||||||||||||||||||||||||||||

| March 31, 2023 | March 31, 2022 | |||||||||||||||||||||||||||||

| Tax | Tax | |||||||||||||||||||||||||||||

| Average | Equivalent | Average | Equivalent | |||||||||||||||||||||||||||

YIELD ANALYSIS |

Balance | Interest | Yield | Yield | Balance | Interest | Yield | Yield | ||||||||||||||||||||||

Interest Earning Assets: |

||||||||||||||||||||||||||||||

Short term investment |

$ | 22,733 | 271 | 4.77% | 4.77% | $ | 28,809 | 17 | 0.24% | 0.24% | ||||||||||||||||||||

FRB Stock |

428 | 6 | 6.00% | 6.00% | 411 | 6 | 6.00% | 6.00% | ||||||||||||||||||||||

Taxable securities |

444 | 7 | 6.31% | 6.31% | 2,577 | 0 | 0.00% | 0.00% | ||||||||||||||||||||||

Tax Free securities |

135,416 | 827 | 2.44% | 3.09% | 139,729 | 680 | 1.95% | 2.46% | ||||||||||||||||||||||

Loans |

272,089 | 4,153 | 6.11% | 6.11% | 243,893 | 2,896 | 4.75% | 4.75% | ||||||||||||||||||||||

Total Interest Earning Assets |

431,110 | 5,264 | 4.88% | 5.09% | 415,419 | 3,599 | 3.47% | 3.64% | ||||||||||||||||||||||

Noninterest Earning Assets: |

||||||||||||||||||||||||||||||

Cash and due from banks |

6,233 | 5,697 | ||||||||||||||||||||||||||||

Other assets |

6,729 | 4,901 | ||||||||||||||||||||||||||||

Allowance for loan losses |

(4,347) | (4,306) | ||||||||||||||||||||||||||||

Total Noninterest Earning Assets |

8,615 | 6,292 | ||||||||||||||||||||||||||||

Total Assets |

$ | 439,725 | $ | 421,711 | ||||||||||||||||||||||||||

Interest Bearing Liabilities: |

||||||||||||||||||||||||||||||

Transaction and Money Market accounts |

173,071 | 1,067 | 2.47% | 2.47% | 176,030 | 110 | 0.25% | 0.25% | ||||||||||||||||||||||

Certificates and other time deposits |

73,213 | 505 | 2.76% | 2.76% | 43,098 | 55 | 0.51% | 0.51% | ||||||||||||||||||||||

Other borrowings |

0 | 0 | 0.00% | 0.00% | 0 | 0 | 0.00% | 0.00% | ||||||||||||||||||||||

Total Interest Bearing Liabilities |

246,284 | 1,572 | 2.55% | 2.55 | % | 219,128 | 165 | 0.30% | 0.30% | |||||||||||||||||||||

Noninterest Bearing Liabilities: |

||||||||||||||||||||||||||||||

Demand deposits |

146,909 | 156,769 | ||||||||||||||||||||||||||||

Other liabilities |

1,875 | 1,358 | ||||||||||||||||||||||||||||

Shareholders' Equity |

44,657 | 44,456 | ||||||||||||||||||||||||||||

Total Liabilities and Shareholders Equity |

$ | 439,725 | $ | 421,711 | ||||||||||||||||||||||||||

Net Interest Income and Spread |

3,692 | 2.33% | 2.53% | 3,434 | 3.16% | 3.34% | ||||||||||||||||||||||||

Net Interest Margin |

3.43% | 3.63% | 3.31% | 3.48% | ||||||||||||||||||||||||||

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| March 31 | March 31 | |||||||||||||

| 2023 | % | 2022 | % | |||||||||||

LOAN PORTFOLIO |

||||||||||||||

Commercial and industrial less PPP |

$ | 147,968 | 54.62% | $ | 142,524 | 57.62% | ||||||||

Real estate: |

||||||||||||||

Commercial |

78,122 | 28.84% | 56,059 | 22.66% | ||||||||||

Residential |

16,574 | 6.12% | 16,653 | 6.73% | ||||||||||

Construction and development |

27,921 | 10.31% | 31,802 | 12.86% | ||||||||||

Consumer |

337 | 0.12% | 320 | 0.13% | ||||||||||

Total loans |

270,922 | 100.00% | 247,358 | 100.00% | ||||||||||

| March 31 | March 31 | |||||||||||||

| 2023 | 2022 | |||||||||||||

REGULATORY CAPITAL DATA |

||||||||||||||

Tier 1 Capital |

$ | 44,859 | $ | 44,094 | ||||||||||

Total Capital (Tier 1 + Tier 2) |

$ | 48,539 | $ | 47,492 | ||||||||||

Total Risk-Adjusted Assets |

$ | 302,197 | $ | 270,950 | ||||||||||

Tier 1 Risk-Based Capital Ratio |

16.06% | 16.27% | ||||||||||||

Total Risk-Based Capital Ratio |

17.32% | 17.53% | ||||||||||||

Tier 1 Leverage Ratio |

11.04% | 10.45% | ||||||||||||

OTHER DATA |

||||||||||||||

Full Time Equivalent |

||||||||||||||

Employees (FTE's) |

25 | 24 | ||||||||||||

Stock Price Range |

||||||||||||||

(For the Three Months Ended): |

||||||||||||||

High |

$ | 88.50 | $ | 80.01 | ||||||||||

Low |

$ | 87.75 | $ | 76.00 | ||||||||||

Close |

$ | 87.75 | $ | 80.01 | ||||||||||

SOURCE: Trinity Bank N.A.

View source version on accesswire.com:

https://www.accesswire.com/752697/First-Quarter-Earnings-Up-197-to-170-Per-Share