LUXEMBOURG, LU / ACCESS Newswire / October 28, 2025 / Ternium S.A. (NYSE: TX) today announced its results for the third quarter and first nine months ended September 30, 2025.

The financial and operational information contained in this press release is based on Ternium S.A.'s operational data and consolidated condensed interim financial statements prepared in accordance with IAS 34 "Interim financial reporting" (IFRS) and presented in U.S. dollars ($) and metric tons. Interim financial figures are unaudited. This press release includes certain non-IFRS alternative performance measures such as Adjusted EBITDA, Cash Operating Income, Free Cash Flow and Net Cash. The reconciliation of these figures to the most directly comparable IFRS measures is included in Exhibit I.

Third Quarter of 2025 Highlights

Interim dividend figure compared to third quarter of 2024. Other figures compared to second quarter of 2025.

Note 1: Includes a $405 million non-cash charge in connection with a write-down of deferred tax assets at Usiminas and a $32 million loss stemming from the quarterly update of the value of a provision for ongoing litigation related to the acquisition of a participation in Usiminas.

Summary of Third Quarter of 2025 Results

CONSOLIDATED |

3Q25 |

|

|

2Q25 |

|

|

DIF |

|

|

3Q24 |

|

|

DIF |

|

|

9M25 |

|

|

9M24 |

|

|

DIF |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Steel Products Shipments (thousand tons) |

|

3,757 |

|

|

|

3,719 |

|

|

|

1 |

% |

|

|

4,123 |

|

|

|

-9 |

% |

|

|

11,333 |

|

|

|

11,858 |

|

|

|

-4 |

% |

Mining Products Shipments (thousand tons) |

|

2,017 |

|

|

|

1,980 |

|

|

|

2 |

% |

|

|

1,781 |

|

|

|

13 |

% |

|

|

5,788 |

|

|

|

4,701 |

|

|

|

23 |

% |

Net Sales ($ million) |

|

3,955 |

|

|

|

3,947 |

|

|

|

0 |

% |

|

|

4,480 |

|

|

|

-12 |

% |

|

|

11,834 |

|

|

|

13,773 |

|

|

|

-14 |

% |

Operating Income ($ million) |

|

215 |

|

|

|

199 |

|

|

|

8 |

% |

|

|

175 |

|

|

|

23 |

% |

|

|

546 |

|

|

|

1,221 |

|

|

|

-55 |

% |

Adjusted EBITDA ($ million) |

|

420 |

|

|

|

403 |

|

|

|

4 |

% |

|

|

368 |

|

|

|

14 |

% |

|

|

1,146 |

|

|

|

1,768 |

|

|

|

-35 |

% |

Adjusted EBITDA Margin (% of net sales) |

|

11 |

% |

|

|

10 |

% |

|

|

|

|

|

|

8 |

% |

|

|

|

|

|

|

10 |

% |

|

|

13 |

% |

|

|

|

|

Provision for Usiminas Participation Acquisition Litigation ($ million) |

|

(32 |

) |

|

|

(40 |

) |

|

|

|

|

|

|

(31 |

) |

|

|

|

|

|

|

(117 |

) |

|

|

(814 |

) |

|

|

|

|

Write-down of Deferred Tax Assets at Usiminas ($ million) |

|

(405 |

) |

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

(405 |

) |

|

|

- |

|

|

|

|

|

Net (Loss) Income ($ million) |

|

(270 |

) |

|

|

259 |

|

|

|

|

|

|

|

93 |

|

|

|

|

|

|

|

132 |

|

|

|

(159 |

) |

|

|

|

|

Equity Holders' Net Income (Loss) ($ million) |

|

21 |

|

|

|

215 |

|

|

|

|

|

|

|

32 |

|

|

|

|

|

|

|

303 |

|

|

|

(335 |

) |

|

|

|

|

Earnings (Losses) per ADS ($) |

|

0.10 |

|

|

|

1.10 |

|

|

|

|

|

|

|

0.16 |

|

|

|

|

|

|

|

1.54 |

|

|

|

(1.70 |

) |

|

|

|

|

Note: Each American Depositary Share, or ADS, represents 10 shares of Ternium's common stock. Results are based on a weighted average number of shares of common stock outstanding (net of treasury shares) of 1,963,076,776.

Third Quarter of 2025 Highlights

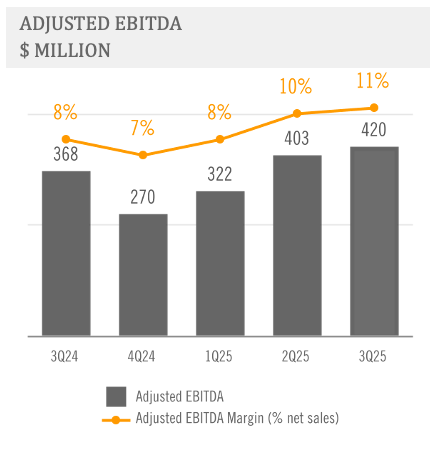

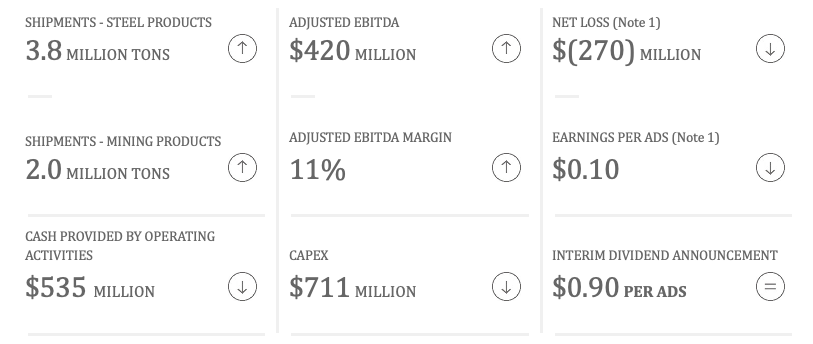

In the third quarter of 2025, Ternium continued improving its Adjusted EBITDA Margin, as steel production costs decreased, mainly reflecting lower raw material and purchased slab costs, as well as efficiency gains.

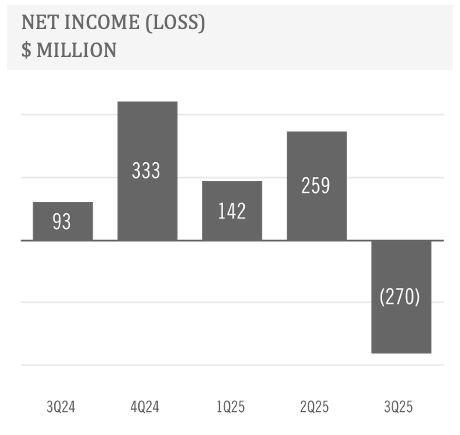

Net result in the third quarter of 2025 was a loss of $270 million. This result includes a $405 million income tax charge in connection with a write-down of deferred tax assets at Usiminas and a $32 million loss stemming from the quarterly update of the value of a provision for ongoing litigation related to the acquisition of a participation in Usiminas.

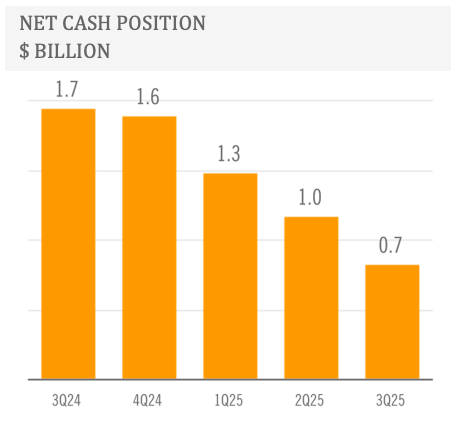

As of the end of September 2025, Ternium's Net Cash position stood at $715 million, decreasing by $303 million since June 2025. This decline reflects the cash demands associated with the ongoing expansion of the company's industrial center in Pesquería, Mexico, and changes in the fair value of Argentine securities.

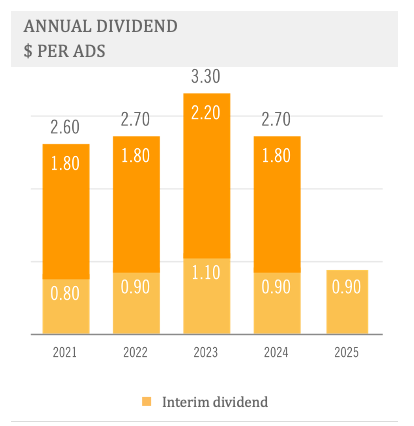

Interim Dividend Payment

Ternium's board of directors approved the payment of an interim dividend of $0.90 per ADS ($0.09 per share), or $177 million based on total shares of common stock outstanding, net of treasury shares.

The interim dividend payment date will be November 11, 2025, with record date on November 10, 2025.

Considering the dividend paid in May 2025 and the announced interim dividend for November 2025, total distributions during 2025 will amount to $2.70 per ADS. Considering Ternium's ADS prevailing market prices, this is equivalent to a dividend yield of approximately 7%.

Outlook

Ternium anticipates a slight decrease in Adjusted EBITDA for the fourth quarter of 2025 compared to the third quarter, largely due to the typical seasonal reduction in shipments in all of the company's markets. Ternium expects its Adjusted EBITDA Margin to remain in line with the third quarter, as a projected decline in revenue per ton in Mexico and Argentina should be largely balanced by ongoing reductions in cost per ton. This reflects lower raw material costs, as well as Ternium's ongoing commitment to implementing cost optimization strategies throughout its operations.

In Mexico, the company expects shipments to decline sequentially in the fourth quarter of 2025, reflecting both subdued construction activity and end-of-year seasonality. The Mexican steel market continues to face challenges, particularly from ongoing tariff negotiations with the United States, which have contributed to an environment of uncertainty.

In Brazil, while the steel market continues to face significant challenges from a persistent influx of unfairly traded steel imports, particularly from Asian producers, Usiminas is proactively strengthening its competitiveness through ongoing cost reduction initiatives and operational improvements, leading to expectations of achieving a better cost per ton in the fourth quarter of 2025 compared to the previous quarter.

In Argentina, with the uncertainty related to the mid-term elections now behind us, the most dynamic sectors of the economy, such as agriculture, mining, and oil and gas, offer significant opportunities for the company's value chain.

Analysis of Third Quarter of 2025 Results$ MILLION |

|

3Q25 |

|

2Q25 |

|

DIF |

|

|

3Q24 |

|

DIF |

|

|

9M25 |

|

9M24 |

|

DIF |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Steel segment |

|

|

3,804 |

|

|

3,812 |

|

|

-0 |

% |

|

|

4,368 |

|

|

-13 |

% |

|

|

11,417 |

|

|

13,453 |

|

|

-15 |

% |

Mining segment |

|

|

151 |

|

|

135 |

|

|

12 |

% |

|

|

112 |

|

|

34 |

% |

|

|

417 |

|

|

320 |

|

|

31 |

% |

Total net sales |

|

|

3,955 |

|

|

3,947 |

|

|

0 |

% |

|

|

4,480 |

|

|

-12 |

% |

|

|

11,834 |

|

|

13,773 |

|

|

-14 |

% |

Adjusted EBITDA

Adjusted EBITDA in the third quarter of 2025 equals net Income adjusted to exclude:

Depreciation and amortization;

Income tax results;

Net financial results;

Equity in earnings of non-consolidated companies; and

Provision charge for ongoing litigation related to the acquisition of a participation in Usiminas.

And adjusted to include the proportional EBITDA in Unigal (70% participation).

Adjusted EBITDA margin equals adjusted EBITDA divided by net sales. For more information see Exhibit I - Alternative performance measures - "Adjusted EBITDA".

Steel Segment

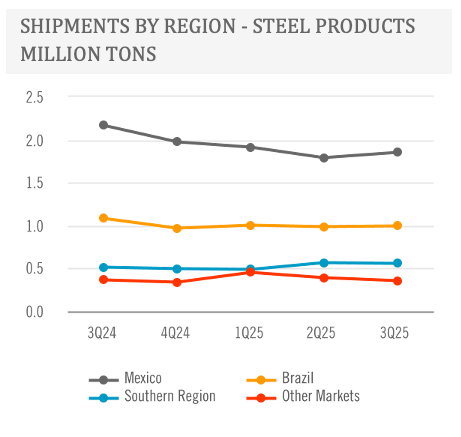

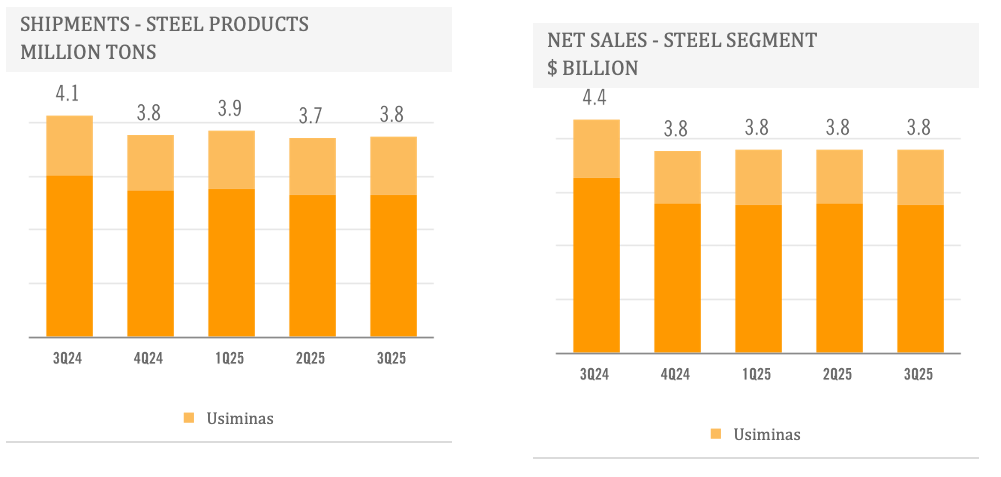

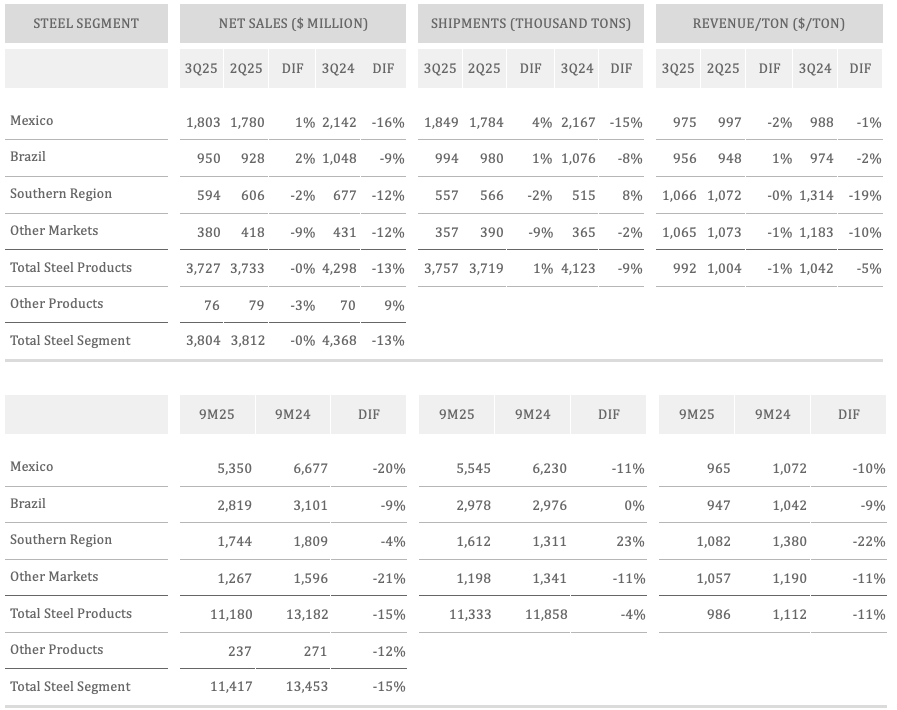

In the third quarter of 2025, the Steel Segment's net sales remained stable sequentially with slightly higher sales volumes offset by slightly lower realized steel prices. Year-over-year, the Steel Segment's net sales declined by 13% in the third quarter of 2025. Sales volumes decreased by 9% year-over-year, primarily driven by lower shipments in Mexico and Brazil, partially offset by higher shipments in the Southern Region. Steel revenue per ton declined by 5% year-over-year, reflecting lower realized steel prices particularly in the Southern Region and Other Markets.

Ternium's shipments in Mexico posted a moderate sequential increase in the third quarter of 2025. On a year-over-year basis, sales volumes in the third quarter declined, as ongoing uncertainty surrounding trade negotiations with the U.S. and weak infrastructure investments in the country continued to dampen overall steel demand.

In Brazil, shipments in the third quarter of 2025 showed a modest sequential increase. On a year-over-year basis, sales volumes declined. Although steel demand in the country grew during 2025, this was offset by a sharp increase in flat steel product imports.

In the Southern Region, shipments showed a slight sequential decrease in the third quarter of 2025. Year-over-year, sales volumes increased, reflecting better steel demand in Argentina.

In Other Markets, declining shipments in the US were partially offset by higher sales volumes in other destinations both sequentially and year-over-year.

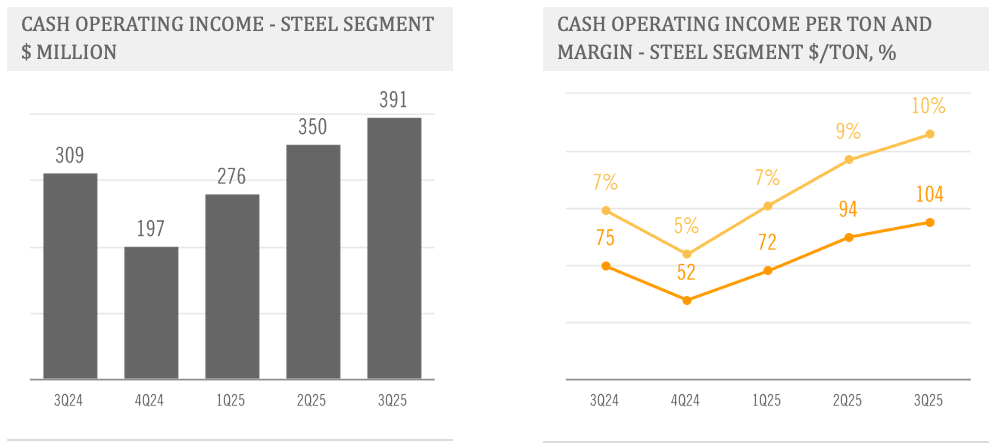

Steel Cash Operating Income

The Steel Segment's Cash Operating Income increased by $41 million sequentially in the third quarter of 2025, mainly driven by better margins. The margin improvement reflected the company's efforts to increase the efficiency in its operations and a decrease in raw material, purchased slab and energy costs, partially offset by a slight decrease in realized steel prices.

Year-over-year, the Steel Segment's Cash Operating Income increased by $82 million in the period, driven by better margins partially offset by lower sales volumes. The margin improvement mainly reflected a decrease in raw material and purchased slab costs, partially offset by lower realized steel prices.

Note: For a reconciliation of the Steel Segment's Cash Operating Income and Cash Operating Income per Ton and Margin to the most directly comparable IFRS measures, see Exhibit I - Alternative performance measures - "Cash Operating Income - Steel Segment".

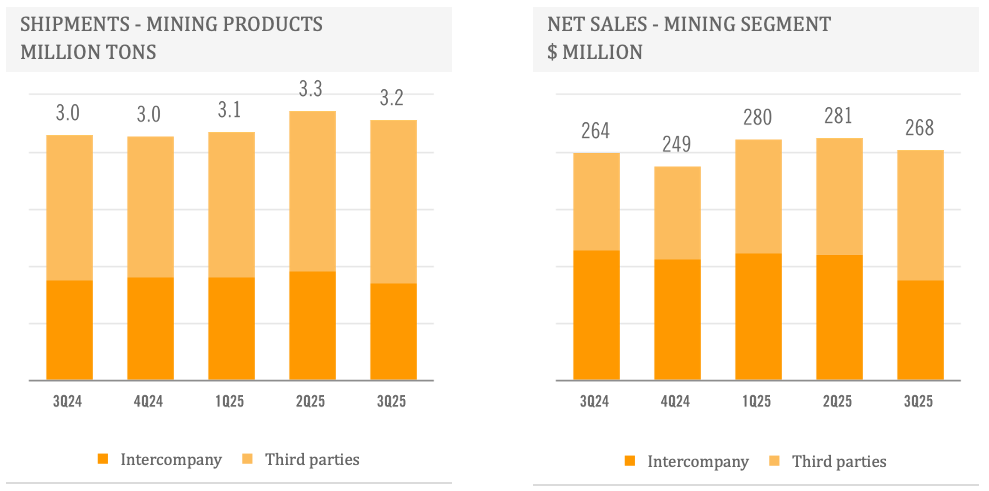

Mining Segment

The Mining Segment's net sales decreased by 5% sequentially in the third quarter of 2025, reflecting lower sales volumes and a slight decrease in realized iron ore prices. Year-over-year, the Mining Segment's net sales increased slightly in the third quarter of 2025, as an increase in sales volumes was mostly offset by lower realized iron ore prices.

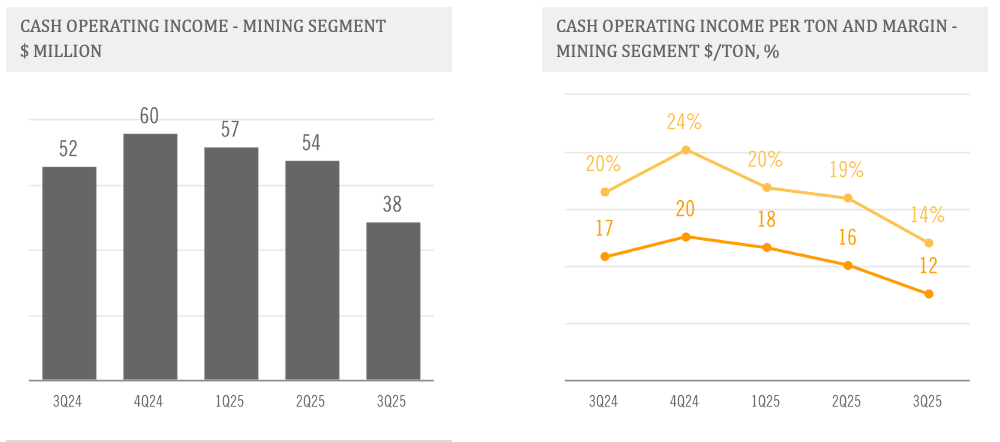

Mining Cash Operating Income

The Mining Segment's cash operating income decreased sequentially and year-over-year in the third quarter of 2025. The sequential decrease was primarily driven by lower margins and reduced sales volumes. On a year-over-year basis, the decline reflected lower margins, partially offset by increased sales volumes. The margin compression in the third quarter of 2025, as compared to the prior quarter and to the same period in 2024, was the result of higher unit costs and lower realized iron ore prices.

Note: For a reconciliation of the Mining Segment's Cash Operating Income and Cash Operating Income per Ton and Margin to the most directly comparable IFRS measures, see Exhibit I - Alternative performance measures - "Cash Operating Income - Mining Segment".

Net Financial Results

Net financial results for the third quarter of 2025 were a loss of $35 million. This included a loss of $34 million in net foreign exchange results, driven mainly by the impact of the Argentine Peso's depreciation against the U.S. dollar on Ternium Argentina's net long local currency position and the impact of the Mexican Peso's appreciation against the U.S. dollar on Ternium Mexico's net short local currency position.

$ MILLION |

|

|

3Q25 |

|

|

|

2Q25 |

|

|

|

3Q24 |

|

|

|

9M25 |

|

|

|

9M24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest result |

|

|

3 |

|

|

|

1 |

|

|

|

17 |

|

|

|

18 |

|

|

|

83 |

|

Net foreign exchange result |

|

|

(34 |

) |

|

|

(35 |

) |

|

|

57 |

|

|

|

(38 |

) |

|

|

(32 |

) |

Change in fair value of financial assets |

|

|

8 |

|

|

|

17 |

|

|

|

11 |

|

|

|

54 |

|

|

|

(131 |

) |

Other financial expense, net |

|

|

(12 |

) |

|

|

(12 |

) |

|

|

(11 |

) |

|

|

(35 |

) |

|

|

(47 |

) |

Net financial results |

|

|

(35 |

) |

|

|

(30 |

) |

|

|

74 |

|

|

|

(2 |

) |

|

|

(127 |

) |

Income Tax Results

Ternium Mexico, Ternium Argentina and Ternium Brasil use the U.S. dollar as their functional currency and are, therefore, affected by deferred tax results. These results account for the impact of local currency fluctuations against the U.S. dollar, as well as for the effect of local inflation.

In the third quarter of 2025, Ternium's income tax expense totaled $444 million. This included a $405 million charge in connection with the write-down of deferred tax assets at Usiminas, following the performance of a recoverability assessment of such assets.

$ MILLION |

|

|

3Q25 |

|

|

|

2Q25 |

|

|

|

3Q24 |

|

|

|

9M25 |

|

|

|

9M24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current income tax expense |

|

|

(13 |

) |

|

|

(47 |

) |

|

|

(63 |

) |

|

|

(85 |

) |

|

|

(312 |

) |

Deferred tax (loss) gain |

|

|

(25 |

) |

|

|

151 |

|

|

|

(80 |

) |

|

|

128 |

|

|

|

(178 |

) |

Write-down of deferred tax assets at Usiminas |

|

|

(405 |

) |

|

|

- |

|

|

|

- |

|

|

|

(405 |

) |

|

|

- |

|

Income tax (expense) gain |

|

|

(444 |

) |

|

|

104 |

|

|

|

(143 |

) |

|

|

(362 |

) |

|

|

(490 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income

Net result in the third quarter of 2025 was a loss of $270 million. This result includes a loss of $405 million in connection with the write-down of deferred tax assets at Usiminas, and a loss of $32 million on account of interest accruals and the appreciation of the Brazilian Real in connection with the provision for ongoing litigation concerning the acquisition of a participation in Usiminas.

Equity Holder's Net Income was $21 million in the period, or $0.10 per ADS, mainly after accounting for the participation of a 76.7% non-controlling interest in Usiminas and a 37.4% non-controlling interest in Ternium Argentina.

$ MILLION |

|

|

3Q25 |

|

|

|

2Q25 |

|

|

|

3Q24 |

|

|

|

9M25 |

|

|

|

9M24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owners of the parent |

|

|

21 |

|

|

|

215 |

|

|

|

32 |

|

|

|

303 |

|

|

|

(335 |

) |

Non-controlling interest |

|

|

(290 |

) |

|

|

44 |

|

|

|

61 |

|

|

|

(171 |

) |

|

|

176 |

|

Net (loss) income |

|

|

(270 |

) |

|

|

259 |

|

|

|

93 |

|

|

|

132 |

|

|

|

(159 |

) |

$ per ADS |

|

|

3Q25 |

|

|

|

2Q25 |

|

|

|

3Q24 |

|

|

|

9M25 |

|

|

|

9M24 |

|

Earnings (losses) per ADS |

|

|

0.10 |

|

|

|

1.10 |

|

|

|

0.16 |

|

|

|

1.54 |

|

|

|

(1.70 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flow and Liquidity

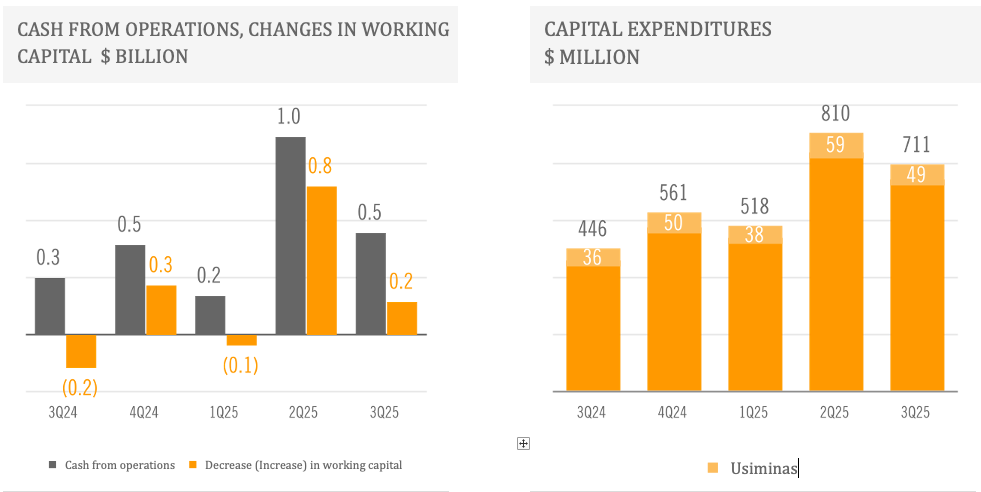

In the third quarter of 2025, cash from operations amounted to $535 million. Working capital decreased by $174 million as a result of a $125 million decline in inventories and a $76 million increase in trade payables and other liabilities, partially offset by a $27 million increase in trade and other receivables.

The inventory value reduction was mainly driven by lower unit costs. Capital expenditures totaled $711 million in the third quarter, primarily reflecting the progress made in the construction of the new facilities at Ternium's industrial center in Pesquería, Mexico.

Ternium's Net Cash position as of the end of September 2025 was $715 million, decreasing by $303 million since the end of June 2025. This reduction included a $114 million decline in the fair value of Argentine securities. As of September 30, 2025, Ternium Argentina's consolidated position of cash and cash equivalents and other investments amounted to $0.9 billion.

Conference Call and Webcast

Ternium will host a conference call on October 29, 2025, at 8:30 a.m. ET in which management will discuss third quarter of 2025 results. A webcast link will be available in the Investor Center section of the company's website at www.ternium.com.

Forward Looking Statements

Some of the statements contained in this press release are "forward-looking statements". Forward-looking statements are based on management's current views and assumptions and involve known and unknown risks that could cause actual results, performance or events to differ materially from those expressed or implied by those statements. These risks include but are not limited to risks arising from uncertainties as to gross domestic product, related market demand, global production capacity, tariffs, cyclicality in the industries that purchase steel products, and other factors beyond Ternium's control.

About Ternium

Ternium is a leading steel producer in the Americas, providing advanced steel products to a wide range of manufacturing industries and the construction sector. We invest in low carbon emissions steelmaking technologies to support the energy transition and the mobility of the future. We also support the development of our communities, especially through educational programs in Latin America. More information about Ternium is available at www.ternium.com.

Income Statement

$ MILLION |

|

|

3Q25 |

|

|

|

2Q25 |

|

|

|

3Q24 |

|

|

|

9M25 |

|

|

|

9M24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

|

3,955 |

|

|

|

3,947 |

|

|

|

4,480 |

|

|

|

11,834 |

|

|

|

13,773 |

|

Cost of sales |

|

|

(3,346 |

) |

|

|

(3,337 |

) |

|

|

(3,902 |

) |

|

|

(10,085 |

) |

|

|

(11,334 |

) |

Gross profit |

|

|

608 |

|

|

|

610 |

|

|

|

578 |

|

|

|

1,749 |

|

|

|

2,439 |

|

Selling, general and administrative expenses |

|

|

(396 |

) |

|

|

(403 |

) |

|

|

(412 |

) |

|

|

(1,195 |

) |

|

|

(1,278 |

) |

Other operating income (expense), net |

|

|

3 |

|

|

|

(8 |

) |

|

|

9 |

|

|

|

(8 |

) |

|

|

60 |

|

Operating income |

|

|

215 |

|

|

|

199 |

|

|

|

175 |

|

|

|

546 |

|

|

|

1,221 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial expense |

|

|

(53 |

) |

|

|

(56 |

) |

|

|

(54 |

) |

|

|

(164 |

) |

|

|

(144 |

) |

Financial income |

|

|

56 |

|

|

|

57 |

|

|

|

71 |

|

|

|

182 |

|

|

|

227 |

|

Other financial (expense) income, net |

|

|

(37 |

) |

|

|

(31 |

) |

|

|

57 |

|

|

|

(19 |

) |

|

|

(210 |

) |

Equity in earnings of non-consolidated companies |

|

|

25 |

|

|

|

25 |

|

|

|

17 |

|

|

|

65 |

|

|

|

51 |

|

Provision for ongoing litigation related to the acquisition of a participation in Usiminas |

|

|

(32 |

) |

|

|

(40 |

) |

|

|

(31 |

) |

|

|

(117 |

) |

|

|

(814 |

) |

Profit before income tax results |

|

|

174 |

|

|

|

155 |

|

|

|

236 |

|

|

|

494 |

|

|

|

331 |

|

Income tax (expense) gain |

|

|

(444 |

) |

|

|

104 |

|

|

|

(143 |

) |

|

|

(362 |

) |

|

|

(490 |

) |

(Loss) profit for the period |

|

|

(270 |

) |

|

|

259 |

|

|

|

93 |

|

|

|

132 |

|

|

|

(159 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owners of the parent |

|

|

21 |

|

|

|

215 |

|

|

|

32 |

|

|

|

303 |

|

|

|

(335 |

) |

Non-controlling interest |

|

|

(290 |

) |

|

|

44 |

|

|

|

61 |

|

|

|

(171 |

) |

|

|

176 |

|

(Loss) profit for the period |

|

|

(270 |

) |

|

|

259 |

|

|

|

93 |

|

|

|

132 |

|

|

|

(159 |

) |

Statement of Financial Position

$ MILLION |

|

SEPTEMBER 30, 2025 |

|

|

DECEMBER 31, 2024 |

|

||

|

|

|

|

|

|

|

||

Property, plant and equipment, net |

|

|

10,104 |

|

|

|

8,381 |

|

Intangible assets, net |

|

|

1,018 |

|

|

|

1,022 |

|

Investments in non-consolidated companies |

|

|

582 |

|

|

|

469 |

|

Other investments |

|

|

0 |

|

|

|

23 |

|

Deferred tax assets |

|

|

1,047 |

|

|

|

1,194 |

|

Receivables, net |

|

|

904 |

|

|

|

961 |

|

Total non-current assets |

|

|

13,656 |

|

|

|

12,050 |

|

|

|

|

|

|

|

|

|

|

Receivables, net |

|

|

1,064 |

|

|

|

902 |

|

Derivative financial instruments |

|

|

75 |

|

|

|

4 |

|

Inventories, net |

|

|

4,132 |

|

|

|

4,751 |

|

Trade receivables, net |

|

|

1,775 |

|

|

|

1,562 |

|

Other investments |

|

|

1,438 |

|

|

|

2,160 |

|

Cash and cash equivalents |

|

|

1,323 |

|

|

|

1,691 |

|

Total current assets |

|

|

9,807 |

|

|

|

11,071 |

|

|

|

|

|

|

|

|

|

|

Non-current assets classified as held for sale |

|

|

8 |

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

Total assets |

|

|

23,471 |

|

|

|

23,129 |

|

Statement of Financial Position (cont.)

$ MILLION |

|

SEPTEMBER 30, 2025 |

|

|

DECEMBER 31, 2024 |

|

||

|

|

|

|

|

|

|

||

Capital and reserves attributable to the owners of the parent |

|

|

11,976 |

|

|

|

11,968 |

|

Non-controlling interest |

|

|

4,325 |

|

|

|

4,163 |

|

Total equity |

|

|

16,300 |

|

|

|

16,132 |

|

|

|

|

|

|

|

|

|

|

Provisions |

|

|

614 |

|

|

|

553 |

|

Deferred tax liabilities |

|

|

43 |

|

|

|

89 |

|

Non current tax liabilities |

|

|

11 |

|

|

|

21 |

|

Other liabilities |

|

|

856 |

|

|

|

766 |

|

Trade payables |

|

|

1 |

|

|

|

5 |

|

Lease liabilities |

|

|

161 |

|

|

|

164 |

|

Borrowings |

|

|

1,494 |

|

|

|

1,560 |

|

Total non-current liabilities |

|

|

3,181 |

|

|

|

3,158 |

|

|

|

|

|

|

|

|

|

|

Provision for ongoing litigation related to the acquisition of a participation in Usiminas |

|

|

527 |

|

|

|

410 |

|

Current income tax liabilities |

|

|

30 |

|

|

|

107 |

|

Other liabilities |

|

|

697 |

|

|

|

630 |

|

Trade payables |

|

|

2,128 |

|

|

|

1,926 |

|

Derivative financial instruments |

|

|

5 |

|

|

|

50 |

|

Lease liabilities |

|

|

51 |

|

|

|

46 |

|

Borrowings |

|

|

552 |

|

|

|

670 |

|

Total current liabilities |

|

|

3,990 |

|

|

|

3,839 |

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

|

7,171 |

|

|

|

6,997 |

|

|

|

|

|

|

|

|

|

|

Total equity and liabilities |

|

|

23,471 |

|

|

|

23,129 |

|

Statement of Cash Flows

$ MILLION |

|

|

3Q25 |

|

|

|

2Q25 |

|

|

|

3Q24 |

|

|

|

9M25 |

|

|

|

9M24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Result for the period |

|

|

(270 |

) |

|

|

259 |

|

|

|

93 |

|

|

|

132 |

|

|

|

(159 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments for: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

197 |

|

|

|

197 |

|

|

|

184 |

|

|

|

578 |

|

|

|

554 |

|

Income tax accruals less payments |

|

|

394 |

|

|

|

(202 |

) |

|

|

204 |

|

|

|

142 |

|

|

|

474 |

|

Equity in earnings of non-consolidated companies |

|

|

(25 |

) |

|

|

(25 |

) |

|

|

(17 |

) |

|

|

(65 |

) |

|

|

(51 |

) |

Provision for ongoing litigation related to the acquisition of a participation in Usiminas |

|

|

32 |

|

|

|

40 |

|

|

|

31 |

|

|

|

117 |

|

|

|

814 |

|

Interest accruals less payments / receipts, net |

|

|

(6 |

) |

|

|

(9 |

) |

|

|

3 |

|

|

|

(6 |

) |

|

|

(10 |

) |

Changes in provisions |

|

|

1 |

|

|

|

1 |

|

|

|

(1 |

) |

|

|

5 |

|

|

|

(70 |

) |

Changes in working capital |

|

|

174 |

|

|

|

781 |

|

|

|

(176 |

) |

|

|

901 |

|

|

|

(273 |

) |

Net foreign exchange results and others |

|

|

38 |

|

|

|

0 |

|

|

|

(17 |

) |

|

|

(17 |

) |

|

|

155 |

|

Net cash provided by operating activities |

|

|

535 |

|

|

|

1,044 |

|

|

|

303 |

|

|

|

1,786 |

|

|

|

1,435 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures and advances to suppliers for PP&E |

|

|

(711 |

) |

|

|

(810 |

) |

|

|

(446 |

) |

|

|

(2,038 |

) |

|

|

(1,304 |

) |

(Increase) decrease in other investments |

|

|

(24 |

) |

|

|

319 |

|

|

|

(164 |

) |

|

|

538 |

|

|

|

166 |

|

Proceeds from the sale of property, plant & equipment |

|

|

3 |

|

|

|

0 |

|

|

|

0 |

|

|

|

4 |

|

|

|

2 |

|

Dividends received from non-consolidated companies |

|

|

2 |

|

|

|

1 |

|

|

|

3 |

|

|

|

4 |

|

|

|

5 |

|

Repayment of additional paid in capital |

|

|

- |

|

|

|

(5 |

) |

|

|

- |

|

|

|

(5 |

) |

|

|

- |

|

Net cash used in investing activities |

|

|

(729 |

) |

|

|

(495 |

) |

|

|

(606 |

) |

|

|

(1,497 |

) |

|

|

(1,132 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends paid in cash to company's shareholders |

|

|

- |

|

|

|

(353 |

) |

|

|

- |

|

|

|

(353 |

) |

|

|

(432 |

) |

Dividends paid in cash to non-controlling interest |

|

|

- |

|

|

|

(2 |

) |

|

|

(3 |

) |

|

|

(2 |

) |

|

|

(49 |

) |

Finance lease payments |

|

|

(15 |

) |

|

|

(15 |

) |

|

|

(13 |

) |

|

|

(50 |

) |

|

|

(46 |

) |

Proceeds from borrowings |

|

|

71 |

|

|

|

9 |

|

|

|

852 |

|

|

|

653 |

|

|

|

1,286 |

|

Repayments of borrowings |

|

|

(387 |

) |

|

|

(162 |

) |

|

|

(652 |

) |

|

|

(934 |

) |

|

|

(1,183 |

) |

Net cash (used in) provided by financing activities |

|

|

(330 |

) |

|

|

(523 |

) |

|

|

183 |

|

|

|

(686 |

) |

|

|

(425 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Decrease) increase in cash and cash equivalents |

|

|

(524 |

) |

|

|

26 |

|

|

|

(121 |

) |

|

|

(397 |

) |

|

|

(123 |

) |

Exhibit I - Alternative Performance Measures

These non-IFRS measures should not be considered in isolation of, or as a substitute for, measures of performance prepared in accordance with IFRS. These non-IFRS measures do not have a standardized meaning under IFRS and, therefore, may not correspond to similar non-IFRS financial measures reported by other companies.

Adjusted EBITDA

$ MILLION |

|

|

3Q25 |

|

|

|

2Q25 |

|

|

|

3Q24 |

|

|

|

9M25 |

|

|

|

9M24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

|

(270 |

) |

|

|

259 |

|

|

|

93 |

|

|

|

132 |

|

|

|

(159 |

) |

Adjusted to exclude: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

197 |

|

|

|

197 |

|

|

|

184 |

|

|

|

578 |

|

|

|

554 |

|

Income tax results |

|

|

444 |

|

|

|

(104 |

) |

|

|

143 |

|

|

|

362 |

|

|

|

490 |

|

Net financial results |

|

|

35 |

|

|

|

30 |

|

|

|

(74 |

) |

|

|

2 |

|

|

|

127 |

|

Equity in earnings of non-consolidated companies |

|

|

(25 |

) |

|

|

(25 |

) |

|

|

(17 |

) |

|

|

(65 |

) |

|

|

(51 |

) |

Provision for ongoing litigation related to the acquisition of a participation in Usiminas |

|

|

32 |

|

|

|

40 |

|

|

|

31 |

|

|

|

117 |

|

|

|

814 |

|

Reversal of other Usiminas contingencies recognized as part of the PPA |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(34 |

) |

Adjusted to include: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proportional EBITDA in Unigal (70% participation) |

|

|

8 |

|

|

|

7 |

|

|

|

8 |

|

|

|

21 |

|

|

|

27 |

|

Adjusted EBITDA |

|

|

420 |

|

|

|

403 |

|

|

|

368 |

|

|

|

1,146 |

|

|

|

1,768 |

|

Divided by: net sales |

|

|

3,955 |

|

|

|

3,947 |

|

|

|

4,480 |

|

|

|

11,834 |

|

|

|

13,773 |

|

Adjusted EBITDA Margin (%) |

|

|

11 |

% |

|

|

10 |

% |

|

|

8 |

% |

|

|

10 |

% |

|

|

13 |

% |

Exhibit I - Alternative Performance Measures (cont.)

Cash Operating Income - Steel Segment

$ MILLION |

|

|

3Q25 |

|

|

|

2Q25 |

|

|

|

3Q24 |

|

|

|

9M25 |

|

|

|

9M24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Income - Management View (Note ‘Segment Information' to Ternium's Financial Statements as of the corresponding dates) |

|

|

333 |

|

|

|

190 |

|

|

|

381 |

|

|

|

766 |

|

|

|

1,252 |

|

Plus/minus differences in cost of sales (IFRS) |

|

|

(96 |

) |

|

|

10 |

|

|

|

(219 |

) |

|

|

(202 |

) |

|

|

(71 |

) |

Excluding depreciation and amortization |

|

|

146 |

|

|

|

144 |

|

|

|

138 |

|

|

|

432 |

|

|

|

410 |

|

Excluding reversal of other Usiminas contingencies |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(34 |

) |

Including proportional EBITDA in Unigal (70% participation) |

|

|

8 |

|

|

|

7 |

|

|

|

8 |

|

|

|

21 |

|

|

|

27 |

|

Cash Operating Income |

|

|

391 |

|

|

|

350 |

|

|

|

309 |

|

|

|

1,018 |

|

|

|

1,583 |

|

Divided by: steel shipments (thousand tons) |

|

|

3,757 |

|

|

|

3,719 |

|

|

|

4,123 |

|

|

|

11,333 |

|

|

|

11,858 |

|

Cash Operating Income per Ton - Steel |

|

|

104 |

|

|

|

94 |

|

|

|

75 |

|

|

|

90 |

|

|

|

134 |

|

Divided by: steel net sales |

|

|

3,804 |

|

|

|

3,812 |

|

|

|

4,368 |

|

|

|

11,417 |

|

|

|

13,453 |

|

Cash Operating Income Margin - Steel (%) |

|

|

10 |

% |

|

|

9 |

% |

|

|

7 |

% |

|

|

9 |

% |

|

|

12 |

% |

Cash Operating Income - Mining Segment

$ MILLION |

|

|

3Q25 |

|

|

|

2Q25 |

|

|

|

3Q24 |

|

|

|

9M25 |

|

|

|

9M24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Result - Management View (Note ‘Segment Information' to Ternium's Financial Statements as of the corresponding dates) |

|

|

(35 |

) |

|

|

(38 |

) |

|

|

(58 |

) |

|

|

(75 |

) |

|

|

(131 |

) |

Plus/minus differences in cost of sales (IFRS) |

|

|

23 |

|

|

|

38 |

|

|

|

64 |

|

|

|

77 |

|

|

|

179 |

|

Excluding depreciation and amortization |

|

|

51 |

|

|

|

53 |

|

|

|

46 |

|

|

|

146 |

|

|

|

145 |

|

Cash Operating Income |

|

|

38 |

|

|

|

54 |

|

|

|

52 |

|

|

|

148 |

|

|

|

192 |

|

Divided by: mining shipments (thousand tons) |

|

|

3,207 |

|

|

|

3,323 |

|

|

|

3,020 |

|

|

|

9,589 |

|

|

|

8,389 |

|

Cash Operating Income per Ton - Mining |

|

|

12 |

|

|

|

16 |

|

|

|

17 |

|

|

|

15 |

|

|

|

23 |

|

Divided by: mining net sales |

|

|

268 |

|

|

|

281 |

|

|

|

264 |

|

|

|

829 |

|

|

|

810 |

|

Cash Operating Income Margin - Mining (%) |

|

|

14 |

% |

|

|

19 |

% |

|

|

20 |

% |

|

|

18 |

% |

|

|

24 |

% |

Exhibit I - Alternative Performance Measures (cont.)

Free Cash Flow

$ MILLION |

|

|

3Q25 |

|

|

|

2Q25 |

|

|

|

3Q24 |

|

|

|

9M25 |

|

|

|

9M24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

|

535 |

|

|

|

1,044 |

|

|

|

303 |

|

|

|

1,786 |

|

|

|

1,435 |

|

Less: capital expenditures and advances to suppliers for PP&E |

|

|

(711 |

) |

|

|

(810 |

) |

|

|

(446 |

) |

|

|

(2,038 |

) |

|

|

(1,304 |

) |

Free Cash Flow |

|

|

(175 |

) |

|

|

234 |

|

|

|

(143 |

) |

|

|

(252 |

) |

|

|

130 |

|

Net Cash

$ BILLION |

|

SEPTEMBER 30, 2025 |

|

|

JUNE 30, 2025 |

|

|

SEPTEMBER 30, 2024 |

|

|||

|

|

|

|

|

|

|

|

|

|

|||

Cash and cash equivalents |

|

|

1.3 |

|

|

|

1.9 |

|

|

|

1.6 |

|

Plus: other investments (current and non-current) |

|

|

1.4 |

|

|

|

1.5 |

|

|

|

2.3 |

|

Less: borrowings (current and non-current) |

|

|

(2.0 |

) |

|

|

(2.4 |

) |

|

|

(2.2 |

) |

Net Cash |

|

|

0.7 |

|

|

|

1.0 |

|

|

|

1.7 |

|

Note: Ternium Argentina's consolidated position of cash and cash equivalents and other investments amounted to $0.9 billion and $1.0 billion as of September 30 and June 30, 2025, respectively, and $1.2 billion as of September 30, 2024.

Sebastián Martí

Ternium - Investor Relations

+1 (866) 890 0443

+54 (11) 4018 8389

www.ternium.com

SOURCE: Ternium S.A.

View the original press release on ACCESS Newswire