Bakery Ingredients Market Rising Focus on Clean Labels and Precision Baking Solutions Reshapes the Global Bakery Ingredients Landscape

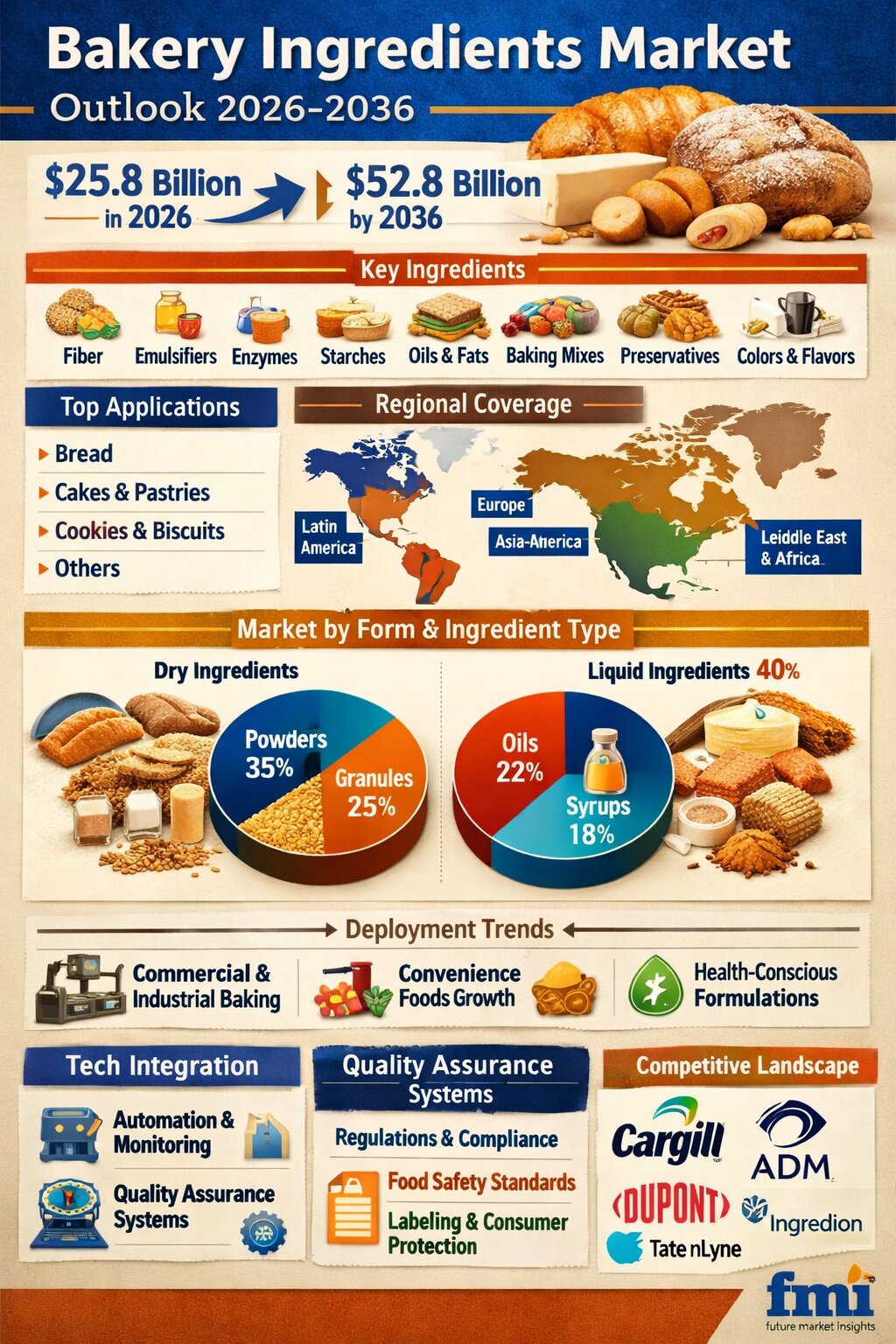

NEWARK, DE / ACCESS Newswire / February 4, 2026 / The global landscape for food science and industrial baking is entering a transformative era of nutritional fortification and process automation. According to the latest strategic outlook by Future Market Insights (FMI), the global Bakery Ingredients Market-valued at USD 25.8 billion in 2026-is on a clear trajectory to hit USD 52.8 billion by 2036, expanding at a robust 7.5% CAGR.

The report highlights a fundamental pivot: bakery ingredients are no longer viewed as simple bulk commodities. Instead, they are becoming high-performance functional systems where procurement teams prioritize batch consistency, clean-label transparency, and compatibility with high-speed automated production lines.

The Rise of "Performance-Led" Procurement

A key driver of this decade-long growth is the move toward structured, multi-track demand. Large-scale industrial players are increasingly managing bakery ingredients as a portfolio decision across distinct channels: artisanal retail, high-volume commercial baking, and specialized health-focused segments.

"Suppliers who can offer validated functional platforms-such as clean-label emulsifiers or heat-stable enzymes-are gaining a massive competitive edge," notes a senior market strategist. "Once an ingredient system is validated within an industrial process window, the relationship becomes incredibly 'sticky.' The risk of production disruption far outweighs the potential savings from switching to a lower-cost, unverified alternative."

This "stickiness" is creating a robust moat for established market leaders, as the cost of requalification and the risk of performance variability act as natural barriers to entry for smaller players.

Segment Insights: The Dominance of Functionality

The market is increasingly defined by specialized inputs that solve technical challenges in large-scale manufacturing:

Emulsifiers (28.7% Share): These remain the industry's functional backbone. Emulsifiers are critical for creating stable moisture-fat bonds, ensuring superior crumb structure, and extending shelf life-a vital factor for the expanding packaged goods sector. They improve dough machinability, which is essential for modern high-speed production lines.

Dry Forms (67.2% Share): Powdered and dry ingredient platforms lead the market due to their ease of storage, lower transport costs, and superior stability in non-refrigerated supply chains. This format supports cost-effective storage management and extended shelf-life performance across global operations.

Bread Applications (42.1% Share): As a global daily staple, bread remains the primary volume driver. The focus here is on "standardized performance," where ingredients must deliver exact results regardless of the manufacturing location, supporting high-volume consumption cycles.

Regional Performance: Asia-Pacific Leads the Growth Curve

While North America and Europe remain the value anchors of the market, the fastest expansion is concentrated in Asia and Latin America:

Country |

Projected CAGR (2026-2036) |

Primary Market Driver |

|---|---|---|

India |

9.2% |

Rapid retail modernization and rising urban consumption patterns. |

China |

8.8% |

Expansion of Western-style bakery chains and "umami" savory trends. |

Brazil |

7.8% |

Industrial bakery expansion and modern retail infrastructure growth. |

France |

7.3% |

Quality-led procurement and artisanal-industrial hybrid models. |

USA |

6.1% |

Clean-label innovation and precision fermentation pipelines. |

India is set to outpace the global average, fueled by a rapidly scaling food processing sector and a shift toward standardized industrial baking.

In China, the focus is on supply continuity and the integration of specialized yeast extracts and starches into broader flavor ecosystems.

The United States remains a high-performance market where ingredients are increasingly used in value-added "clean-label" pipelines for health-conscious consumers.

Navigating Restraints: The Documentation Barrier

The path to USD 52.8 billion is not without technical hurdles. The report identifies that the primary "bottleneck" in the current market is the rigorous documentation and revalidation required to switch suppliers.

For a large-scale manufacturer, changing a single enzyme or emulsifier can trigger weeks of pilot-scale testing, shelf-life studies, and regulatory review. While this extends the sales cycle for new entrants, it provides immense security for incumbents who maintain high performance-stability grades. Regulatory programs in several regions maintain strict food safety compliance, which influences long-term investment strategies for large-scale technology operations.

Key Market Stats (2026 Forecast)

Metric |

|

Value / Metric |

|---|---|---|

Current Total Market Size (2026) |

|

USD 25.8 Billion |

Forecasted Size (2036) |

|

USD 52.8 Billion |

Emulsifier Market Share |

|

28.7% |

Leading Form (Dry Forms) |

|

67.2% |

Growth Leader |

|

India (9.2% CAGR) |

Competitive Landscape: The Power of Scale

The competitive field is dominated by global specialists who have mastered strain, grade, and formulation management at scale. Leaders are successfully positioning themselves as "full-industry-chain service providers."

These companies are increasingly moving beyond raw material supply and offering "customized formulation solutions," particularly in high-growth areas like specialized gluten-free flours, plant-based fat systems, and yeast-derived nutritional enhancers.

Key Players in the Global Bakery Ingredients Market:

Cargill Inc.

Archer Daniels Midland Company

DuPont de Nemours Inc.

Ingredion Incorporated

Tate & Lyle PLC

DSM Nutritional Products

Associated British Foods

Corbion N.V.

Novozymes A/S

Puratos Group

Kerry Group PLC

Strategic Outlook: The Future of Baking

As the market moves toward 2036, the integration of automation technologies, digital monitoring platforms, and quality assurance systems will be the deciding factor for market leadership. Manufacturers are no longer just buying ingredients; they are investing in the stability of their automated production environments.

For an in-depth analysis of evolving formulation trends and to access the complete strategic outlook for the Bakery Ingredients Market through 2036, visit the official report page at: https://www.futuremarketinsights.com/reports/bakery-ingredients-market

Related Reports:

UK Bakery Ingredients Market : https://www.futuremarketinsights.com/reports/united-kingdom-bakery-ingredients-market

Bakery Emulsions Market : https://www.futuremarketinsights.com/reports/bakery-emulsions-market

Bean Ingredients Market : https://www.futuremarketinsights.com/reports/bean-ingredients-market

Bakery Enzymes Market : https://www.futuremarketinsights.com/reports/baking-enzymes-market

USA Bakery Ingredients Market : https://www.futuremarketinsights.com/reports/united-states-bakery-ingredients-market

About Future Market Insights (FMI)

Future Market Insights (FMI) is a leading provider of market intelligence and consulting services, serving clients in over 150 countries. Headquartered in Delaware, USA, with a global delivery center in India and offices in the UK and UAE, FMI delivers actionable insights to businesses across industries including automotive, technology, consumer products, manufacturing, energy, and chemicals.

An ESOMAR-certified research organization, FMI provides custom and syndicated market reports and consulting services, supporting both Fortune 1,000 companies and SMEs. Its team of 300+ experienced analysts ensures credible, data-driven insights to help clients navigate global markets and identify growth opportunities.

For Press & Corporate Inquiries

Rahul Singh

AVP - Marketing and Growth Strategy

Future Market Insights, Inc.

+91 8600020075

For Sales - sales@futuremarketinsights.com

For Media - Rahul.singh@futuremarketinsights.com

For web - https://www.futuremarketinsights.com/

SOURCE: Future Market Insights, Inc.

View the original press release on ACCESS Newswire