Given the industry tailwinds, it’s likely that AI-focused themes will continue to grab the limelight in 2026. However, there can be some hidden gems or under-the-radar stocks that deliver healthy returns.

Toyota Industries (TYIDY) is one such name that seems interesting for 2026. The little-known stock has rallied by almost 60% in the last 12 months. With a privatization bid, there seems to be more legs in the rally.

In June 2025, Toyota Group (through its real estate arm, Toyota Fudosan) announced a 4.7 trillion-yen ($30 billion) deal to take Toyota Industries private.

Amidst the debate on the deal value, Elliott Investment Management, the activist investor, has boosted its stake in Toyota Industries from 3.26% in September to 5.01% in December.

About Toyota Industries

Headquartered in Kariya-shi, Japan, Toyota Industries is a manufacturer of textile machinery, materials handling equipment, automobiles, and automobile parts. The company has a global presence, with key markets being Japan, the United States, and Europe.

For fiscal year 2025 (ended March 2025), the company reported revenue of 4,084 billion yen. For the same period, Toyota Industries reported a profit of 262.3 billion yen.

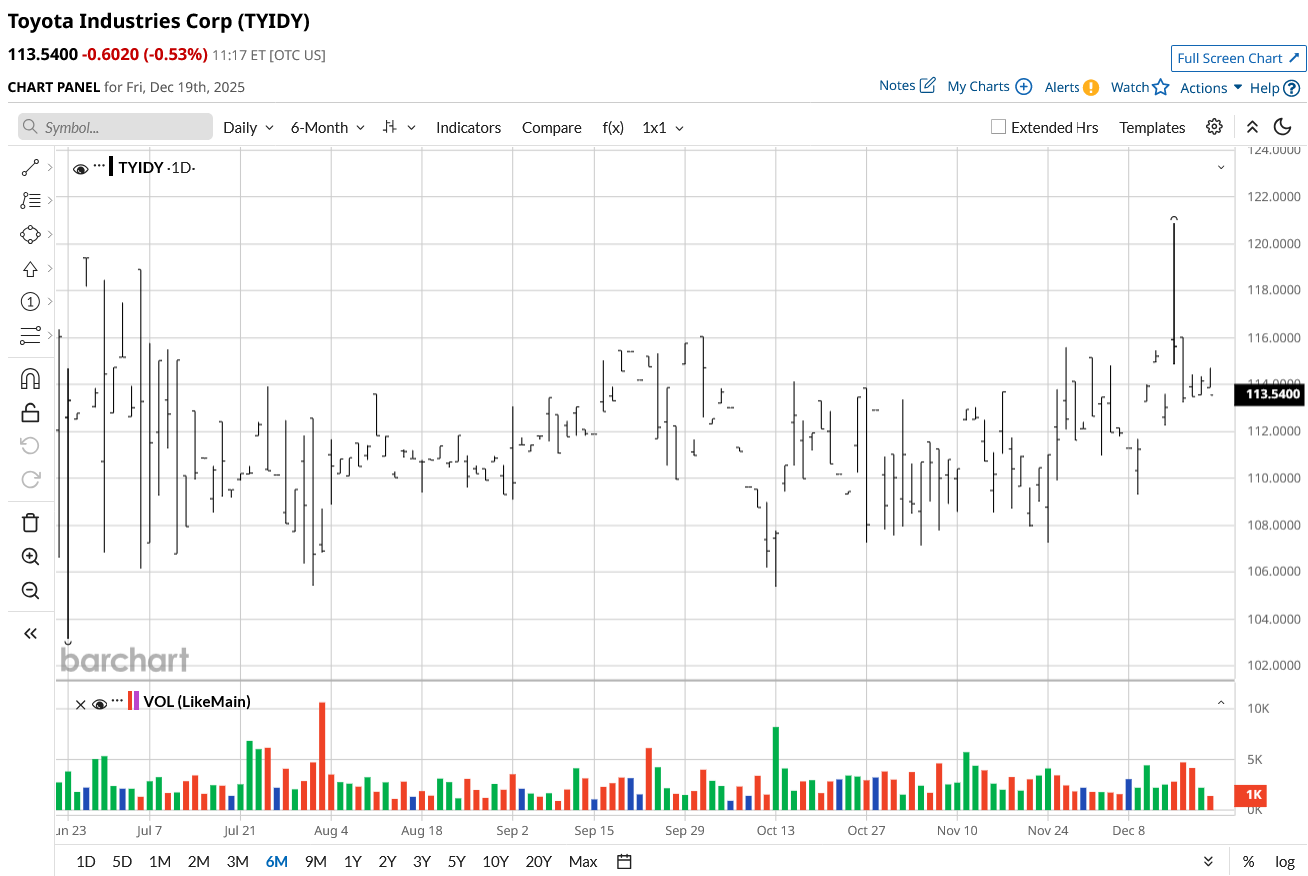

With the news of Toyota Group’s bid to take the company private, TYIDY stock has trended higher by 40.5% for the year. However, the price action has been sideways in the past six months as the markets wait for the deal's outcome.

Valuations Could Be Higher

An important point to note is that when the deal was announced in June 2025, Toyota Industries shares slumped by 13%. This was a clear indication of the point that the markets are disappointed with the deal value.

Arun George, a global equity research analyst, indicated that “some factors suggest that the offer is unattractive.” According to George, the offer price was below the midpoint of the valuation range given by commissioned independent financial advisers.

Further, Zennor Asset Management pointed to the fact that Toyota Industries has substantial real estate assets that are recorded at 1.5 trillion yen in the balance sheet. The potential real estate asset valuation further strengthens the case for a higher deal value.

As a matter of fact, Toyota Chairman Akio Toyoda had indicated in April 2025 that the founder's family was proposing to acquire Toyota Industries for a consideration of $42 billion. The final deal was therefore meaningfully lower than the targeted valuation.

It’s therefore not surprising that Elliott Investment Management believes that the deal does not reflect the true value of the company.

Steady Financial Performance

Toyota Industries has delivered steady financial performance in the last few years. The company’s revenue has increased from 3,380 billion yen in FY 2023 to 4,085 billion yen in FY 2025.

In the last FY, the material handling equipment segment contributed to 68.2% of the revenue. Further, the automobile business contributed 28.4% to the total revenue. While FY 2026 performance has been impacted due to tariffs, it’s likely that the long-term trend will be positive.

To put things into perspective, Toyota Industries is targeting to deliver operating cash flow of one trillion yen in the next three years (FY 2025 to FY 2028). During the same period, the company intends to invest in next-generation technology and pursue opportunistic M&A to boost growth.

It’s also important to note that global economic activity has been sluggish. However, with expansionary monetary policies, it’s likely that GDP growth will accelerate. This will ensure top-line growth acceleration. A forward price-earnings ratio of 24.7, therefore, looks attractive. Further, it’s also likely that dividends will swell with an increase in profitability in the coming years.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Micron Says ‘We Are More Than Sold Out.’ Should You Buy MU Stock After Earnings?

- IonQ Is Down More Than 30% Since September. What Happened to the Quantum Computing Leader?

- This Investor Is Betting $1 Billion on a Lululemon Stock Turnaround. Should You Buy the Dip Here in Hopes of Gains to Come?

- CoreWeave Stock Soars 19% on Genesis Mission, but Is It a Buy?