With Christmas right around the corner, it’s no surprise that everyone’s gearing up for the holidays. But did you know Saint Nick has a long-standing tradition of gift-giving on Wall Street, too?

The Santa Claus rally is a phenomenon that happens during the last five trading days of December and the first two trading days of January. During these times, stocks have historically performed well. The phenomenon is theorized to be caused by holiday-season optimism, the arrival of bonuses that free up cash flow for regular folks, portfolio rebalancing, and the end of tax-loss selling.

To set proper expectations, though, when I say “well,” I don’t mean double-digit swings. The average Santa Claus Rally is roughly between 1 and 2%.

Further, the Santa Claus rally occurs roughly 80% of the time. However, in 2023-2024, the Santa Claus rally returned -1.03%, and in 2024-2025, it was -1.56%. So, it’s not by any means a certainty.

Still, 80% is good odds, and the reversals over the last two years may indicate a different outcome this time. So if you want to bet on the Santa Claus rally this year, I have the perfect options trade for you.

What are bull put spreads?

A bull put spread, also known as a put credit spread, is a strategy that combines two put option contracts on the same underlying asset with the same expiration date but different strike prices. The investor sells a higher-strike put and buys a lower-strike put. The difference between the two is a net credit for the trade, which is your maximum profit.

Bull put spreads are used during neutral or moderately bullish market conditions. The goal is for the stock or ETF to trade above the short strike price at expiration. That’s why short strikes are usually below the current trading price right at the start of the trade.

So why would you want to sell bull puts during the Santa Claus rally? Well, since we’re expecting moderate price increases during the period, the bull put allows you to capitalize on the move while keeping your risk defined. Unlike a long call, which typically requires a sharp bullish price move to start becoming profitable, the bull put can still be profitable even if the stock price goes down, just as long as it doesn’t go below your strike price.

Bull put trade examples

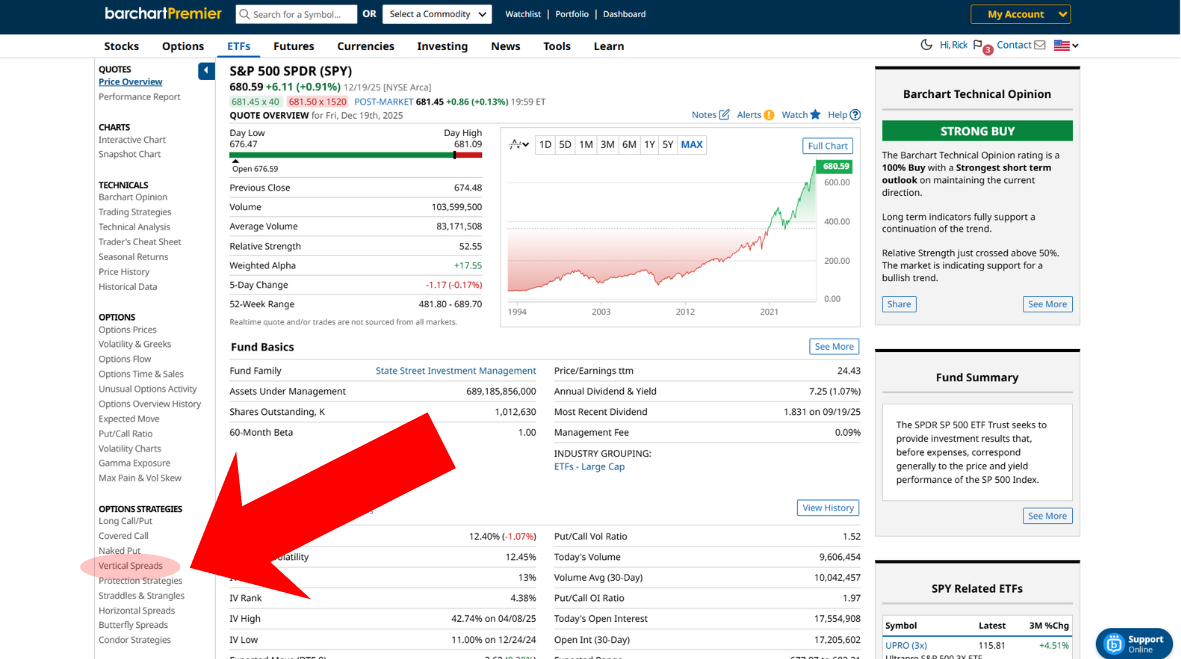

Now, I’ll use the SPDR S&P 500 ETF Trust (SPY) for this trade, since it’s highly liquid and closely tracks the broader U.S. market.

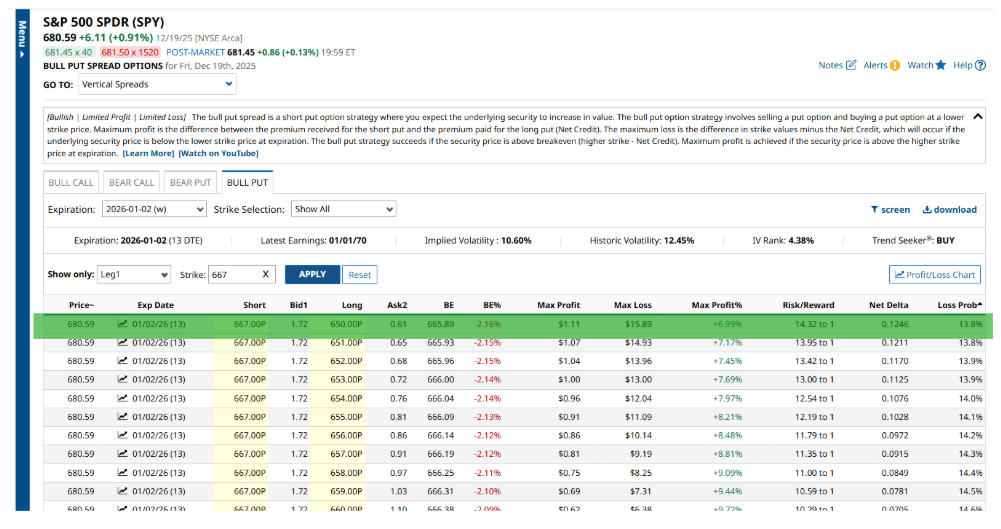

To access suggested bull puts, go to the ETF’s profile page and click Vertical Spreads on the left-hand navigation pane, then the Bull Put tab.

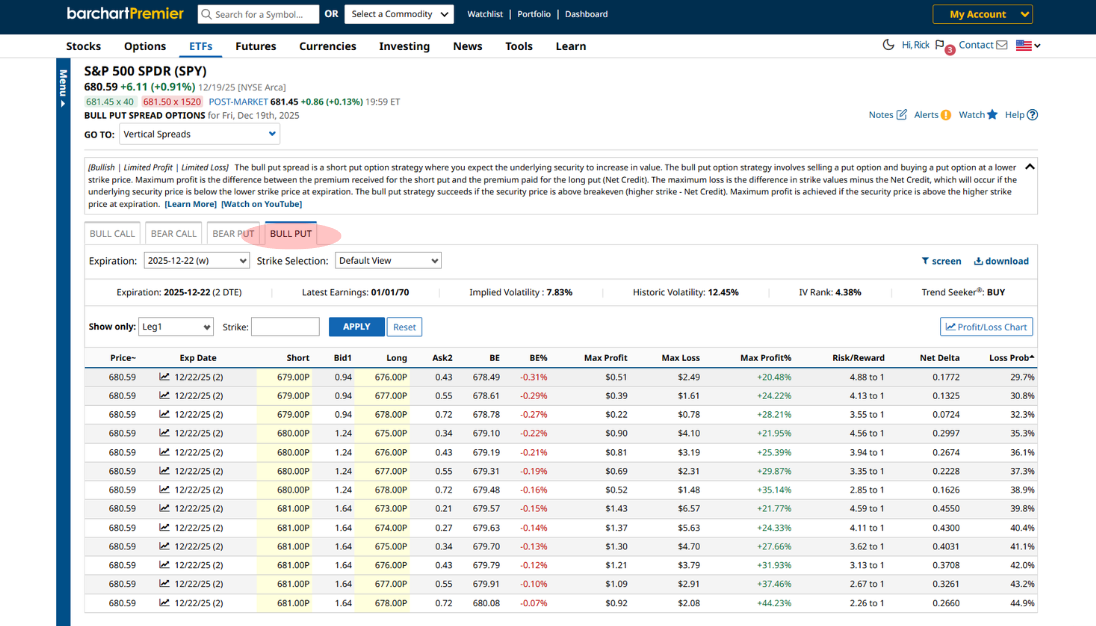

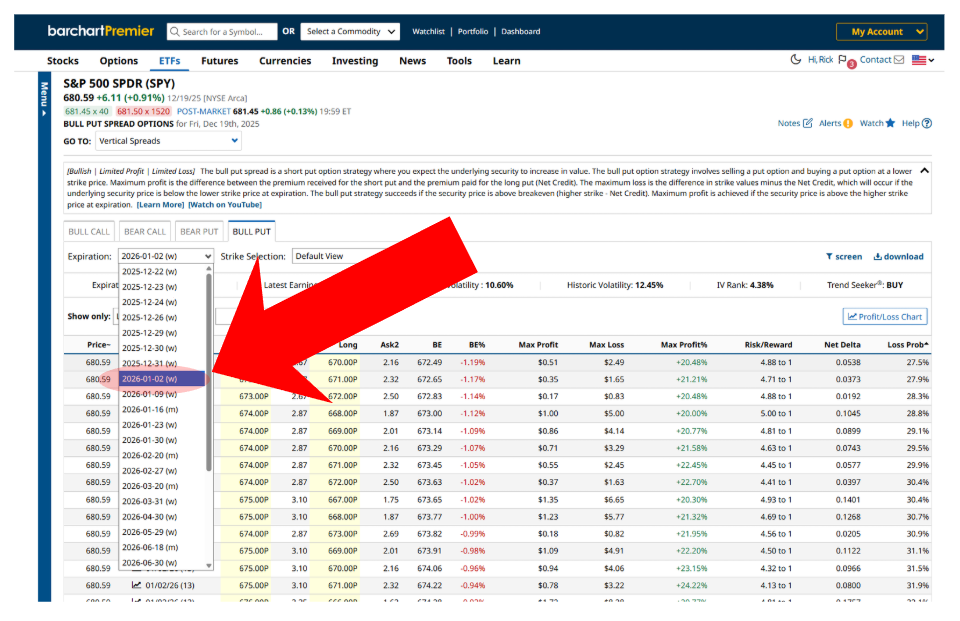

Since you’re aiming to capitalize on the Santa Claus rally, you’d want to choose trades that expire close to the second trading day of 2026, which is January 3, 2026. There are weekly bull puts that will expire on January 2, so I’ll use that date.

I’ve arranged the results by lowest loss probability. Next comes choosing the strike price.

Remember when I mentioned that the last two years had declines of around 1-2%? We can use that here as a safety net or reference point, meaning I’ll set the strike price 2% or more below the current trading price of $680.59, just in case. That’d be around $667, so I’ll look for bull puts with $667 short strikes.

And with that, the top one trade right here meets these criteria.

Trade Breakdown

According to the screener, you can sell a 667-650-strike bull put on SPY and receive $1.11 per share or $111 per contract. The trade expires in 13 days and has a 14% loss probability.

The advantage of bull put spreads is that they start at a net credit, meaning you can write as many as you can, as long as you have enough money in your account to cover the potential maximum losses.

Speaking of which, this trade has a maximum loss of $1,589 per contract, which will crystallize if SPY trades at or below $650 at expiration. On the other hand, as long as SPY trades above $667 through January 2, you keep the net credit with no other obligation.

Remember, SPY is trading at $680.59 now, so it will have to go down 2% to reach your short strike, and more than 4% for your trade to end at maximum loss.

Final thoughts

Stock market calendar effects may not always be 100% accurate, but they do give valuable insight into what market participants might expect during specific periods. This is especially applicable to Santa Claus rallies, where traders might set up risk-moderated trades to capitalize on moderately bullish expectations.

But don’t let yourself get too optimistic about the holiday festivities. Even if it has an 80% chance of happening, you still need to stay 100% on top of your trade so that you can make the necessary adjustments should the market go against your thesis.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart