When it comes to reasons for gaining fame and recognition in the investment world, the paths of Warren Buffett and Michael Burry could not have been any different. While the Oracle of Omaha bats for concentrated, long-term bets on companies that he finds conviction in, the latter is known for his short bets during the 2008 financial crisis.

So, when Burry pounds the table on a healthcare stock and endorses it for investors to hold it for the long term, it certainly warrants attention.

About Molina Healthcare

Founded in 1980, Molina Healthcare (MOH) is a managed care health insurer that primarily serves Medicaid and Medicare populations under state and federal programs and also offers insurance through the Affordable Care Act (ACA) Marketplace in select states. It operates its business through four segments, namely, Medicaid, Medicare, Marketplace, and Other.

Valued at a market cap of $9.1 billion, the MOH stock is down 40% on a year-to-date (YTD) basis. However, that has not deterred Burry from his bullishness on the stock.

In a recent post on Substack, the investor of “Big Short” fame posted, “Molina is looking to make money (albeit less money) in Medicaid in 2026 while most of its competition loses money and seems best-positioned to emerge stronger as the cycle turns.”

However, can Molina reach the legendary heights of GEICO in the insurance space, making it an appropriate investment bet for the long haul? Let's find out.

Financials Stable Despite Sharp Earnings Downturn

Molina Healthcare's third-quarter earnings came in well below expectations, with EPS falling 69.4% year-over-year (YoY) to $1.84, missing the $3.90 consensus by a considerable distance. Management attributed the shortfall largely to challenges in the Medicare and Marketplace businesses, while other parts of the operation held up better.

However, revenue still managed an 11% gain to $11.48 billion, led by an 11.8% rise in premium income to $10.84 billion. Meanwhile, over the past ten years, Molina has compounded revenue and earnings at annual rates of 12.90% and 19.69%. Encouragingly, consensus estimates are for 11.58% revenue growth going forward, ahead of the sector's 7.65% median.

Notably, the medical care ratio widened to 92.6% from 89.2%, signaling higher claims costs eating into premiums, a figure investors prefer to see trending lower.

Shifting to cash on hand, it stayed comfortable at $4.2 billion with no short-term debt outstanding. Operating cash flow for the first nine months of 2025, however, turned negative at $237 million versus a positive $868 million a year earlier, an area that merits attention.

On valuation, MOH trades at a forward P/E of 14.78 and P/B of 2.07—both notably below sector medians of 19.54 and 3.25.

Is Burry Right About Molina?

In my previous analysis of Molina earlier this month, I had highlighted how Molina's scale, widespread acceptance, and integrated model give it a distinct advantage in the managed healthcare space. The stock is up 12.4% since then.

And with most of the tailwinds intact, Molina also has another thing going for it, although it does not grab much spotlight. Molina operates a relatively modest Medicare Advantage (MA) business compared to its dominant Medicaid franchise, and it has consistently taken a cautious approach to coding patient risk profiles, which is much more restrained than the larger MA players. That means it generates far less revenue tied to risk-adjustment payments and doesn't rely heavily on high-risk scores or aggressive diagnosis capture for profitability.

Meanwhile, while carriers loaded up on MA exposure could spend years dealing with tighter CMS guidelines and possible clawbacks from audits, Molina heads into this environment with very little baggage. Its profit stream is built in a way that shrugs off shifts in risk-adjustment rules, giving it a cleaner regulatory profile than most peers.

Add in a track record of winning dual-eligible members and a concentrated presence in states with solid fiscal health, and Molina is better equipped to handle membership turnover than the market gives it credit for. Those strong state budgets are undoubtedly why the company can still post revenue growth even as national Medicaid rolls stay flat or shrink.

Finally, longer life spans and a rising number of dual-eligible individuals are steadily enlarging the overall opportunity set for Molina and similar focused providers.

Analyst Opinion of MOH Stock

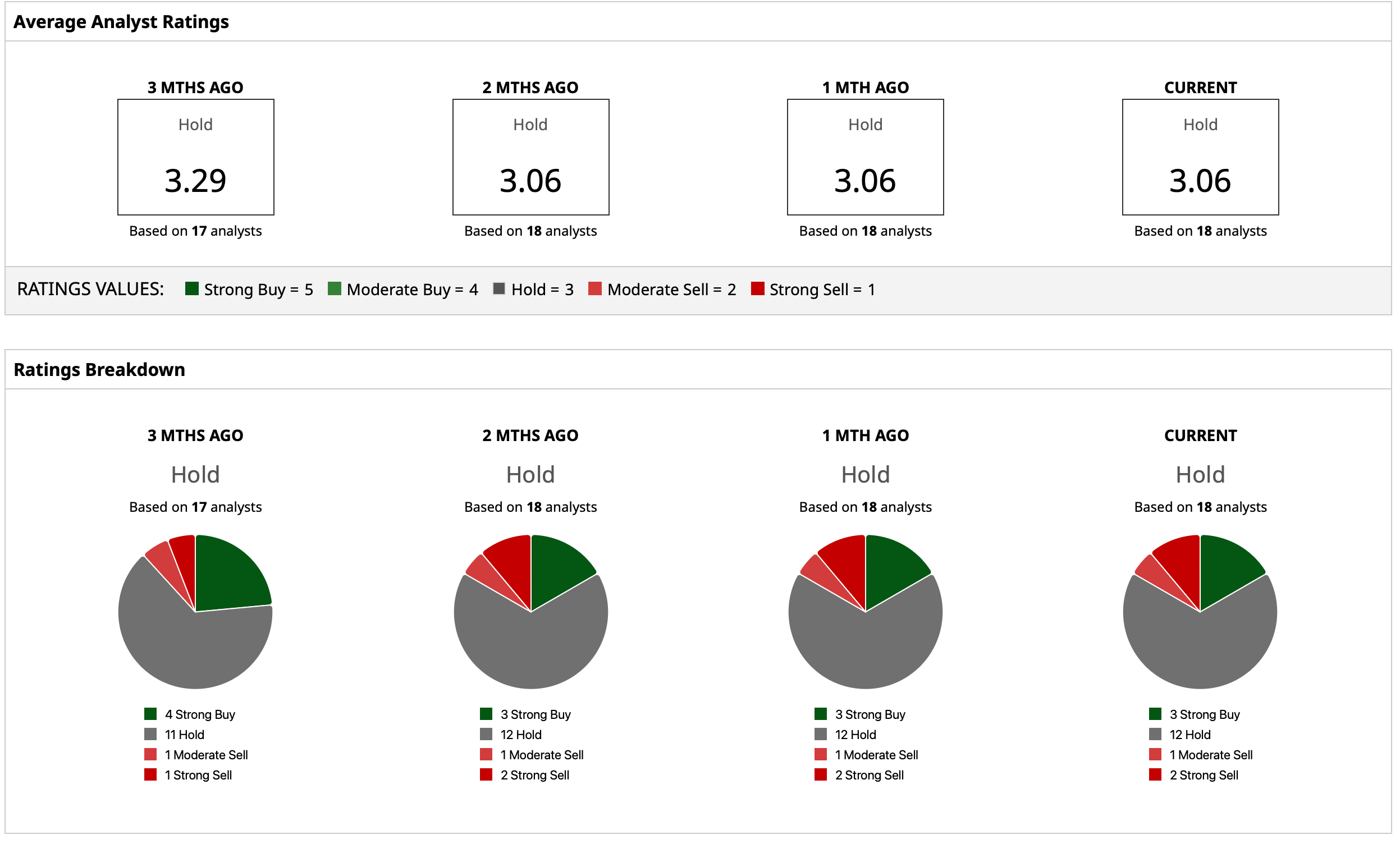

Overall, analysts have attributed an overall rating of “Hold” for MOH stock, with a mean target price that has already been surpassed. The high target price of $200 indicates upside potential of about 15% from current levels. Out of 18 analysts covering the stock, three have a “Strong Buy” rating, 12 have a “Hold” rating, one has a “Moderate Sell” rating, and two have a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- A $100 Million Reason to Buy This Critical Minerals Stock in 2026

- Unusual Activity in Occidental Petroleum Call Options - A Signal Investors Expect a Dividend Hike

- Ulta Stock ‘Unleashed’ Gains in 2025. Should You Keep Buying Shares in 2026?

- Nvidia Could Buy AI21 Next. What Does That Mean for NVDA Stock?