NIKE (NKE), the global icon of sport and streetwear, is hitting the reset button at the very top. With news that the company is dramatically reshuffling its C-suite under CEO Elliott Hill’s “Win Now” plan, senior leaders are being replaced, new roles created, and decision-making streamlined as the brand pivots toward speed, efficiency, and digital-first execution.

Nike is restructuring its senior leadership team as part of its turnaround strategy, aiming to cut unnecessary management layers, strengthen consumer connections, and accelerate its “sport offense.” At the heart of the shake-up, longtime supply-chain head Venkatesh Alagirisamy is elevated to a newly minted Chief Operating Officer role, while absorbing not just logistics and manufacturing, but also technology leadership. As a result, Nike has eliminated the Chief Technology Officer position, leading to the departure of Dr. Muge Dogan.

In a broader shift, the heads of Nike’s four major geographies: Greater China, EMEA, North America, and APLA, will now join the senior leadership team and report directly to CEO Elliott Hill. The company is also removing the Chief Commercial Officer role, while Global Sales and Nike Direct will now report to CFO Matt Friend, positioning him to closely align marketplace strategy with Nike’s broader priorities.

In light of these sweeping changes, is now the time to buy, sell, or hold NKE stock?

About NIKE Stock

Headquartered in Beaverton, Oregon, Nike is a leading global designer, marketer, and retailer of athletic footwear, apparel, sports equipment and accessories. Known worldwide for its iconic Swoosh logo and brands such as Nike, Air Jordan, and Converse, Nike serves a broad base of athletes, sports enthusiasts, and casual consumers across countries through its own stores, wholesale partners, and e-commerce platforms. Nike’s market cap stands around $97.1 billion.

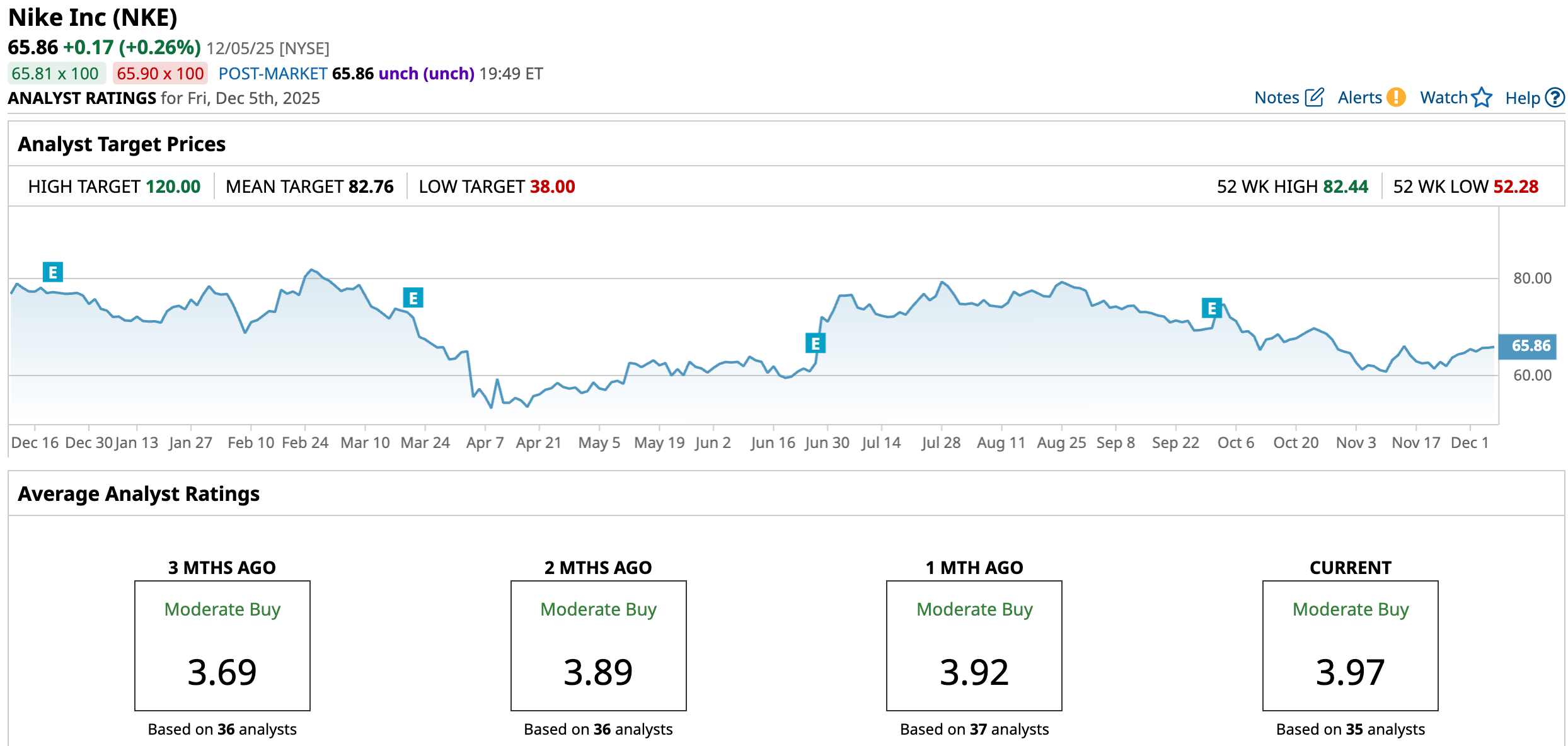

Nike has experienced a turbulent stock performance over the past year, marked by sharp swings and a broader downtrend as the company works through a pivotal turnaround. After hitting a 52-week high of $82.44 in February, the stock has faced a pullback of 20.3% from that high, closing the last session at $65.82. The stock has slumped 16.2% over the past year and 13% year-to-date (YTD), underperforming the broader market and reflecting the brand’s ongoing challenges.

Much of the volatility stems from the interplay between internal restructuring and external economic pressures. Under CEO Elliott Hill, Nike has embarked on an aggressive “Win Now” turnaround that aims to rebuild its wholesale business, reignite innovation, and correct past missteps in its direct-to-consumer strategy. Investors have shown guarded confidence as early signs of progress emerge, with occasional rallies punctuating an otherwise difficult year.

Still, several headwinds continue to weigh on the stock. A slowdown in fresh, compelling product releases has opened the door for rivals. High inventory levels, especially have forced Nike into discounting, pressuring margins already strained by tariffs and cost pressures. Meanwhile, weak consumer sentiment in China and broader macroeconomic uncertainty have dampened demand across key regions.

However, the stock is trading at a premium compared to industry peers at 40.03 times forward earnings.

Mixed Q1 Results

NIKE reported its fiscal first quarter (Q1 FY2026) results on Sept. 30, covering the period ended Aug. 31. Revenue came in at $11.7 billion, just a 1% increase from the prior-year quarter.

The company saw a 7% rise in wholesale revenue, which reached $6.8 billion, while Nike Direct revenues came in at $4.5 billion, down 4% year-over-year (YOY). Also, revenues for Converse stood at $366 million, down 27%. Inventories stood at $8.1 billion, down 2% compared to the same period the prior year.

Profitability took a hit. Gross margin shrank by 320 basis points to 42.2%, reflecting a mix of higher discounts, increased product costs (including tariffs, particularly in North America), and an unfavorable shift in channel mix. As a result, net income fell about 31% to $0.7 billion, and earnings per share (EPS) dropped 30% YOY to $0.49, but exceeded expectations.

On the geographic front, growth was uneven. North America delivered modest gains of 4% in revenues driven by apparel, equipment, and a rebound in demand for running, training, and basketball categories, while the wholesale channel gained traction. But markets like Greater China continued to underperform with nearly a 9% decline, weighing on overall results.

Further, management signaled cautious optimism. The company emphasized that although wholesale and certain geographies are showing signs of recovery under its “Win Now” turnaround plan, progress will not be exactly linear. The company expects Q2 revenues to be down low single digits and gross margins to be down 300 to 375 basis points.

Analysts predict EPS to be around $1.65 for fiscal 2026, down 23.6% YOY, before surging by 56.36% annually to $2.58 in fiscal 2027.

What Do Analysts Expect for Nike Stock?

Recently, RBC Capital reaffirmed its “Outperform” rating and $85 price target on Nike, pointing to continued progress in cleaning up excess inventory, a key factor in the firm’s confidence that the company will enter 2026 in a stronger operational position.

Analyst Piral Dadhania noted that Nike appears to be nearing the end of its intensive inventory reset and is unlikely to deliver any major surprises in its upcoming Q2 results. RBC also expects Nike’s fiscal Q3 2026 outlook to signal stabilizing revenue and earnings trends, a shift investors would likely welcome. The firm additionally highlighted Nike’s product pipeline, including the 2026 Football World Cup kits, refreshed footwear lines, and new Basketball releases scheduled for early 2026.

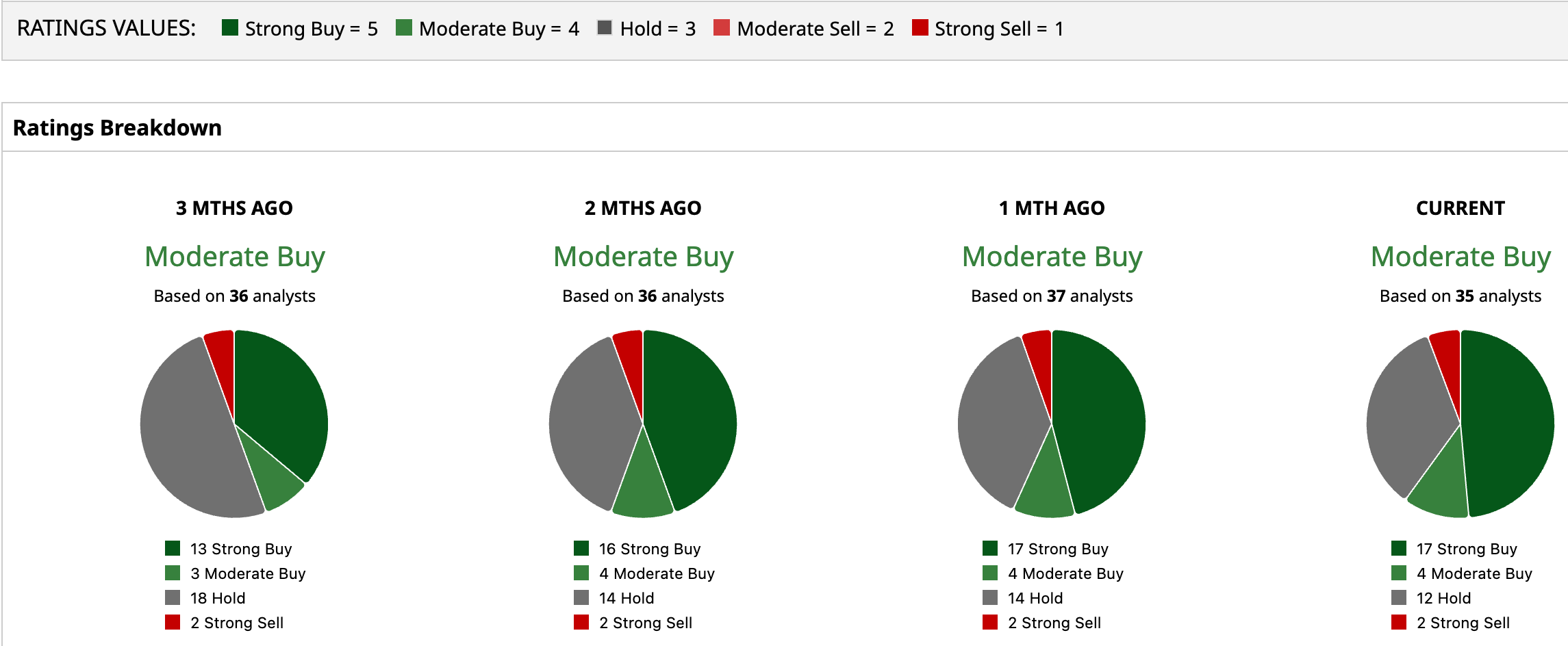

Overall, NKE has a consensus “Moderate Buy” rating. Of the 35 analysts covering the stock, 17 advise a “Strong Buy,” four suggest a “Moderate Buy,” 12 analysts are on the sidelines, giving it a “Hold” rating, and two recommend a “Strong Sell.”

The average analyst price target for NKE is $82.76, indicating a potential upside of 25.5%. The Street-high target price of $120 suggests that the stock could rally as much as 82.2%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart