Valued at a market cap of $270 billion, Caterpillar (CAT) manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in the United States and internationally.

Founded in 1925, Caterpillar has spent decades building its reputation on bulldozers and excavators. Today, the industrial giant is well positioned to benefit from the artificial intelligence (AI) megatrend, with its power and energy division becoming its fastest-growing business unit, driven by surging demand for generators powering AI data centers.

Let's see if you should buy this blue-chip stock for its widening AI moat.

Is Caterpillar a Good Stock to Buy Right Now?

Caterpillar is making its biggest bet in 15 years on artificial intelligence. The industrial giant announced it will spend $725 million to expand its Lafayette, Indiana, plant and more than double its turbine engine production capacity by decade's end. Caterpillar aims to benefit from growing demand, as AI data centers require massive amounts of energy to power generative AI models such as ChatGPT.

CEO Joe Creed said the company has better visibility into future demand than at any point in his 29-year career, thanks to long-term agreements and detailed forecasts from hyperscale customers building data centers. Caterpillar expects annual sales growth between 5% and 7% through 2030, up from a 4% average in recent years.

Data center electricity demand is expected to triple by 2035, according to the International Energy Agency. That's the equivalent of powering 15 New York City-sized computing infrastructures. Caterpillar plays across the entire value chain, from drilling for natural gas to burning it in generators that power these facilities. The company already has frame agreements in place with major customers and a record backlog, giving management confidence to invest heavily in new capacity.

Caterpillar secured a deal with Joule Capital Partners to deliver four gigawatts of power to a Utah data center campus and a partnership with Hunt Energy to deploy up to one gigawatt of generation capacity across North America.

The generator business is attractive because it generates recurring service revenue. A natural gas generator running 24/7 in a data center generates 40 times more service opportunities over its lifetime than a diesel backup unit.

Solar Turbines, Caterpillar's gas turbine subsidiary, is expanding capacity by 2.5 times to meet demand from data centers and from oil and gas customers, who still represent half of the global energy mix.

Caterpillar isn't abandoning its core construction and mining businesses. The company announced plans to grow services revenue to $30 billion by 2030 and expects to generate between $6 billion and $15 billion in free cash flow annually. Management is committed to returning all free cash substantially to shareholders and raising dividends by high single digits each year through 2030.

With AI infrastructure spending approaching $1 trillion annually before the decade's end, Caterpillar has positioned itself at the center of the buildout.

What Is the CAT Stock Price Target?

Analysts tracking CAT stock forecast revenue to grow from $66.24 billion in 2025 to $80 billion in 2029. In this period, adjusted earnings per share are projected to expand from $18.65 to $43.10.

Currently, CAT stock trades at 28x forward earnings, which is higher than its 10-year average multiple of 18.3x. If we assume a 20x earnings multiple, CAT stock should gain 50% from current levels.

Analysts also expect its free cash flow to increase from $8.41 billion in 2025 to $14 billion in 2029. A widening free cash flow should help the industrial behemoth to raise the annual dividend from $5.94 per share to $8 per share over the next four years.

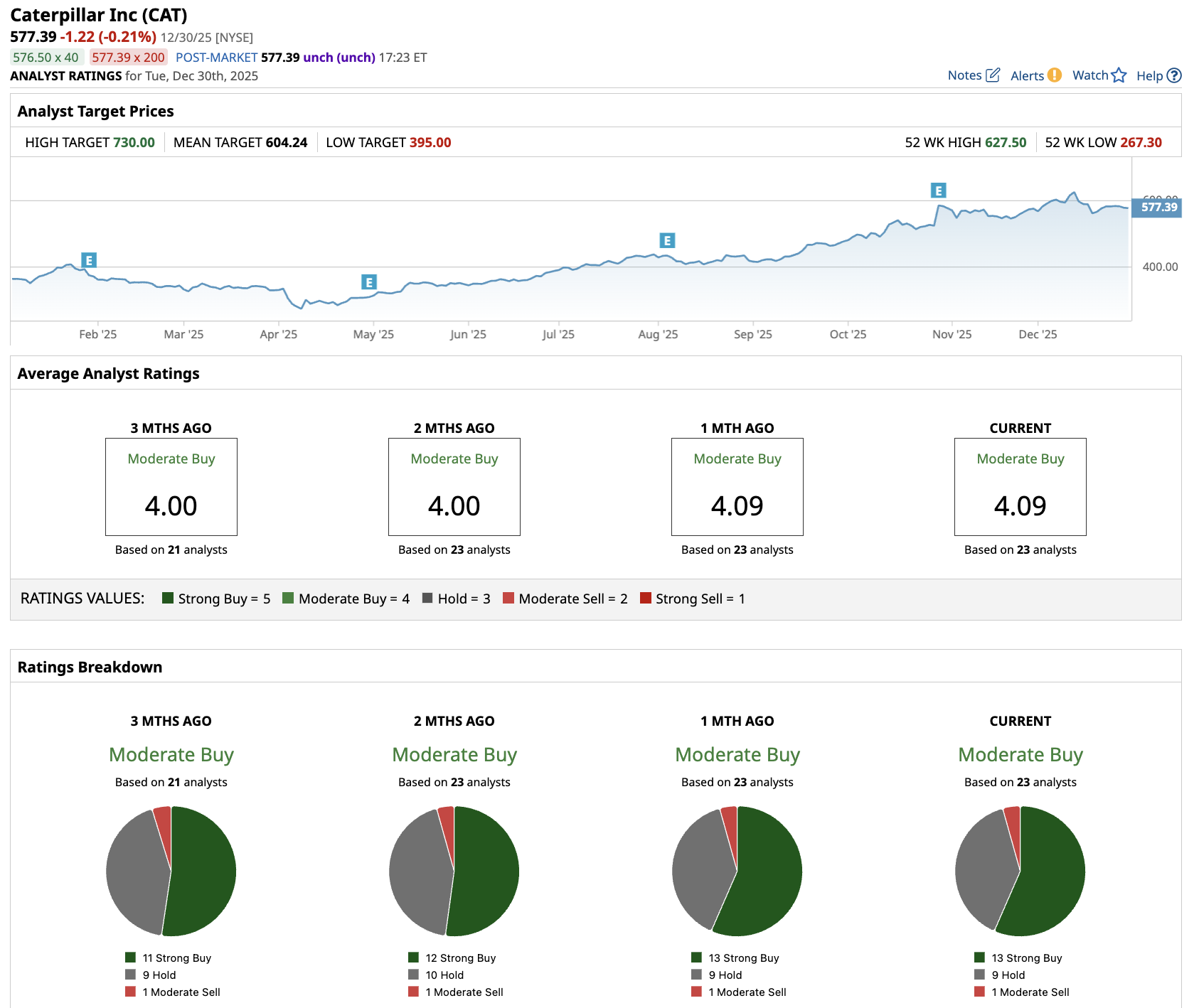

Out of the 23 analysts covering CAT stock, 13 recommend “Strong Buy,” nine recommend “Hold,” and one recommends “Moderate Sell.” The average Caterpillar stock price target is $604.24, above the current price of about $577.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart