Elon Musk has a tendency to be “creative” with numbers when it comes to Tesla (TSLA), a stock that arguably has the biggest cult-like following for any company. He just announced a major change in the way people buy Full Self-Driving (FSD). Buyers will soon have to pay a monthly subscription fee of $99 as opposed to the prior one-time $8,000 fee. The change will come into effect on Feb. 14, Valentine’s Day, a cheeky selection for Tesla to turn its relationship with customers on its head! Customers who already paid the $8,000 fee can continue with their lifetime access the same way as before.

Tesla’s Full Self-Driving system can handle lane changes, traffic signals, and obstacles without any input from the driver. However, it isn’t a fully autonomous system and still requires human supervision. Tesla’s long-term plans include autonomy, which would be added in the form of software upgrades to the existing FSD software. If there is any company that can achieve that, it is Tesla, thanks to the vast amount of data its cars collect every single day. Once that autonomy is reached, the value generation could go way beyond just numbers, as it would have implications in many other industries through robotics and automation.

About Tesla Stock

Tesla is an automotive and energy company that sells EVs, energy generation and storage solutions, and solar energy products. It is led by Elon Musk and is headquartered in Austin, Texas.

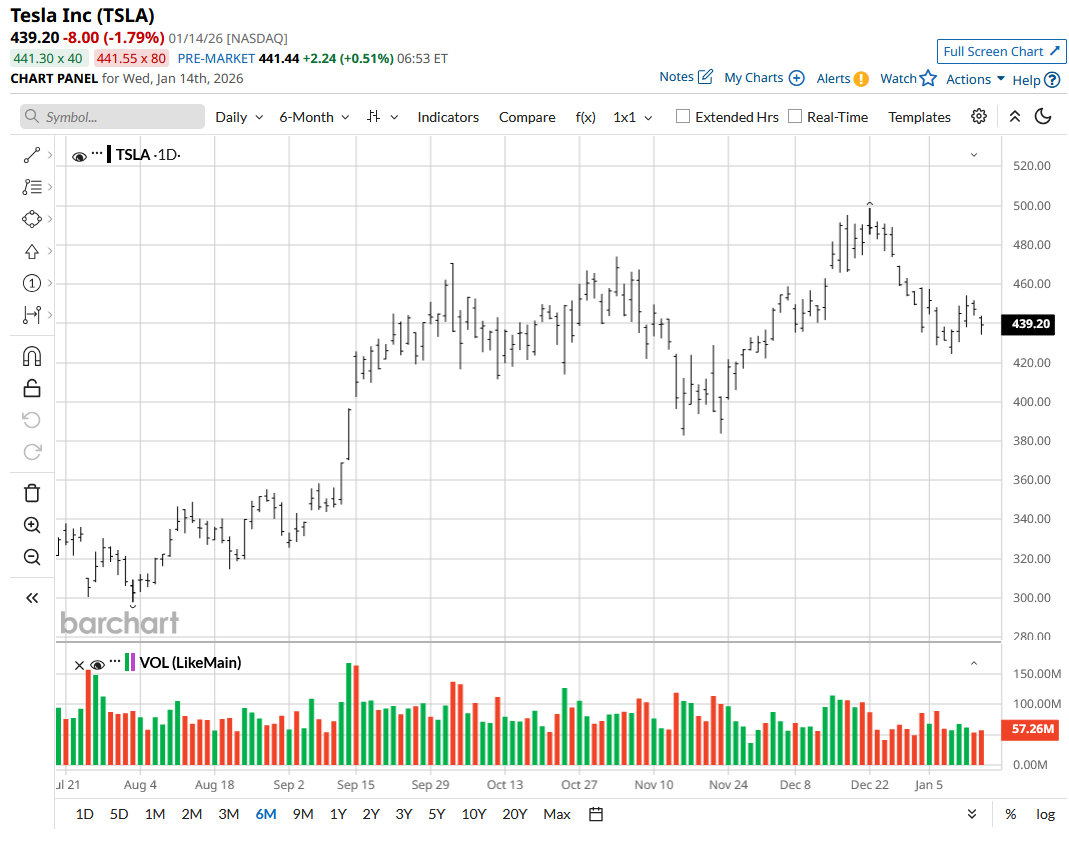

TSLA stock currently stands at around the same price it was exactly one year ago. During this time, Elon Musk has gone from President Donald Trump’s most favorite associate to a vocal critic and back to friends again. The S&P 500 ($SPX) has nudged up by over 16% in the same year.

The new payment model has confused many investors regarding valuation. How does one look at Tesla now? Is a self-driving Tesla car a long-term asset or just software that one rents? Is Tesla a car company or a software company? If it’s the latter, comparisons with software companies will start making more sense. That Tesla wasn’t just a car company was already clear to many because of the diversification into energy and robotics. But a payment model that now makes it look like a software company complicates things further.

In the near term, this change is going to hit Tesla hard. No upfront FSD payment could negatively impact cash flows. However, investors would also appreciate that Tesla’s 2025 sales number was down 8.6% YoY, and the company has already lost its leadership position to BYD (BYDDY) in both the United Kingdom and Germany. If it’s not selling as many cars as before, it wasn’t going to get as many upfront FSD payments anyway. So the change in the payment model is Tesla’s way of saying, "We'll take the short-term hit, which was coming our way anyway, and convert that headwind into long-term, reliable, recurring income in the form of an FSD subscription." It could be a masterstroke from Elon, though the market does not seem very excited about it right now.

Tesla Misses Earnings Estimates

For the quarter ending Sept. 29, Tesla missed the Wall Street EPS consensus by 9.76%. The decline in profit was mainly due to lower EV prices, further worsened by increased spending on AI R&D projects.

Tesla’s FSD was at the center of attention on the earnings call, accounting for only 12% of the company’s total fleet. In the past, the management has blamed strict regulation for the lack of progress. Projects like the Robotaxi have faced severe headwinds, and the reasons lie in the technology, not in the sales and marketing departments. Converting FSD into a subscription model will only be successful once Tesla perfects the technology. Perhaps that’s why the market hasn’t positively reacted to the news.

What Are Analysts Saying About TSLA Stock?

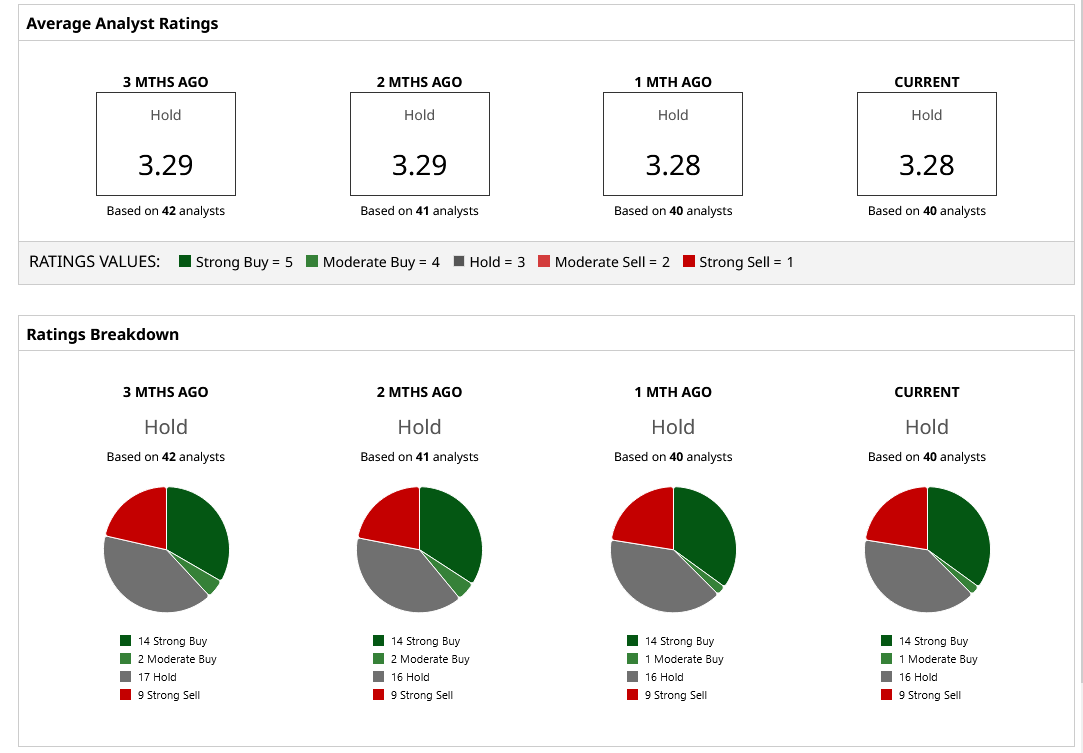

Wall Street sentiment regarding Tesla keeps swinging sharply from one extreme to the other. The 14 “Strong Buy,” nine “Strong Sell,” and 16 “Hold” ratings spread not only show that the opinion is divided but also how hard it can be to value a disruptive company like Tesla. Just yesterday, Cathie Wood of ARK Invest sold $38 million in TSLA while RBC Capital reiterated its “Buy” rating on the stock. UBS also raised the target price from $247 to $307, though the stock is trading well over the $400 mark, which is where the median Wall Street target price lies currently.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Cathie Wood Is Trimming Her Palantir Stake Again. How Should You Play PLTR in January 2026?

- As Trump Unveils His ‘Great Healthcare Plan,’ How Should You Play UnitedHealth Stock?

- ‘It Makes No Sense To Me’: Nvidia’s Jensen Huang Slams Americans Who ‘Vilified Energy,’ Praises Trump for ‘Sticking His Neck Out’

- Morgan Stanley Says Chip Sales Weakened in November. What Does That Mean for Nvidia Stock?