Penny fintech stocks have been highly volatile over the last year, especially those tied to Trump Jr.’s crypto ventures. One notable name is Alt5 Sigma (ALTS), which struck a $1.5 billion token-for-equity deal last December with World Liberty Financial, which is the stablecoin firm co-founded by Donald Trump Jr. and Eric Trump. This “Trump-linked” penny stock rocketed into the mid-teens on that news, then collapsed as filing delays and leadership shakeups raised doubts.

In mid-January 2026, ALTS announced it had finally filed its delayed 10-Q and regained Nasdaq compliance, sending shares sharply higher on Wednesday. With ALTS now back in good standing and momentum returning to the stock, investors are beginning to ask whether this rebound could extend into 2026 or if the recent surge is already priced in.

About ALTS Stock

Based in Las Vegas, Alt5 Sigma is a boutique fintech/crypto infrastructure company. It operates blockchain-powered payment and settlement networks that process cryptocurrency-to-fiat transactions. It also maintains a small legacy biotech segment, though nearly all recent revenue comes from its fintech unit. Uniquely, Alt5 has adopted a $WLFI token treasury strategy; it holds billions of WLFI governance tokens for the USD1 stablecoin ecosystem (a project linked to Trump Jr.), a bet that distinguishes it from typical payments firms.

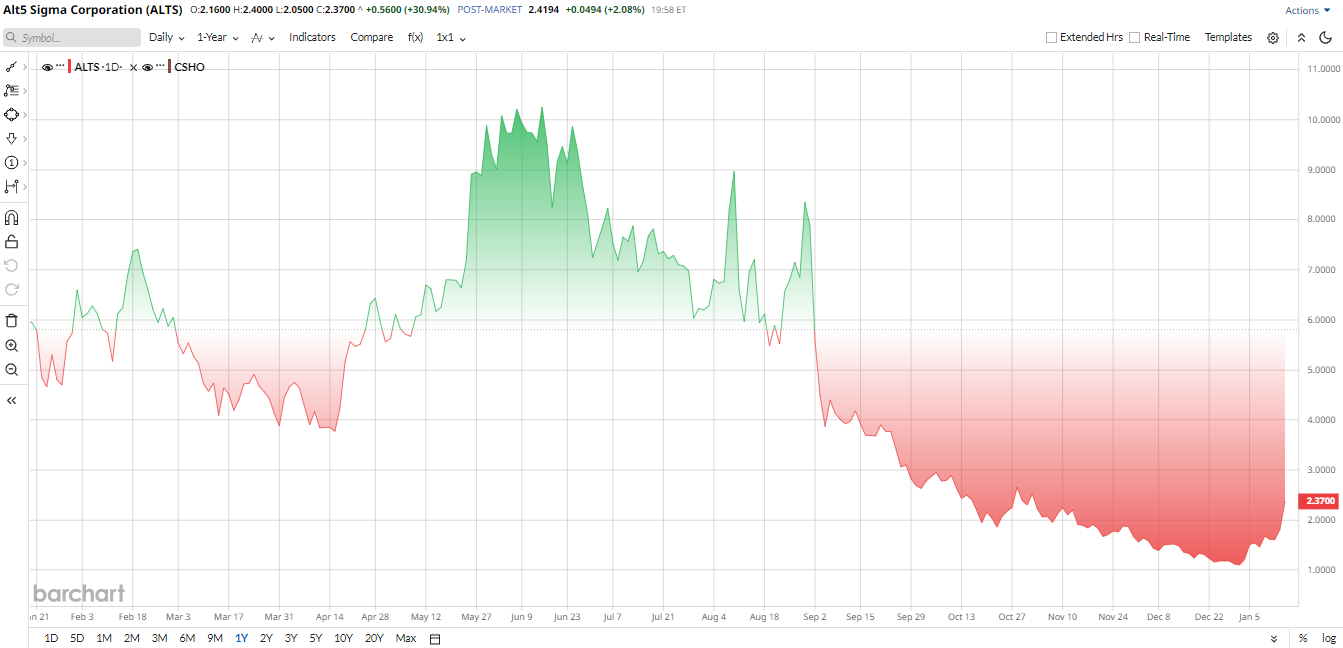

ALTS shares have swung wildly over the last year. After trading around $1 to $2 at the start of 2025, the stock briefly spiked into double digits on crypto news, hitting a 52-week high of $11 in June. However, as governance issues emerged in Q3, the stock plunged back down. As of mid-January 2026, ALTS traded near $2.40 after jumping 30% on the compliance news. Barchart data show roughly 125% up so far this year, though this reflects a rally off the prior low, and the price remains 78% below its 2025 high peak.

Nasdaq Compliance News

Alt5 just announced that Sigma has restored Nasdaq compliance. The company said it received a Nasdaq notification confirming that, after filing the overdue Q3 2025 report on Jan. 12, it again meets the Rule 5250 periodic filing requirements and “remains in good standing.” Nasdaq had warned ALTS on Nov. 19 that it was “not in compliance” due to the late report, so this news formally closes that issue. In a statement, CEO Tony Isaac commented that he is “pleased that this matter has been resolved and that the Company is once again back in compliance” under Nasdaq standards.

Regaining compliance removes an immediate delisting risk and may restore some investor confidence. Still, analysts note that underlying growth hinges on its crypto ventures and main payments business, so future stock moves will depend on operational progress now that this overhang is cleared.

Q3 2025 Results and Outlook

Alt5 Sigma finally reported Q3 2025 results with the Jan 12 filing. The core fintech segment generated $7.6 million in revenue during Q3 with a 35% gross margin, contributing to $19.5 million for the first three quarters.

Net income was a hefty $57 million, a figure inflated by the valuation of its WLFI token holdings, boosting book equity to $1.6 billion. Management highlighted that the fintech operations grew “via enterprise, institutional and international” demand. Tony Isaac noted these results “highlight our significant operational and financial achievements,” saying that Q3 “delivered meaningful revenues and strengthened our balance sheet through the establishment of our $WLFI treasury strategy.”

ALT5 did not issue formal guidance with the release. Comprehensive analyst coverage remains scarce, but consensus forecasts see full-year 2025 revenue around $37.5 million and EPS about -$1.00. Just for context, 2024 revenue was low, so 2025 is on pace for strong growth percentage-wise.

For 2026, the lone analyst predicts roughly $62.6 million in revenue and a $0.60 per-share loss. The next quarterly report for Q4 2025 is expected in late March 2026. Investors will be looking for any hints of formal guidance. So far, the focus remains on whether the company can leverage its $WLFI holdings and crypto infrastructure to drive future results.

The Bottom Line on ALTS Stock

Wall Street coverage of ALTS is nonexistent. To date, not a single analyst surveyed by Barchart has initiated official coverage on the stock.

Regaining Nasdaq compliance is a clear positive milestone for ALTS, which somehow removes a regulatory cloud. However, the stock remains a high-risk, speculative play. Its high swings suggest big potential rewards if the company’s crypto strategy pays off, but those estimates assume best-case scenarios.

In sum, ALTS now trades on fundamentals rather than fear of delisting, but it will likely remain volatile. Risk-tolerant investors excited by the Trump-affiliated crypto angle may find the stock intriguing, while conservative investors may prefer to wait for more stable earnings proof before 2026.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart